Are you feeling overwhelmed by the recent changes to your tax withholding certificate? You're not aloneânavigating these adjustments can be tricky, but understanding them is essential for managing your finances effectively. In this article, we'll break down what you need to know about these changes and how they impact your paycheck. So, let's dive in and explore the details together!

Purpose of Change

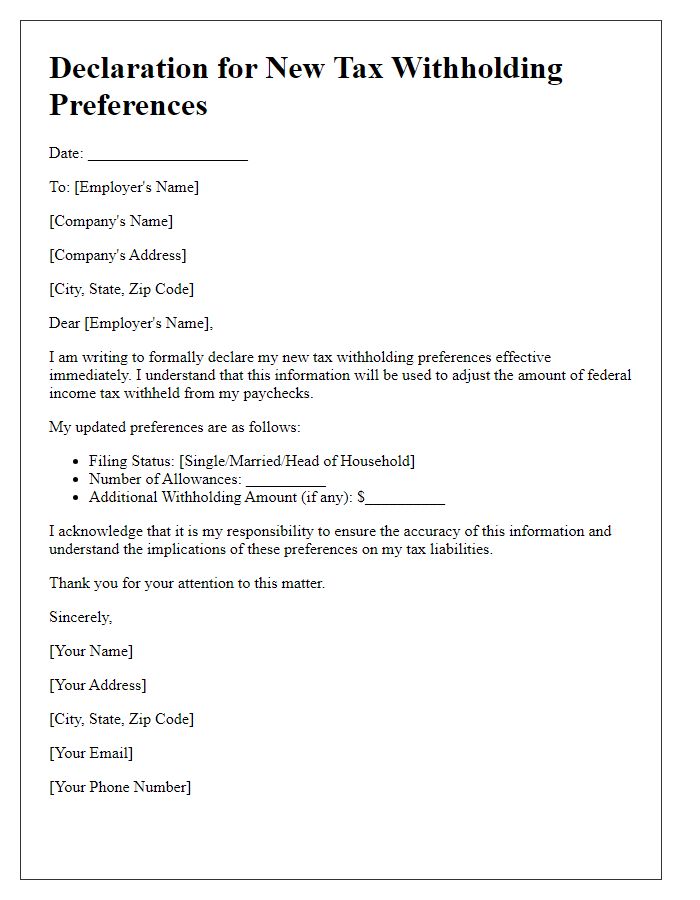

Changes to tax withholding certificates are essential for ensuring accurate tax deductions reflecting current income levels. Adjustments may arise from various circumstances, such as alterations in employment status, fluctuations in salary, or shifts in personal life events including marriage or childbirth. A new W-4 form for employees in the United States may need to be submitted to the employer, which outlines the preferred amount of federal income tax withholding. Key elements on the form include the employee's personal identification details, updated allowances based on current financial situations, and any additional withholding amounts that may be desired. Timely reporting of changes ensures compliance with federal tax regulations and prevents potential underpayment penalties. Moreover, reviewing these certificates periodically can help individuals manage their tax liabilities effectively throughout the fiscal year.

