Are you a senior citizen seeking relief from the burden of taxes? You're not aloneâmany seniors find themselves in need of financial assistance to navigate the complexities of tax season. In this article, we'll explore effective letter templates specifically designed to help you communicate your situation to tax authorities and request the relief you deserve. So, let's dive in and discover how you can take the first step towards easing your tax worries!

Personal Identification Information

Senior citizens often face financial challenges, particularly regarding taxes. Personal identification information includes the taxpayer's full name, Social Security number, and residential address. This information is crucial for proper identification and ensures eligibility for tax relief programs specifically designed for seniors, such as the Low-Income Home Energy Assistance Program (LIHEAP) or state-specific exemptions. Accurate documentation helps tax authorities, like the Internal Revenue Service (IRS) or local tax offices, determine qualification and process applications efficiently, often leading to significant savings on property taxes or income tax credits for individuals aged 65 and older.

Clear Statement of Request

Senior citizens often face financial challenges, especially regarding tax obligations. Seeking tax relief options tailored to individuals aged 65 and above is essential for easing financial burdens. Various government programs, such as the Property Tax Assistance Program in California, provide exemptions and reductions based on income thresholds, offering significant savings for low-income seniors. Additionally, local municipalities may have unique initiatives aimed at assisting elderly residents with property taxes, providing crucial support that can help manage living expenses. Understanding eligibility criteria, such as income limits or residency requirements, is vital in applying for these relief programs effectively.

Detailed Explanation of Financial Situation

Senior citizens seeking tax relief often face unique financial challenges. Many retirees depend on fixed incomes, such as Social Security benefits, which averaged around $1,500 per month in 2022, providing limited financial flexibility. Expenses, including healthcare costs, have been rising significantly, with average out-of-pocket expenses for seniors exceeding $6,500 annually. Additionally, property taxes can weigh heavily, especially in states like New Jersey, where seniors pay an average of $8,000 annually in property taxes. Many seniors have fixed assets, like homes, that may not be liquid, making it difficult to cover these costs. Furthermore, inflation rates, reported at 7.9% in 2022, exacerbate the purchasing power of fixed incomes. Financial stability is often compromised by unexpected expenses, including medical emergencies or home maintenance, emphasizing the need for tax relief to support this vulnerable demographic.

Relevant Tax Code References

Senior citizens often face financial challenges, particularly regarding tax obligations. The Internal Revenue Code (IRC) offers provisions that provide tax relief options for eligible elderly taxpayers, notably under Section 7520, which addresses special valuation methods for determining the present value of interests in trust, specifically benefiting seniors. Additionally, the Age Exemption under Section 2001 grants zer0 estate tax for estates below a certain threshold, often adjusted for inflation. Furthermore, states might offer additional exemptions; for example, the Homestead Exemption available in Florida can significantly reduce property tax liabilities for residents over 65, providing vital savings. Awareness of these provisions is critical for seniors seeking to ease their fiscal burdens during retirement years.

Supporting Documentation Attached

Senior citizens often face increased financial burdens during retirement, particularly concerning tax obligations. Tax relief programs, such as the Senior Citizen Property Tax Exemption, provide significant financial assistance by reducing property taxes for qualifying individuals aged 65 and older. States like California offer exemptions ranging from $7,000 to $100,000 based on income and property value, while the federal government provides specific tax credits for low-income seniors. Supporting documentation, including proof of age, income statements, and property assessments, is essential for applicants to demonstrate eligibility and secure the necessary relief. Initiatives aimed at enhancing awareness about these programs continue to evolve, fostering greater accessibility for seniors, particularly in regions with a high elderly population.

