Are you feeling a bit overwhelmed by all the paperwork involved in claiming your excise tax refund? You're not alone; many individuals and businesses navigate this complex process. Luckily, we've put together a straightforward letter template that will simplify your notification and ensure your application is clear and effective. Ready to learn how to streamline your tax refund experience? Read on for more insightful tips!

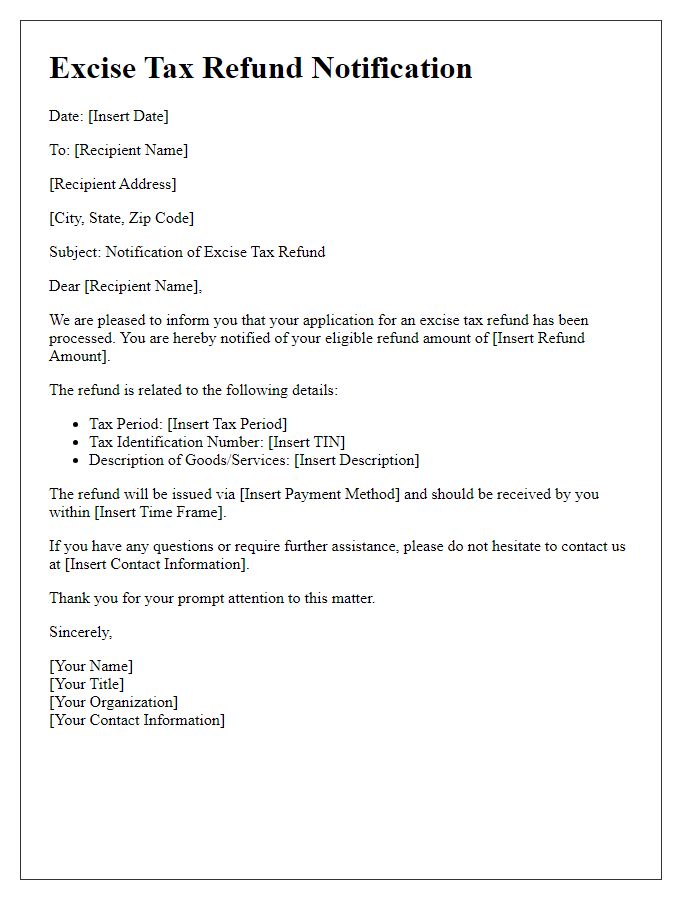

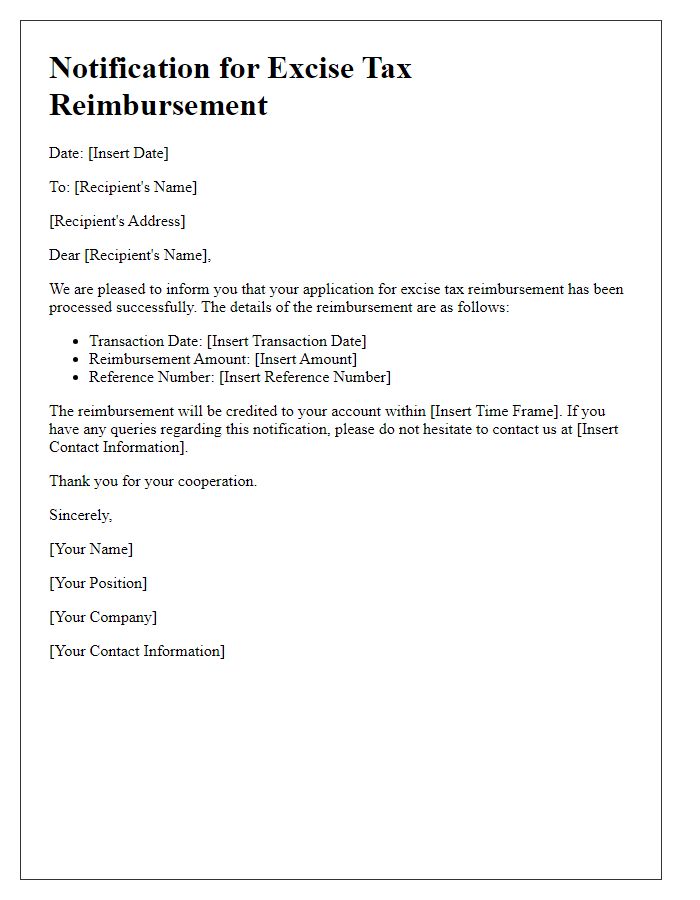

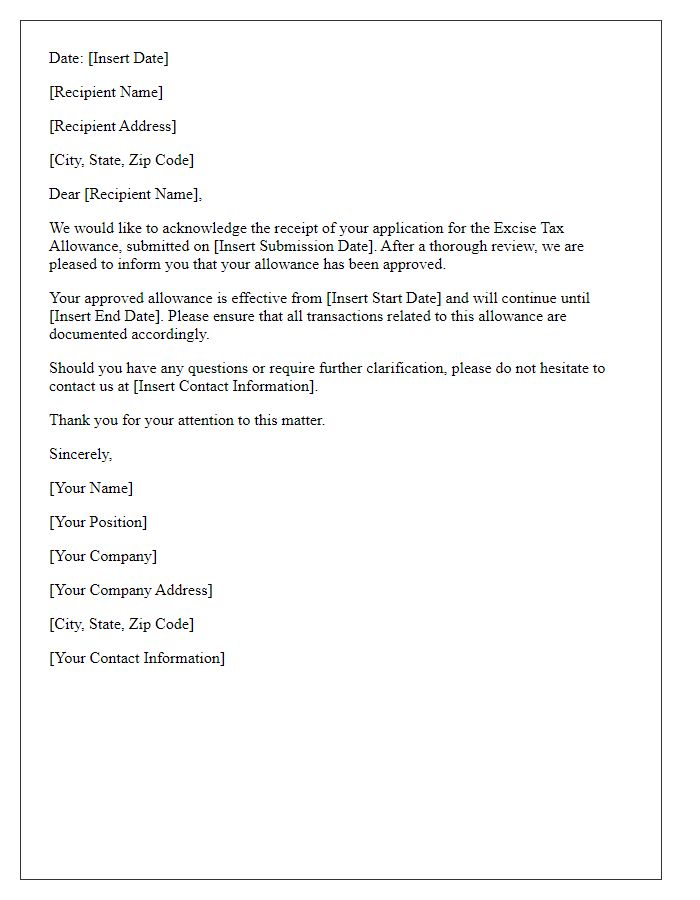

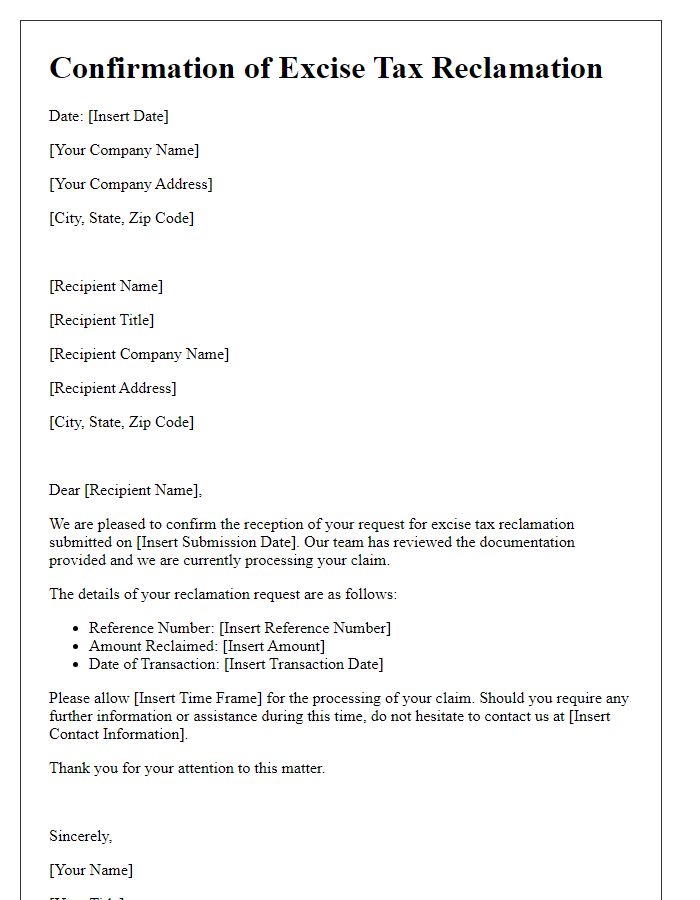

Recipient's contact information

