Hey there! If you're looking to request proof for tax exemption, you've come to the right place. Crafting the perfect letter can make all the difference in ensuring a smooth process. In this article, we'll guide you through the essential elements to include and provide a handy template to make your request crystal clearâso let's dive in!

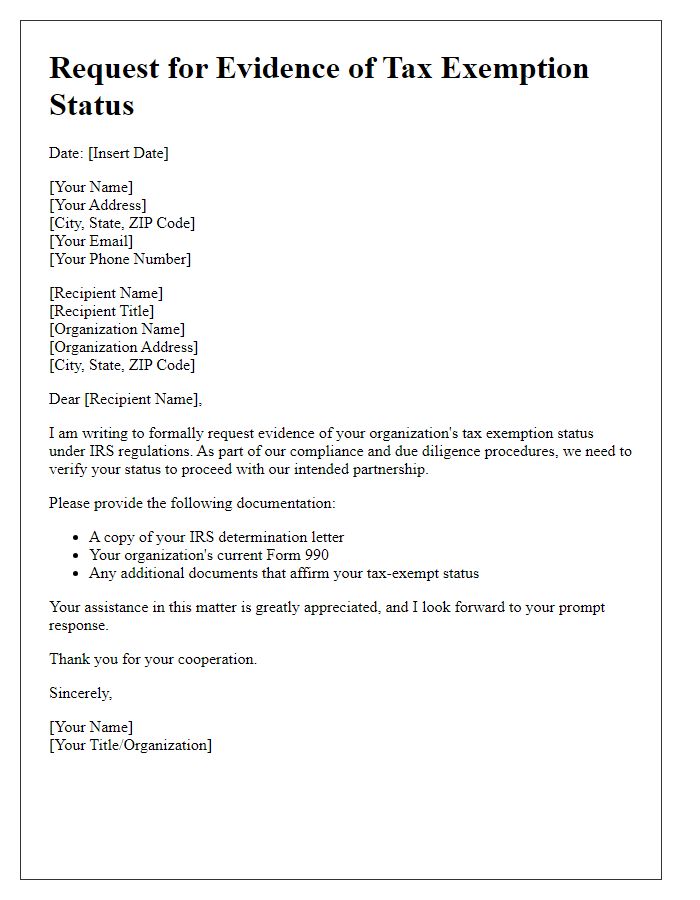

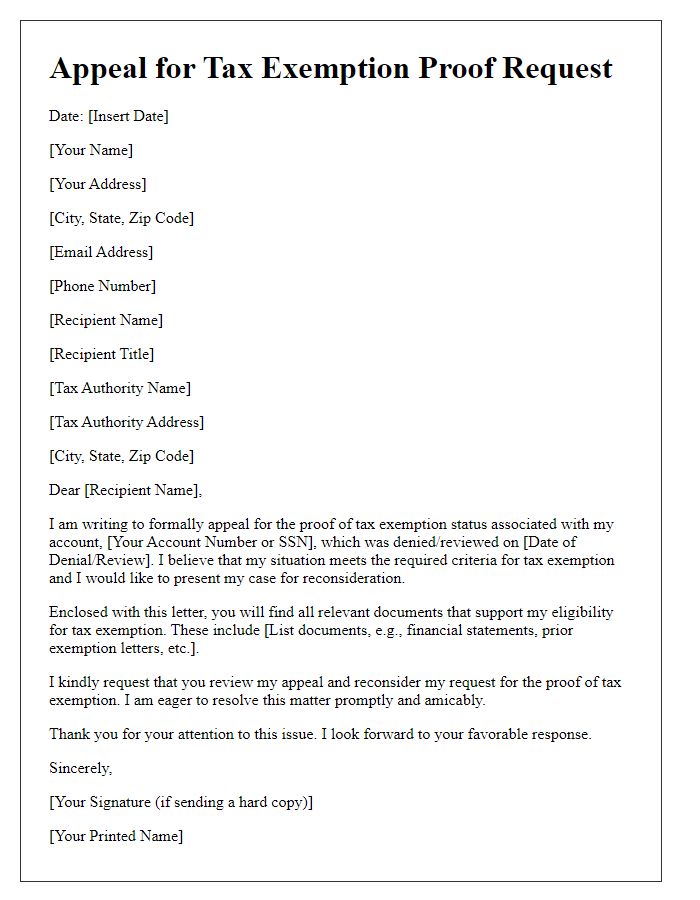

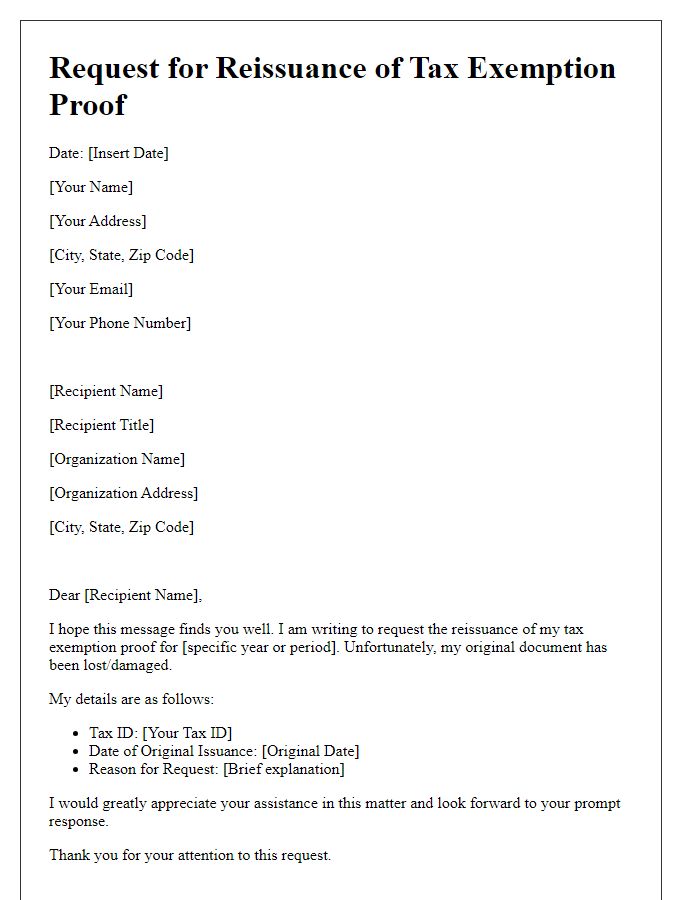

Contact Information

Tax exemption proof is a crucial document for several financial transactions and personal records. It is typically required by government authorities, financial institutions, or organizations providing grants or funding. When requesting this proof, one must include pertinent details such as full name, address, and any relevant identification numbers (like Social Security or Employee ID numbers). The request should specify the type of exemption being referred to, such as charitable organizations under Section 501(c)(3) of the Internal Revenue Code. Additionally, making note of the required forms or documents will streamline the process, facilitating quicker attention from the tax authority or corresponding office. Always ensure to provide accurate contact information to facilitate any follow-up conversations or clarifications needed during the request process.

