Are you facing the complex world of deferred tax liabilities and feeling overwhelmed? You're not alone; many businesses find themselves in similar situations, navigating the ins and outs of tax regulations and financial reporting. In this article, we'll break down the key steps for resolving deferred tax liabilities, providing you with practical insights and solutions. Stick around to discover how you can simplify your tax processes and achieve a smoother financial path!

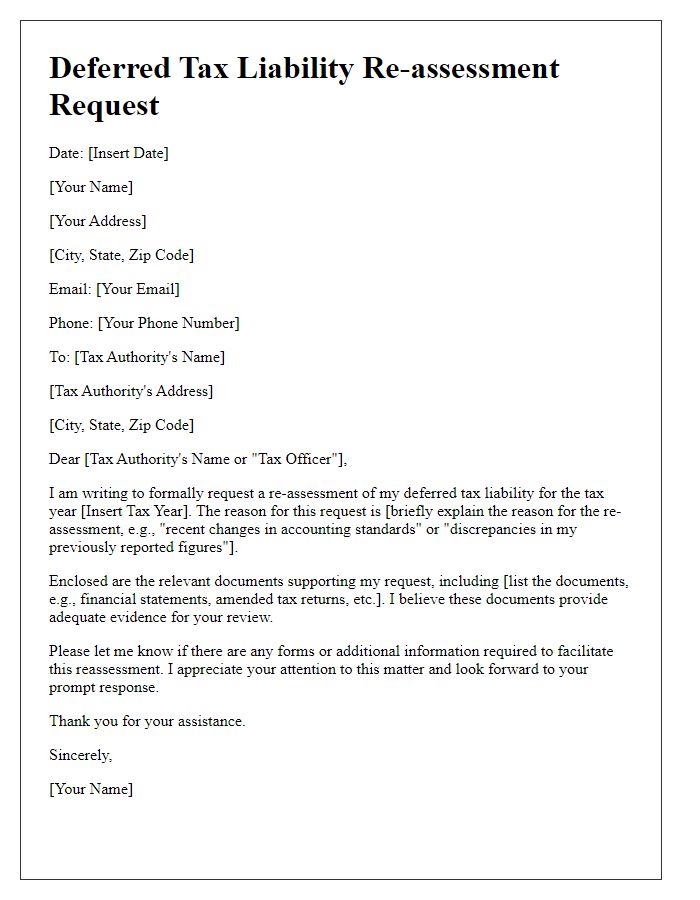

Clear identification of the taxpayer and relevant tax period.

A deferred tax liability arises when income is recognized for accounting purposes but not yet taxable under tax regulations, impacting financial statements. Taxpayers, such as corporations (for example, Tech Inc.), often have periods tracking these liabilities, typically aligning with fiscal years (e.g., January 1, 2022, to December 31, 2022). Clear identification of the taxpayer involves stating the business name, tax identification number, and specific address of the entity. Relevant tax periods must be specified to delineate the duration for which the deferred tax liability applies, aiding tax authorities in processing and resolving any outstanding issues related to the tax obligations.

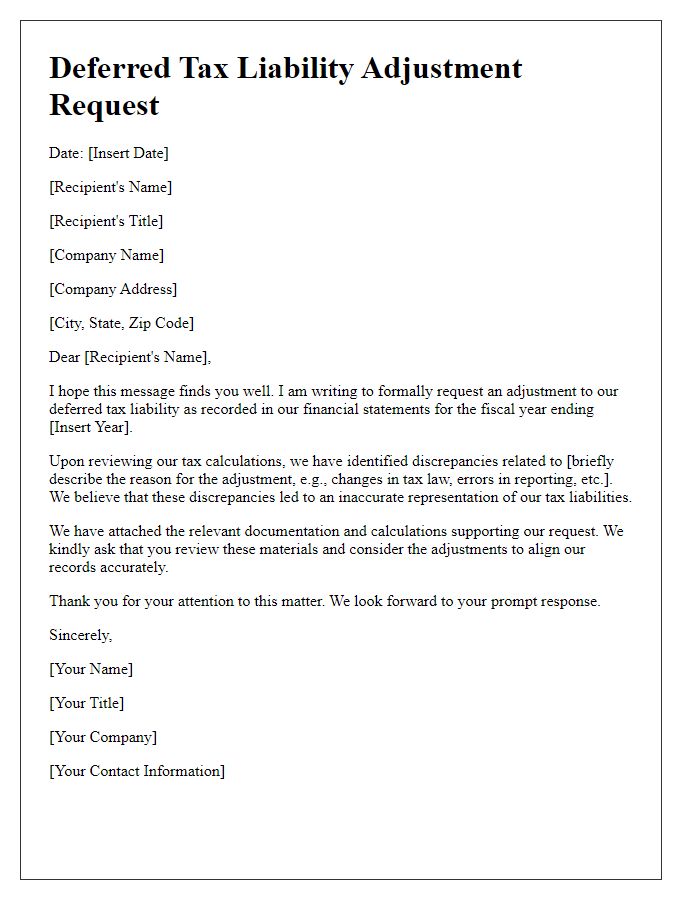

Detailed explanation of the deferred tax liability.

