Are you feeling a bit lost when it comes to confirming your real estate tax payments? You're not alone! Navigating the world of property taxes can be confusing, but understanding your responsibilities is crucial for maintaining your investments and financial health. To help you out, we've put together an informative article that breaks down everything you need to know about confirming your real estate tax payments, so let's dive in!

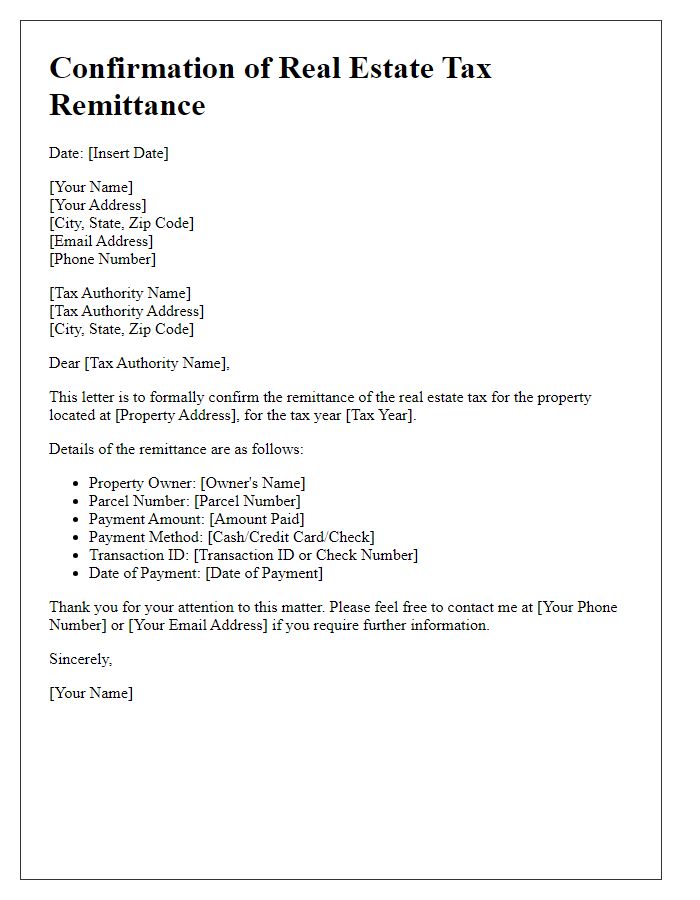

Property Owner's Information

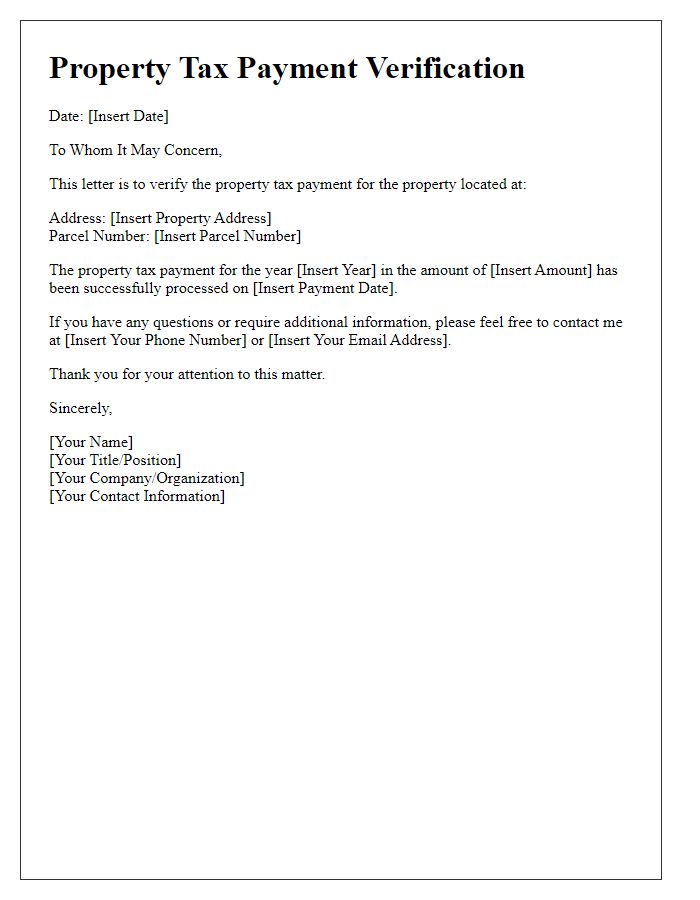

Property owners are required to maintain accurate records of their real estate tax payments to comply with local government regulations. This essential documentation typically includes taxpayer identification numbers, property addresses, and payment reference numbers to facilitate seamless audits and verifications. The tax payment confirmation serves as an official acknowledgment from the local tax office, often issued after payments are processed. This document includes key details such as payment dates, amounts, and property identification numbers, clearly defining the tax obligations fulfilled. Accurate and timely confirmation prevents issues during tax declarations and ensures the property remains in good standing in real estate databases, impacting future assessments and potential transactions.

