Are you a small business owner looking to maximize your tax savings? Understanding the various tax benefits available to small businesses can be a game changer for your financial health. In this article, we'll explore the key advantages and strategies to help you navigate the application process effortlessly. So, grab a cup of coffee and read on to discover how you can make the most of your tax benefits!

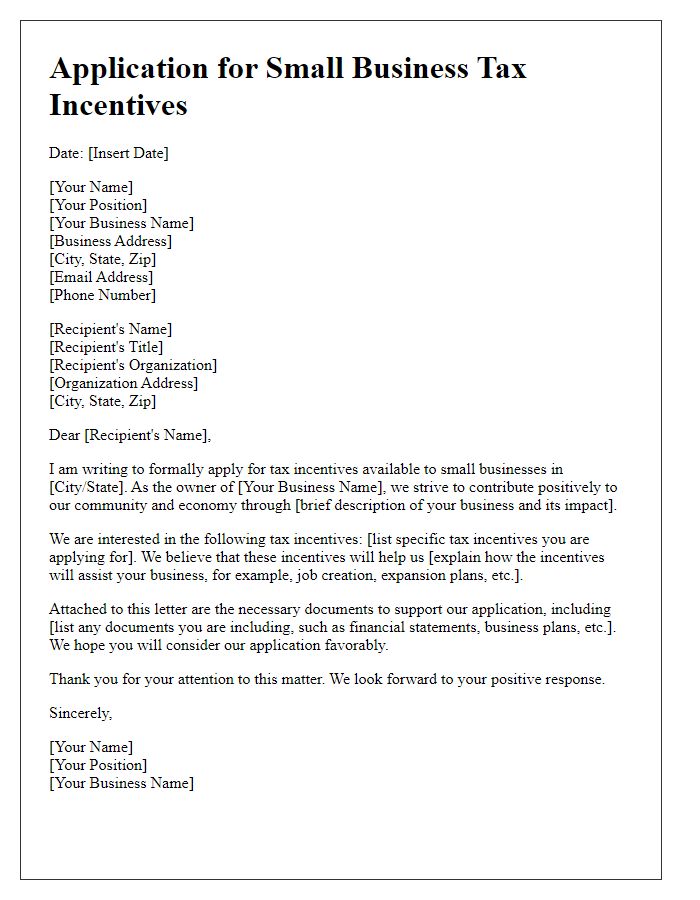

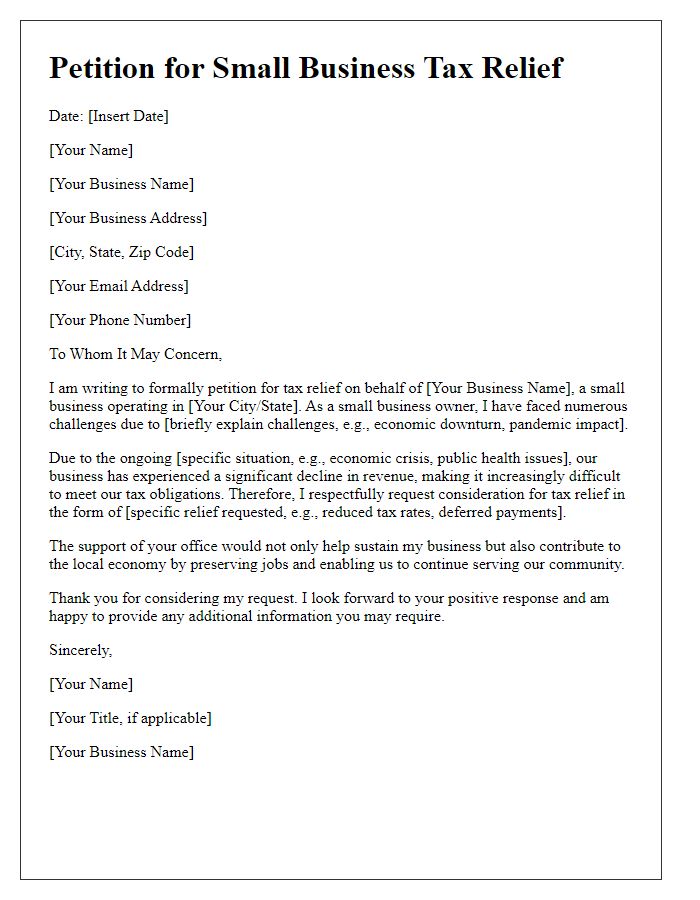

Clear Business Identification

A clear business identification ensures proper categorization within tax systems, crucial for small business tax benefits. Unique identifiers such as Employer Identification Number (EIN) issued by the Internal Revenue Service (IRS) streamline tax processing. Additionally, a valid business structure, whether sole proprietorship, partnership, or corporation, influences tax obligations and benefits. Registration with the state in which the business operates enhances credibility and compliance, while correct classification under appropriate industry codes (such as NAICS - North American Industry Classification System) aligns businesses with specific tax relief opportunities. Maintaining accurate records of business names, addresses, and contact information is essential for audits and eligibility verification for financial incentives, grants, or credits.