Account and Personal Information

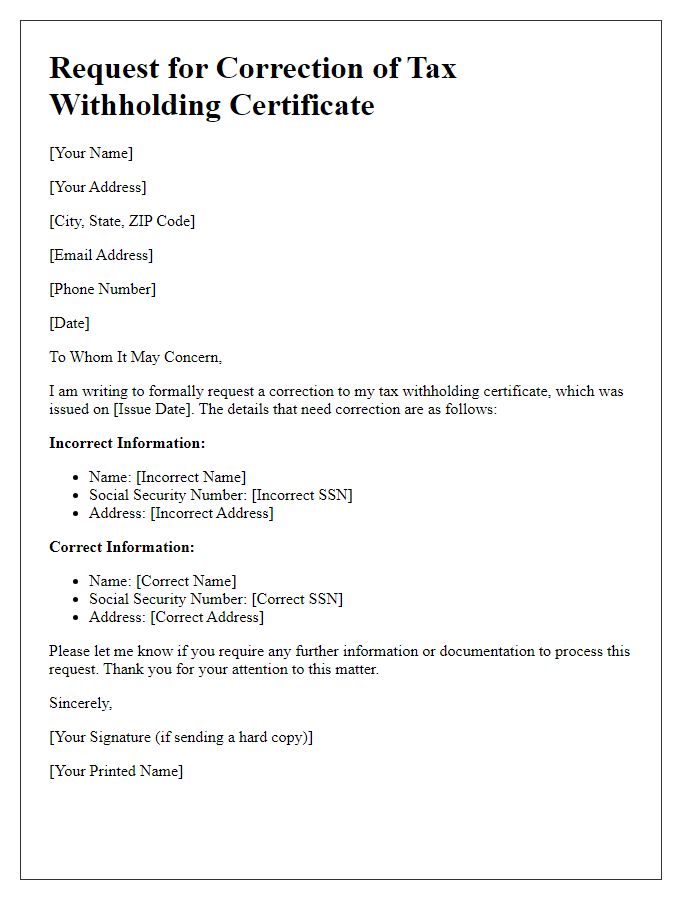

Tax withholding certificate changes, particularly in relation to account and personal information, are crucial for accurate payroll deductions. The Internal Revenue Service (IRS) Form W-4 is the primary document used for this purpose in the United States. Changes in personal details, such as marital status or number of dependents, can significantly impact the withholding amount. For example, individuals who update their status to 'married' may qualify for different tax brackets, potentially reducing the amount withheld from their wages. Furthermore, a change in home address can affect local and state withholding requirements, highlighting the importance of providing accurate residency information. Taxpayers must ensure timely submission of any changes to maintain compliance and avoid tax underpayment or overpayment scenarios.

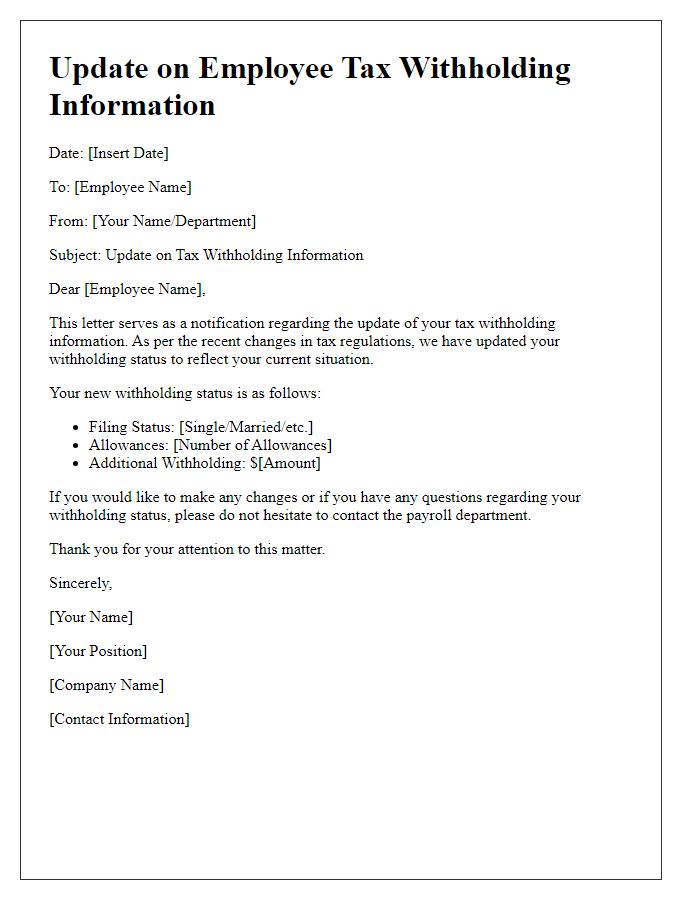

New Withholding Details

Tax withholding certificates are essential for adjusting an individual's or entity's federal and state tax responsibilities. Changes in withholding details can arise from various life events, such as marriage, having children, or significant income alterations. The IRS Form W-4, for example, must be updated to reflect adjusted allowances or exemptions, impacting the amount withheld from each paycheck. Employers, such as firms in New York or California, are required to implement these changes to ensure compliance with tax regulations. Accurate updates minimize the risk of underpayment, which could result in penalties or interest charges. Employees should review their withholding at least annually or whenever substantial changes occur in their financial situation.

