Navigating the intricacies of capital gains tax can feel overwhelming, but it doesn't have to be! In this article, we'll break down the essential components of a capital gains tax declaration letter, making the process a lot simpler and more manageable for you. We'll also provide practical tips and templates to help you craft your own letter with ease. So, if you're ready to demystify capital gains tax, let's dive in!

Accurate Personal and Contact Information

Accurate personal and contact information is essential for submitting a capital gains tax declaration. Individuals must include full name, Social Security number or taxpayer identification number (TIN), current residential address, and accurate phone number. In the United States, this information is crucial for IRS records, facilitating correspondence or clarifications. Any discrepancies in contact details can lead to delays in processing or issues with tax refunds. Additionally, an email address can enhance communication with tax authorities, allowing for faster correspondence regarding the declaration status. Accurate and updated information ensures compliance and smooth processing during tax seasons.

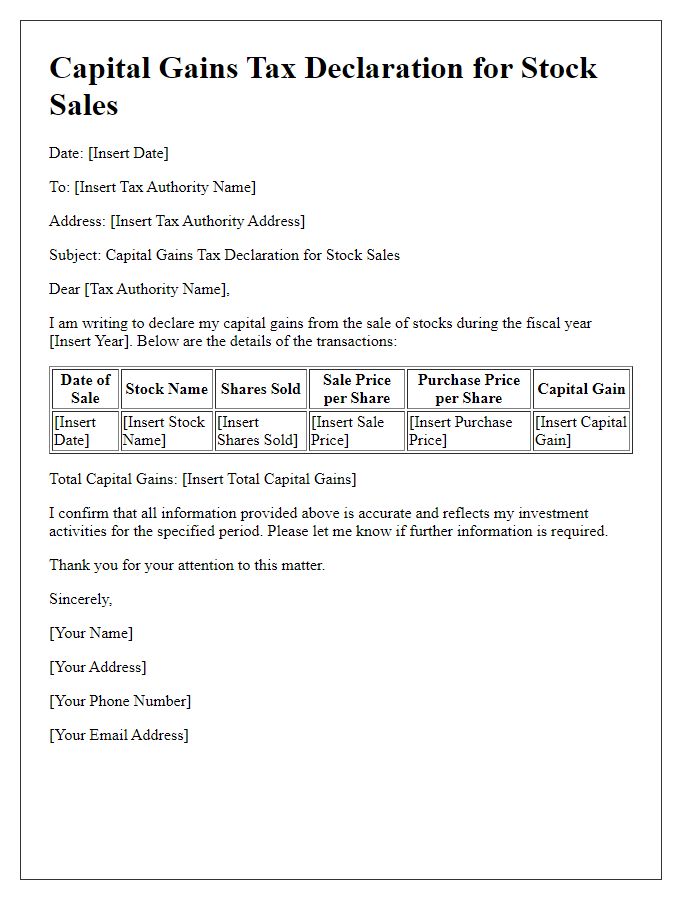

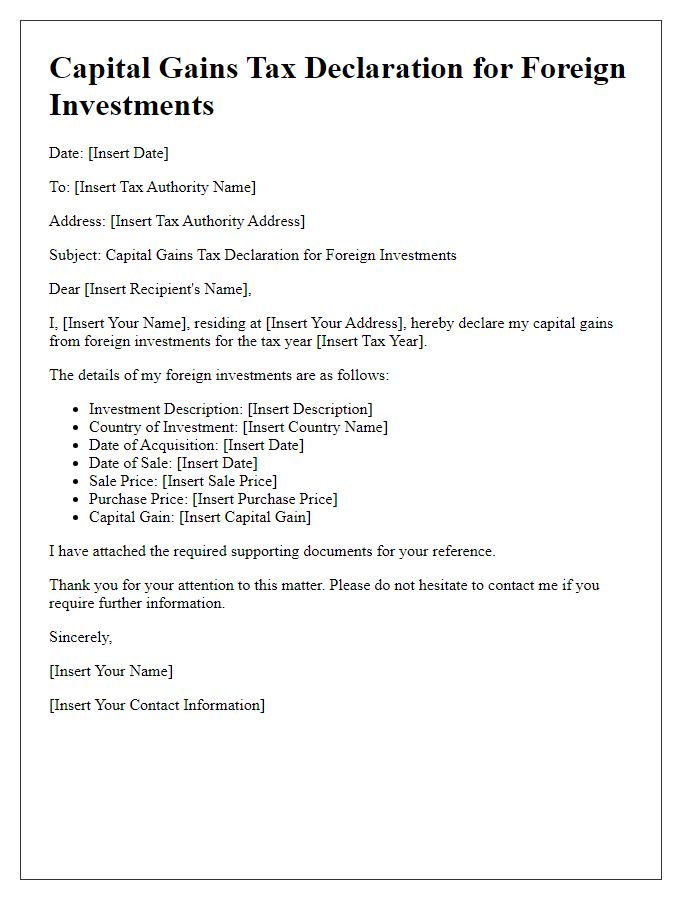

Detailed Asset Information

Capital gains tax declaration requires meticulous documentation of asset information, including specific details necessary for accurate reporting. Real estate properties, for example, must include address (such as 123 Main Street, Springfield), purchase date (October 5, 2015), and sale date (August 15, 2023). Furthermore, the purchase price ($250,000), sale price ($400,000), and any associated costs (like renovations or realtor fees) should be outlined for accurate calculations. Investments in stocks, such as shares of Company ABC, necessitate details like purchase date (June 12, 2018), purchase price ($50 per share), selling date (September 20, 2023), and selling price ($80 per share). Documentation should also reflect any additional pertinent information, such as unique identifiers, market conditions, or significant events influencing asset value during the holding period. Properly organized details ensure compliance with tax regulations and support transparent reporting to the appropriate tax authority.

Calculations of Gains or Losses

