Hey there! If you've ever found yourself puzzled over tax documents, you're definitely not alone. It's important to keep everything in order, especially when it comes to corrections that might affect your financial responsibilities. In this article, we'll walk you through a simple letter template that can help you notify the necessary parties about any required tax document corrections. Whether you're looking to clarify something or simply make sure your records are accurate, keep reading for a straightforward guide!

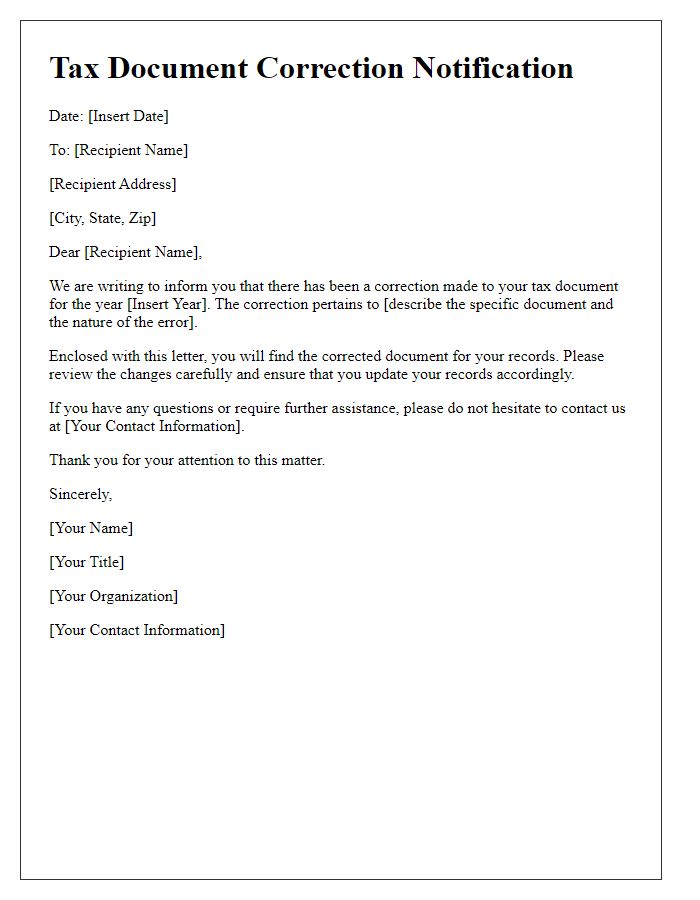

Clear Heading and Purpose Statement

Notice of Tax Document Correction - Important Update This notification serves to inform you of a critical correction made to your tax documents for the tax year 2022. The updated information reflects accurate data in accordance with IRS regulations. Please review the attached corrected forms, specifically the 1040 form, which includes revised income figures due to adjustments received from your employer, ABC Corporation, located in New York, NY. Ensure that all discrepancies are addressed to avoid potential penalties during the tax filing process. Your prompt attention to this matter is necessary to maintain compliance with federal tax regulations.