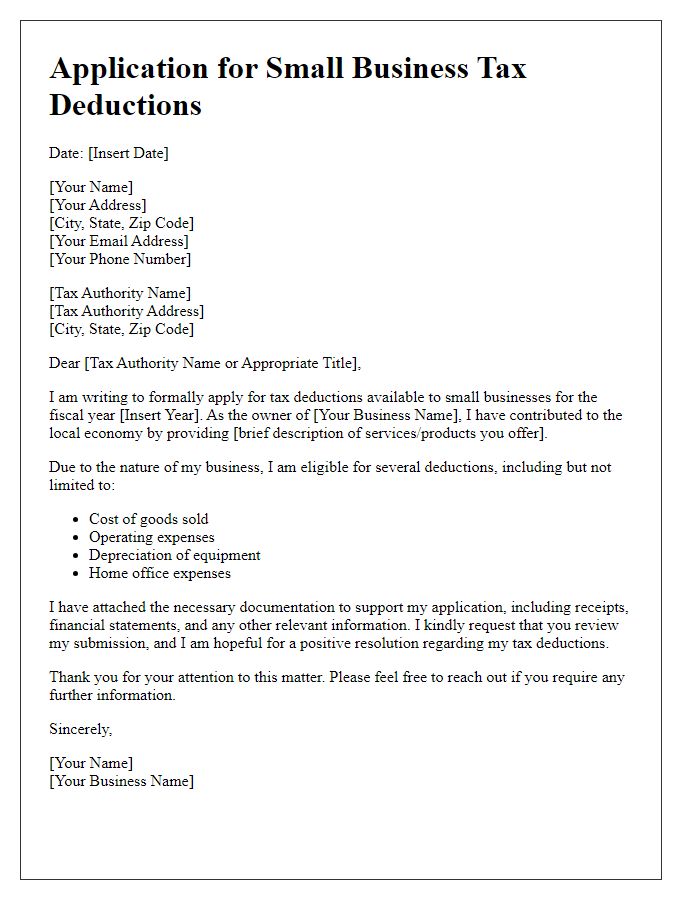

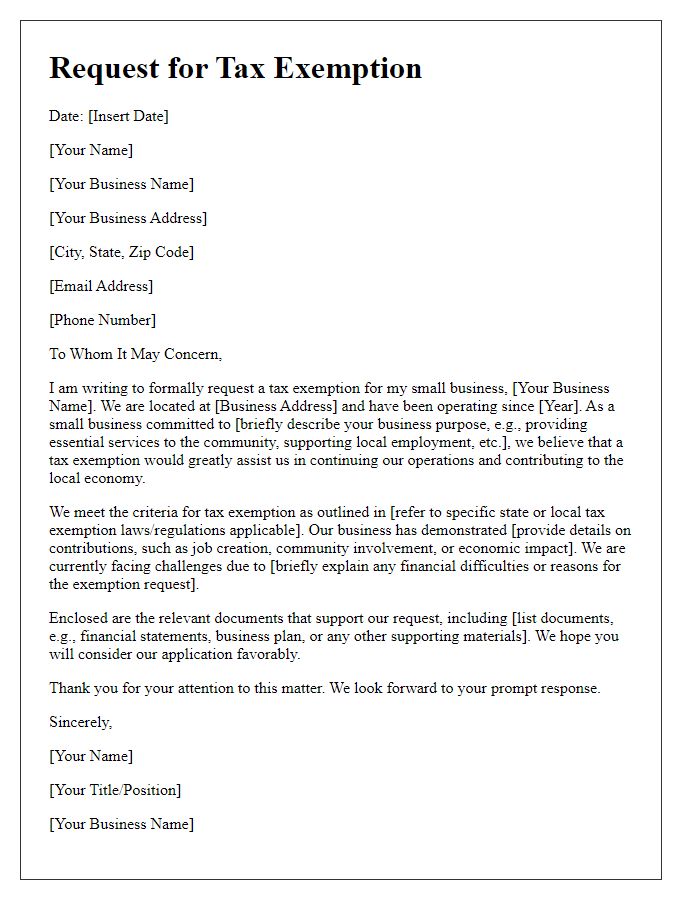

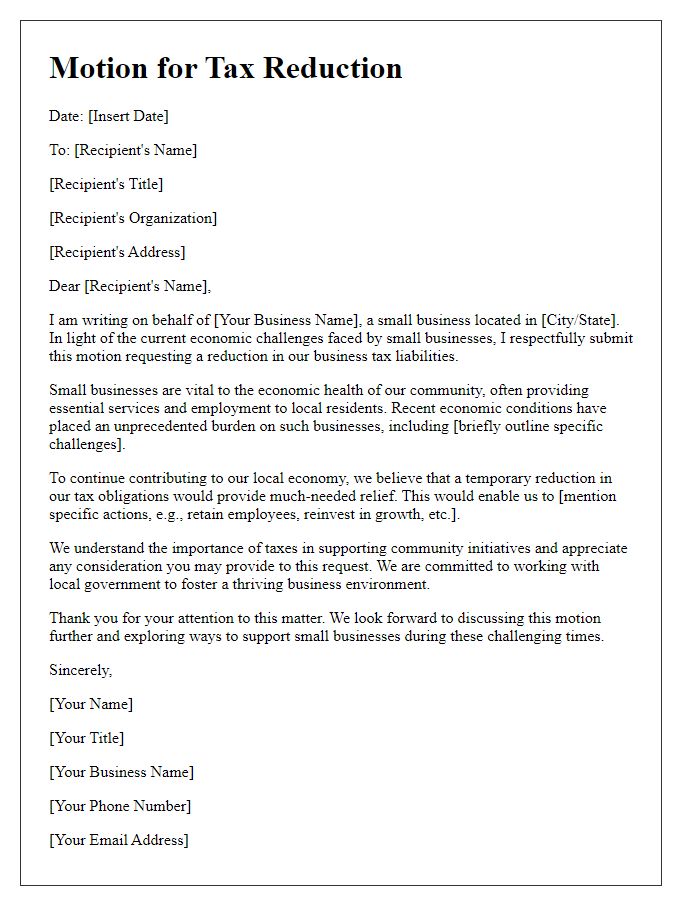

Specific Tax Benefits Requested

Small businesses often seek specific tax benefits to enhance their financial stability and growth. For instance, Section 179 of the Internal Revenue Code allows businesses to deduct the full purchase price of qualifying equipment and software, fostering investment in essential tools. The Employee Retention Credit provides significant relief by incentivizing businesses to retain employees during economic downturns or crises, a vital measure during challenging periods such as the COVID-19 pandemic. Research and Development Tax Credits reward companies investing in innovation, contributing to technological advancements and economic development. Additionally, local or state-level tax incentives may be available to encourage business expansion within specific regions, such as Opportunity Zones designated by the U.S. government to stimulate growth in economically distressed areas. Understanding and applying for these advantages can drive a small business's success.