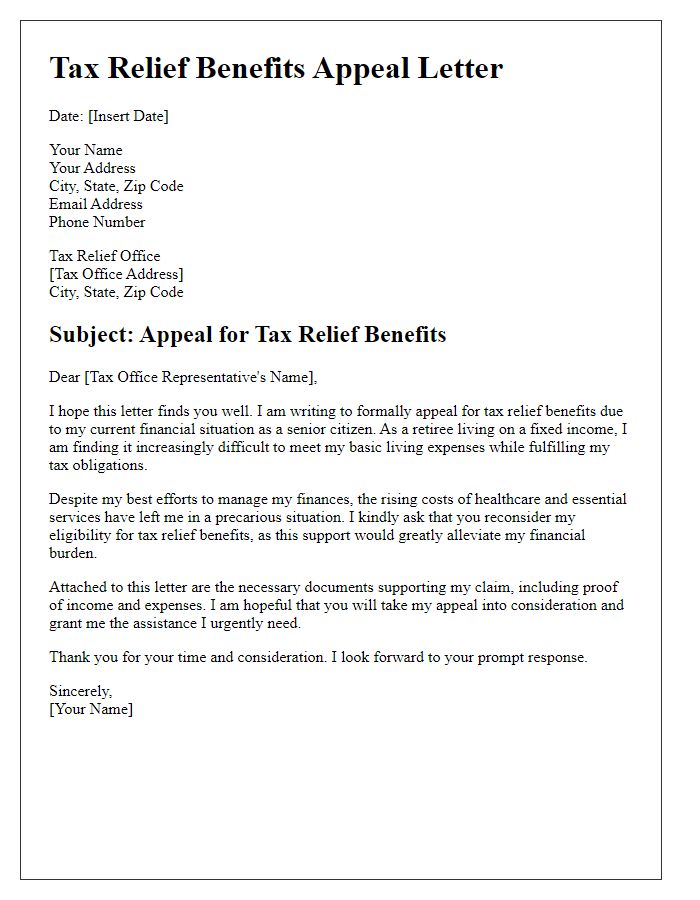

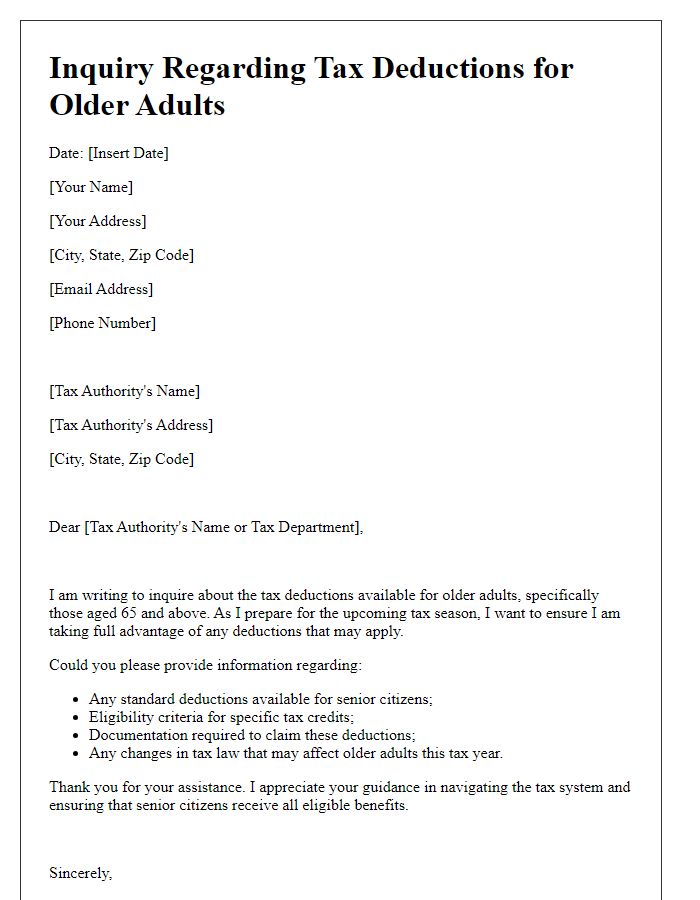

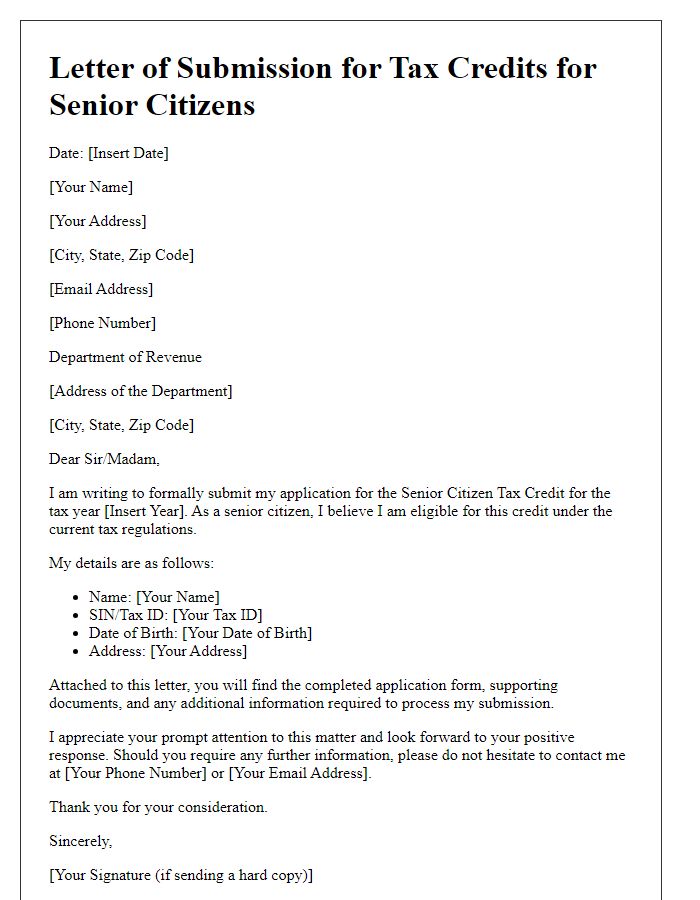

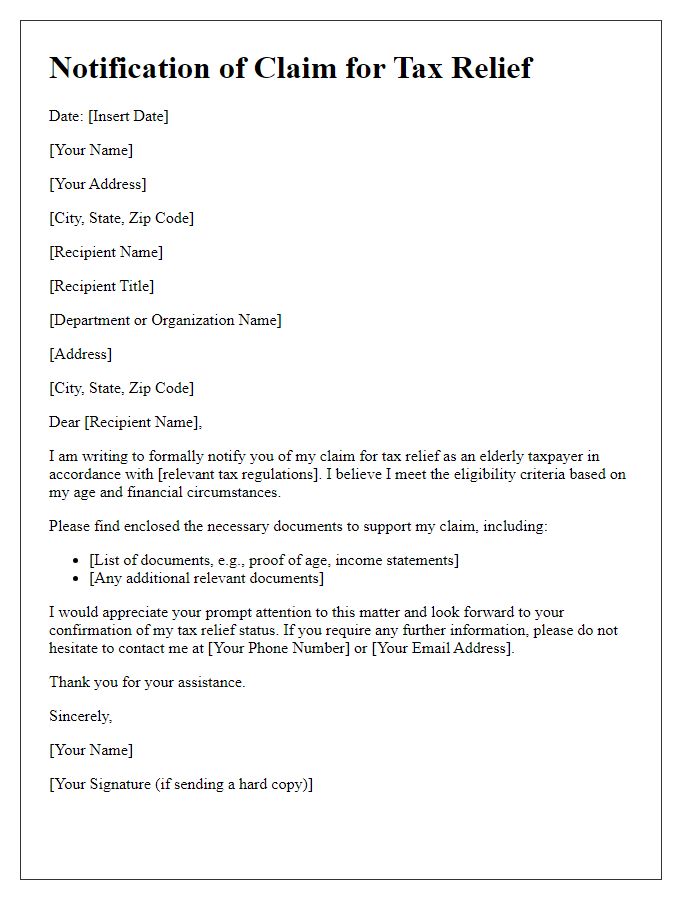

