Are you ready to dive into the world of tax regulations and understand how serious allegations of tax evasion can impact individuals and businesses alike? In this article, we'll explore the intricacies of investigating such claims, shedding light on the legal processes and potential consequences involved. With a conversational tone, we aim to break down the complexities of tax laws and offer insights into what you need to know if you find yourself entangled in such a situation. So, grab a cup of coffee and join us as we unpack this important topic together!

Subject Line: Tax Evasion Investigation Notification

Tax evasion investigations often involve complex financial schemes spanning multiple jurisdictions. The Internal Revenue Service (IRS) in the United States oversees such inquiries, analyzing documents and transactions to identify discrepancies in reported income versus actual earnings. Alleged offenders may face consequences including significant monetary penalties, interest on unpaid taxes, and potential imprisonment. Investigators utilize forensic accounting techniques, scrutinizing bank records, investment portfolios, and business transactions to unravel illicit activities that may involve offshore accounts or underreported cash revenues. Such investigations typically last several months, requiring collaboration with various governmental agencies for comprehensive oversight.

Recipient Information: Name, Address, Contact Details

The investigation into tax evasion allegations involves a comprehensive analysis of financial records, compliance with tax laws, and possible illicit activities. Authorities use forensic accounting techniques to scrutinize discrepancies that may indicate fraudulent behavior. High-profile cases often arise in commercial centers like New York City, where corporations may engage in dubious tax practices to minimize liabilities. The Internal Revenue Service (IRS) implements strict regulations to ensure adherence to taxation policies. Investigations could lead to significant legal repercussions, including fines, penalties, or criminal charges, especially for repeat offenders or cases involving substantial amounts, often exceeding $50,000.

Statement of Allegation: Description and Context

Tax evasion allegations can significantly impact both individuals and organizations, leading to extensive investigations and potential legal ramifications. Such allegations often arise from discrepancies detected in financial records, such as suspicious transactions exceeding $10,000 or unreported income sources. Investigators typically focus on patterns indicating fraudulent activity, such as inconsistencies in reported revenue versus lifestyle indicators, including luxury purchases or high-value real estate holdings. Regulatory bodies, such as the Internal Revenue Service (IRS) in the United States, may initiate audits in response to whistleblower tips or data analysis that flags anomalies. These investigations often take place over several months and can encompass various financial documents, including bank statements, tax returns, and third-party correspondence. In major cases, outcomes can involve substantial fines, criminal charges, and reputational damage to the involved parties.

Request for Documentation: Specific Records Needed

A comprehensive investigation into allegations of tax evasion necessitates the collection of specific financial documentation related to the taxpayer's income, expenses, and financial transactions. Essential records include bank statements from the past five years, itemized receipts for deductible expenses, and any relevant financial statements from business entities linked to the individual. Additionally, documentation such as tax returns filed with the Internal Revenue Service (IRS) and state tax authorities is crucial for verifying reported income versus actual earnings. Payroll records and contracts associated with employment or freelance work must also be provided to establish accurate income reporting. Supporting documents such as invoices, correspondence with tax professionals, and any prior audit findings can offer insight into potential discrepancies. Comprehensive retrieval of this documentation is vital to facilitate an accurate assessment and resolution of the allegations.

Compliance and Response Deadline: Date and Instructions

A formal investigation into tax evasion allegations requires strict adherence to compliance protocols and response deadlines. The inquiry, conducted by the Internal Revenue Service (IRS), seeks documentation related to financial transactions, income statements, and tax filings from the last five years. Entities involved must submit their responses by November 30, 2023, to avoid penalties. Failure to comply may result in further legal action or additional scrutiny. Key documents include bank statements, receipts, and records of assets over $10,000. All submissions should follow specified formats, such as PDF, for efficient processing. Ensure that all information is accurate to mitigate risks associated with non-compliance.