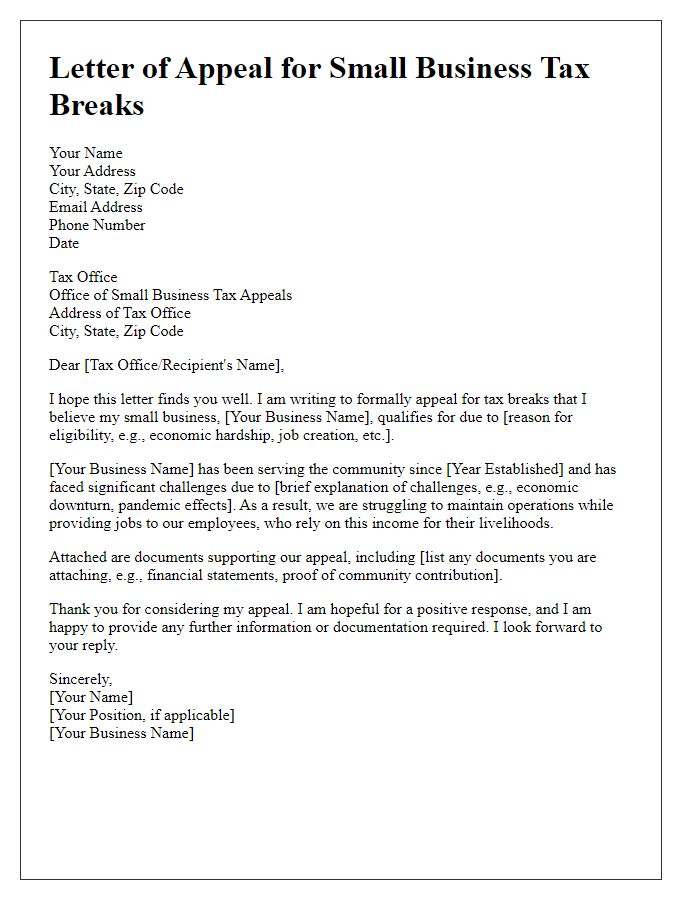

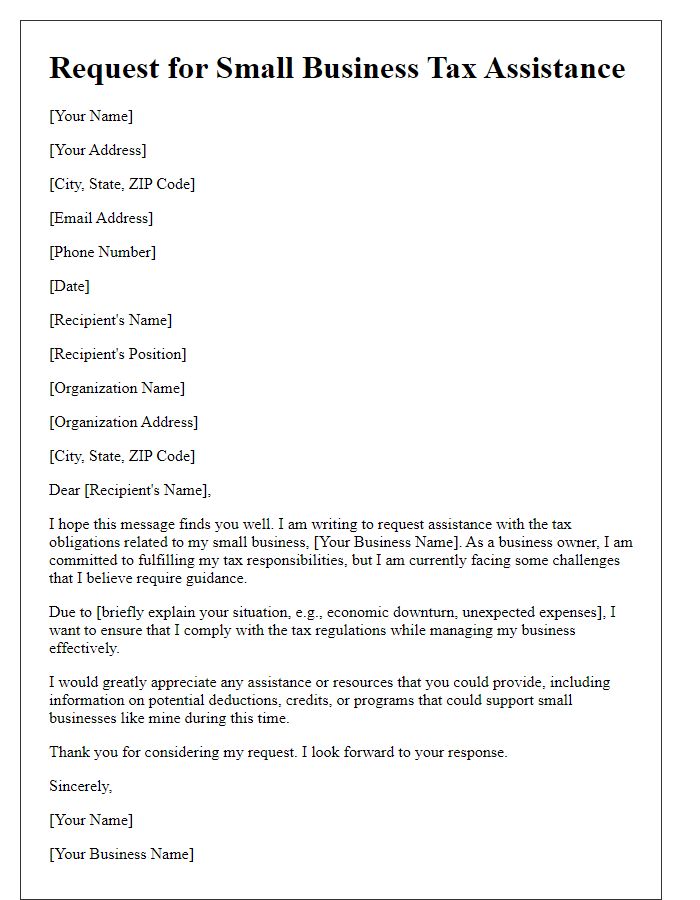

Detailed Financial Information

Small businesses often seek tax benefits to enhance their financial standing and operational capabilities. Detailed financial information plays a crucial role in this application process. Financial statements, including income statements, balance sheets, and cash flow statements provide a comprehensive overview of the business's fiscal health. These documents should reflect accurate revenues, expenditures, and cash reserves over the past fiscal year. Specific figures, such as annual revenue exceeding $500,000 or total liabilities under $250,000, can qualify businesses for certain tax credits, like the Small Business Health Care Tax Credit. Documentation of the business's expenditures on employee salaries, materials, and services is essential to illustrate eligibility for various deductions. Properly detailing these financial metrics supports an argument for tax benefits, showcasing the business's commitment to growth and contribution to the local economy.