Calculating capital gains or losses involves determining the difference between the selling price and the purchase price of an asset, such as stocks or real estate. For example, if a property in California purchased for $350,000 in 2018 is sold for $500,000 in 2023, the capital gain would be $150,000. This amount must be reported for tax purposes, and specific deductions may apply, such as improvements made to the property or selling costs incurred, which can lower the taxable gain. Accurate record-keeping of dates, amounts, and transaction details is essential for compliance with IRS regulations. Furthermore, gains may be subject to different tax rates depending on the holding period, categorized as short-term (assets held for less than one year) or long-term (assets held for more than one year). Tax rates can vary significantly, with long-term capital gains generally taxed at lower rates than ordinary income, enhancing the importance of effective tax planning strategies.

Tax Exemption Clauses or Deductions

When preparing a capital gains tax declaration, understanding tax exemption clauses is essential for minimizing tax liabilities. Specific exemptions apply to sales of primary residences, where homeowners can exclude up to $250,000 in gains for individuals and $500,000 for married couples filing jointly. Retirement accounts, such as 401(k) plans or IRAs, also offer tax deferral benefits, allowing gains to grow without immediate taxation until withdrawal. Certain investments in Qualified Opportunity Zones can lead to deferred or reduced capital gains taxes when the investment meets specific criteria established by the IRS. Notably, investors must keep detailed records of transactions, purchase prices, and improvements made to properties to substantiate claims for deductions or exemptions during the tax filing process. Understanding these provisions within the Internal Revenue Code can significantly impact an individual's financial responsibility each tax year.

Declaration and Signature Section

Capital gains tax declaration documents must include a Declaration and Signature section to validate the information provided by the taxpayer. The declaration statement typically affirms that all reported capital gains, such as from the sale of real estate or stocks, are accurately captured according to the tax year's regulations. Taxpayers should include their full name, social security number, and the specific tax year, ensuring compliance with Internal Revenue Service (IRS) guidelines. Signatures must be added, often requiring both the taxpayer and, if applicable, a spouse or co-owner, with dates to confirm the submission's authenticity. Notary acknowledgment may enhance the document's credibility, particularly for significant transactions, ensuring proper legal standing in case of audits.