The notification regarding excise tax refunds requires clear communication with relevant details. The recipient's contact information should include full name, physical address (including street name, city, postal code), email address, and telephone number to ensure accurate delivery of the notification. Providing these specifics streamlines the process and facilitates any required follow-up communication concerning the refund process. Proper documentation and verification of the recipient's identity can expedite the refund application under applicable state or federal guidelines, ensuring timely processing and adherence to legal requirements.

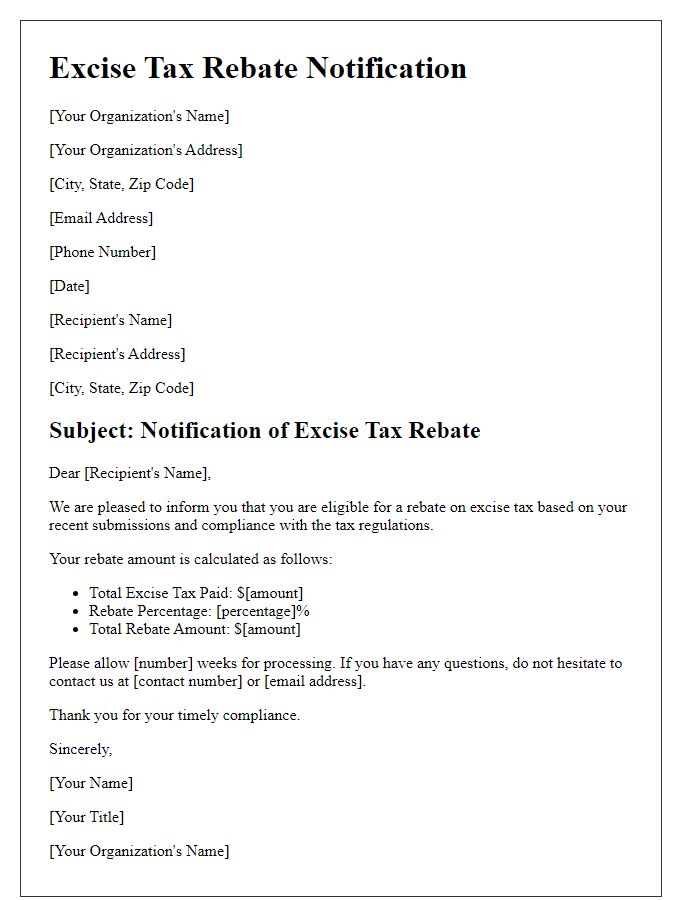

Clear statement of purpose

Excise tax refunds provide financial relief for businesses and individuals who have overpaid on certain goods or services, typically including fuel, alcohol, and tobacco products. The process for claiming a refund involves submitting a formal application to the relevant tax authority, such as the Internal Revenue Service (IRS) in the United States. Applicants must include detailed records of previous excise tax payments and the justification for the refund request, ensuring compliance with federal guidelines. Deadlines for submission vary by jurisdiction, necessitating prompt action to secure funds. Successful applications can result in significant monetary recovery, influencing cash flow for operations and future investments.

