Are you looking to streamline your communication with your tax preparer? Keeping your tax preparer updated with essential information can help ensure a smooth tax filing process. By using a well-crafted letter template, you can easily relay important updates related to your finances and any changes that may impact your tax situation. Dive into our article to discover the best practices for writing an effective letter to your tax preparer!

Personalized Greeting

Personalized greeting enhances client relationships in tax preparation. Personalized greetings utilize the client's name, establishing rapport and indicating attention to detail. Examples include "Dear [Client's Name]" or "Hello [Client's Name]." Effective personalized greetings can contribute to a positive client experience, fostering trust and encouraging open communication, essential during tax season when clients seek assistance with forms such as 1040 or 1099. Employing a warm and professional tone, while addressing specific client circumstances, ensures engagement and reinforces the importance of personalized service in the tax preparation industry.

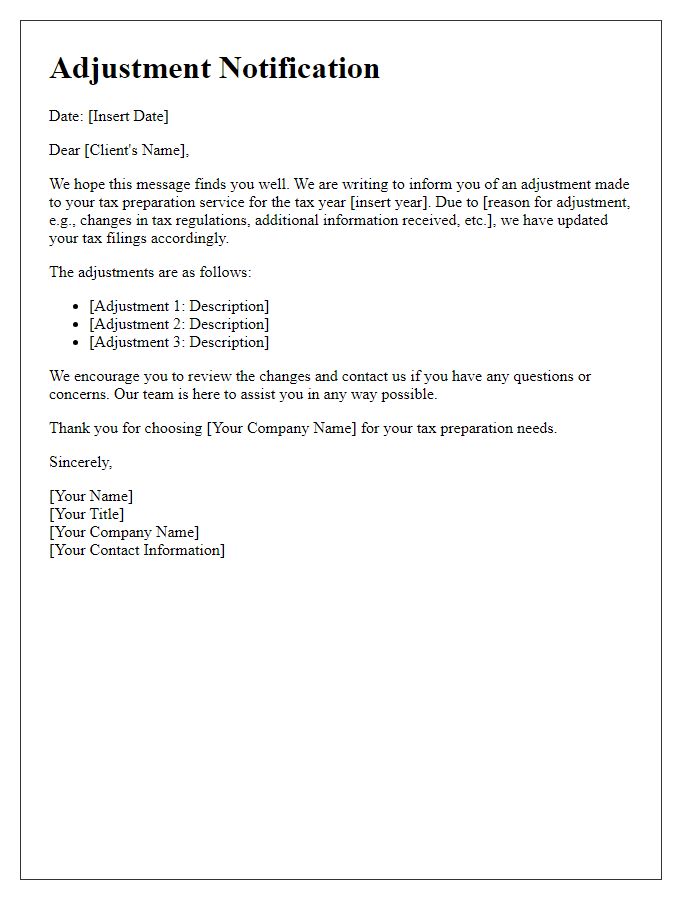

Current Tax Regulations

Tax preparers must stay updated on the evolving landscape of current tax regulations, particularly those stipulated by the Internal Revenue Service (IRS) for the 2023 tax year. Significant changes include adjustments to standard deduction amounts, which have risen to $13,850 for single filers and $27,700 for married couples filing jointly. Additionally, modifications to capital gains tax rates may affect high-income earners, with rates now reaching 20% for individuals with taxable incomes exceeding $492,300. Recent guidance on cryptocurrency reporting requires taxpayers to disclose transactions exceeding $600, underlining compliance importance. Furthermore, the implementation of the Inflation Reduction Act introduces new credits for clean energy investments, designed to incentivize renewable energy use among taxpayers, particularly in residential solar installations, which can lead to a credit of 30% off installation costs. Staying informed about these regulations ensures accurate filing and maximization of client benefits.