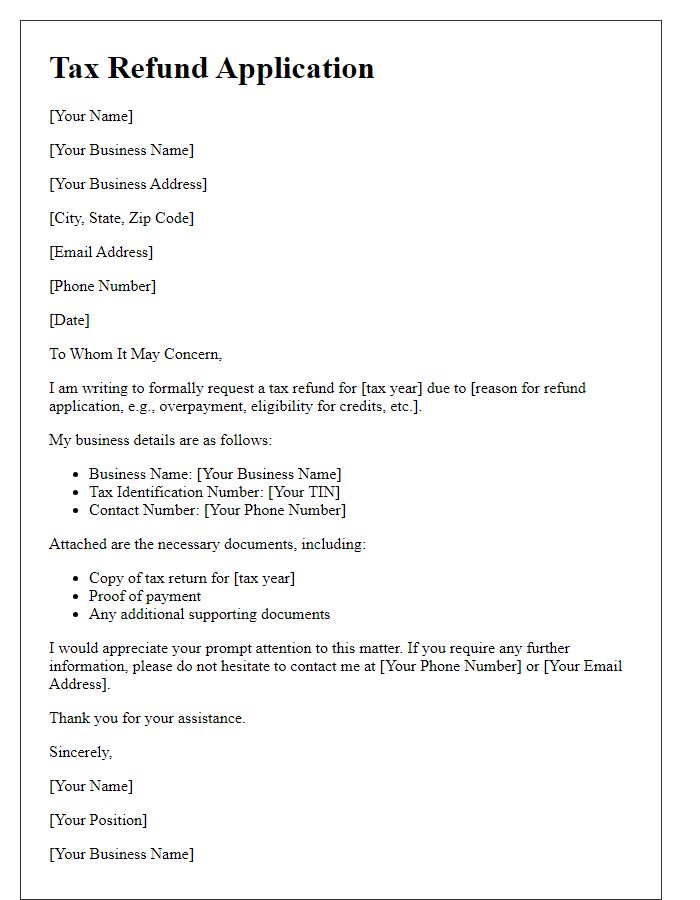

Supporting Documentation

Supporting documentation plays a crucial role in the tax benefits application for small businesses. This includes financial statements, such as profit and loss statements and balance sheets, providing an overview of the business's performance during the fiscal year (typically January to December). Tax returns from the previous year (for instance, 2022 returns) are necessary to demonstrate compliance with tax obligations. Payroll records detailing employee wages, hours worked, and withholdings can substantiate claims related to employment tax credits. Additionally, invoices or receipts related to business expenses including supplies, equipment purchases, and utilities can highlight eligibility for deductions. Independent contractor agreements may also be included to showcase freelance services contributing to business operations. Finally, bank statements reflecting cash flow patterns ensure a comprehensive understanding of financial health when applying for potential tax benefits.

