Looking to navigate the complexities of expatriate tax laws? Whether you're moving abroad or returning home, understanding your tax obligations can feel overwhelming. Our expert consultation is designed to simplify the process, ensuring you stay compliant while maximizing your financial benefits. Ready to demystify expatriate taxes and gain peace of mind? Read on to discover how we can help!

Personalized Salutation

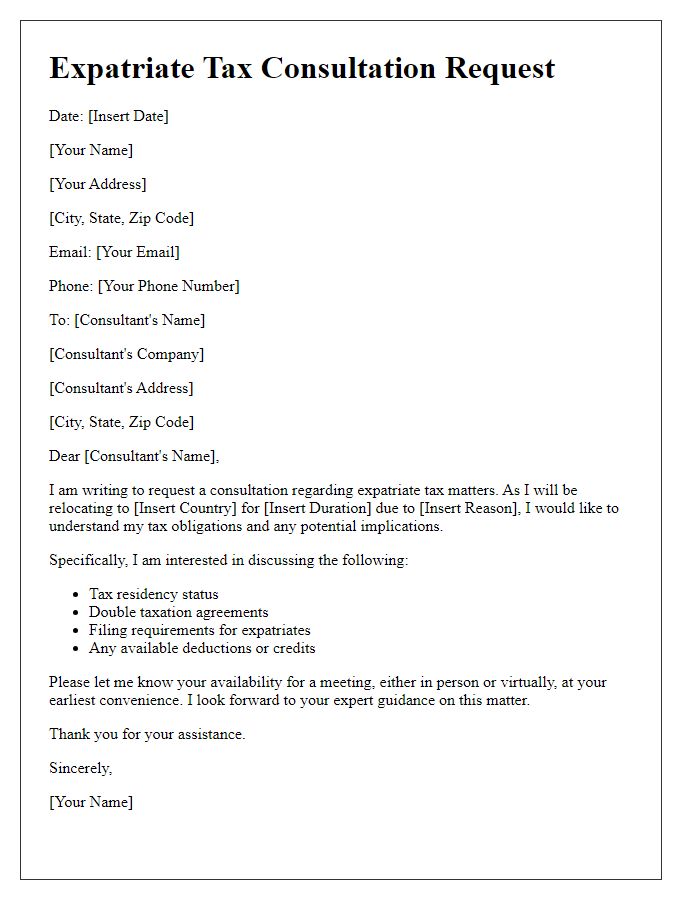

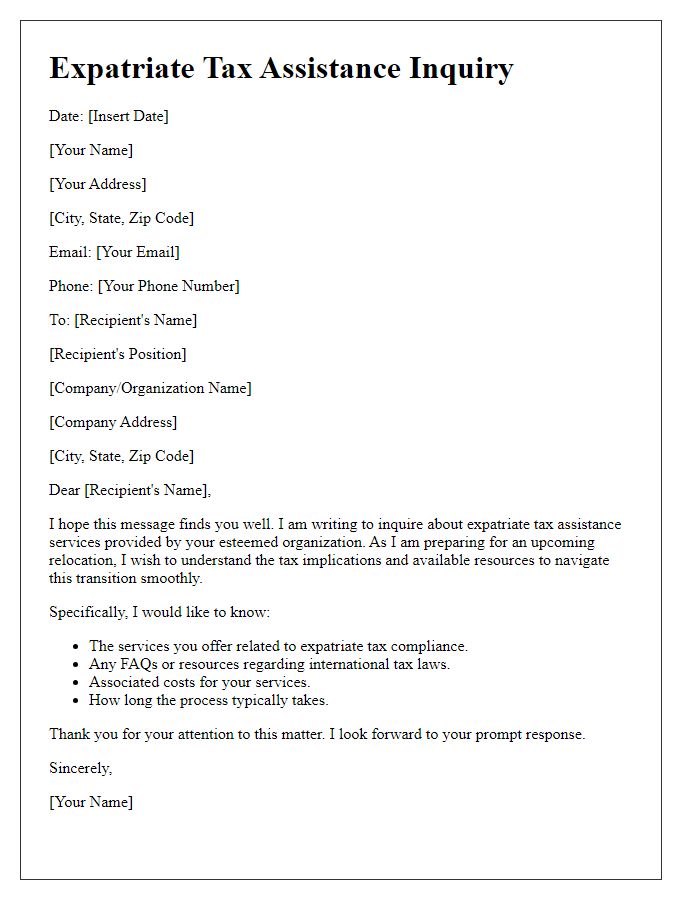

Setting an appointment with a specialized tax consultant can provide essential guidance for expatriates navigating complex tax regulations. Expatriate tax consultants, like those from reputable firms such as PwC or Deloitte, offer tailored advice on international tax obligations, foreign income reporting, and compliance with local laws. Many expatriates may be unaware of potential pitfalls, such as double taxation or residency status, which could significantly impact their financial situation. By scheduling a consultation, individuals can receive personalized insights and strategies for minimizing tax liabilities while adhering to the regulations outlined by governing bodies like the Internal Revenue Service (IRS) in the United States or HM Revenue and Customs (HMRC) in the United Kingdom.

