Are you feeling overwhelmed by the complexities of professional taxes? It's a common challenge many face, and understanding the nuances can make a significant difference in your financial health. Our team of experienced tax consultants is here to help you navigate this intricate landscape and ensure you're maximizing your benefits. Ready to take the first step towards tax clarity? Read more to discover how we can assist you!

Personalization of Recipient Details

A personalized invitation for a professional tax consultation can enhance engagement and build rapport with the recipient. Including specific details such as the recipient's name, business title, and company can create a welcoming tone. Mentioning relevant tax topics, deadlines, or challenges specific to their industry, such as corporate tax changes or personal deductions, can demonstrate an understanding of their needs. Highlighting the benefits of the consultation, such as maximizing tax savings or ensuring compliance with regulations like the Internal Revenue Code, can encourage participation. Offering a convenient meeting method, whether in-person or virtual, can enhance accessibility and accommodate the recipient's preferences for the consultation.

Clear Objective Statement

Myriad businesses navigate the complexities of tax regulations, often requiring expert guidance for compliance and optimization. Professional tax consultation provides tailored insights, ensuring adherence to evolving laws and maximizing tax benefits. Understanding nuances such as eligible deductions and credits can significantly enhance financial outcomes. Engaging a tax professional not only alleviates the burden of tax season but also fosters strategic planning throughout the fiscal year. Through this personalized consultation, clients can expect clarity in tax implications, ultimately driving informed decision-making for business growth.

Highlight Expertise and Qualifications

Expert tax consultation services offer invaluable insights for individuals and businesses seeking to navigate the complexities of financial regulations. Certified Public Accountants (CPAs) with specialized tax training, such as Enrolled Agents (EAs), possess in-depth knowledge of current tax laws and strategies for maximizing deductions. Their experience with audits extends to understanding IRS procedures and regulations, providing clients peace of mind during potential investigations. Additionally, tax consultants often hold advanced degrees in Finance or Accounting, equipping them with analytical skills necessary for effective tax planning. With extensive experience across various sectors, including healthcare, technology, and real estate, these professionals can tailor tax strategies to specific industry needs, optimizing financial outcomes for their clients.

Call to Action and Response Instructions

Invitation to professional tax consultation can enhance personal financial understanding and strategic planning. Engaging a certified tax consultant can provide invaluable insights into tax compliance, deductions, and credits applicable to individual circumstances. Moreover, tailored advice can help navigate complex tax laws, potentially saving individuals significant amounts of money during filing seasons. To participate, simply respond with your preferred availability for a consultation call, specifying time slots on weekdays, and the expert will provide personalized solutions based on your unique financial situation.

Contact Information and Availability

Consider scheduling a professional tax consultation to navigate the complexities of tax regulations and optimize your financial strategies. Tax laws, such as the Internal Revenue Code in the United States, can be intricate and continually changing. Engaging with a qualified tax consultant can help clarify deductions, credits, and compliance requirements, ultimately maximizing your tax benefits. Availability for consultations may vary; securing a time early can ensure you receive timely expert advice specific to your needs. Please be ready to discuss important documents, such as income statements and expense records, during your session to facilitate a productive meeting.

