Are you ready for some important news regarding municipal tax changes? Navigating local taxation can often feel overwhelming, but understanding these updates is key to managing your finances effectively. In this article, we'll break down what you need to know about the recent changes in municipal tax and how they may impact you. So, stick around to learn more and stay informed!

Subject Line and Header Information

Notification of Municipal Tax Change for [Year] Dear [Property Owner/Resident], This notice serves to inform you about the upcoming changes to municipal tax rates for the fiscal year [Year]. Effective [Start Date], the new tax rates will be implemented, which may affect your property tax assessment. The [City or Municipality Name] has determined these adjustments based on [Reasons for Change such as increased budget needs, infrastructure development, or changes in property values]. Please review the following details regarding the changes that apply to your property: - Current Tax Rate: [Current Rate]% - New Tax Rate: [New Rate]% - Effective Date: [Start Date] For further inquiries or detailed information about your specific tax situation, please contact [Department Name or Official's Name] at [Contact Information]. Thank you for your attention to this important matter. Sincerely, [Your Name] [Your Title] [Municipality or City Name] [Date]

Clear Announcement of Tax Change

Municipal tax adjustments occur annually, impacting residential and commercial property owners. In 2023, the city of Springfield implemented a 5% increase in property tax rates to fund public services, including education and infrastructure improvements. This adjustment will affect all property assessments conducted as of January 1st, with the new rates taking effect on July 1st. Official notices will be dispatched to property owners detailing the updated assessment values. Property owners should review their statements for accuracy and prepare for potential increases in their monthly payments, as the new rates will influence overall annual budgeting and financial planning.

Explanation and Detailed Breakdown

Municipal tax changes in cities, such as New York or Los Angeles, can significantly impact residents' financial obligations. The municipal tax structure typically consists of property taxes, which are determined based on assessed property values. For instance, an increase from 1.2% to 1.5% in property tax rates can result in a substantial rise in annual payments, affecting homeowners across diverse neighborhoods. A detailed breakdown of the changes may include categories such as residential and commercial properties, along with exemptions for specific groups like seniors or veterans. Additionally, public hearings may be scheduled to discuss these changes in community centers, providing residents an opportunity to voice concerns. Notification regarding these tax adjustments may be disseminated via official channels such as mail, local government websites, and social media platforms, ensuring awareness and transparency regarding the implications of such fiscal policy shifts.

Effective Dates and Payment Instructions

Municipal tax changes can significantly impact residents, municipalities, and financial planning. Effective from January 1, 2024, an increase of 10% in property tax rates will be instituted across the city of Springfield, reflecting the need for enhanced local services and infrastructure improvements. Property owners should prepare to adjust their financial budgets to accommodate these changes. Payment instructions will provide options for the first quarter installment by March 1, 2024, ranging from online payments through the municipal website (www.springfield.gov) to in-person payments at the City Hall (located on Main Street). Residents are encouraged to review their property assessments for accuracy to ensure fair taxation. The city aims to utilize these funds for essential services such as public safety, education, and community development.

Contact Information for Inquiries

Municipal tax changes could significantly impact homeowners and businesses within the jurisdiction. With adjustments to tax rates or valuation methodologies, residents may face variations in yearly tax liabilities (potentially ranging from 1% to 5% increases). Property owners in cities like New York or Los Angeles should stay informed about these updates, as they can influence budget planning. For inquiries regarding municipal tax changes, residents can reach out to the local tax assessor's office or municipality's website, typically offering contact information via phone (often a dedicated line, such as 311 in NYC) or email, ensuring efficient communication regarding tax obligations. Detailed guidelines and assistance resources may also be available online to navigate any complexities.