Clear Purpose Statement

Expatriate tax consultation appointments are essential for individuals residing abroad, particularly in navigating complex tax obligations. International tax laws (e.g., the Foreign Account Tax Compliance Act) often require expatriates to file annual returns, even when income is earned outside the home country. Individuals in specific countries, such as the United States, face unique challenges, including double taxation risks. Additionally, understanding deductions and credits, such as the Foreign Earned Income Exclusion (up to $112,000 in 2022), is crucial for optimizing tax liabilities. Consulting experts specializing in expatriate taxation can provide tailored strategies for compliance and minimize tax exposure, ensuring financial well-being while living overseas.

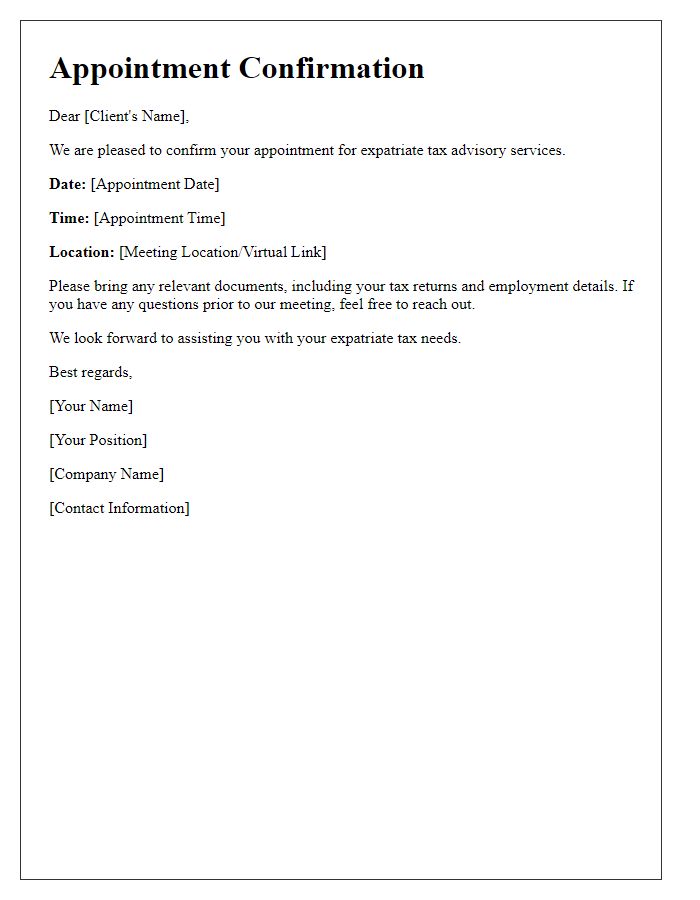

Specific Appointment Details

Expatriate tax consultation appointments are essential for individuals navigating complex tax obligations. Appointments typically include a review of specific tax treaties applicable to the expatriate's home country and the host country, often focusing on income earned abroad. Consultations usually take place at specialized tax firms in financial hubs such as New York City or London, where seasoned tax consultants analyze individual financial situations. Key elements discussed during the appointment include residency status, foreign earned income exclusion limits (up to $112,000 for the 2023 tax year), as well as potential tax credits and deductions available. Understanding local tax regulations, such as those set by the IRS for U.S. citizens abroad, is crucial for ensuring compliance and optimizing tax liabilities. Preparing necessary documentation, such as prior tax returns and income statements, significantly enhances the efficiency and effectiveness of the consultation session.

Required Documents List

To effectively prepare for your expatriate tax consultation appointment, it is essential to gather specific documents. Start with identification documents such as a valid passport, which serves as proof of citizenship and residency status. Next, compile your tax returns from the last three years, detailing income and deductions, especially any foreign earned income exclusions and tax credits. Include W-2 forms or 1099 forms from the United States, reflecting your income and withholdings during your time abroad. Collect documentation of foreign income, such as pay stubs, bank statements, or employment contracts, showcasing your earnings in your host country. Additionally, obtain any relevant bank statements and financial documents that reflect your investment income, including dividends or interest received from overseas accounts. It's also beneficial to gather documents pertaining to home ownership or rental agreements, as they may impact your tax obligations. Lastly, if applicable, prepare documents related to any foreign tax payments made, which may include tax returns from your host country, as they could lead to potential credits or deductions.

Contact Information and Next Steps

Expatriate tax consultation appointments are essential for navigating complex international tax regulations. Confirm appointment details, including date and time, often scheduled at local offices like those in international hubs, such as London or Singapore. Provide contact information, including phone numbers and email addresses, for direct communication. Gather necessary documents like tax returns from previous years and residency proof to streamline the process. Prepare for potential questions about double taxation agreements and various foreign income types - these elements are crucial for ensuring compliance and maximizing deductions. Following the consultation, schedule follow-up meetings to address additional inquiries and clarify tax filing obligations specific to expatriates.

Comments