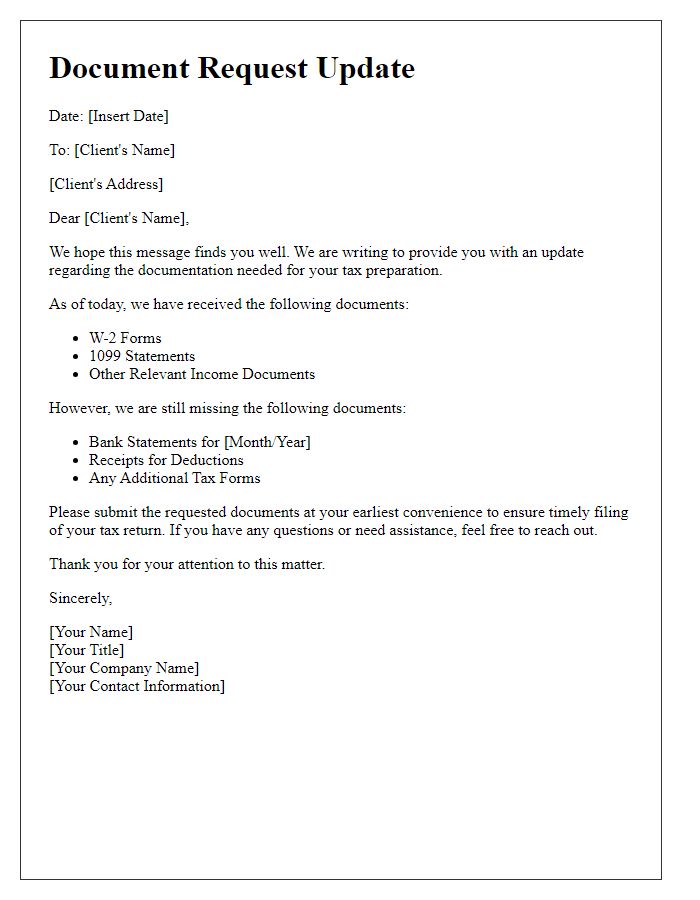

Client's Financial Overview

Clients' financial overview includes income sources, deductions, and credits. Total income may derive from wages, self-employment earnings, or investment returns. Deductions, such as mortgage interest (averaging $13,000 nationally), healthcare expenses, and charitable contributions, significantly impact taxable income. Tax credits like the Earned Income Tax Credit (up to $6,660 for qualifying families) can reduce overall tax liability. Understanding these components assists clients in optimizing tax returns and planning for future financial strategies. Regular updates ensure accuracy and compliance with IRS regulations, fostering a clear communication channel between tax preparers and clients.

Specific Tax Considerations

Tax preparers must consider several specific factors when handling individual tax filings, especially for self-employed individuals or small business owners. Deductions eligible under the Internal Revenue Code (IRC) include expenses such as home office costs, which can arise from percentages of utility bills and mortgage interest associated with the designated workspace. Additionally, self-employed individuals may qualify for the Qualified Business Income (QBI) deduction, allowing a deduction of up to 20% on qualified income. Understanding the implications of the Tax Cuts and Jobs Act (TCJA) is crucial, as it introduced significant changes affecting itemized deductions including state and local tax (SALT) limits, currently capped at $10,000. Enhanced awareness of tax credits, such as the Earned Income Tax Credit (EITC), can also provide considerable savings for eligible taxpayers. Tracking significant tax deadlines, such as the April 15th filing date, ensures compliance and avoids penalties. Additionally, considering local tax implications in specific jurisdictions can influence overall tax liabilities significantly.

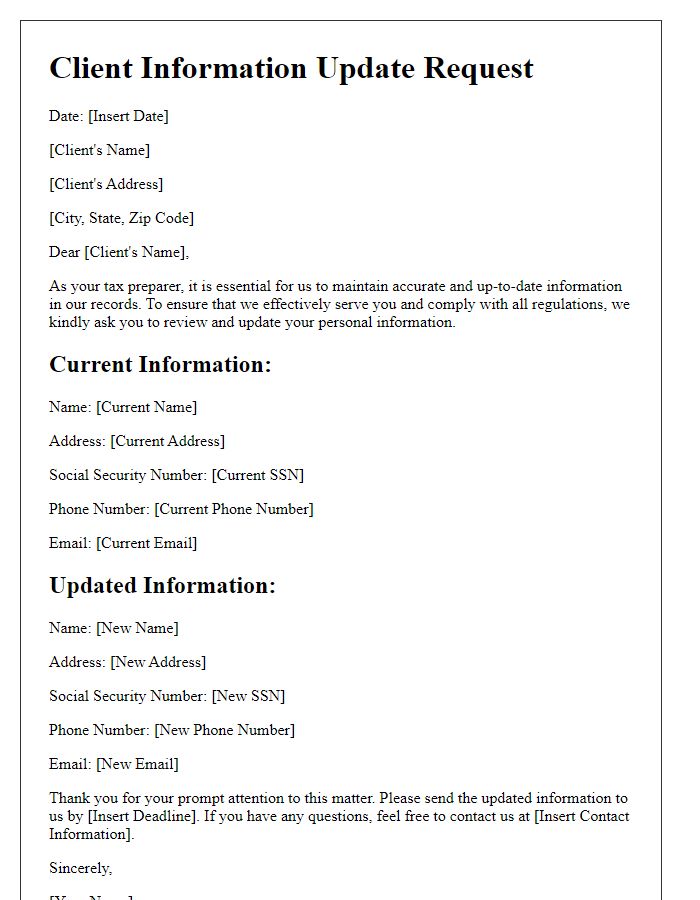

Contact and Response Information

Efficient communication with tax preparers is crucial for ensuring accurate and timely handling of tax returns. Tax professionals often require current contact details, such as phone numbers (e.g., mobile: 123-456-7890) and email addresses (like: name@example.com) to facilitate direct correspondence. Response information, including preferred methods of communication (e.g., secure messaging through tax software platforms like Intuit ProConnect), should be clearly stated. Additionally, timely updates regarding changes in financial situations (e.g., sale of property, new employment) are essential for maximizing deductions and credits, ultimately impacting the taxpayer's financial outcome for the year. Regularly reviewing and updating this information prior to tax season (typically starting in January and concluding on April 15 in the United States) ensures that tax preparers have the necessary resources to provide optimal service.

Comments