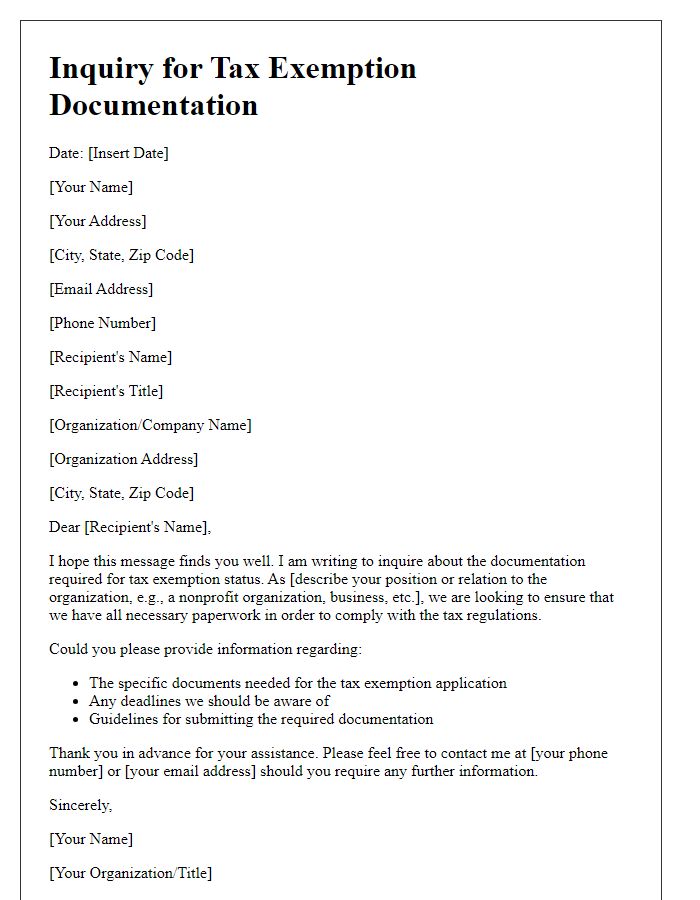

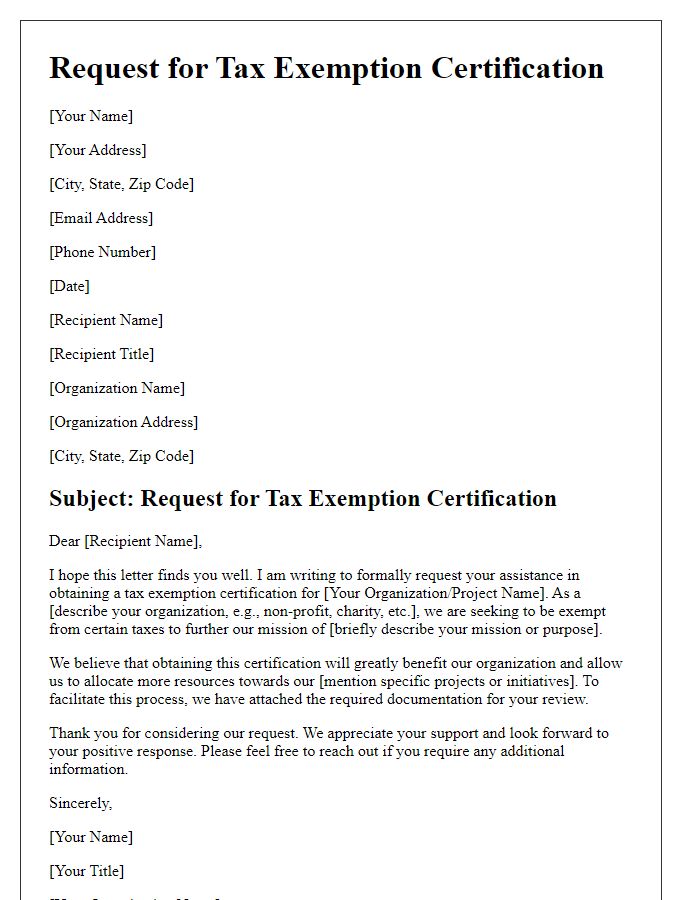

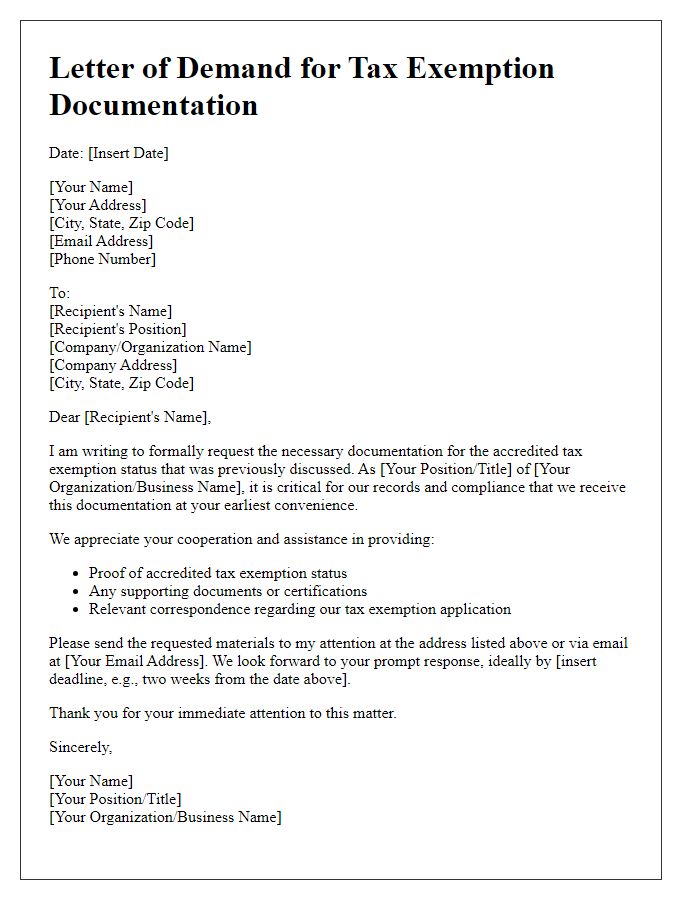

Recipient's Details

Tax exemption proof request typically involves documentation from government entities, such as the Internal Revenue Service (IRS) in the United States. Organizations seeking tax-exempt status, like nonprofit entities, often require acknowledgment letters from the IRS stating their exemption status. Providing the recipient with their specific details, including organization name, legal identification number, and specific exemption type (such as 501(c)(3)), can aid in efficient processing. Additional context includes reasons for requesting proof, such as applying for grants, demonstrating financial responsibility to partners, or fulfilling compliance obligations. Having accurate contact details, including phone number and email address, ensures smooth communication during this process.

