Are you feeling confused about the complexities of municipal tax rebates? You're not aloneâmany residents share your concerns about understanding their eligibility and the application process. This article aims to break down the essential information you need to know, making the tax rebate process more accessible and less daunting. So, if you're ready to demystify municipal tax rebates, keep reading for a clear and comprehensive guide!

Subject line clarity

Subject lines play a crucial role in ensuring communication is clear and effective, especially in municipal tax rebate clarification requests. For instance, a well-structured subject line such as "Request for Clarification on Municipal Tax Rebate Eligibility for 2023" provides immediate context regarding the purpose of the email. Including specific details, like the year (2023) and the focus on eligibility, helps in directing the inquiry to the appropriate department within the municipal office, thereby facilitating a quicker response. Other effective examples might include "Inquiry Regarding Application Process for Local Tax Rebate" or "Clarification Needed on Tax Rebate Issuance Timeline." These phrasing techniques enhance clarity and efficiency in municipal correspondence.

Proper salutation

Municipal tax rebates can provide significant financial relief for homeowners in various jurisdictions. These rebates often apply to property taxes collected by local governments (e.g., cities, towns) aiming to assist eligible residents. Understanding eligibility criteria, which may include income limits or property value assessments, is vital for taxpayers. Specific forms, deadlines (typically annually), and submission processes must be followed to qualify. Municipalities may offer varying rebate amounts, reflecting local budgets and policy priorities. Homeowners are encouraged to contact their local tax office for clarification on specific rebate programs and to ensure proper documentation is submitted on time.

Reference to specific tax rebate

Municipal tax rebates, such as those offered by the City of Boston, often provide financial relief for residents facing economic hardships. These rebates can significantly reduce annual property tax bills, encouraging local engagement and community support. The specific tax rebate, known as the Senior Tax Exemption, allows qualified senior citizens (aged 65 and older) to receive up to a 50% reduction on their property taxes, contingent upon meeting income limits (typically set at $58,000 for single applicants). Residents must apply annually, providing necessary documentation to confirm eligibility. Understanding the eligibility requirements and application deadlines, which typically fall around the end of January, is vital to benefit from this municipal support.

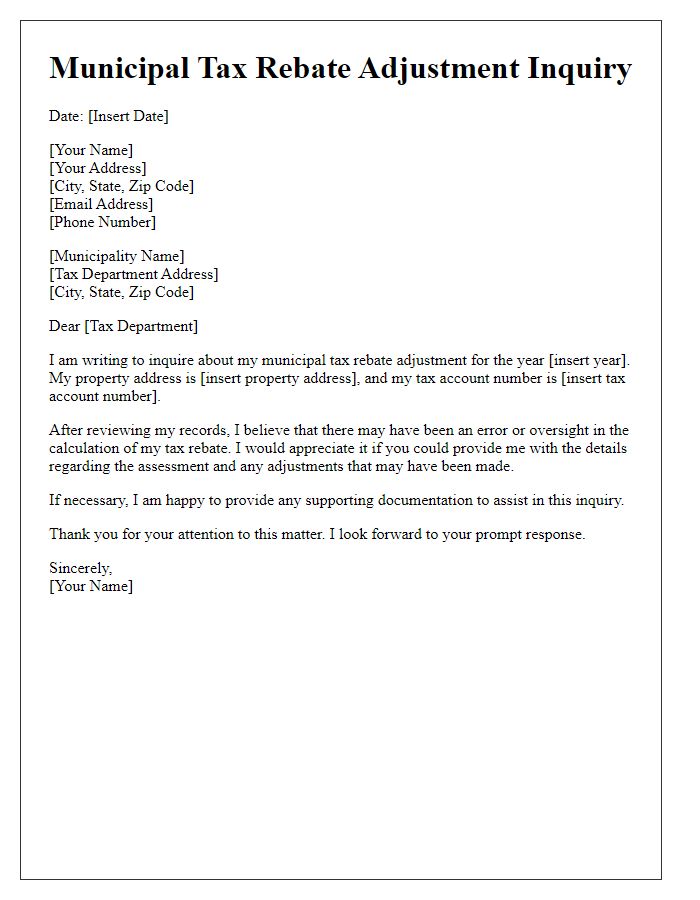

Clear explanation of the query

Municipal tax rebate programs offer residents potential financial relief on property taxes, yet many individuals encounter confusion regarding eligibility criteria, application processes, and rebate amounts. Specific parameters, such as income thresholds, property ownership status, and the required documentation (for example, proof of residency and income verification), often create uncertainty. Furthermore, deadlines for submission can vary, impacting a resident's ability to benefit from available rebates. Local municipal offices, such as the Department of Finance in New York City, typically provide resources but may be overwhelmed during peak times, causing delays in response. Overall, efficient clarification of these aspects is crucial for residents seeking to navigate tax rebate opportunities effectively.