Letter Template For Capital Gains Tax Declaration Samples

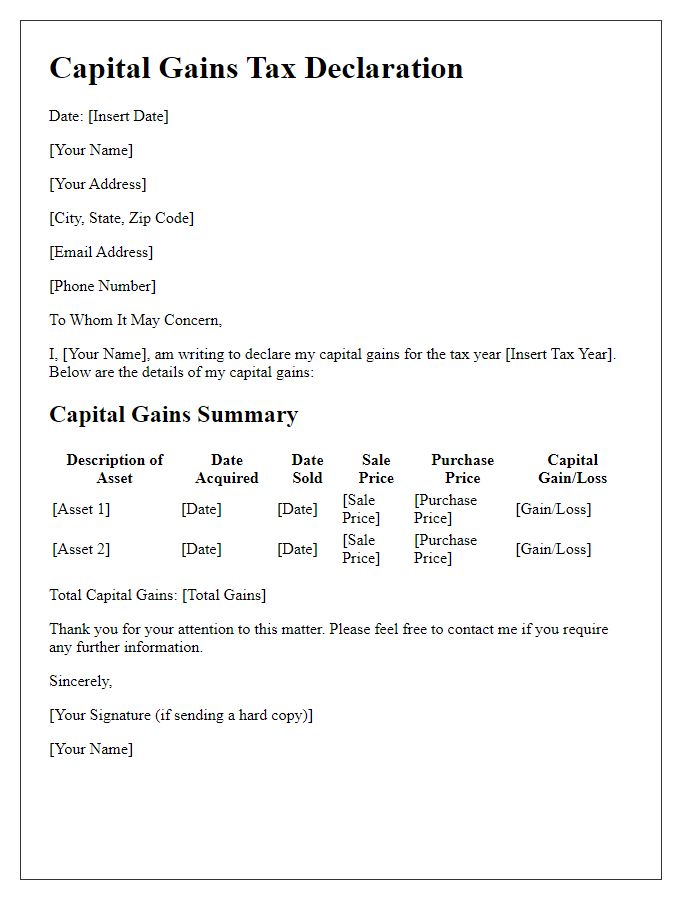

Letter template of capital gains tax declaration for individual investors.

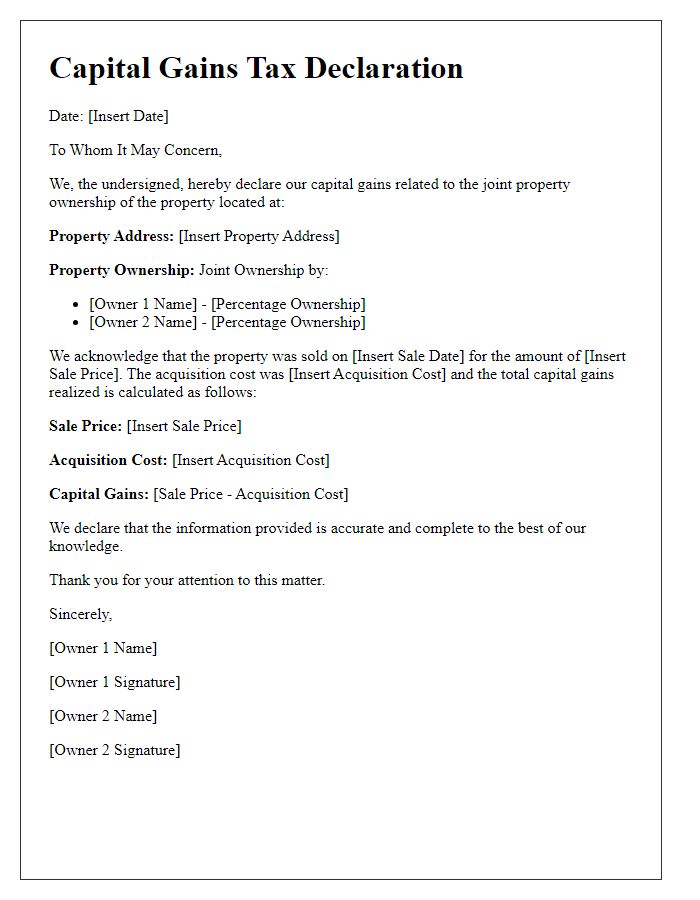

Letter template of capital gains tax declaration for joint property owners.

