Are you ready to dive into the world of withholding tax rebates? In this article, we'll break down everything you need to know about confirming your rebate, ensuring you understand each step of the process. With clear guidance and helpful tips, you'll be well-prepared to navigate the complexities of tax benefits. Stick around as we unveil expert insights that will empower you to maximize your refund!

Recipient's Full Name and Address

Withholding tax rebates are financial adjustments made to correct tax withholdings for individuals or entities. These rebates can significantly impact the annual tax return in countries like the United States (IRS Form 1040) or Canada (T1 General). Confirmation of a withholding tax rebate is typically initiated through official correspondence from tax authorities, detailing the specific amounts due, relevant tax years, and any required documentation. Proper communication ensures that taxpayers can accurately reflect these adjustments in their financial records. Taxpayers should also keep meticulous records of all withholdings and communications to substantiate their claims and avoid potential disputes with tax authorities.

Date of Issuance

Withholding tax rebate confirmations are essential documents for individuals and businesses to ensure proper tax compliance and receive refunds overpaid to the tax authorities. Key details include issuance date (Date of Issuance), taxpayer identification number (TIN), rebate amount, and relevant tax years (e.g., 2021, 2022). This confirmation serves to validate the claimant's eligibility for the rebate under regulations set by the Internal Revenue Service (IRS) or local tax agencies. Prompt issuance (typically within 30 days) is crucial to facilitate timely filing of tax returns and receipt of the refund.

Reference Number

Withholding tax rebate confirmation is an essential document for taxpayers. The reference number, typically a unique identifier issued by tax authorities, allows for efficient tracking and processing of claims. Tax rebate requests often arise from overpayments during the annual tax filing process, impacting personal finances significantly. In many countries, such rebates are processed within a specific timeframe, often ranging from 30 to 90 days, increasing the importance of accurate documentation. Taxpayers must include personal details like Social Security numbers or Tax Identification numbers alongside the reference number for verification and accurate processing.

Details of Withholding Tax Rebate

Withholding tax rebate confirmation represents a critical financial document detailing amounts refunded to taxpayers. This confirmation outlines specific data such as the taxpayer's identification number, which uniquely associates the individual with tax records. The confirmation includes the period for which the rebate is applicable, typically linked to previous fiscal years, and itemizes the amounts withheld by the employer or financial institution. Additionally, the document specifies the jurisdiction - such as state or country - responsible for administering the tax, ensuring compliance with local taxation laws. A summary of total rebate amounts is typically highlighted to provide clarity on the taxpayer's monetary return, reinforcing the importance of accurate tax documentation and timely responses to tax queries.

Contact Information (for further inquiries)

The withholding tax rebate confirmation process requires accurate contact information to facilitate efficient communication regarding any inquiries. Essential details include a primary contact number (preferably a direct line), an email address that is monitored regularly, and a designated office address for postal correspondence. Including a full name (of the representative or department) and specific working hours can enhance clarity. Additionally, providing an online inquiry form link or a customer service portal can streamline the process, ensuring that taxpayers can easily obtain assistance or clarification concerning their withholding tax rebates.

