Receiving a tax assessment notice can feel overwhelming, but it's essential to respond thoughtfully and promptly. In this article, we'll guide you through crafting a well-structured letter that clearly addresses your concerns while maintaining a professional tone. We'll provide you with a handy template and valuable tips to ensure your response is both effective and respectful. So, if you're ready to take the next step in addressing your tax assessment, read on!

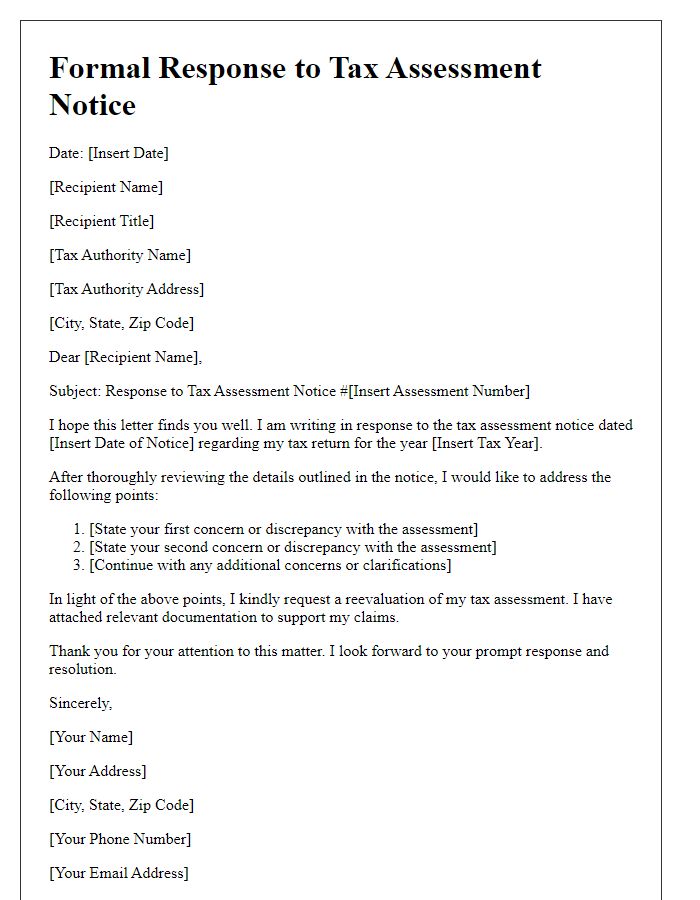

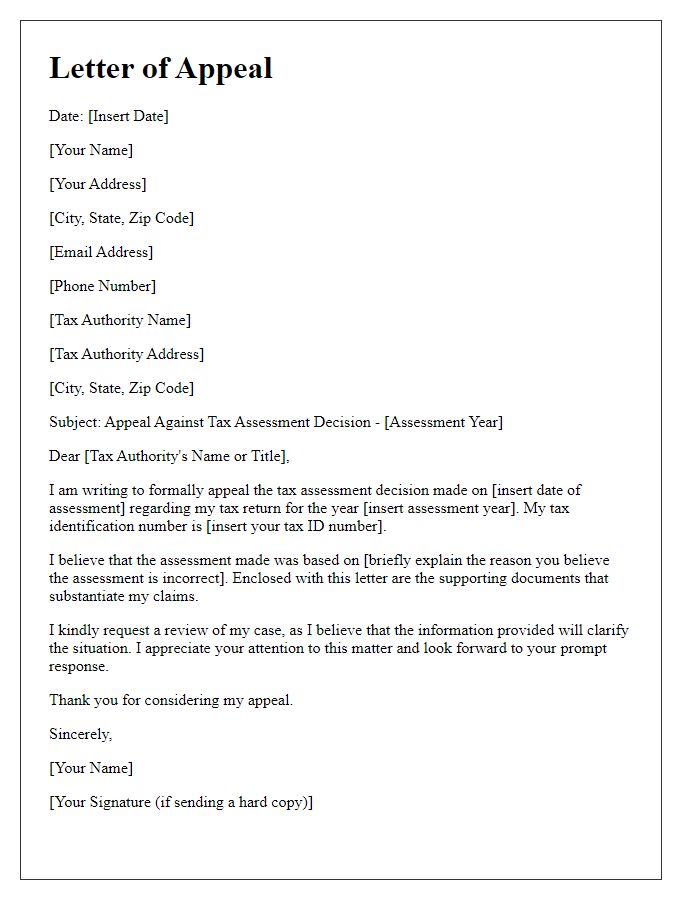

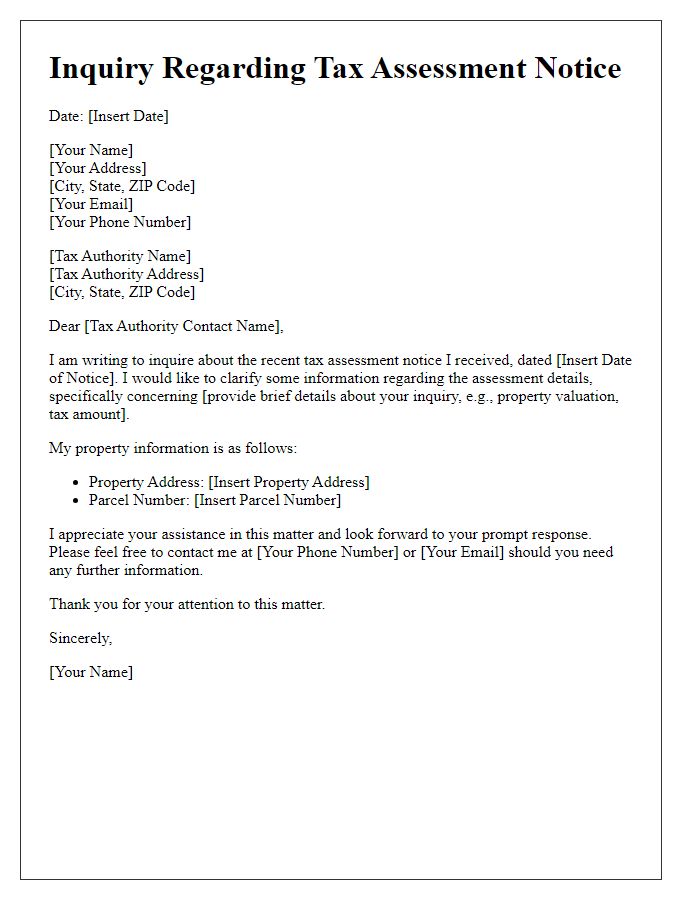

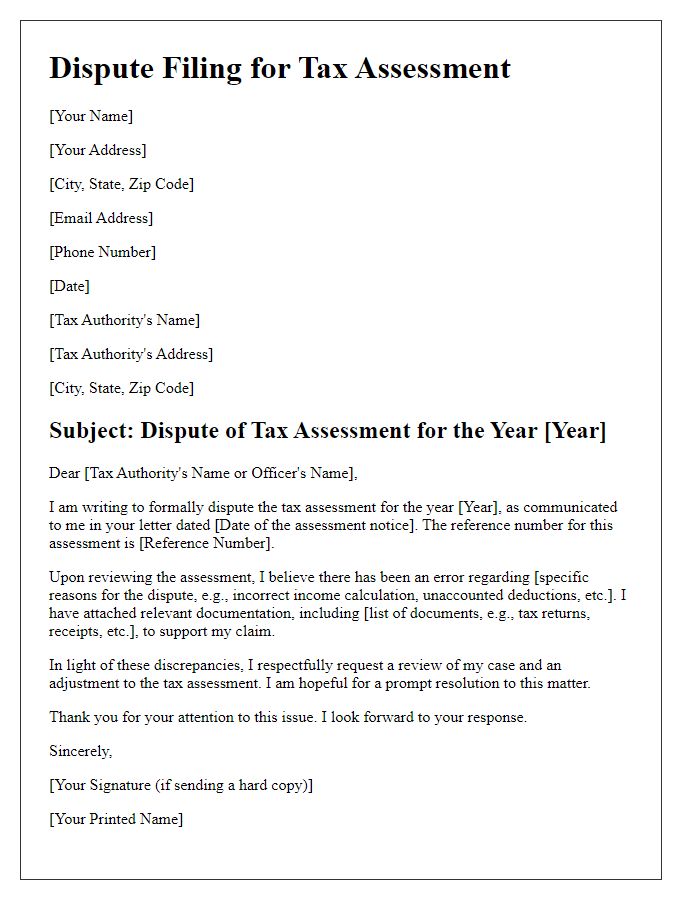

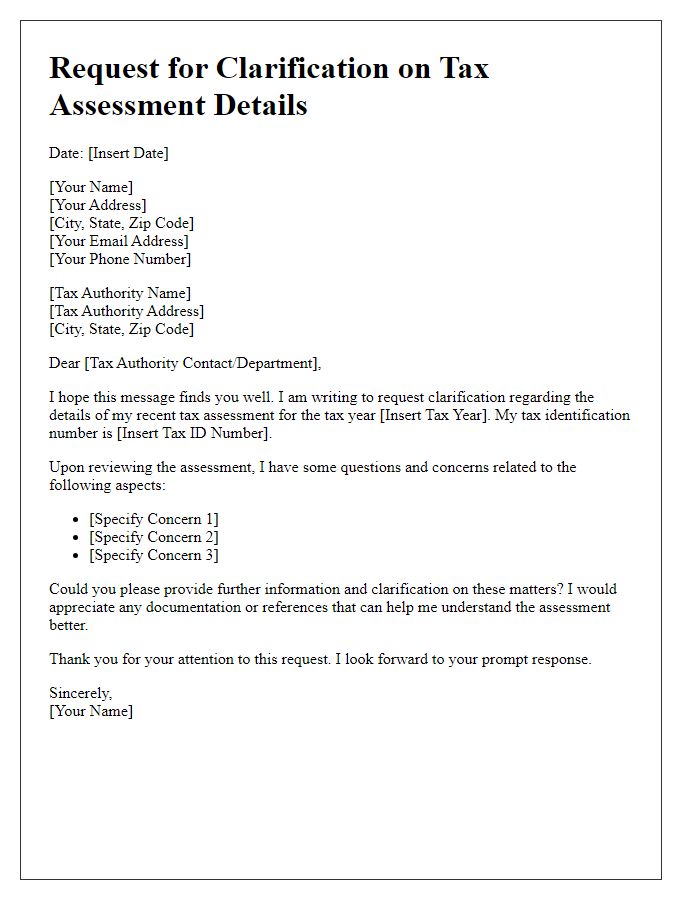

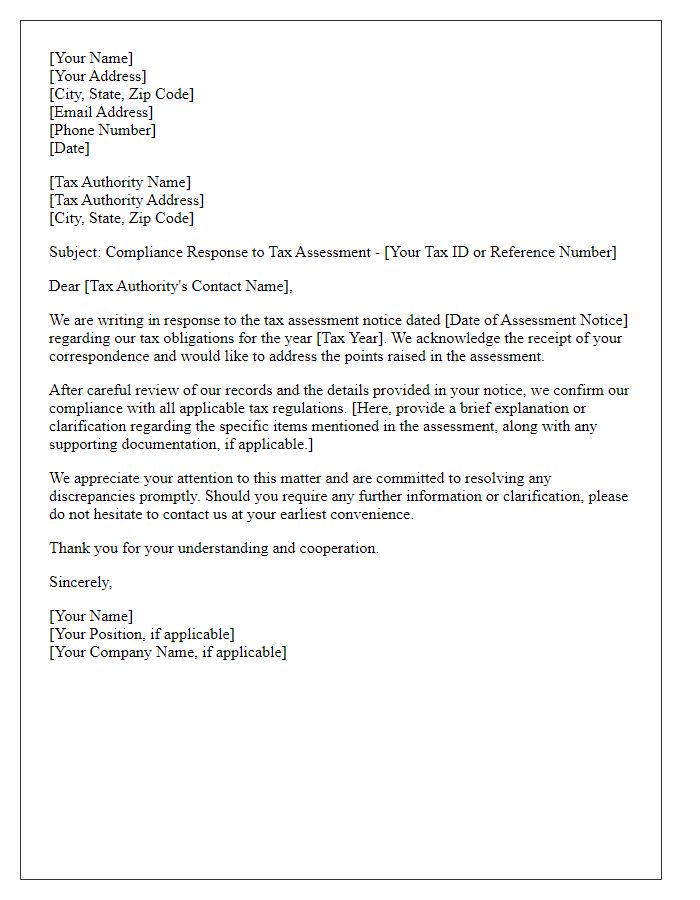