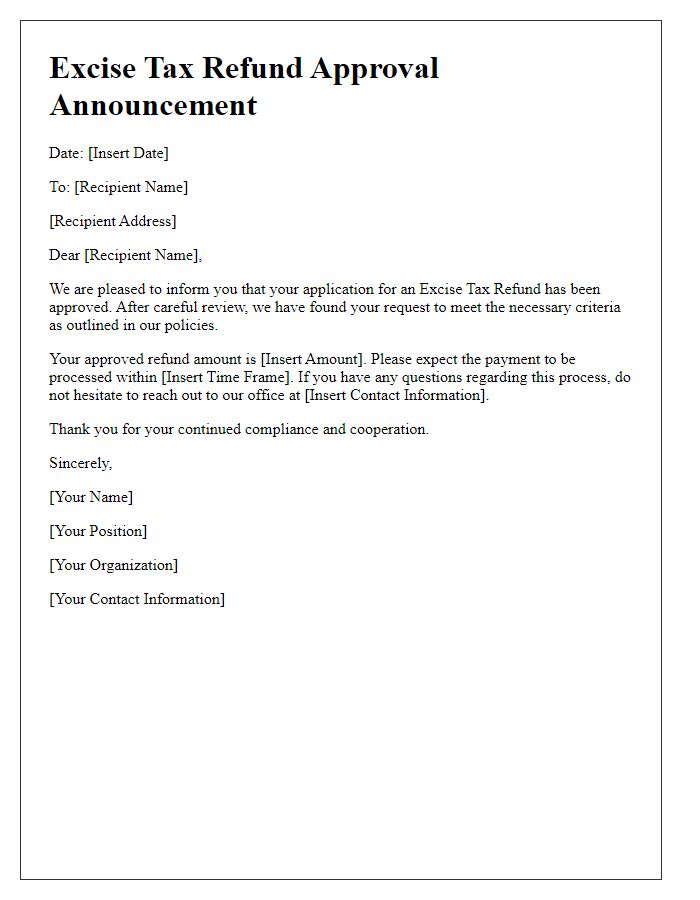

Details of excise tax refund

The excise tax refund process involves several crucial steps and details for accurate submission. Excise taxes, levied on specific goods such as gasoline, tobacco, and alcohol, require a thorough understanding of applicable regulations established by the Internal Revenue Service (IRS) or other governmental agencies. Key documentation includes Form 8849 (Claim for Refund of Excise Taxes), detailing the taxpayer's information, refund type, and the total amount being claimed. Refund eligibility criteria encompass situations like overpayment or tax exemptions due to sales to exempt organizations. The refund claim must be submitted within a three-year timeframe from the date of the tax payment to ensure consideration. Fast processing times may vary, often taking several weeks, depending on the complexity of the claim and agency workload. Specific regions or jurisdictions may have additional requirements or forms that enhance successful completion of the refund request.

Relevant refund process instructions

Excise tax refund requests require precise adherence to the guidelines established by the Internal Revenue Service (IRS). Taxpayers must complete Form 8849, titled "Claim for Refund of Excise Taxes," detailing the specific tax periods and amounts paid. Relevant documentation includes copies of invoices, payment records, and any prior correspondence regarding the tax payment. Submissions must be directed to the appropriate IRS address, often indicated on the form itself, depending on the type of excise tax being claimed. Timeliness is crucial, as claims submitted beyond the three-year statute of limitations may be rejected. Refunds typically process within eight to ten weeks from the date of receipt, allowing taxpayers to track their claims via the IRS refund status tool.

Contact information for queries

Excise tax refunds are vital financial instruments for businesses operating under various jurisdictions, such as state or federal levels. Taxpayers eligible for refunds must maintain precise documentation, typically including invoices, receipts, and relevant forms. Queries regarding refund status or application procedures can be addressed to official tax authority contact centers, generally listed on their websites, including phone numbers, email addresses, or online chat options for assistance. Timely communication with representatives during business hours ensures efficient resolution of any issues related to refund processing. Always verify the authenticity of contact information to prevent scams and unauthorized communications.

Comments