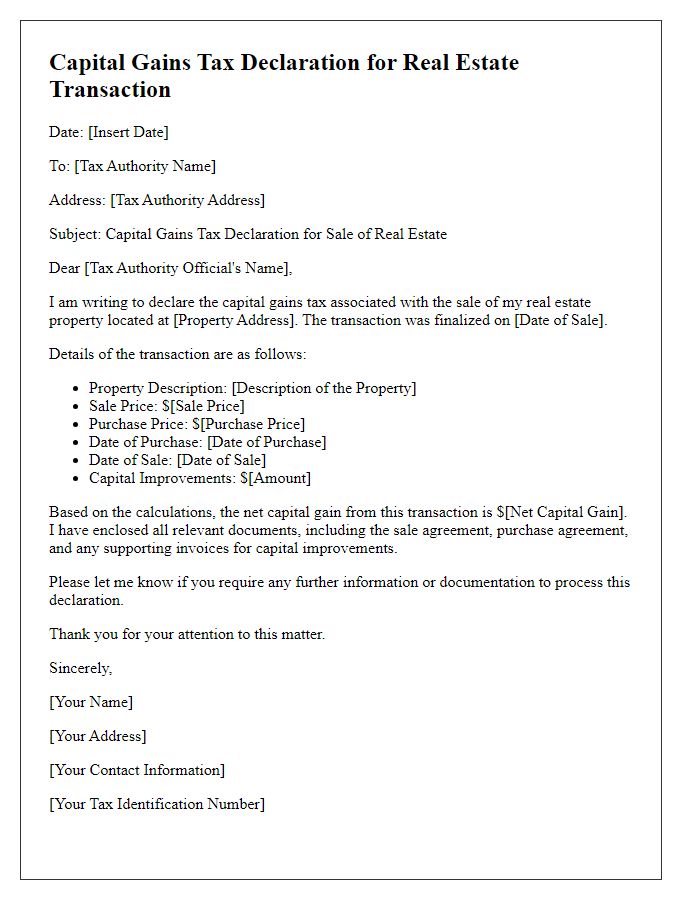

Letter template of capital gains tax declaration for real estate transactions.

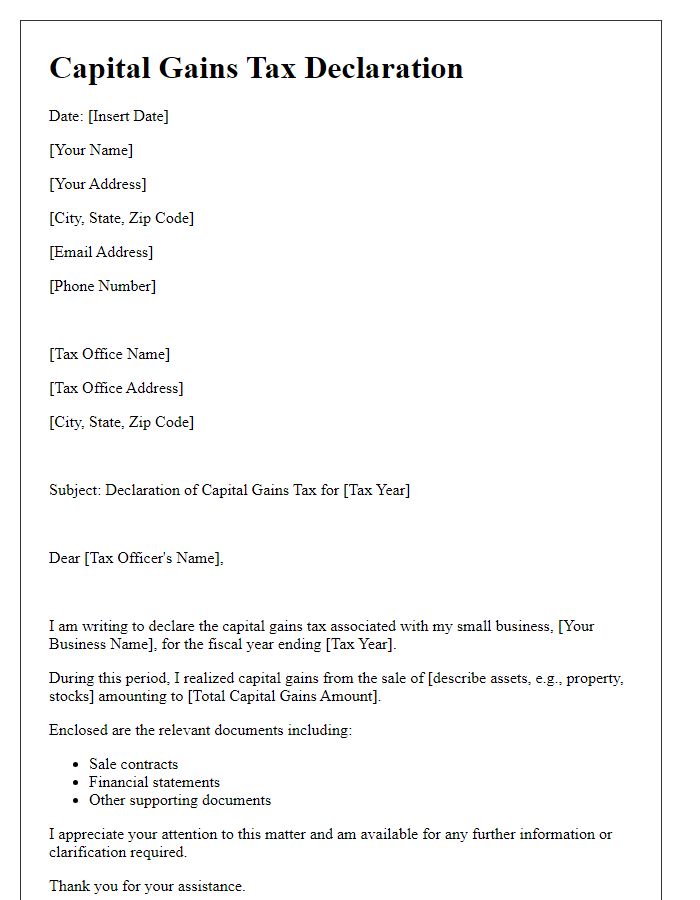

Letter template of capital gains tax declaration for small business owners.

