Are you navigating the complex waters of tax rebates in the tourism industry? Understanding the ins and outs of these financial incentives can be daunting, but it's essential for maximizing your business's potential. With the right strategies, you can uncover various opportunities that not only help your bottom line but also support the growth of tourism in your area. Dive into our article to explore how to effectively apply for tourism industry tax rebates and boost your profitability!

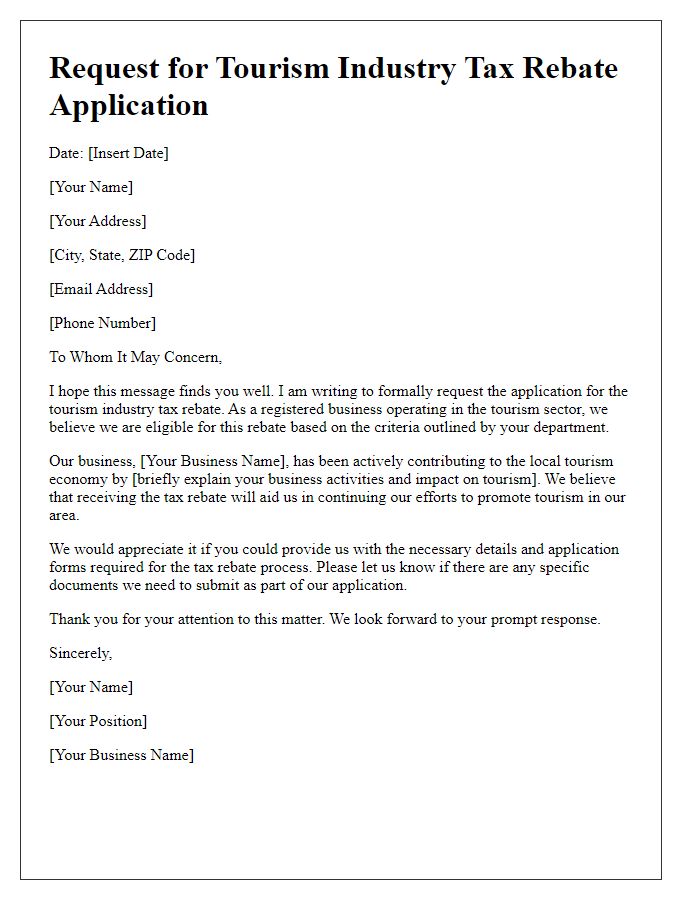

Business Identification Details

Tourism operators in the industry such as hotels, tour companies, and travel agencies must accurately submit their Business Identification Details for tax rebate applications. Essential information includes the business's legal name, operating address, and federal tax identification number (EIN), which enables proper verification by regulatory bodies. The date of establishment, registration status with the local chamber of commerce, and the nature of services offered such as accommodations, guided tours, or transportation also play a critical role in the validation process. Furthermore, documentation proving compliance with health and safety regulations, especially in popular tourist destinations like Orlando or Paris, can strengthen the application. Accurate details ensure businesses reap the full benefits of available tax rebates, ultimately bolstering the tourism sector's economic recovery.

Specific Tax Rebate Code or Reference

Tourism industry tax rebates serve as a financial relief for businesses affected by economic fluctuations, such as the COVID-19 pandemic. Specific Tax Rebate Codes, like the 1234-5678 referenced in local tax regulations, streamline application processes for reimbursable expenses and tax credits for eligible entities. This program aids various sectors within tourism, including hotels, restaurants, and travel agencies, fostering economic recovery in tourist-heavy areas like Orlando, Florida, and Las Vegas, Nevada. By implementing these rebates, local governments aim to stimulate job creation and sustain livelihoods tied to the tourism economy, ultimately enhancing visitor experiences and increasing regional competitiveness.