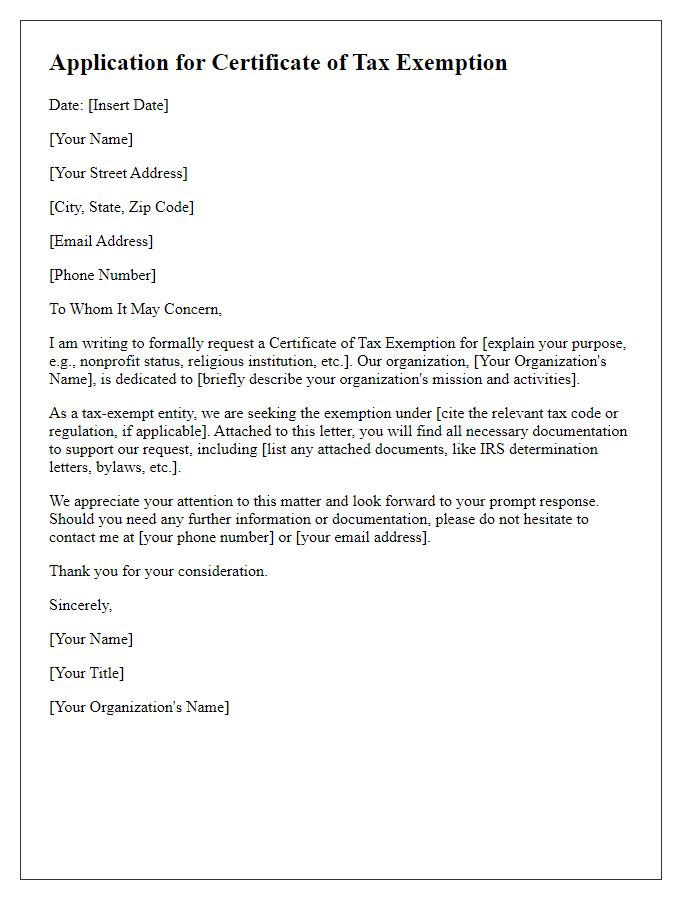

Subject Line

A tax exemption request typically requires formal documentation and clear communication regarding the specific tax exemption status. For instance, organizations aiming for a tax-exempt status under Section 501(c)(3) of the Internal Revenue Code in the United States need to provide proof of their charitable purpose. This proof can come in the form of a determination letter issued by the Internal Revenue Service (IRS) or equivalent local government authority. Such documentation is essential for validating eligibility for benefits like exemption from federal income tax, deductibility of donations, or state sales tax privileges. In cases of audits or specific financial transactions, organizations often request these documents ensuring compliance with local and federal tax regulations.