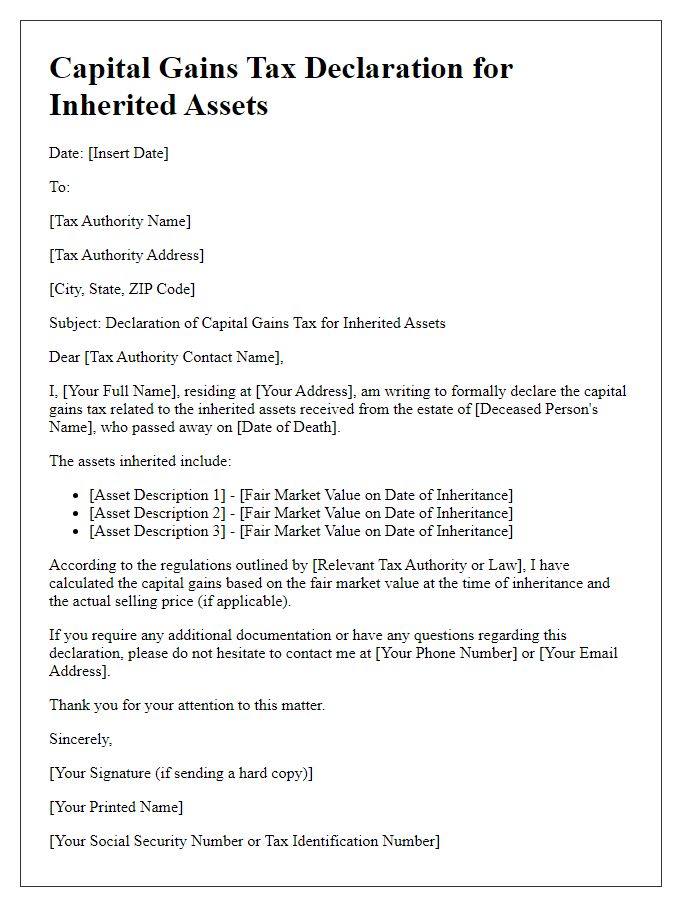

Letter template of capital gains tax declaration for inheritance assets.

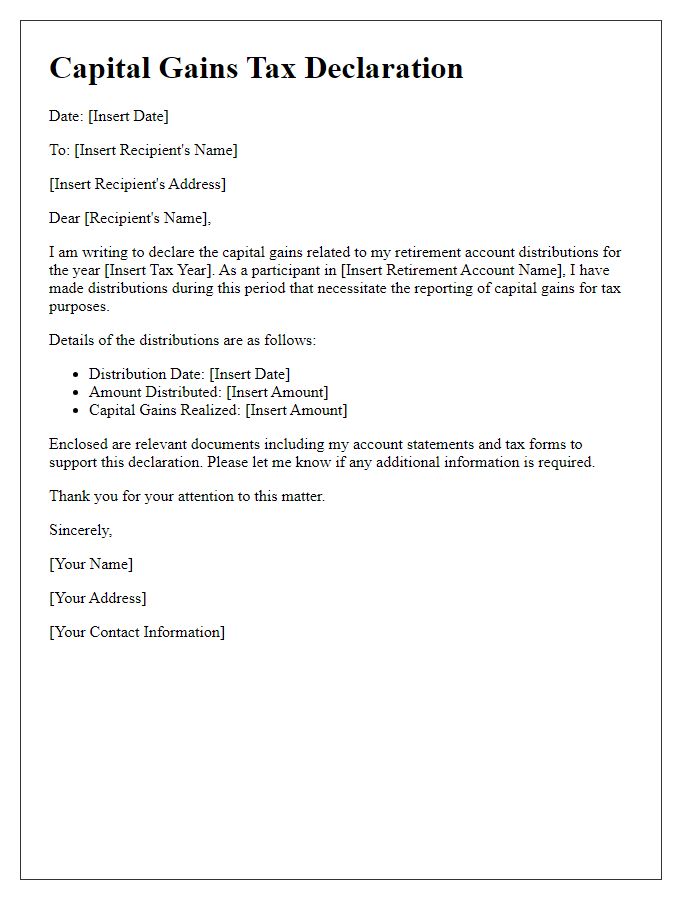

Letter template of capital gains tax declaration for retirement account distributions.

