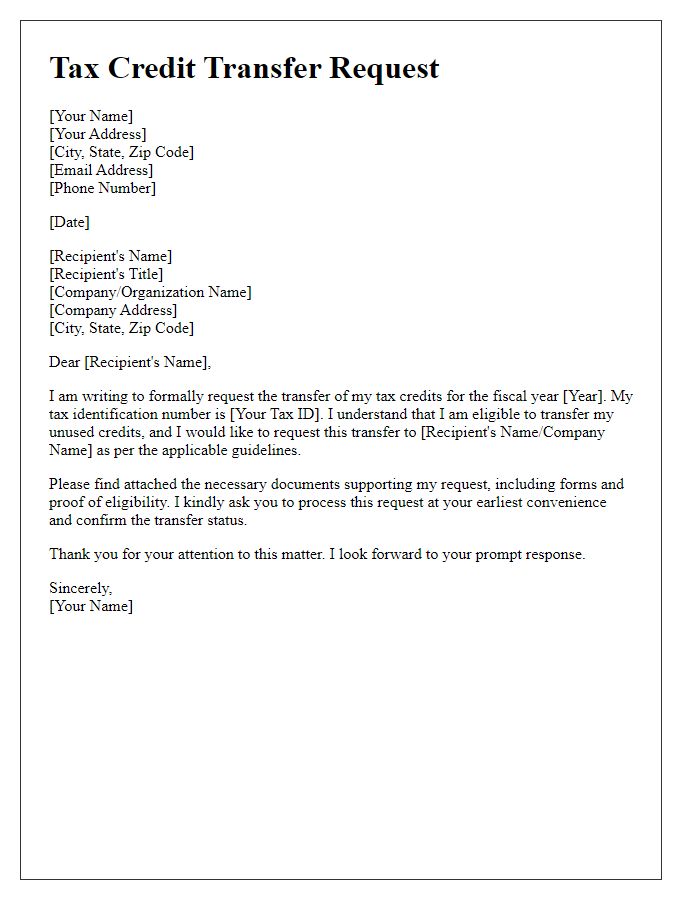

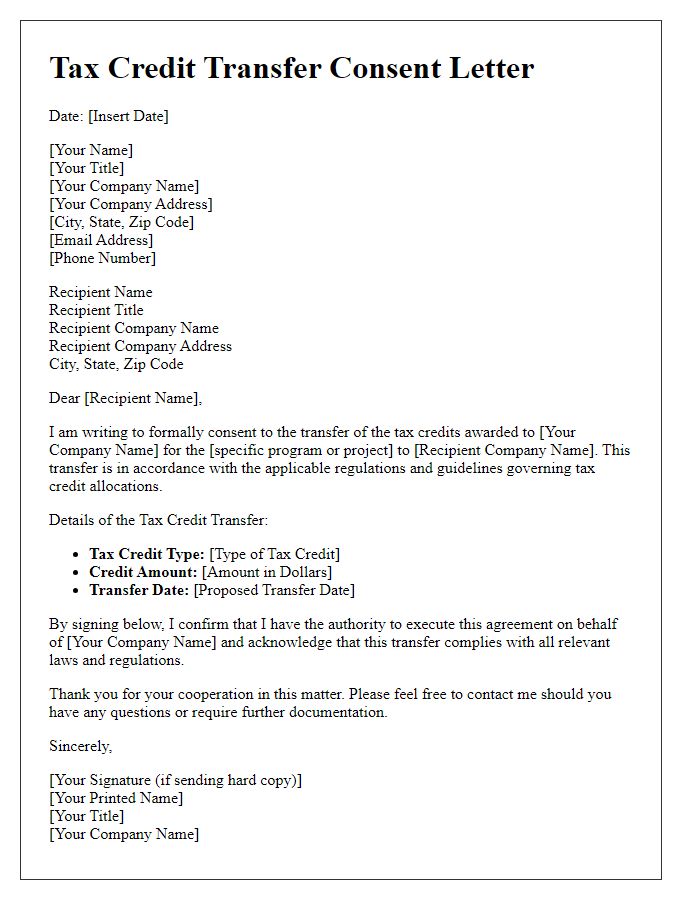

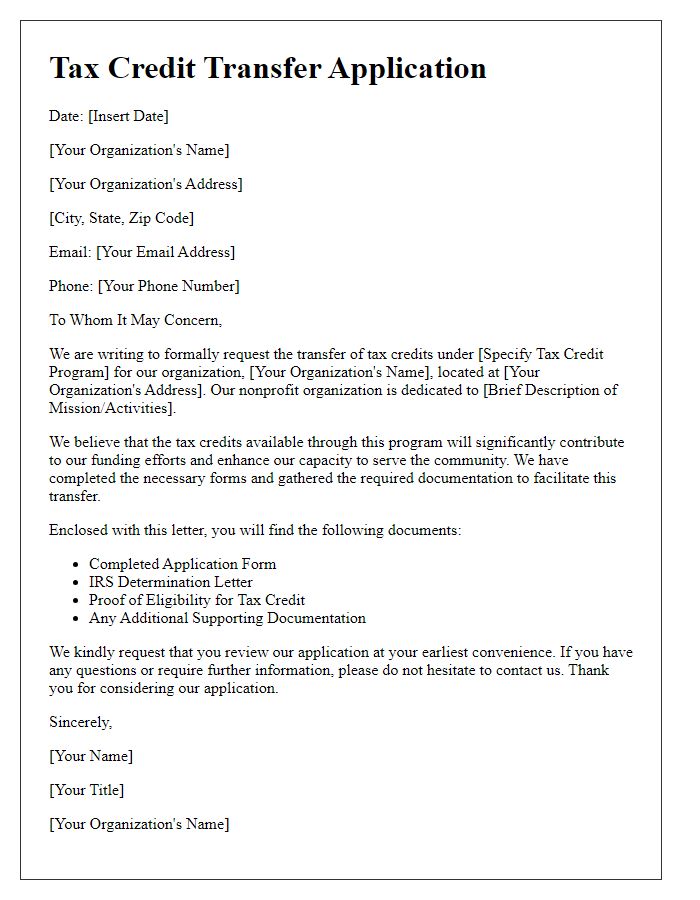

Are you looking to simplify the process of transferring your tax credits? Our tax credit transfer authorization letter template is designed to make your life easier by providing a clear, concise format you can easily customize. Whether you're transferring credits to another individual or a business, having the right documentation is essential for a smooth transaction. Curious to learn more about how to use this template effectively? Keep reading!

Taxpayer Identification Details

Taxpayer identification details play a crucial role in the tax credit transfer process, ensuring that the transferring individual or entity is properly recognized by the Internal Revenue Service (IRS). This information typically includes the Taxpayer Identification Number (TIN), employed by the IRS to track tax obligations and correspondence. Additionally, the legal name associated with the TIN, as well as the address registered with the IRS, must be accurately noted. For individuals, this often includes social security numbers (SSNs), while businesses may use Employer Identification Numbers (EINs). Properly detailing these identification elements guarantees that tax credits, such as the Earned Income Tax Credit or Child Tax Credit, are accurately applied to the correct taxpayer, avoiding potential delays or disputes during the credit transfer process.

Tax Credit Details

A tax credit transfer authorization involves the formal procedure of designating a specific individual or entity, such as a family member or business partner, to receive tax credits facilitated by government programs. These tax credits, often related to income taxes, could be due to various qualifying activities, like investing in clean energy solutions (such as solar energy systems) or contributing to education expenses (such as tuition for college students). Certain states, like California and New York, have specific guidelines outlining eligibility criteria for these tax credits, including income limits and necessary documentation requirements. The transfer process may need to be conducted within a designated timeframe, typically before tax submission deadlines for the relevant tax year (which usually falls on April 15th in the United States). Properly authorized signatures and accompanying identification information are critical to ensure compliance and prevent fraud during the transfer.