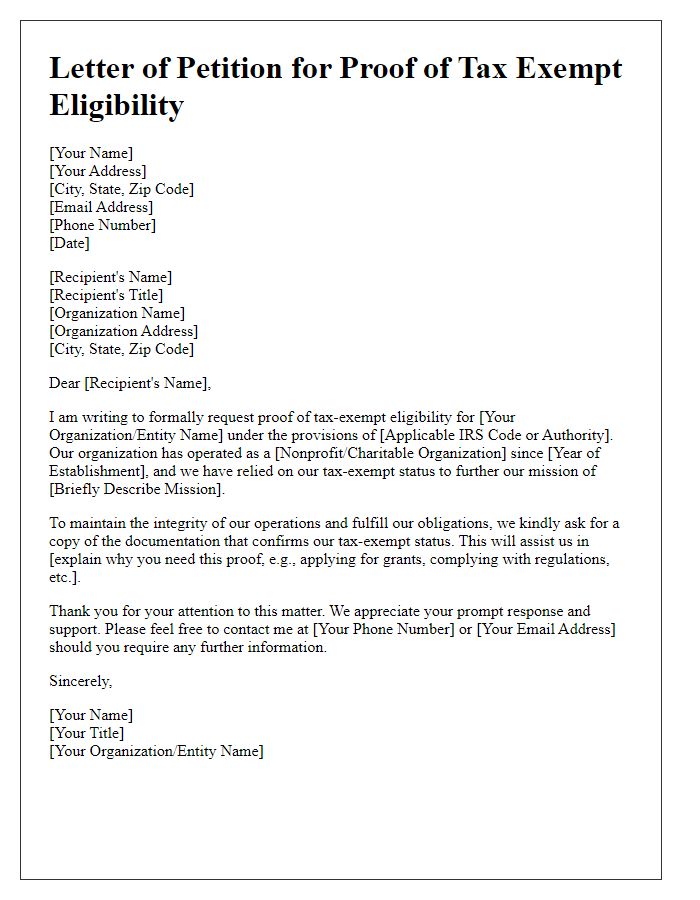

Reason for Request

Individuals or organizations may seek tax exemption proof due to various circumstances. For example, a nonprofit organization, classified under 501(c)(3) by the Internal Revenue Service (IRS) in the United States, requires tax exemption proof to demonstrate eligibility for certain grants or funding opportunities. Furthermore, personal circumstances, such as a disability, may warrant a tax exemption request for individuals complying with specific state regulations. This proof not only enables the claimant to benefit from potential financial relief but also ensures compliance with applicable laws, helping them avoid future disputes with tax authorities.