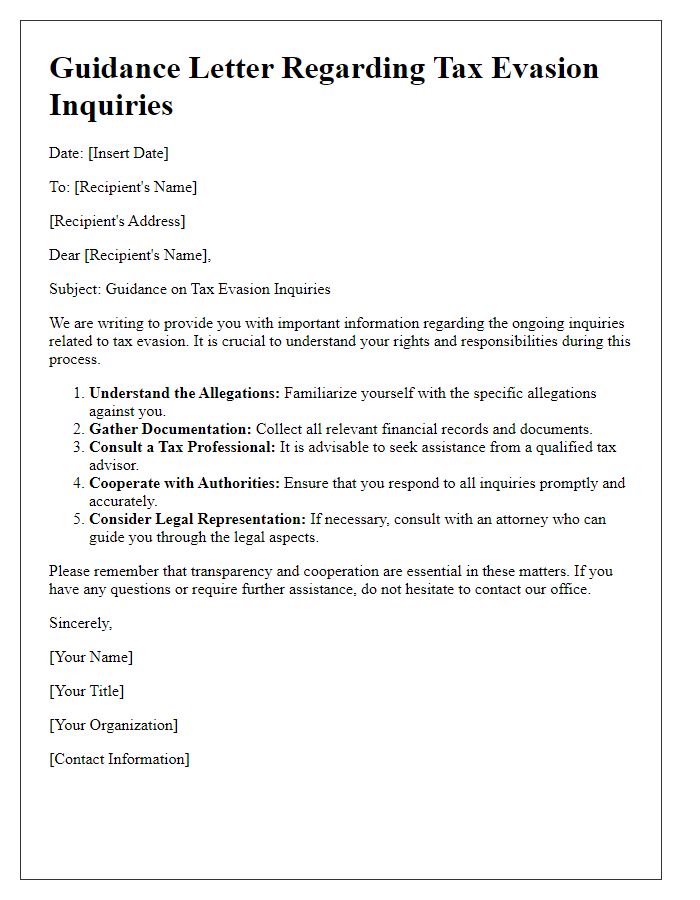

Letter Template For Investigation Into Tax Evasion Allegations Samples

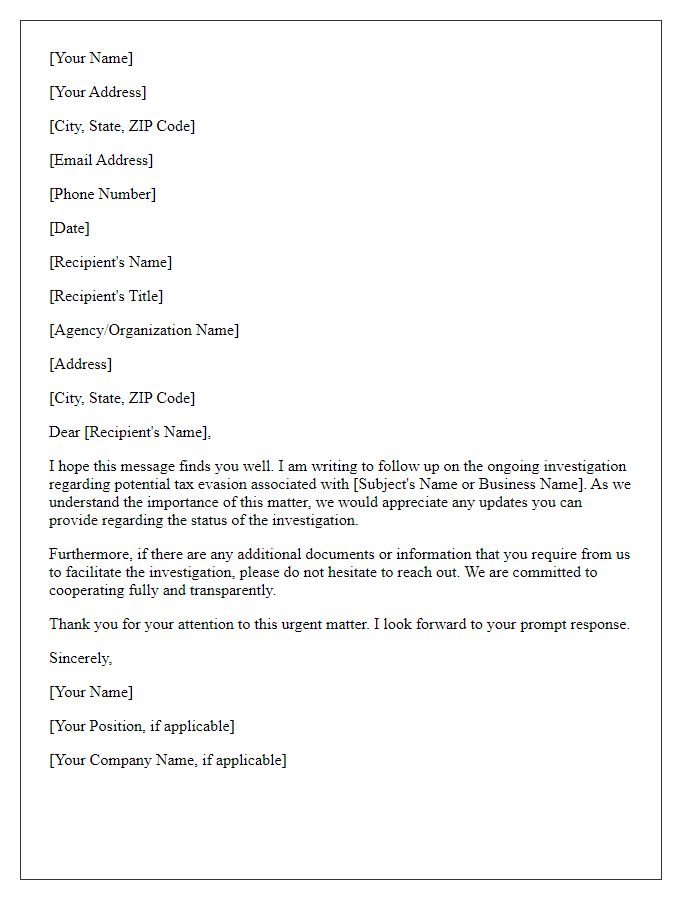

Letter template of notification for tax evasion investigation proceedings

Comments