Letter Template For Tax Relief For Senior Citizens Samples

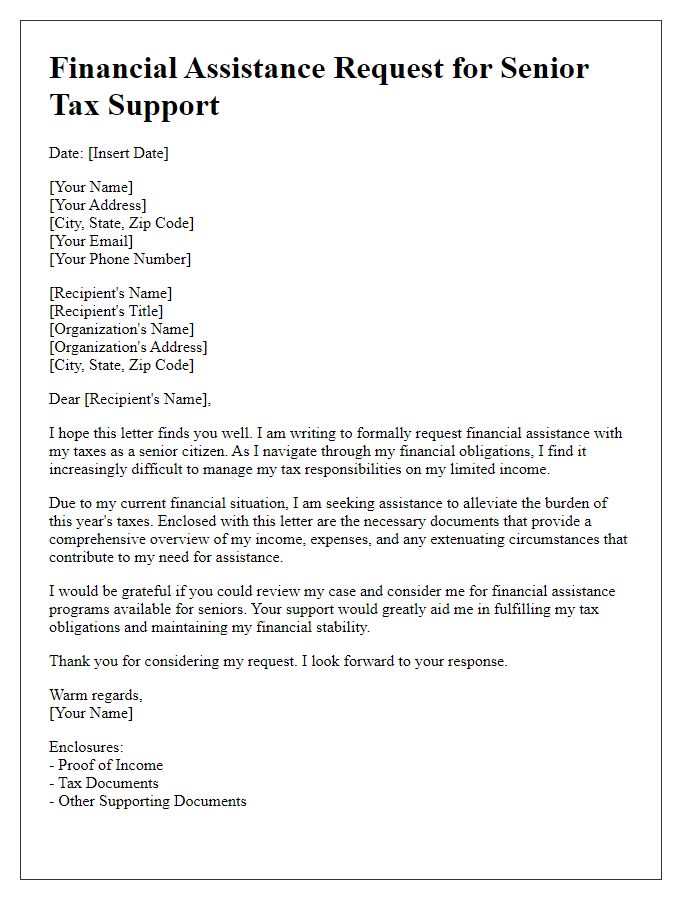

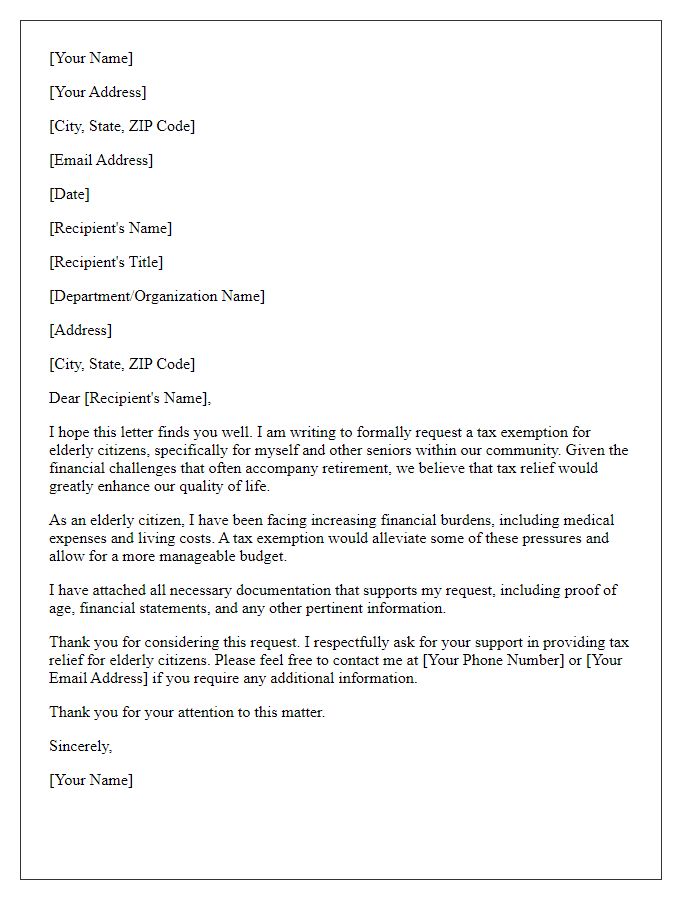