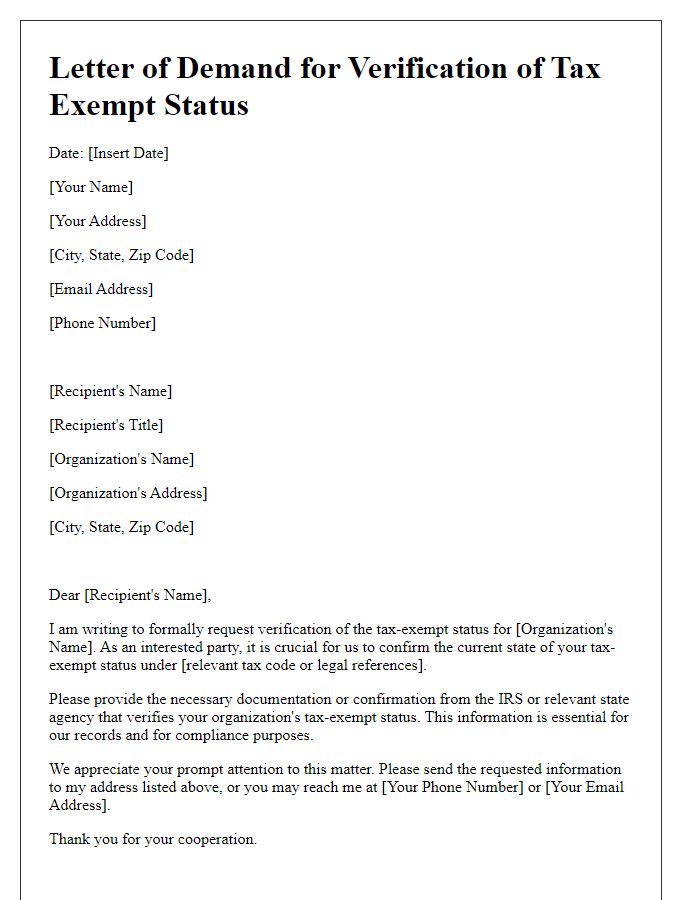

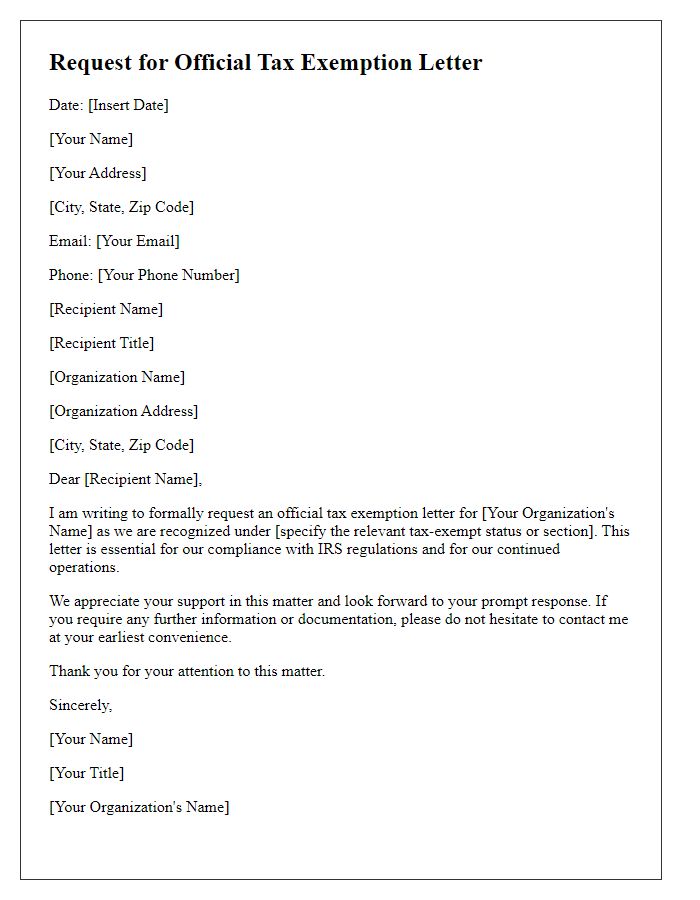

Closing and Signature

Tax exemption proof requests often occur within the context of financial compliance or nonprofit status. Organizations, such as charitable foundations or educational institutions, typically seek this documentation to establish eligibility for tax relief benefits under IRS code section 501(c)(3). When drafting a closing and signature for such a letter, ensure to include pertinent details: organization name, tax identification number, and the specific exemption requested. Closing: "Thank you for your attention to this matter. Your prompt response would be greatly appreciated as it is essential for our records and compliance requirements. Should you need further information or clarification regarding our request, please feel free to contact me directly at [Your Phone Number] or [Your Email Address]." Signature: "[Your Name], [Your Title] at [Organization Name], [Organization Address], Tax Identification Number: [Your Tax ID]

Comments