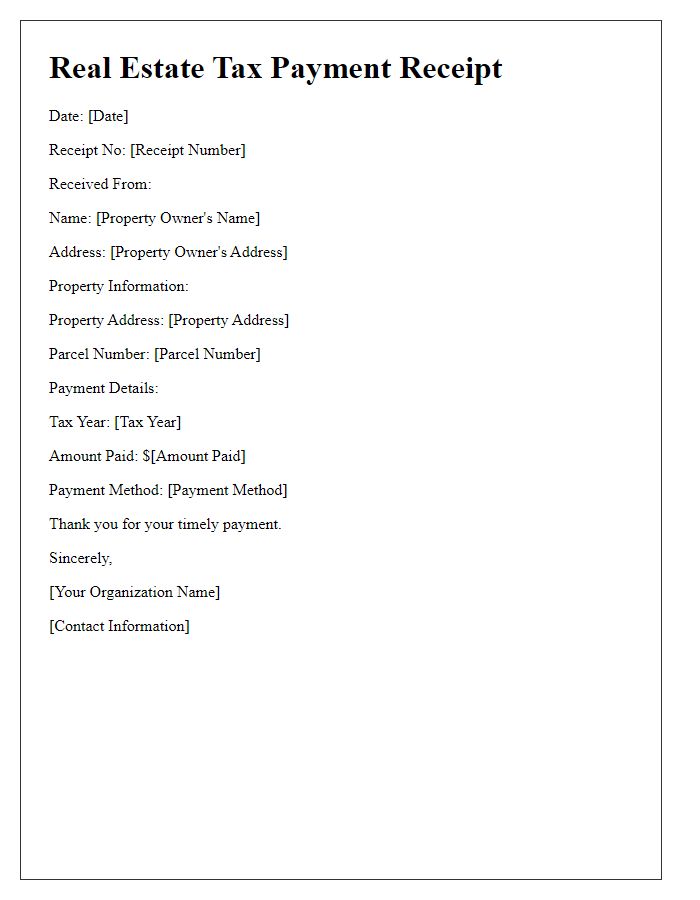

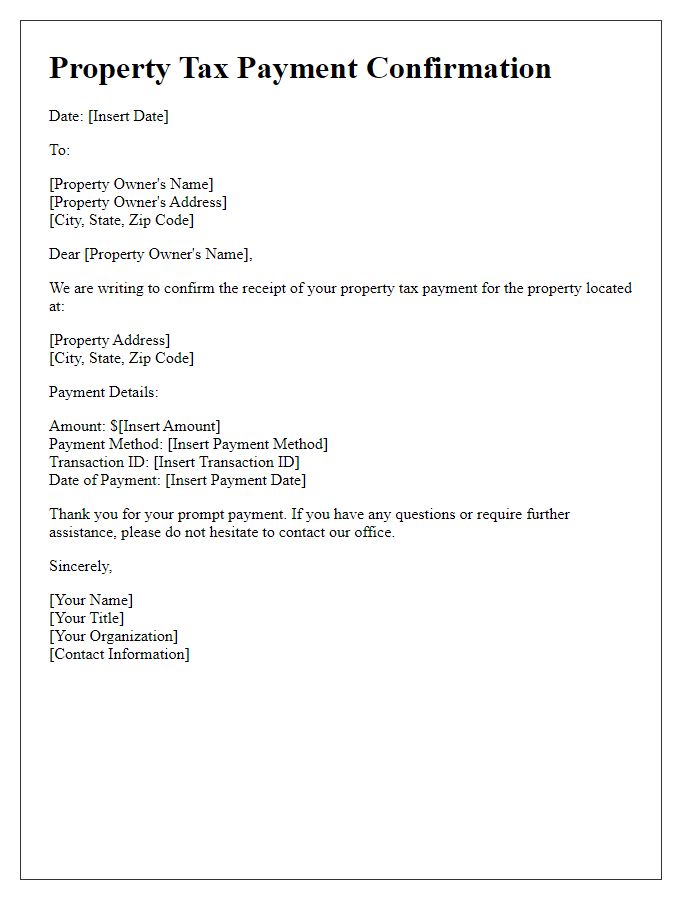

Tax Payment Details

Real estate tax payment confirmation serves as an essential document for property owners. The receipt (dated October 15, 2023) confirms the payment of $3,500 for the property located at 123 Maple Street, Springfield, IL. This payment represents the annual property tax obligation, which funds local services such as public education, road maintenance, and emergency services. The transaction number associated with this payment is 789456123. It is vital for property owners to retain this confirmation for personal record-keeping and potential future inquiries.

Property Description

A real estate tax payment confirmation illustrates proof of payment for property ownership. For example, a residential property located at 123 Maple Street in Springfield, Illinois, with a property identification number (PIN) of 01-123-456-789. The tax payment for the fiscal year 2023 amounts to $3,200, reflecting an assessed property value of $320,000. This documentation usually includes details such as the payment date, typically recorded on April 1, payment method (e.g., electronic transfer or check), and the confirmation number issued by the county tax assessor's office. Such records ensure compliance with local tax obligations and provide necessary information for potential future transactions or financing purposes.