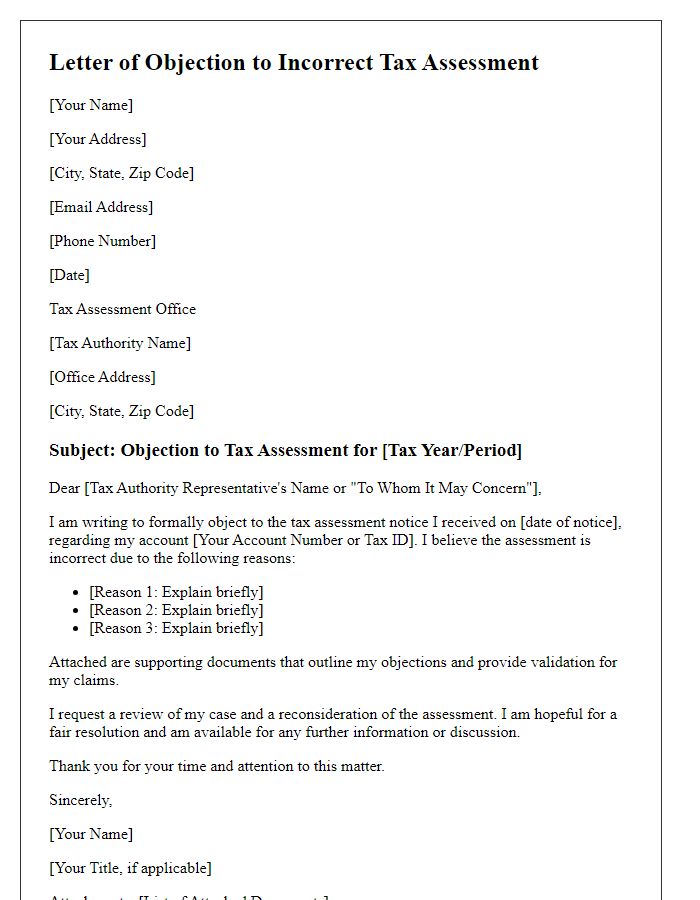

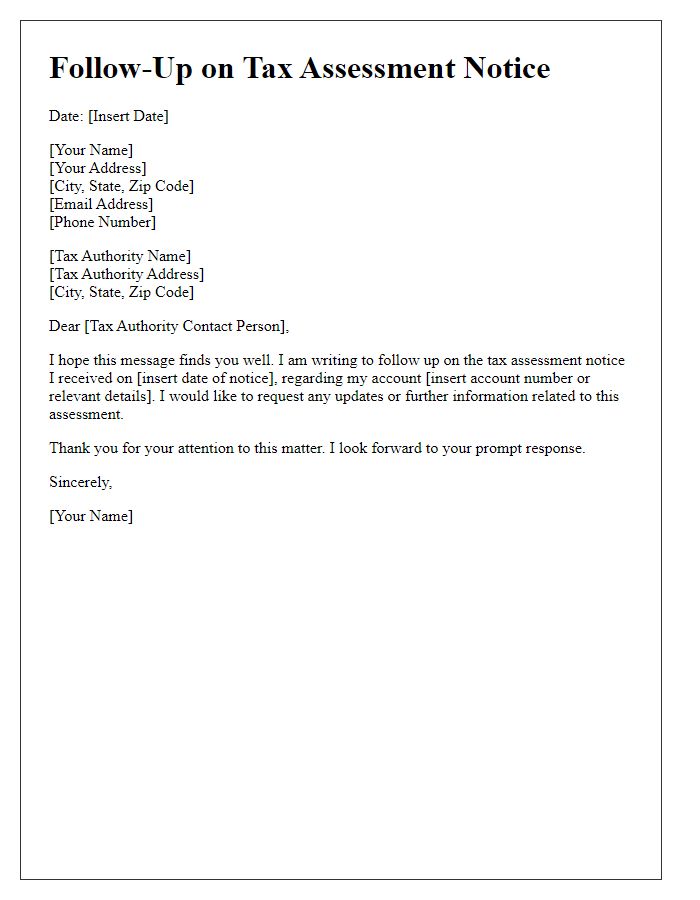

Address and Contact Information

When responding to a tax assessment notice, you should include your full name and address at the top of the document for identification purposes. For instance, include details such as your street address (e.g., 123 Main Street, Apartment 4B), city (e.g., Springfield), state (e.g., Illinois), and zip code (e.g., 62704). Additionally, provide your email address (e.g., yourname@email.com) and phone number (e.g., (555) 123-4567) to facilitate further communication. This contact information ensures that the tax authority can reach you if necessary while offering clarity regarding your location and identity in relation to the tax assessment.