Contact information for follow-up

Municipal tax rebates, such as those offered by city governments, can significantly alleviate financial burdens for residents. Local jurisdictions often provide essential details regarding eligibility criteria, application processes, and deadlines. For instance, cities like Chicago may have specific income thresholds or property value limits that determine rebate eligibility. Residents are encouraged to gather required documents, including proof of income and property ownership, to streamline the application process. Clarification on criteria can typically be obtained from the local tax office's contact information, which often includes a dedicated phone number or email address for inquiries. It is vital for residents to stay informed about potential changes in policy or deadlines to ensure they do not miss out on available financial relief options.

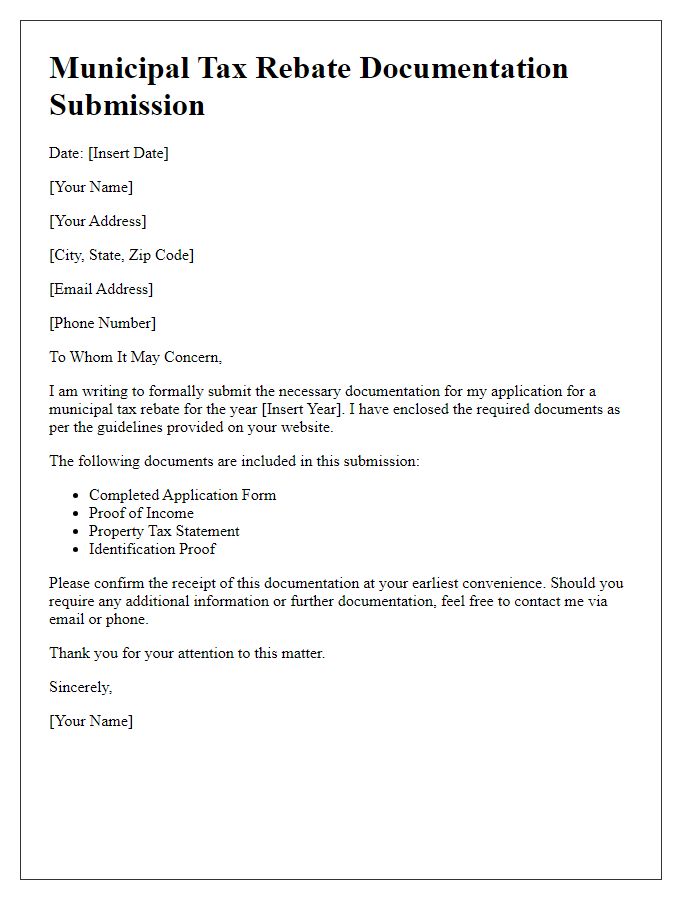

Letter Template For Municipal Tax Rebate Clarification Samples

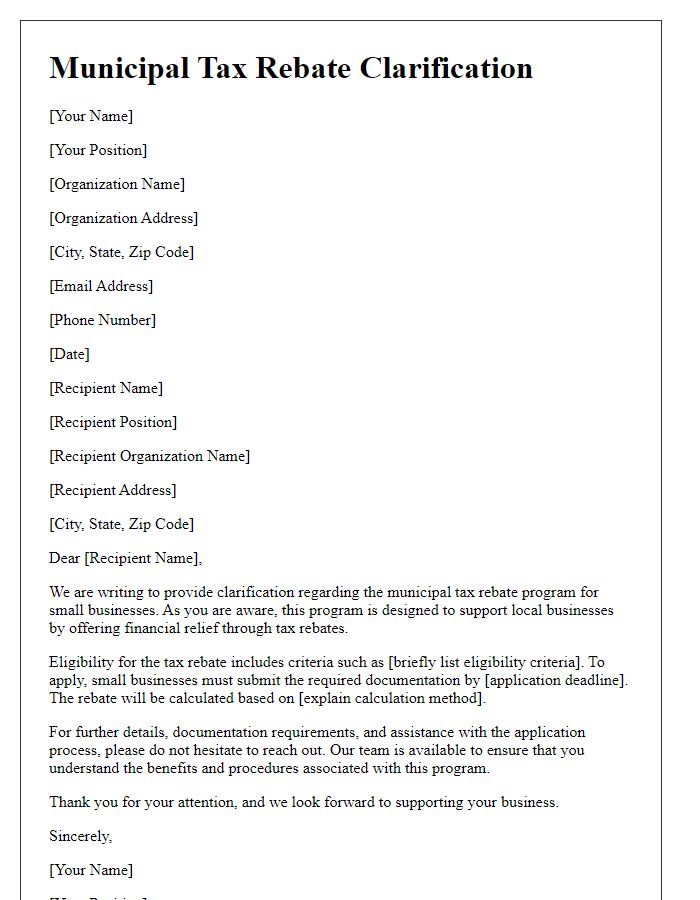

Letter template of municipal tax rebate clarification for small businesses.