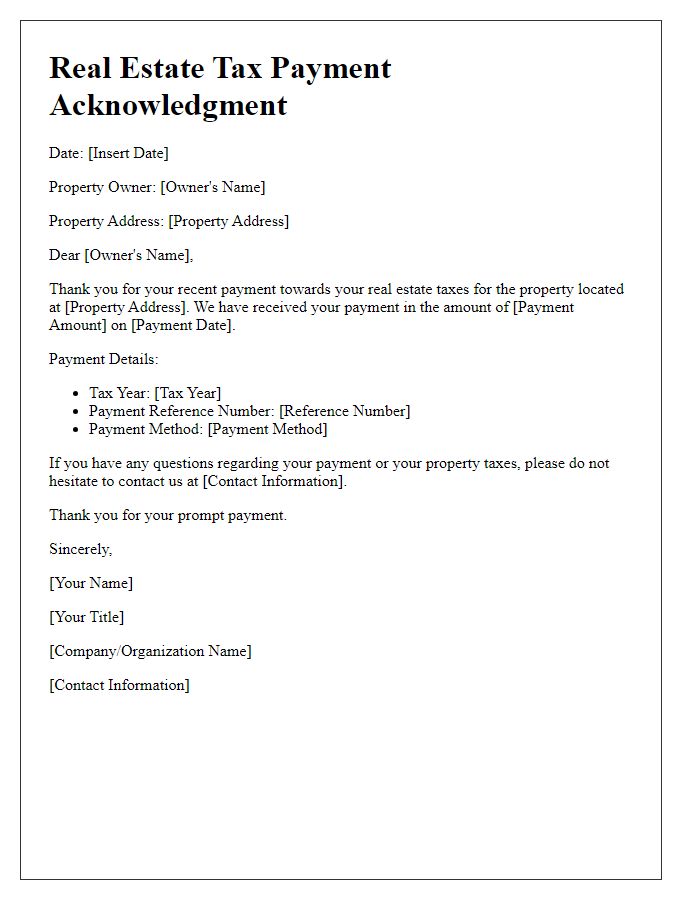

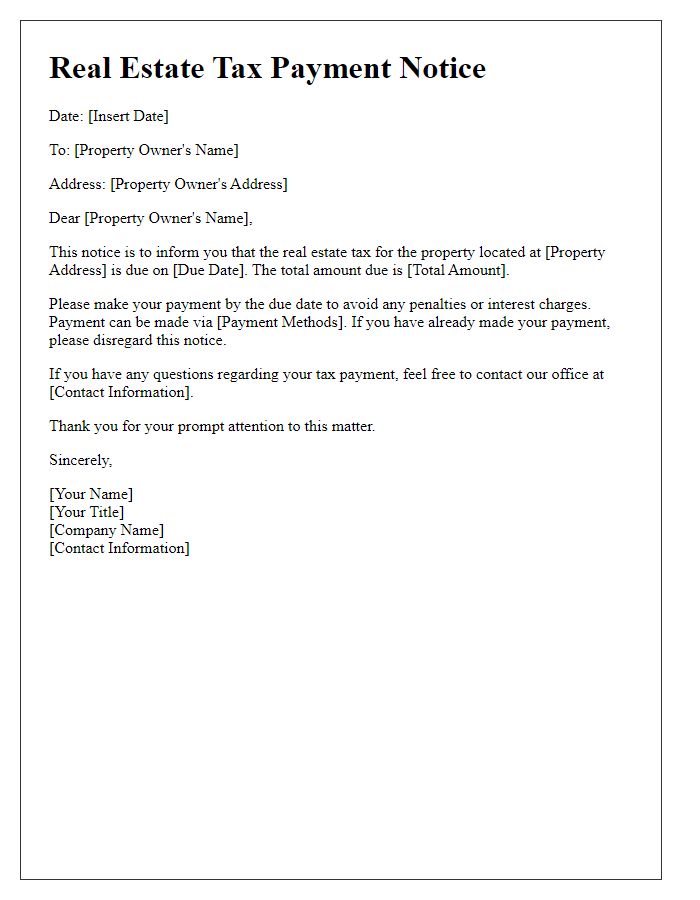

Acknowledgment of Payment

Real estate tax payments serve a crucial role in funding local government services and maintaining community infrastructure. The acknowledgment of payment signifies the receipt of funds designated for property taxes, typically assessed annually based on property value, which can vary significantly across different regions. In many jurisdictions, property tax rates may range from 0.5% to 2.5% of the assessed value, impacting homeowners' financial obligations. Timely confirmation of payment not only assures taxpayers that their contributions support essential public services--like education, public safety, and road maintenance--but also serves as a safeguard against penalties or late fees imposed by local tax authorities, such as the Internal Revenue Service (IRS). This formal documentation often includes details such as the payment amount, due date, property identification, and the specific tax year being covered, providing clarity and peace of mind for property owners.