Letter Template For Professional Tax Consultation Invitation Samples

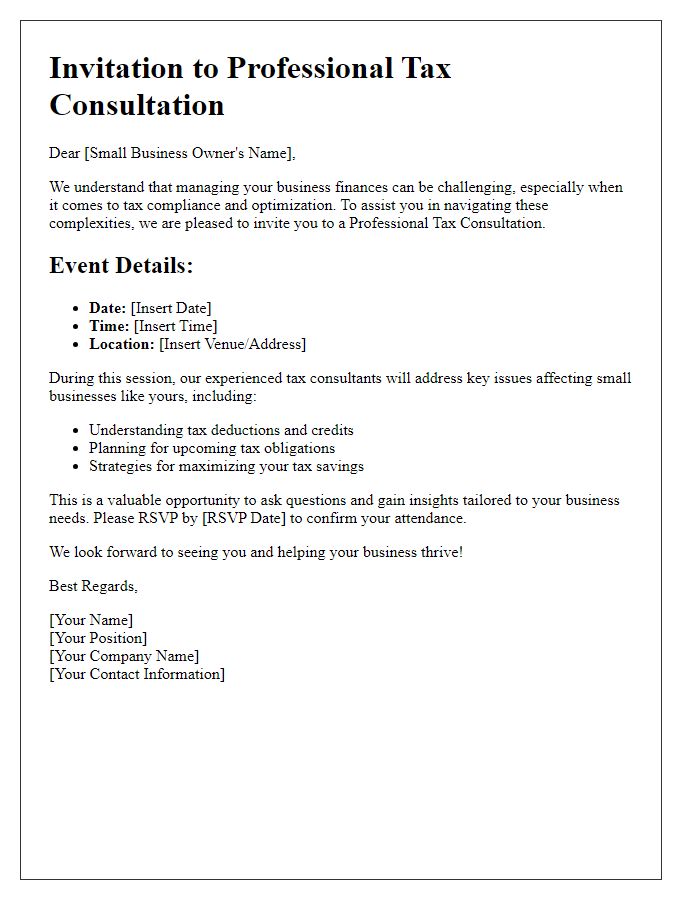

Letter template of Professional Tax Consultation Invitation for Small Business Owners