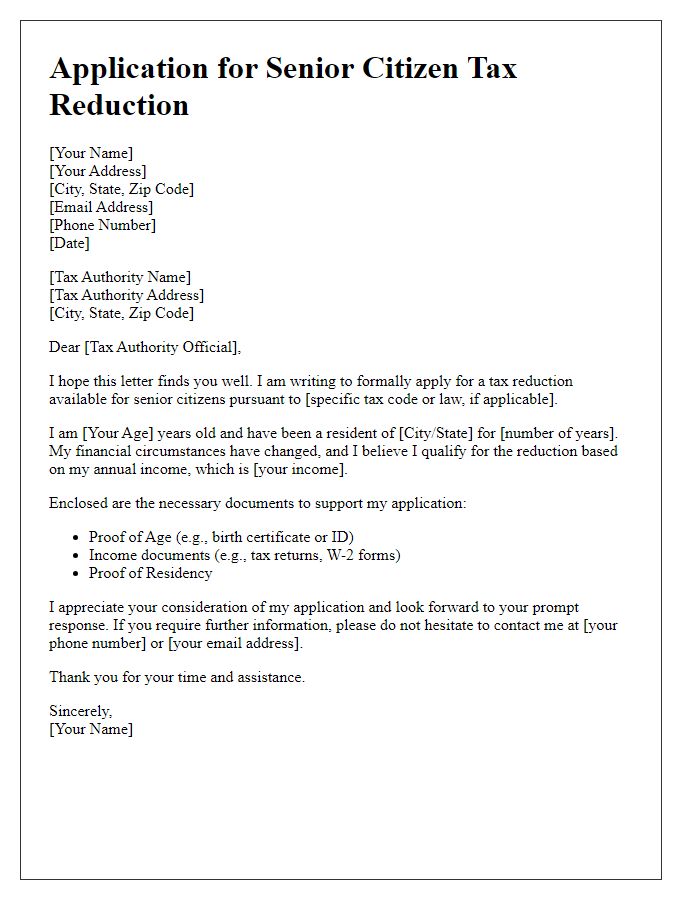

Letter template of documentation for financial assistance in taxes for seniors

Comments