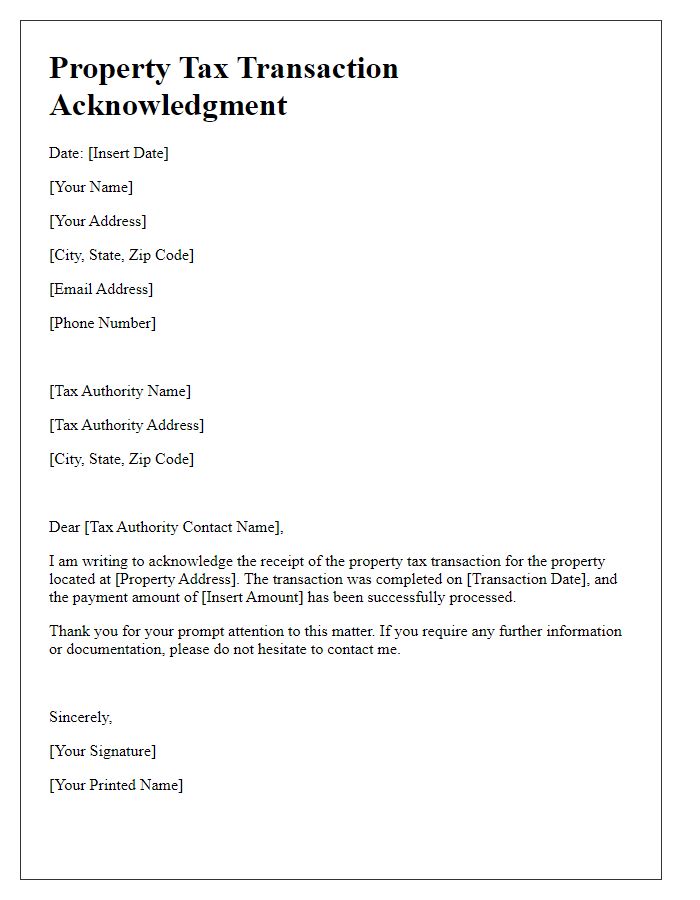

Contact Information for Inquiries

Real estate tax payment confirmation serves as an official acknowledgment of tax payments made by property owners, ensuring compliance with local tax regulations. Property taxes, typically assessed yearly, vary based on property value and local tax rates, which can range from 0.5% to 2% depending on the jurisdiction. It is crucial for property owners to keep accurate records of these payments, especially for financial planning and potential deductions during tax season. Clear contact information for inquiries, usually including phone numbers and email addresses of the local tax assessor's office or treasurer's department, facilitates communication for any questions or disputes regarding tax bills, payment status, or property assessments. For example, a property owner in Los Angeles might need to connect with the Los Angeles County Assessor's office for clarification on tax payment discrepancies related to recent property appraisals.

Comments