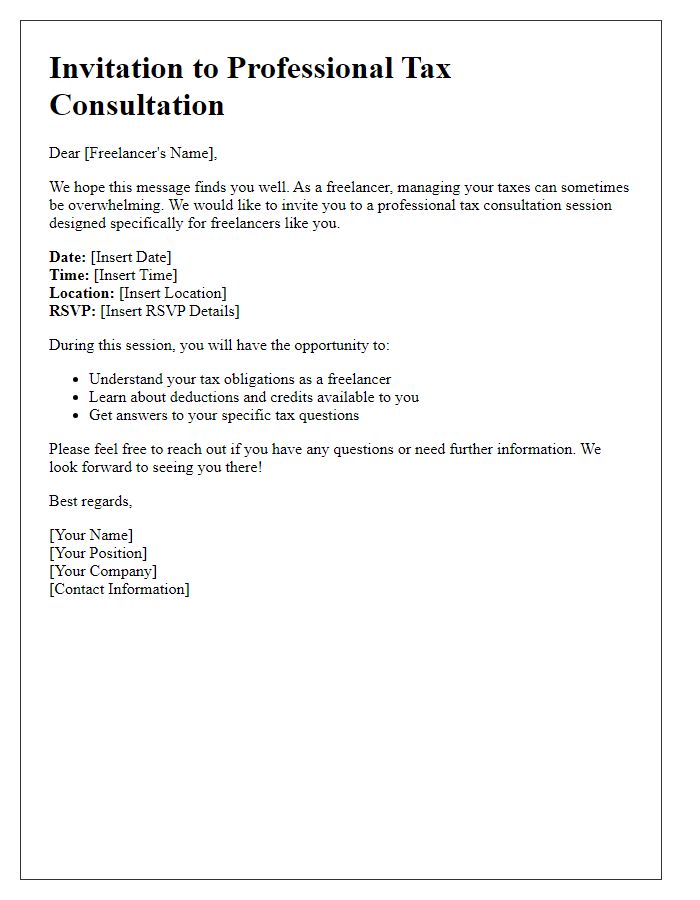

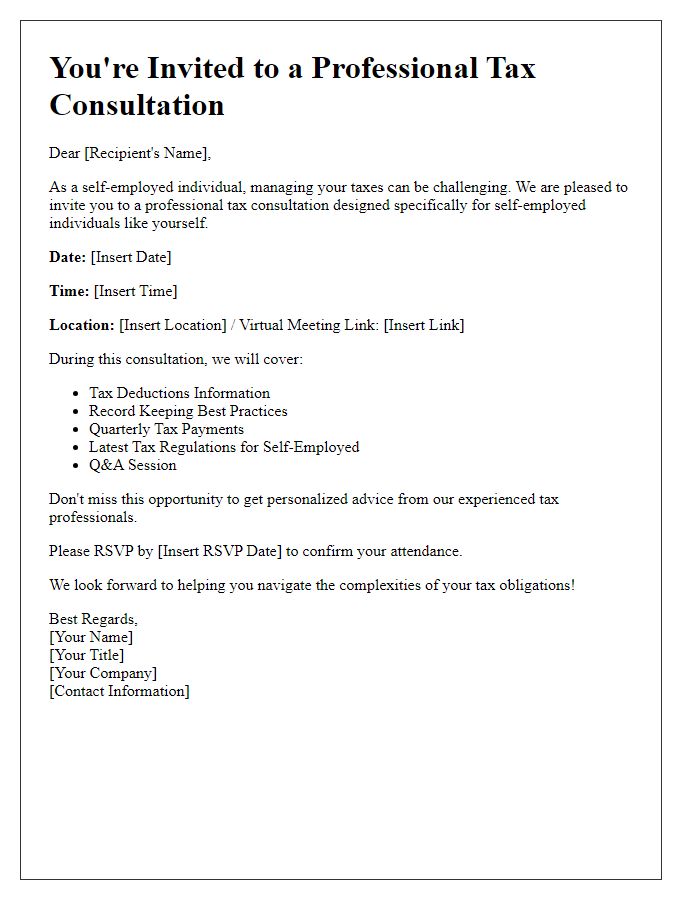

Letter template of Professional Tax Consultation Invitation for Freelancers

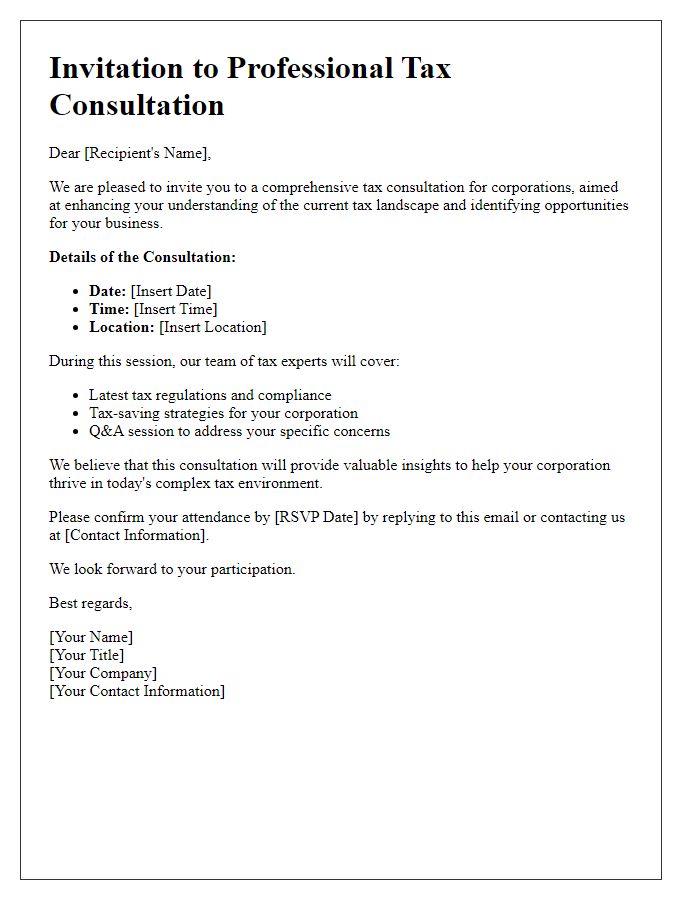

Letter template of Professional Tax Consultation Invitation for Corporations

Letter template of Professional Tax Consultation Invitation for Nonprofits

Letter template of Professional Tax Consultation Invitation for Remote Workers

Letter template of Professional Tax Consultation Invitation for Real Estate Investors