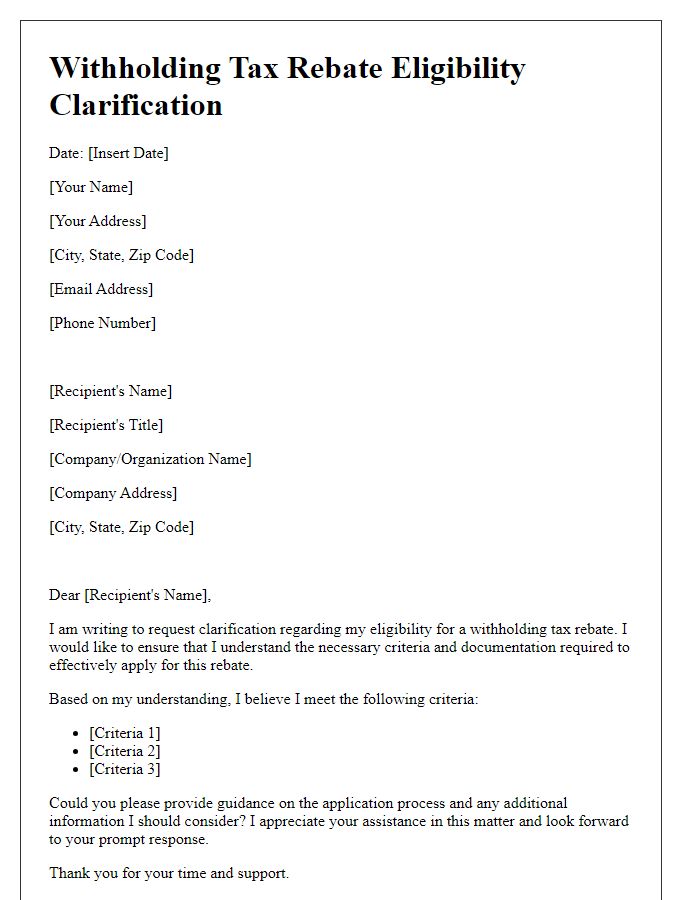

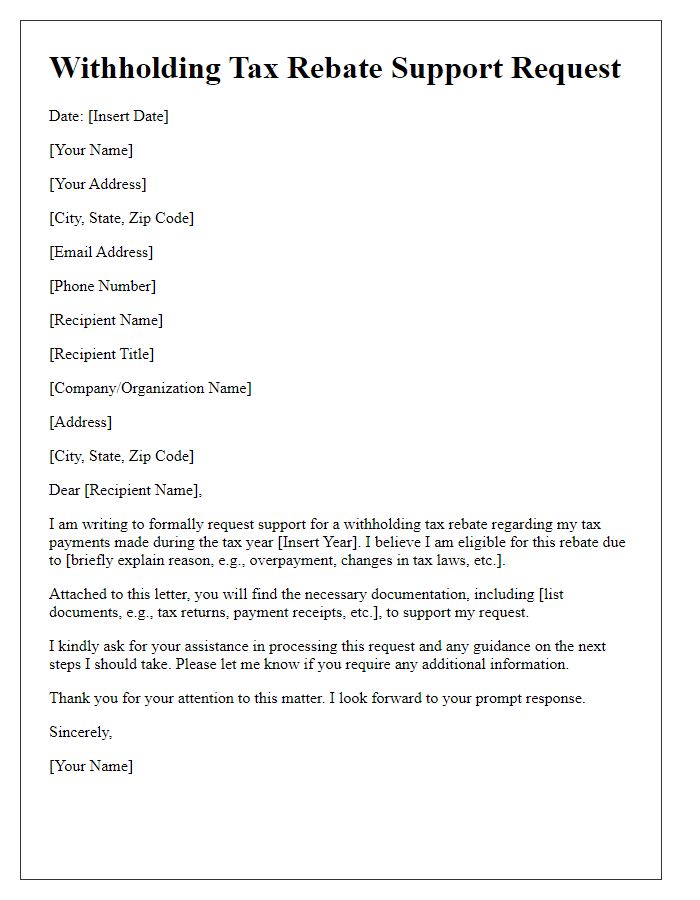

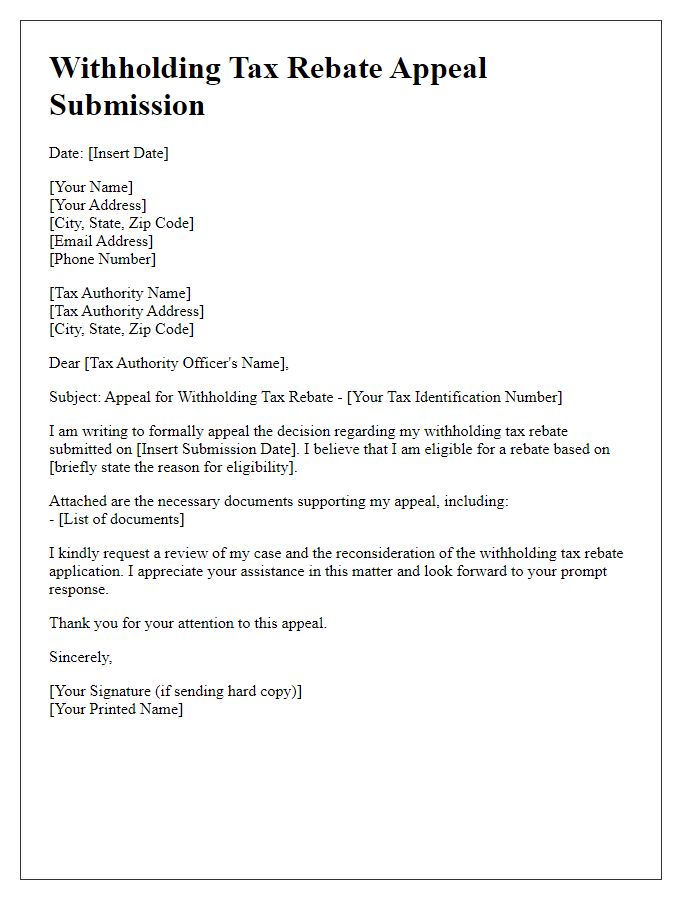

Letter Template For Withholding Tax Rebate Confirmation Samples

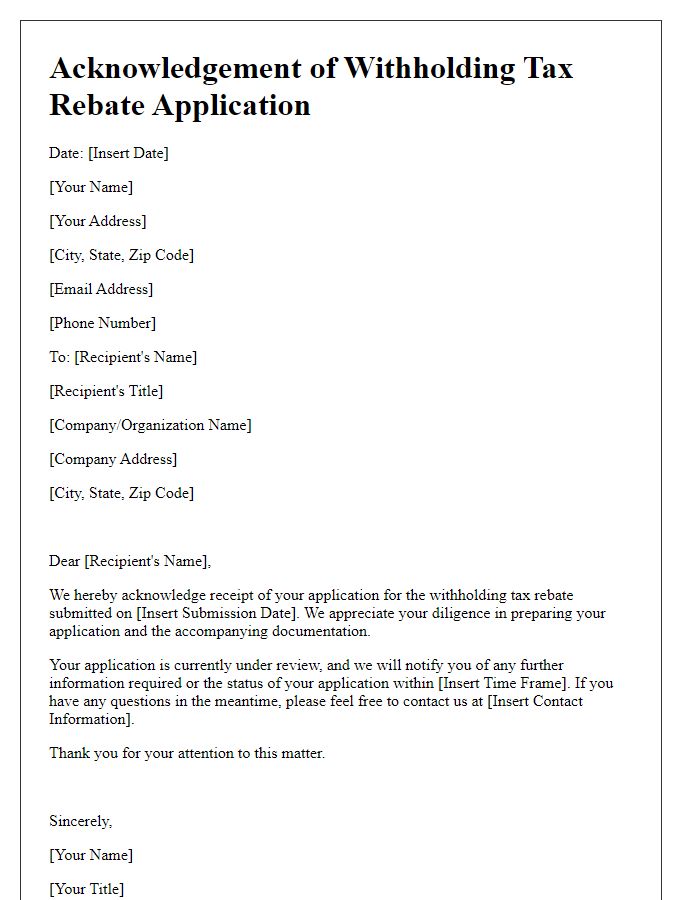

Letter template of acknowledgement for withholding tax rebate application

Comments