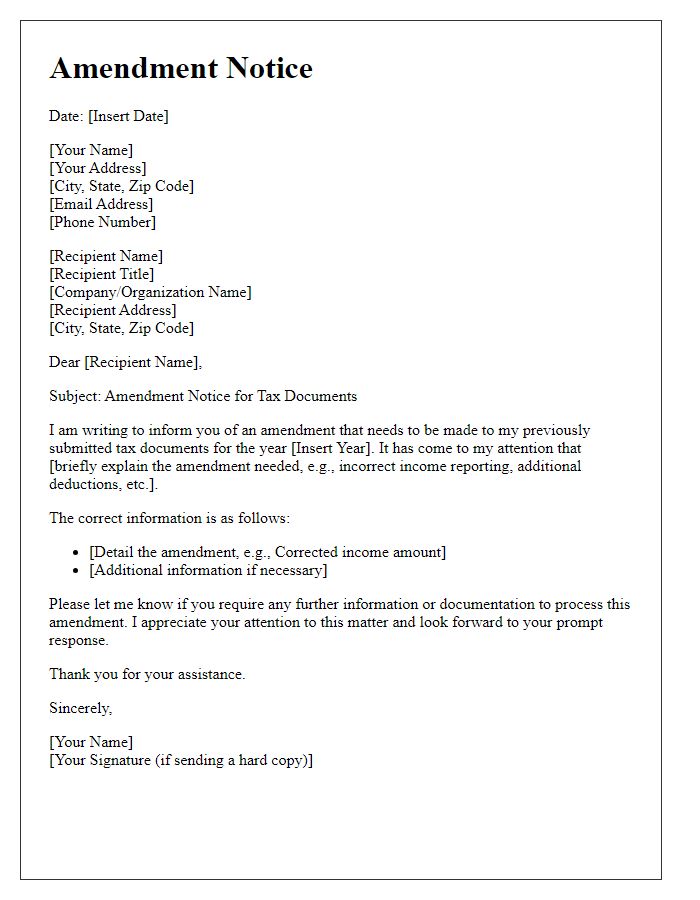

Taxpayer Information and Identification

In the realm of tax administration, accurate taxpayer information is paramount. Taxpayer identification numbers, commonly referred to as TINs or Employer Identification Numbers (EINs), play a crucial role in ensuring proper tracking of individual and business tax obligations. Errors in personal details, such as names or addresses, can lead to significant issues, including delays in refunds or complications during audits. Regulatory bodies, including the Internal Revenue Service (IRS) in the United States, emphasize the importance of rectifying discrepancies swiftly to maintain compliance. Moreover, all changes should be documented meticulously to avoid future complications, ensuring that taxpayers remain in good standing within the tax system.

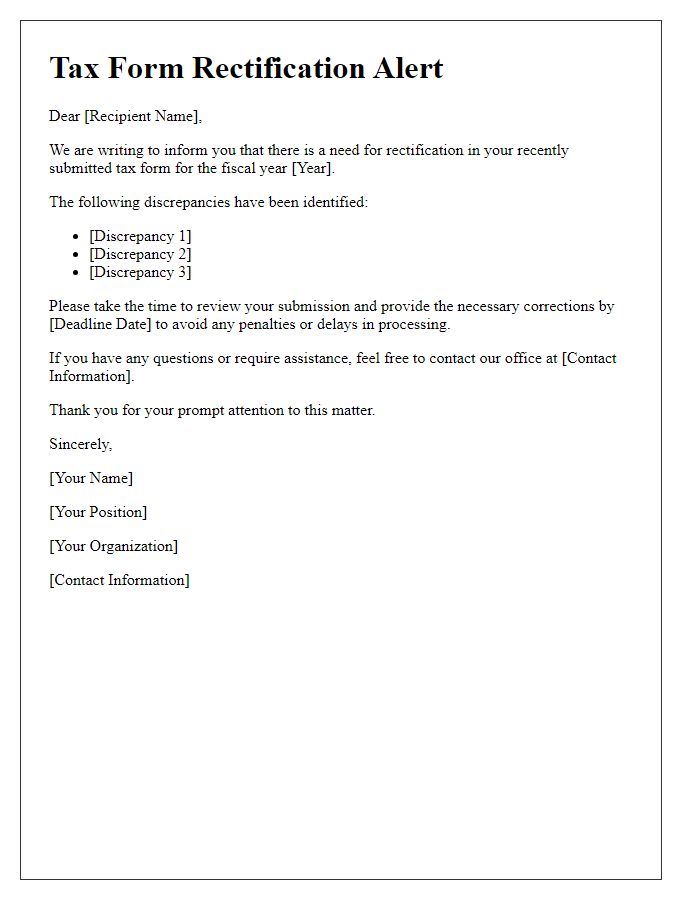

Corrected Information and Amendments

Tax document corrections are essential for ensuring accurate records. The Internal Revenue Service (IRS) often issues Form 1040-X, the Amended U.S. Individual Income Tax Return, to rectify previously filed information. In 2022, approximately 4 million taxpayers utilized this form to correct discrepancies in their tax filings, including income statements, deductions, and credits. Timely submission within three years from the original filing date is critical to avoid penalties and ensure compliance. Additionally, supporting documentation, such as W-2 forms or 1099 statements, may be required to validate changes made to the original information, ensuring proper adjustment of tax obligations.

Reference to Original Tax Document

Inaccuracies in tax documents can lead to complications during tax season, affecting individuals and businesses alike. The Internal Revenue Service (IRS) mandates adherence to deadlines, typically March 15 for corporations and April 15 for individuals, to submit corrected forms such as Form 1099 or W-2. Incorrect information may result in underpayment or overpayment of taxes, which can incur penalties or delays in refunds. Additionally, the original tax document must include a clear reference to the changes in the amended document, ensuring that taxpayers can trace discrepancies in financial record-keeping. Timely communication regarding corrections is essential to maintain compliance with federal regulations and to avoid potential audits or financial discrepancies.

Contact Details for Queries and Assistance

Tax document corrections often require clear communication and assistance channels for the concerned parties. Providing up-to-date contact details can facilitate prompt queries and support. For inquiries regarding the correction of tax documents, individuals can reach out to the designated tax office via phone at (555) 123-4567, or send email correspondence to support@taxservice.com. Furthermore, visitors can access in-person assistance at the office located at 456 Finance Ave, Suite 200, Metropolis, State X, Zip Code 01234. Operating hours are Monday through Friday, 9 AM to 5 PM, ensuring ample opportunity for taxpayers to seek guidance on their tax documentation issues.

Comments