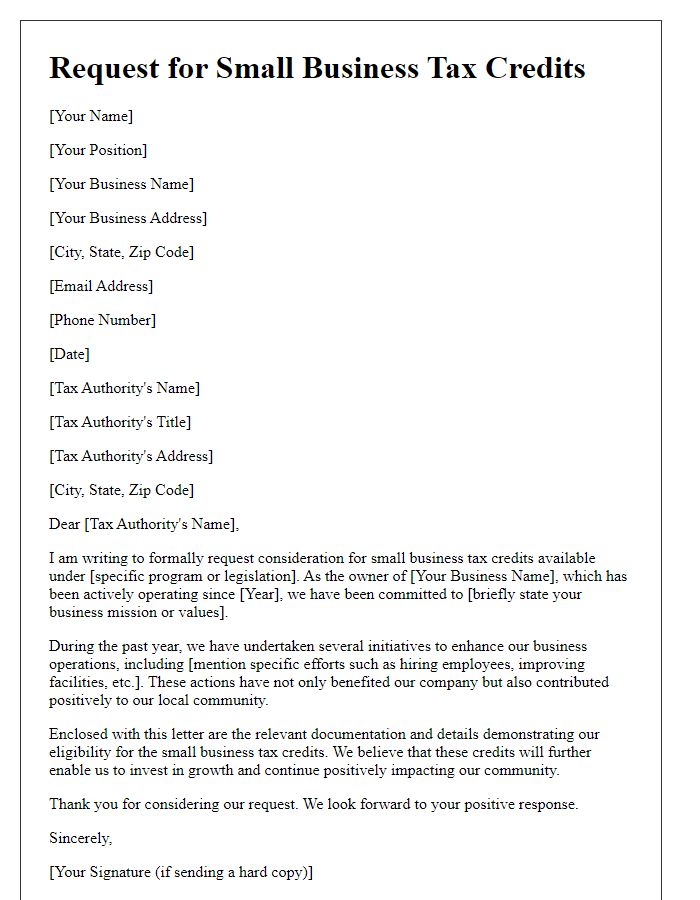

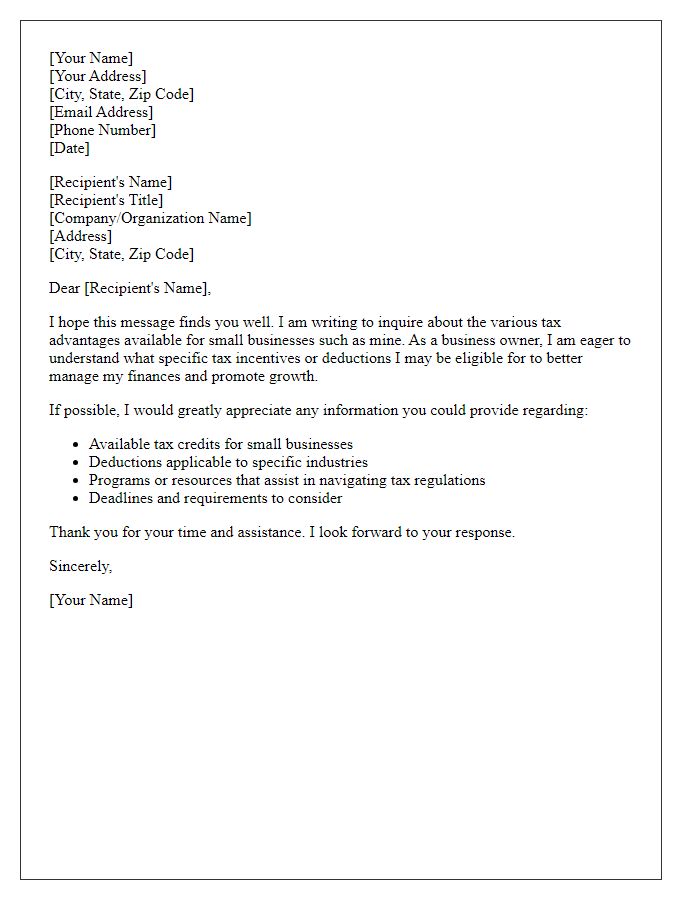

Contact Information

Contact information for small business tax benefits applications should include essential details for easy communication with relevant agencies. Primary contact name, specific business title, and direct phone number are crucial. Include a valid email address, which serves as an efficient communication channel for notifications or updates. Complete business address, including street number, city, state, and zip code, is necessary for correspondence. Additionally, tax identification number (TIN) or employer identification number (EIN) provides unique identification for the business entity. Providing this accurate information streamlines the application process, ensuring that small businesses can effectively access applicable tax benefits.

Comments