Letter Template For Notification Of Municipal Tax Change Samples

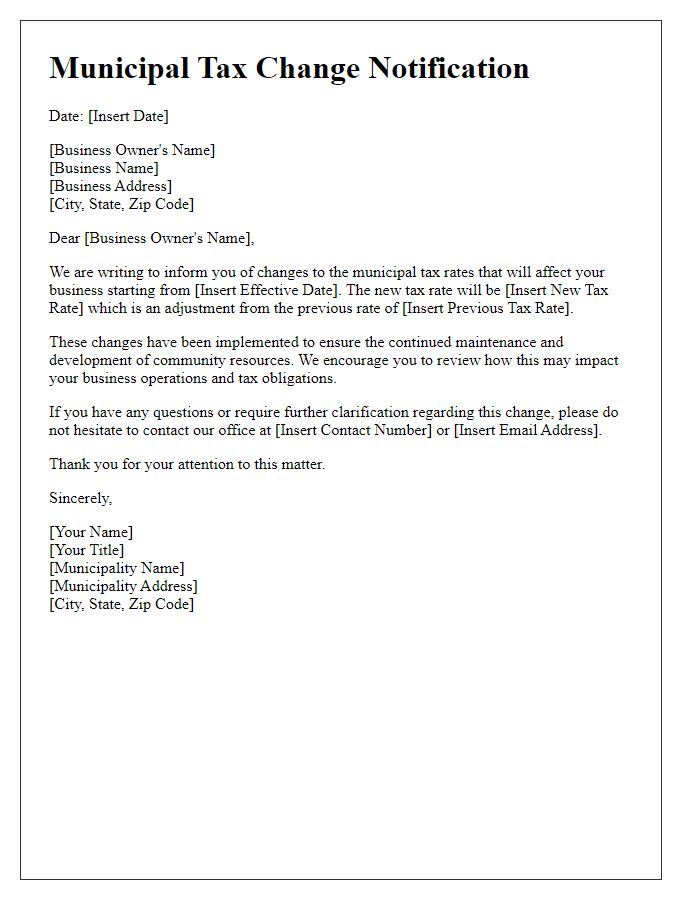

Letter template of municipal tax change notification for business owners

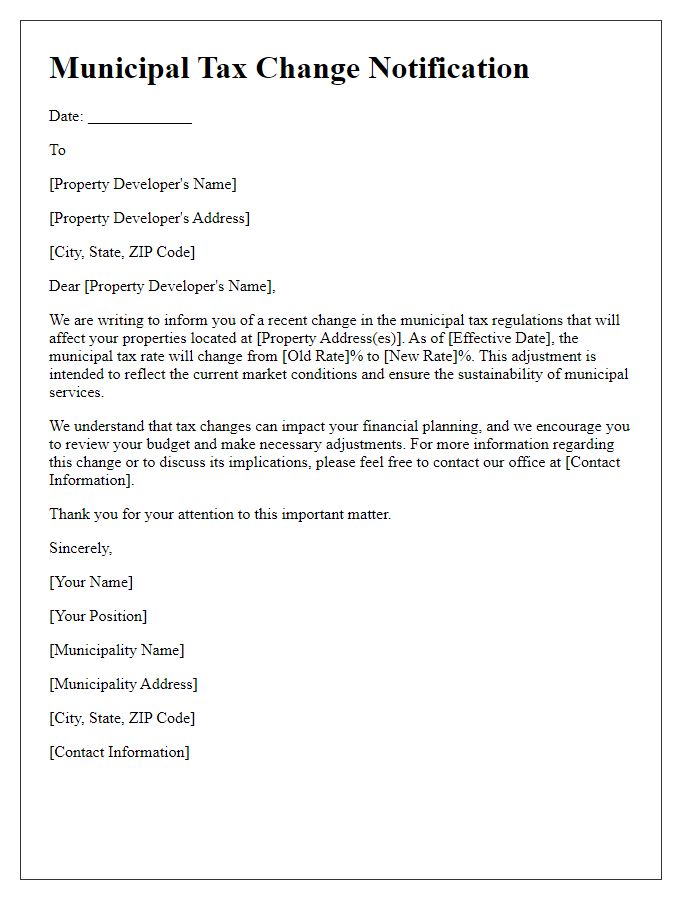

Letter template of municipal tax change notification for property developers

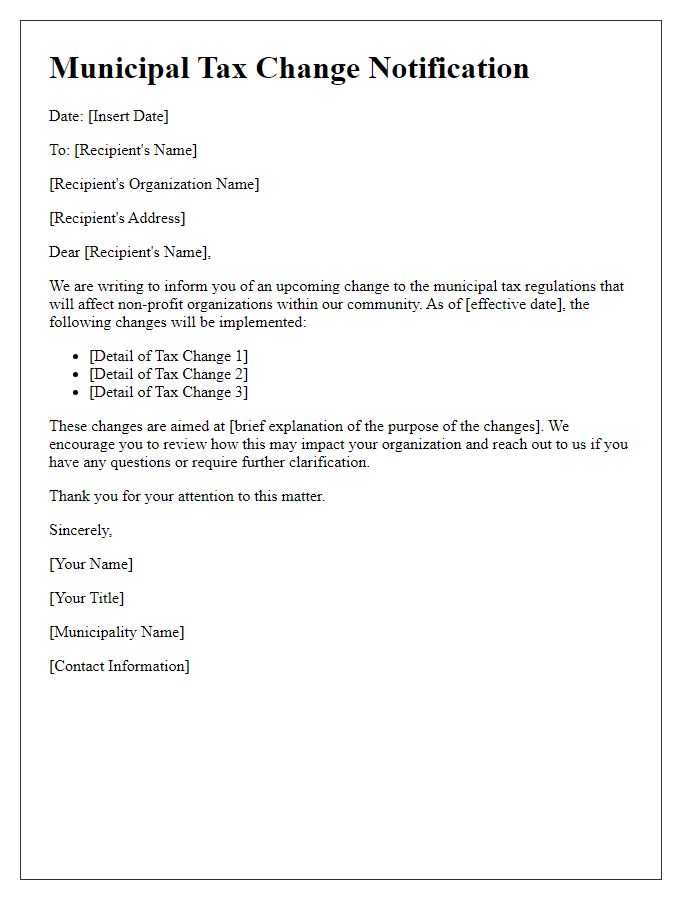

Letter template of municipal tax change notification for non-profit organizations

Letter template of municipal tax change notification for estate executors

Comments