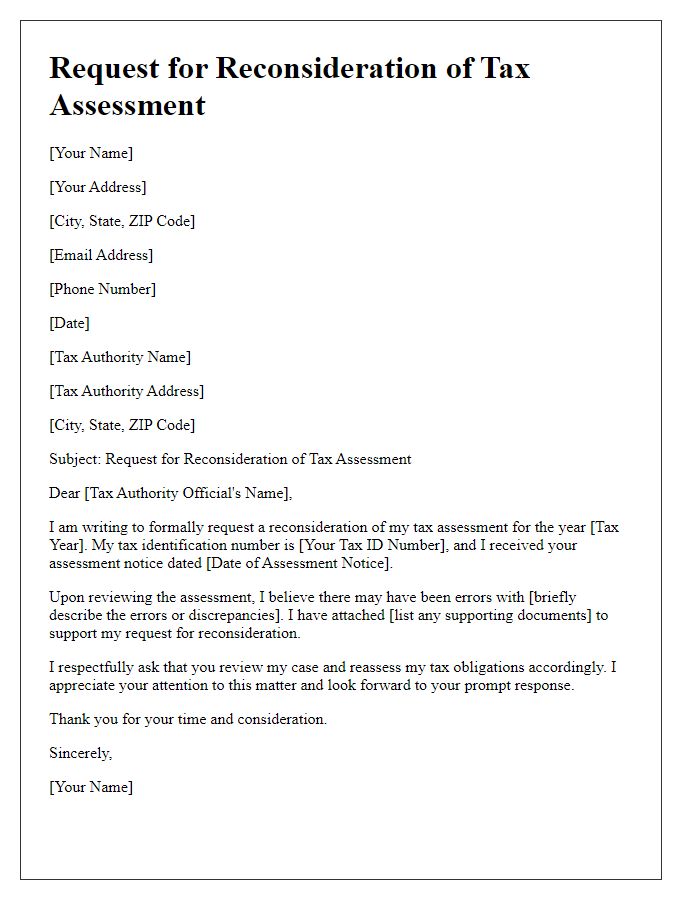

Tax Assessment Reference Number

Tax assessment notices often detail discrepancies in reported income or property values. Upon receiving such a notice, taxpayers must reference their Tax Assessment Reference Number for accurate identification. For example, if a taxpayer receives a notice stating an assessment of $15,000 for real property at 123 Elm Street, they should verify their property tax records against the local jurisdiction's evaluations. Any discrepancies like incorrect square footage or unaccounted renovations may require narrative evidence like photographs or contractor invoices for resolution. Providing timely responses, typically within 30 days, ensures the taxpayer's right to appeal is preserved, safeguarding their financial interests against potentially inflated assessments.

Explanation or Dispute Clarification

Tax assessment notices often require careful examination and can raise concerns regarding accuracy or fairness. When disputing an assessment, taxpayers may provide detailed explanations, including discrepancies in reported income, deductions, or applicable tax credits. For instance, the notice might indicate an assessment of $5,000, when tax documents reflect valid deductions that should reduce taxable income significantly. Additionally, taxpayers should reference relevant tax code sections, such as IRS Section 501(c)(3) for non-profit status or Sections 121 and 1031 for real estate transactions, to substantiate claims. Including copies of supporting documentation, like W-2 forms, receipts, and prior correspondence with tax authorities, strengthens the case. Timely submission of dispute letters, ideally within 30 days of the notice date, ensures that taxpayers maintain the right to challenge unfair assessments effectively.

Supporting Documentation

Tax assessment notices can prompt taxpayers to provide supporting documentation to verify their claims or disputations. Essential documents include prior tax returns, W-2 forms, 1099 statements, and receipts for deductible expenses. Accurate financial records and bank statements are crucial for demonstrating income and expenditures, especially for self-employed individuals or those with multiple income sources. Organizing documentation chronologically can streamline the review process by tax authorities, such as the Internal Revenue Service (IRS) in the United States, ensuring all specified tax years are represented. Properly addressing issues raised in the notice can prevent potential penalties and interest charges due to unresolved discrepancies.

Formal Closing and Signature

The formal closing of a response to a tax assessment notice typically includes respectful phrases and a signature line. Standard phrases to consider are "Sincerely," or "Respectfully yours," followed by the sender's name and title. For example, if you are writing on behalf of a business, include the business's name and your position. Add space for a handwritten signature above the typed name to personalize the communication. Ensure to include contact information, such as a phone number or email, for any necessary follow-up.

Comments