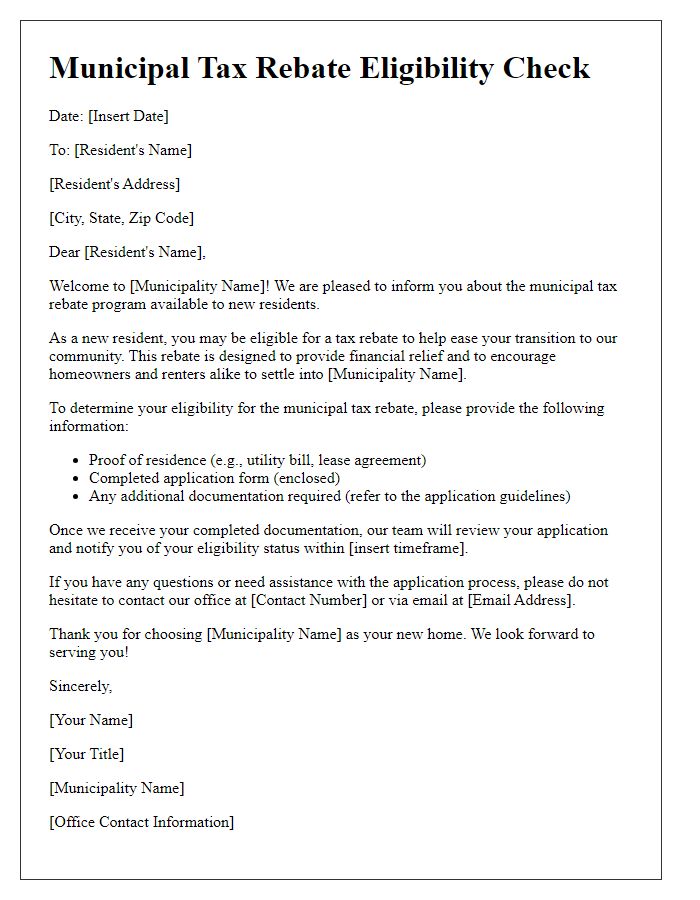

Letter template of municipal tax rebate eligibility check for new residents.

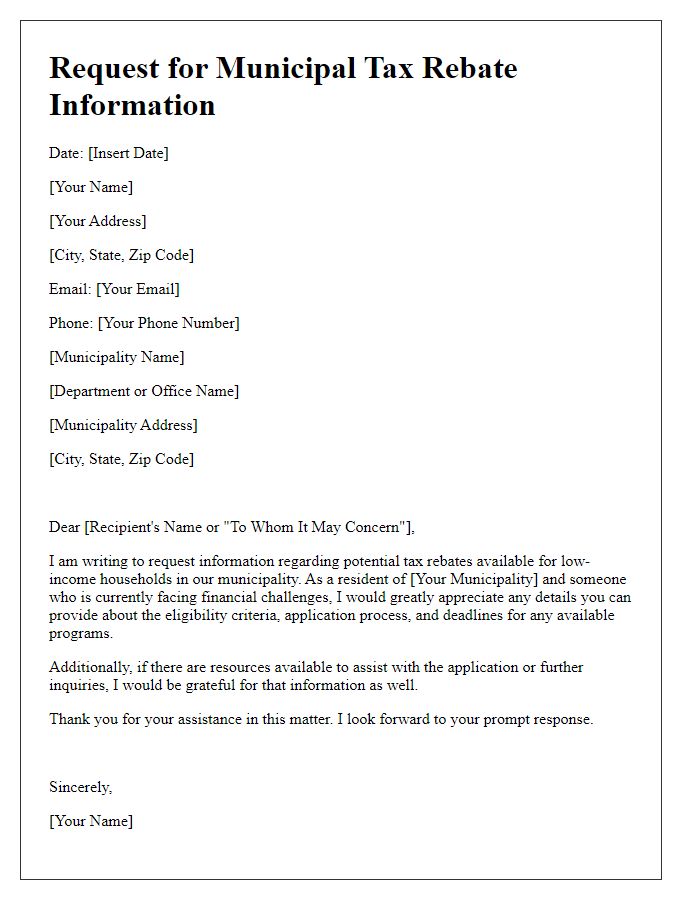

Letter template of municipal tax rebate information request for low-income households.

Comments