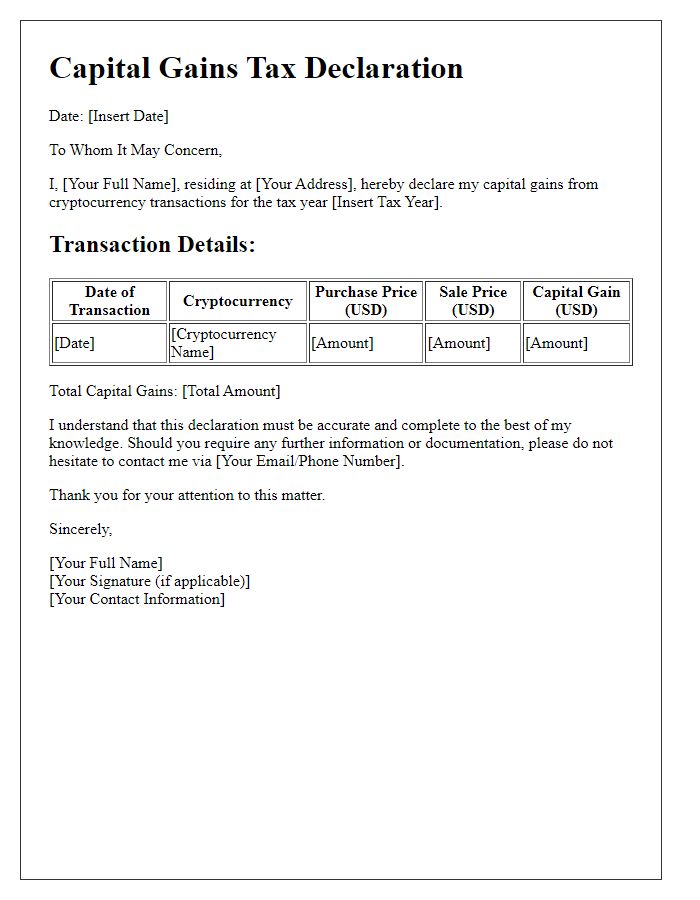

Letter template of capital gains tax declaration for cryptocurrency transactions.

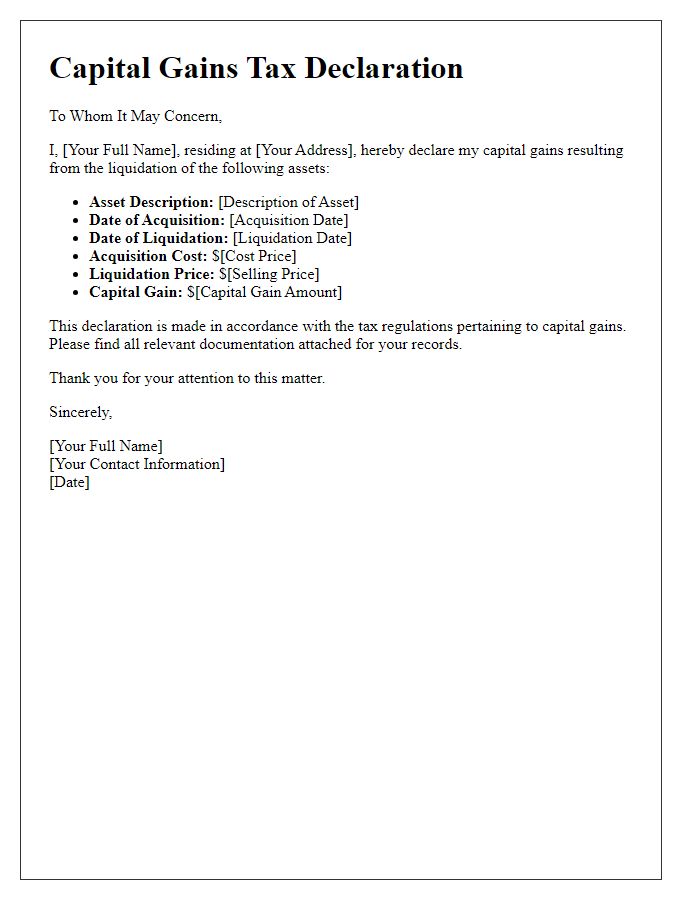

Letter template of capital gains tax declaration for asset liquidations.

Comments