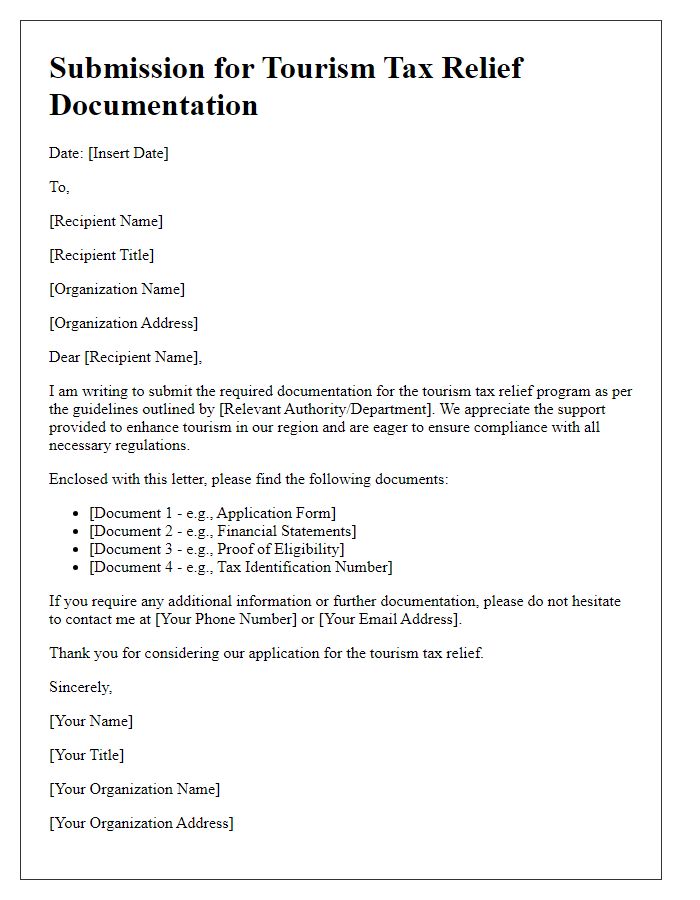

Detailed Revenue and Expense Report

A comprehensive revenue and expense report for the tourism industry outlines vital financial data critical for assessing tax rebate eligibility, specifically for businesses operating within tourist hotspots like Orlando, Florida. This document should include a breakdown of revenue streams, such as hotel accommodations (averaging $150 per night per room), guided tours (often priced between $50 to $300 per person), and food and beverage sales, which can significantly fluctuate during peak seasons (June to August). Additionally, the report should detail specific operational expenses, including staff salaries (with roles such as tour guides and hospitality services), utility costs (which can rise to $1,500 monthly), and marketing expenditures (often requiring substantial investment to attract diverse travelers). Accurate record-keeping and documentation throughout the fiscal year are imperative for substantiate claims during tax rebate applications aimed at revitalizing economic growth in the tourism sector.