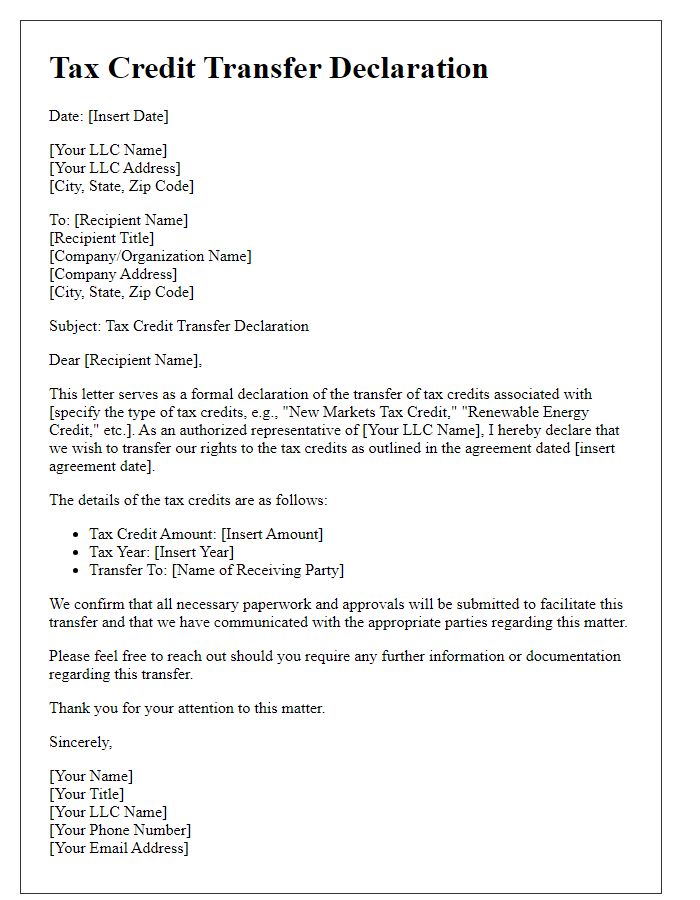

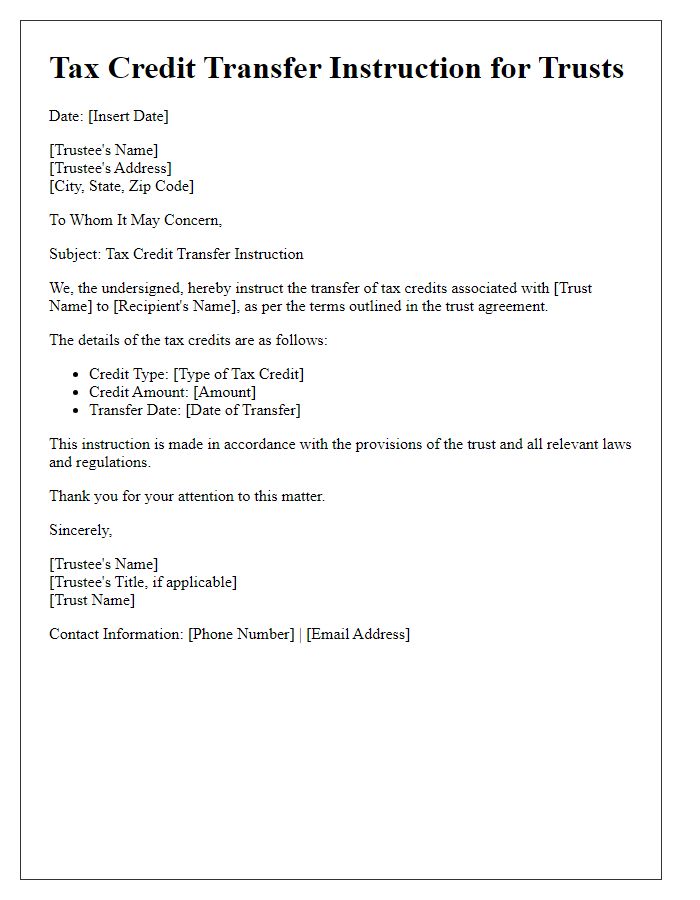

Authorization Statement

A tax credit transfer authorization involves a formal statement allowing the transfer of tax benefits from one party to another. The process typically requires specific details, including the names of both the taxpayer (transferor) and the recipient (transferee), relevant identification numbers, the amount of the tax credit being transferred, and the applicable tax year. It is essential to also include an explicit declaration that the transfer has been consented by all involved parties. Additionally, mentioning the governing authority, such as the Internal Revenue Service (IRS) in the United States, strengthens the validity of the authorization. Proper signatures and dates confirm the authenticity of the authorization statement, ensuring compliance with local tax laws and regulations.

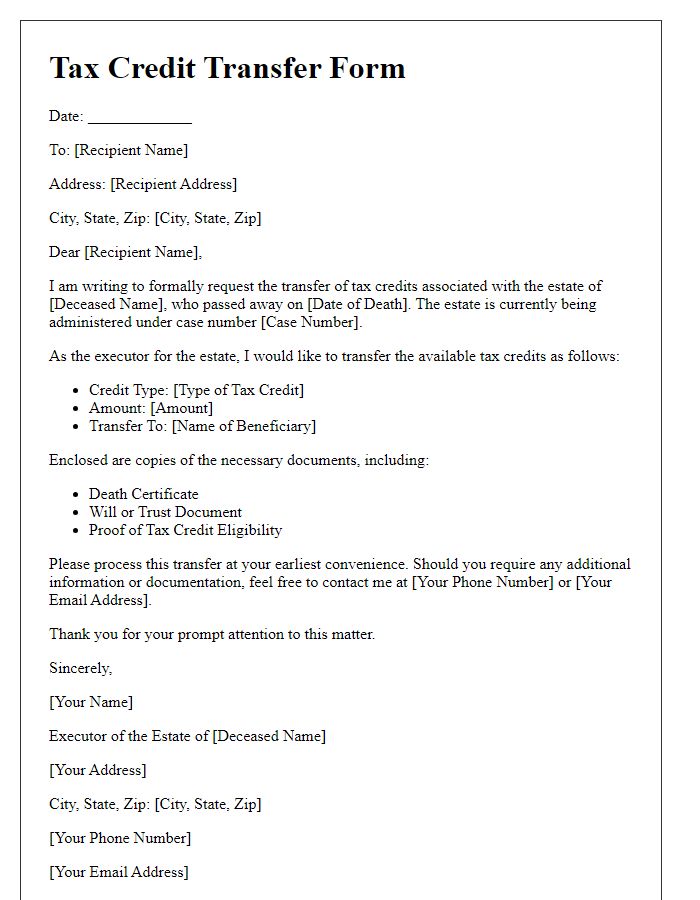

Recipient Information

Tax credit transfer authorization requires detailed recipient information for proper processing. The recipient's name, including first and last, must be accurately provided. Additionally, the recipient's taxpayer identification number (TIN or Social Security Number) is crucial for identification purposes. The recipient's mailing address, consisting of street, city, state, and zip code, ensures that any correspondence or documentation reaches the intended individual. Furthermore, contact information such as a phone number and email address can facilitate communication regarding the transfer process. Specifics regarding the type of tax credit, including relevant tax year or account number, must also accompany the recipient's details for verification and efficiency in the transfer process.

Signature and Date

Tax credit transfer authorization involves formal documentation granting permission to transfer credits, often relevant in financial or tax-related contexts. This process typically requires a specified format with clear designation of parties involved, precise details regarding the tax credit, including applicable amounts and relevant tax years (such as 2022 or 2023), along with explicit instructions on transfer methods. A signature line is essential for the authorizing individual's name, validating the request, followed by the date to establish the legitimacy and timeframe of the authorization.

Comments