Letter template of Professional Tax Consultation Invitation for Startups

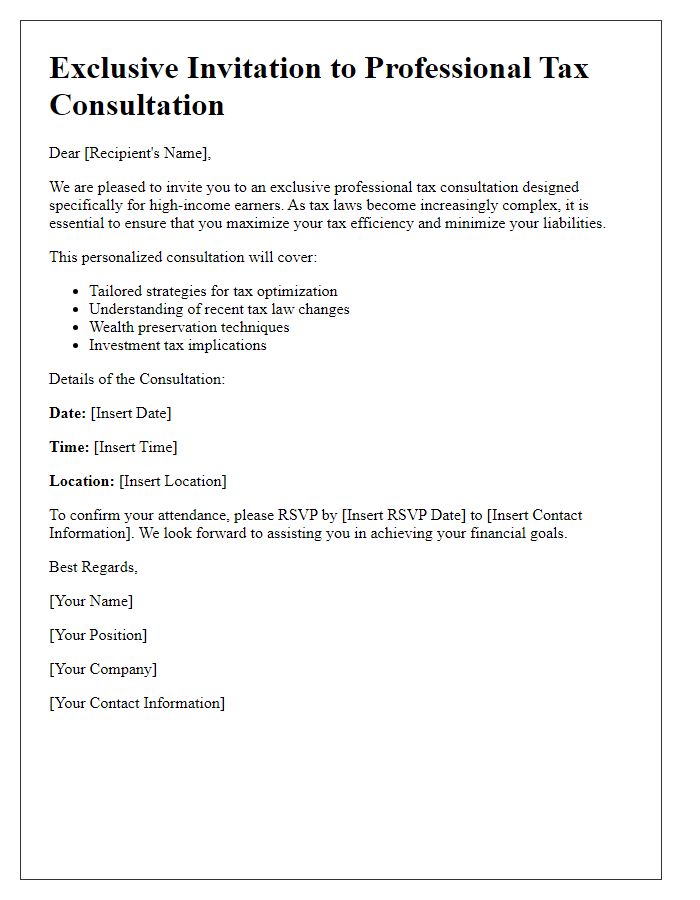

Letter template of Professional Tax Consultation Invitation for High-Income Earners

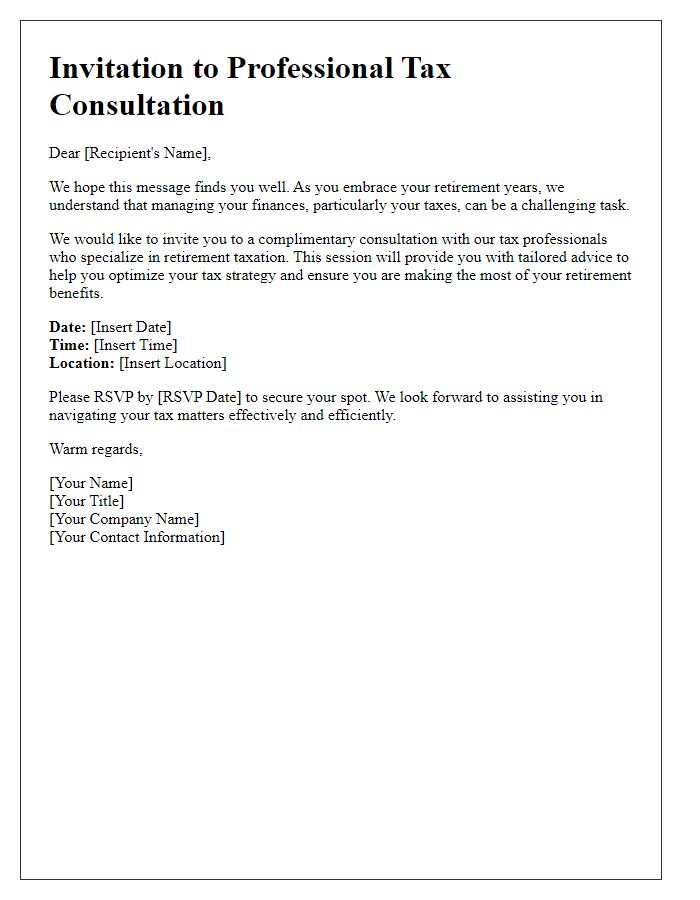

Letter template of Professional Tax Consultation Invitation for Retirees

Comments