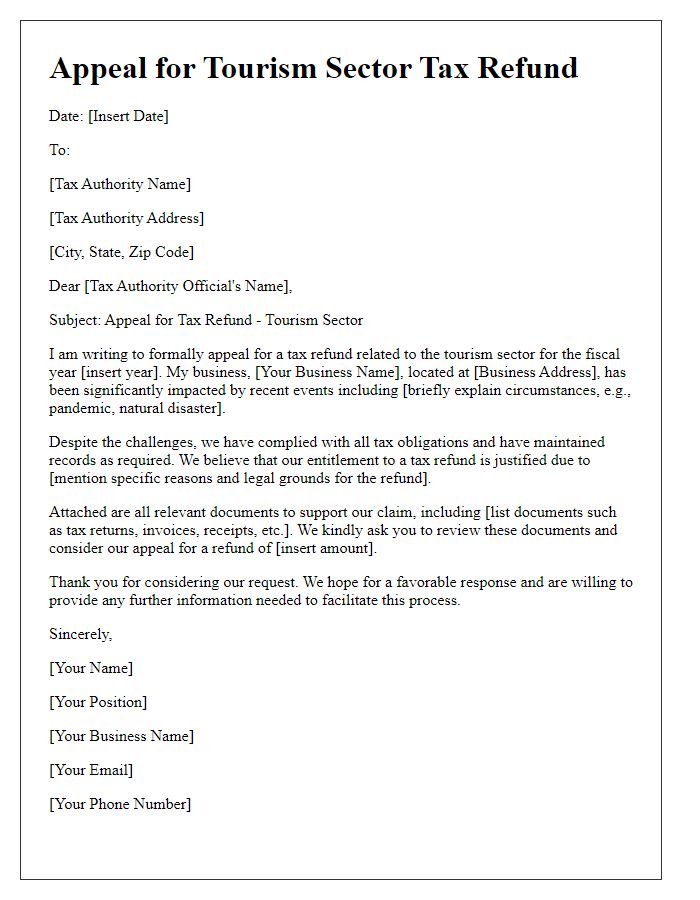

Justification for Tax Rebate Claim

The tourism industry experienced a significant decline during the global pandemic, particularly in 2020. Tourism hotspots, such as Bali, Maldives, and Paris, saw visitor numbers plummet by over 75%, leading to unprecedented financial strain on businesses reliant on tourist spending. Hotels, restaurants, and local attractions faced closures and mass layoffs. The recovery phase in 2021 and 2022 saw varying levels of success, with many regions still struggling to regain pre-pandemic visitor rates. In response, governments introduced tax rebate initiatives to support the sector, with financial recovery efforts focusing on relief for affected entities. The claim for tax rebates aims to alleviate ongoing financial burdens, sustain jobs, and revitalize local economies, especially in areas heavily reliant on tourism revenue.

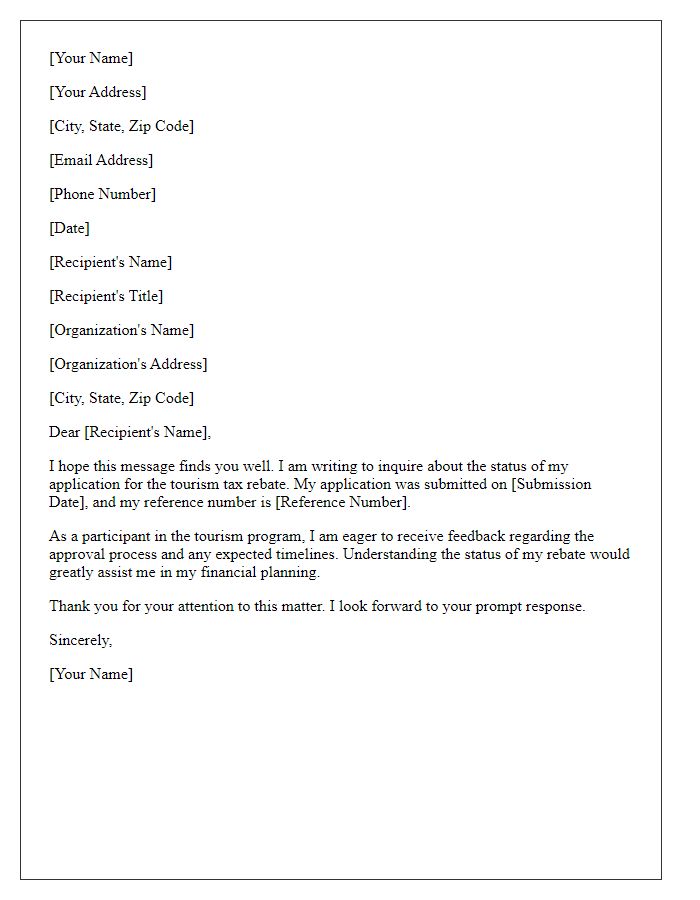

Contact Information for Follow-up and Queries

Tourism-related tax rebates provide financial relief to businesses impacted by fluctuations in visitor numbers, particularly during off-peak seasons. The government typically designates a specific department to handle inquiries and follow-up regarding these tax relief programs, ensuring timely assistance. Phone numbers, often listed on official tourism department websites, facilitate direct communication for businesses seeking clarification on application processes or eligibility criteria. Email addresses may also be provided for more detailed inquiries, allowing stakeholders to submit documents or receive specific guidance on the application procedure. Local tourism boards, often based in key destination cities like Paris, New York, or Tokyo, also play a critical role in disseminating information about tax incentives available to local hospitality and travel enterprises, fostering a supportive environment for economic recovery and growth.

Comments