Authorization and Signature

Tax withholding certificate updates, such as Form W-4 in the United States, require careful completion for accurate federal income tax withholding adjustments. The certification process demands the taxpayer's personal information, including name, social security number, and filing status, ensuring compliance with IRS regulations. Additionally, changes in exemptions, deductions, and additional withholding amounts require appropriate documentation and signatures to validate the request legally. Submission of this revised information to the employer within the specified time frame is crucial for reflecting adjustments in the next paycheck cycle, contributing to accurate tax liability management for the individual taxpayer.

Contact Information

The Tax Withholding Certificate changes require updated contact information to ensure accurate processing. The form may request details such as the taxpayer's first name, last name, Social Security Number (SSN), and current address to facilitate communication. Accurate phone numbers, including area codes, are critical to allow the Internal Revenue Service (IRS) representatives to reach the individual efficiently for any follow-up questions regarding tax status. Additionally, email addresses may be requested for electronic correspondence, offering a quicker method for receiving updates or notifications about changes in tax withholding status. Ensuring this information is current is vital for compliance with federal tax regulations and timely receipt of refunds.

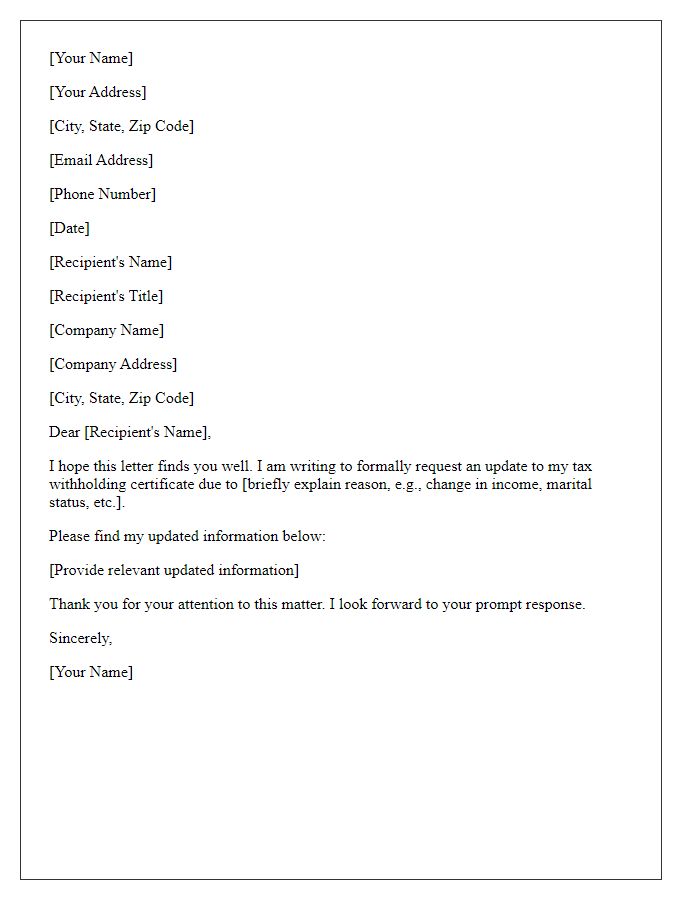

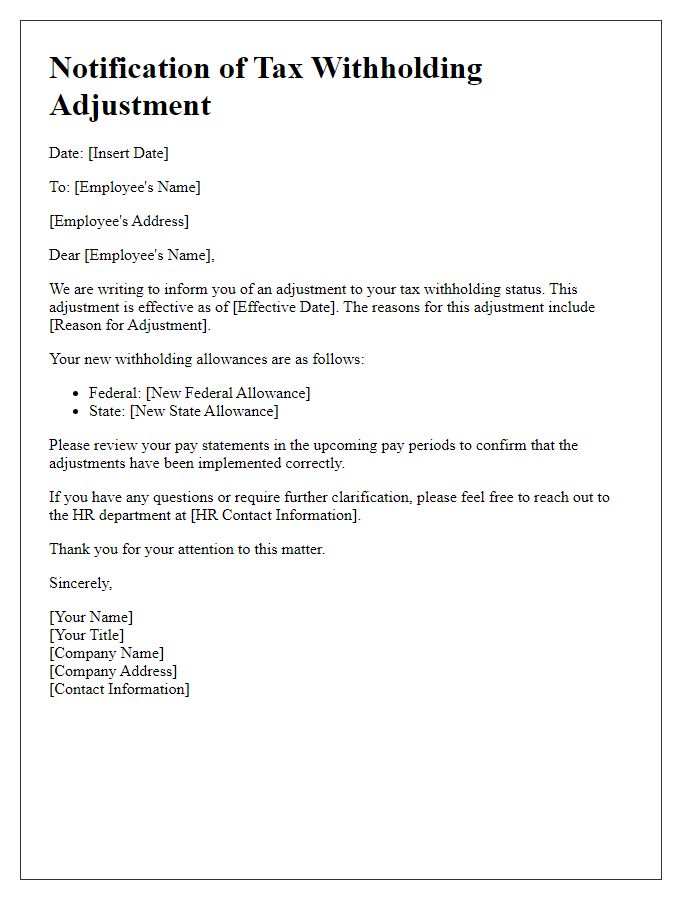

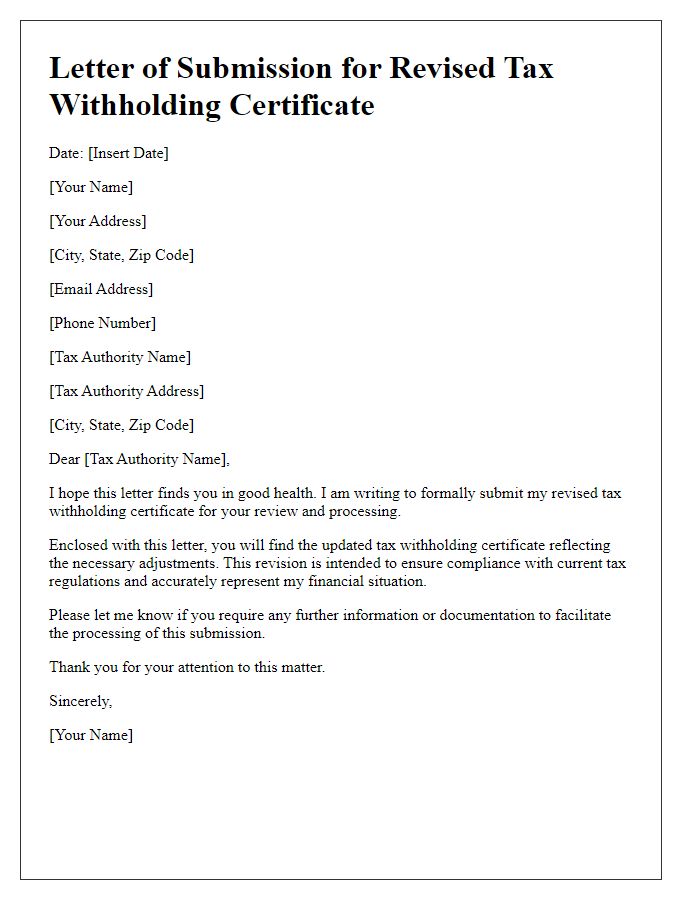

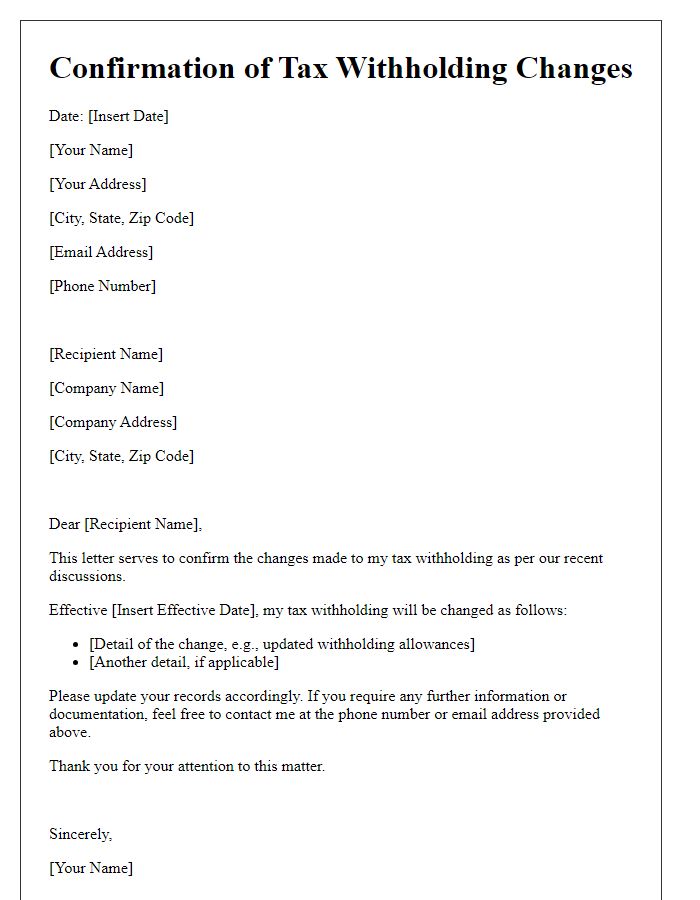

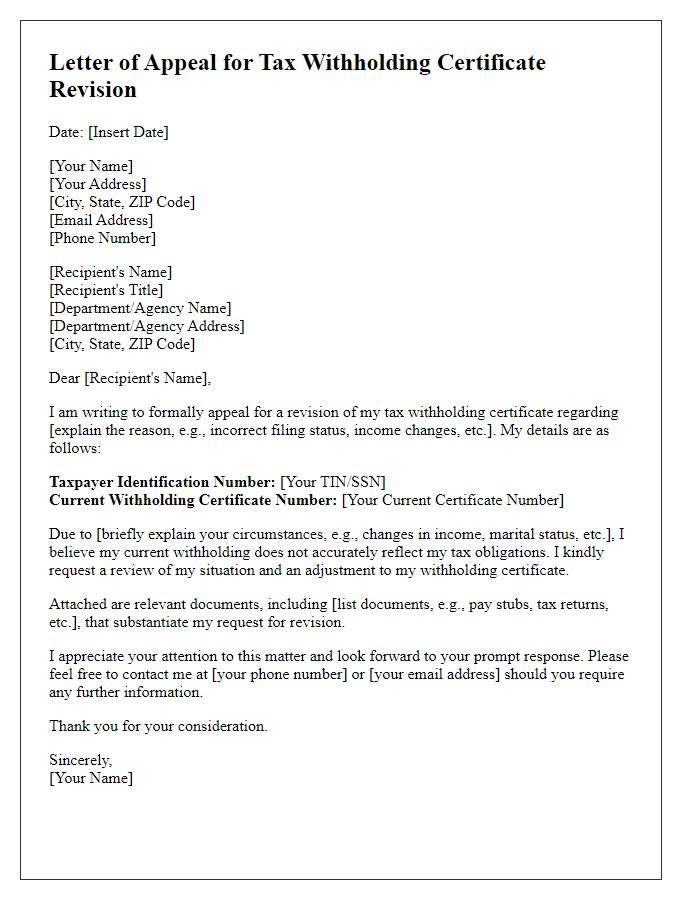

Letter Template For Tax Withholding Certificate Changes Samples

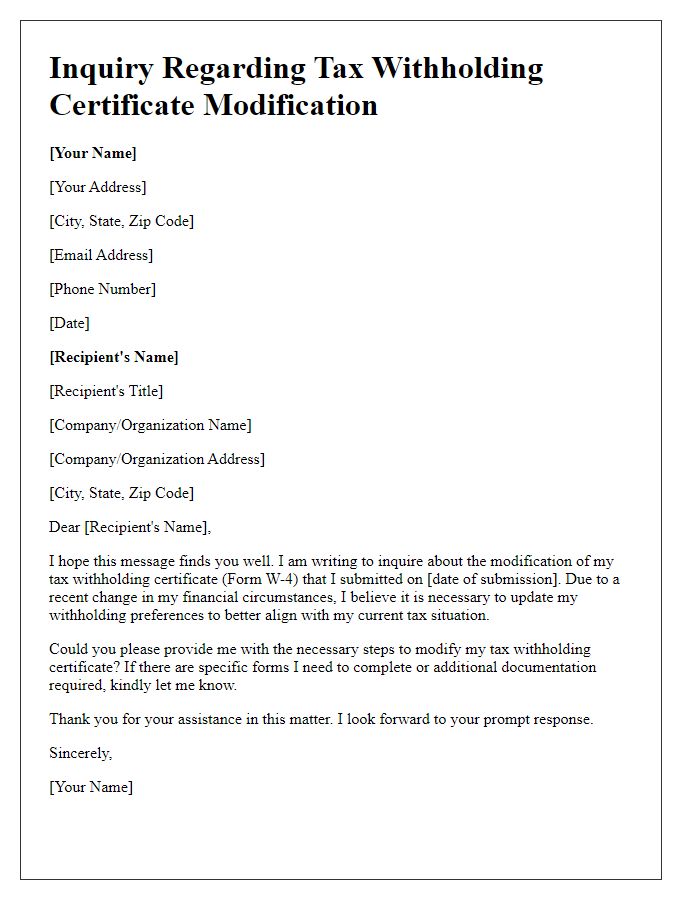

Letter template of inquiry regarding tax withholding certificate modification

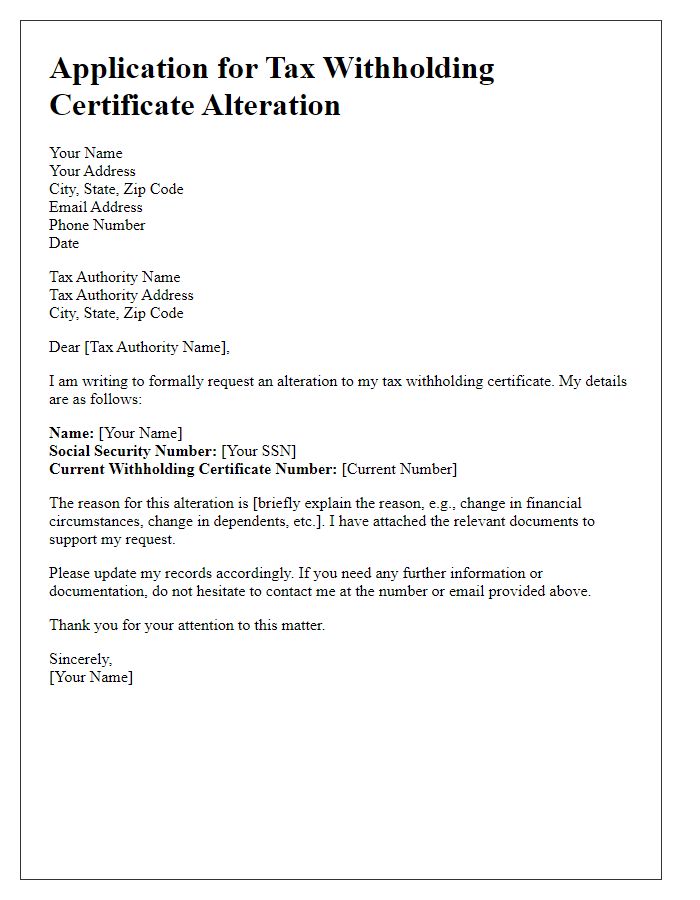

Letter template of application for tax withholding certificate alteration

Comments