Deferred tax liabilities represent the taxes owed in the future due to temporary differences between the accounting income reported on financial statements and the taxable income reported to tax authorities. These discrepancies often arise from differences in revenue recognition, depreciation methods, or expense timing. For instance, a company may recognize revenue in its financial statements before it is taxable, leading to an increase in the deferred tax liability. The calculation of this liability involves applying the prevailing tax rate to the temporary differences. Common instances that lead to deferred tax liabilities include accelerated depreciation under tax law, unrealized gains on investments, and provisions for future expenses not yet deductible. Understanding deferred tax liabilities is crucial for accurately assessing a company's financial position and future tax obligations.

Proposed resolution and payment plan.

In the realm of financial accounting, deferred tax liabilities arise when taxable income is greater than accounting income, causing future tax obligations. A proposed resolution must include a comprehensive payment plan detailing the total liability amount, which may reach millions of dollars for large corporations. Establishing an installment plan over a specified period, such as 12 to 24 months, can ease cash flow issues. For instance, an initial payment of 30% followed by monthly payments can ensure timely settlement. Incorporating clear milestones for each payment and potential penalties for late payments maintains accountability. Organizations such as the Internal Revenue Service (IRS) may require supporting documentation to validate the proposed payment strategy, thereby ensuring compliance with tax regulations.

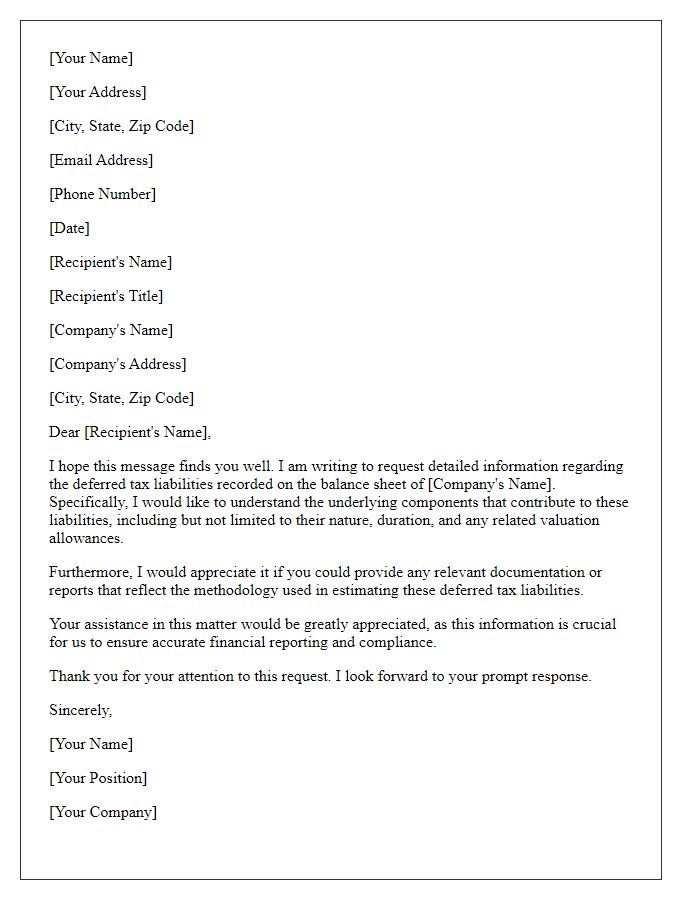

Supporting documentation references.

Deferred tax liability refers to a tax obligation that a company expects to pay in the future due to temporary differences between accounting income and taxable income. Supporting documentation plays a critical role in the resolution of deferred tax liability, which typically arises from differences in asset valuations, revenue recognition, or expense deductions. Common references include IRS regulations, specific accounting standards such as GAAP (Generally Accepted Accounting Principles), and financial statements that outline temporary differences. Additionally, internal reports detailing estimates of future taxable income, as well as calculations explaining how the deferred tax liability was determined, aid in providing clarity. Properly organized documentation, such as tax returns and correspondence with tax authorities, can enhance compliance and facilitate smoother resolution processes.

Contact information and request for acknowledgment.

Deferred tax liabilities represent taxes owed in the future due to temporary differences between accounting and tax treatment. For instance, a company like Apple Inc. may recognize revenue for accounting purposes that is not taxable until a later period. The difference can create a deferred tax liability on the balance sheet, impacting financial statements significantly. This liability could be recorded under current liabilities, potentially exceeding millions of dollars in large corporations. Resolving this deferred tax liability often involves thorough documentation and communication with tax authorities such as the Internal Revenue Service (IRS) in the United States to ensure compliance and avoid penalties. Proper acknowledgment from the tax authority can facilitate the necessary adjustments in financial reporting and strategic planning, essential for forecasting future tax obligations.

Comments