Writing a letter to claim a deceased person's tax refund can feel daunting, but it doesn't have to be. It's important to approach this task with compassion and care, honoring the memory of the individual while navigating the necessary bureaucratic steps. This guide will simplify the process, providing a clear template for your letter to ensure that your claim is both respectful and effective. Ready to get started? Let's dive in!

Deceased's full legal name and Social Security Number

Filing a tax refund claim for a deceased individual requires specific information and documentation to ensure proper processing. The full legal name of the deceased, required for identification, must match the name on their Social Security record. The Social Security Number (SSN) plays a crucial role, uniquely identifying the individual and linking their tax records to the IRS system. To initiate the process, the executor or administrator must gather necessary documents such as the deceased's final tax return, proof of death (like a death certificate), and any relevant forms like the 1040 series, indicating the type of claim being made. Proper handling of this sensitive matter is essential for compliance and respect towards the deceased's estate.

Executor's or claimant's contact information

The executor's contact information is crucial for tax refund claims related to a deceased individual, ensuring proper handling of financial matters. Executors typically provide their name, address, phone number, and email address to facilitate communication with tax authorities. The executor acts on behalf of the deceased, managing matters like filing tax returns and claiming refunds. Accurate contact details ensure timely responses from entities such as the Internal Revenue Service (IRS) in the United States. Proper documentation should include the deceased individual's Social Security number to link the claim clearly, along with all essential legal documentation like the death certificate and letters testamentary.

Proof of executor's authority (e.g., Certificate of Appointment)

A tax refund claim for a deceased individual's estate requires the executor to provide documentation demonstrating authority, such as a Certificate of Appointment of Estate Trustee (often referred to as a probate certificate). This legal document, issued by a probate court, confirms the executor's role and responsibility to manage the deceased's financial affairs. In jurisdictions like Ontario, Canada, this certificate is pivotal in facilitating the claim process with tax authorities, allowing for the retrieval of any outstanding refunds owed to the deceased. Additionally, including a copy of the death certificate confirms the individual's passing and validates the necessity of the executor's claim on behalf of the estate. Proper documentation, such as bank statements or previous tax returns, may also be requisite to substantiate the claim further.

Tax identification numbers or tax-related documents

When preparing a tax refund claim for a deceased individual, it is crucial to gather essential documents and information, such as the taxpayer's Tax Identification Number (TIN), which serves as a unique identifier for tax purposes. The necessary documents include the last filed tax return, relevant W-2 forms from employers, and any applicable 1099 forms highlighting income sources. Date of death must be documented accurately, as it impacts filing status and potential refunds. Ensure all details align with the Social Security Administration records to prevent delays. Submitting a completed Form 1040, along with supporting documentation to the appropriate IRS address based on the state of residence, is essential for processing the refund claim efficiently.

Explanation of refund claim and relevant tax year information

Submitting a tax refund claim for a deceased individual requires attention to specific details. In the case of John Smith, who passed away on March 15, 2023, the relevant tax year for the refund claim is 2022, during which he was still filing as a single taxpayer. His annual income reached $50,000, with total federal taxes withheld amounting to $5,000. Documentation includes the final tax return, Form 1040, filed on April 15, 2023, reflecting his income and taxes withheld, alongside the death certificate confirming the date of death. This claim aims to recover overpaid taxes which arise from deductions not accounted for in the final return. Completing IRS Form 1310, "Statement of Person Claiming Refund Due a Deceased Taxpayer," is necessary to properly authorize the refund to be issued, ensuring compliance with tax regulations.

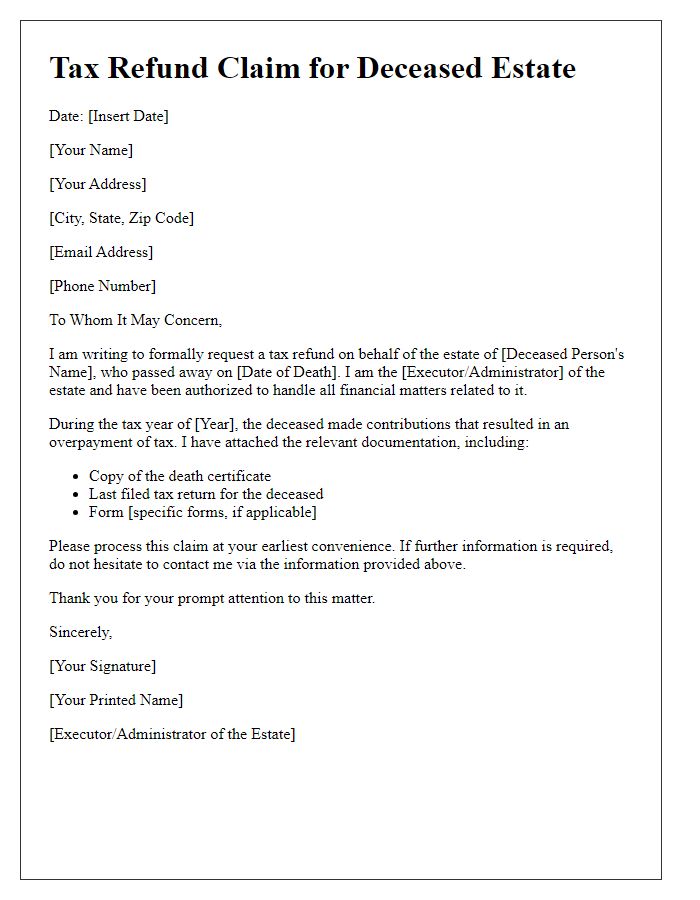

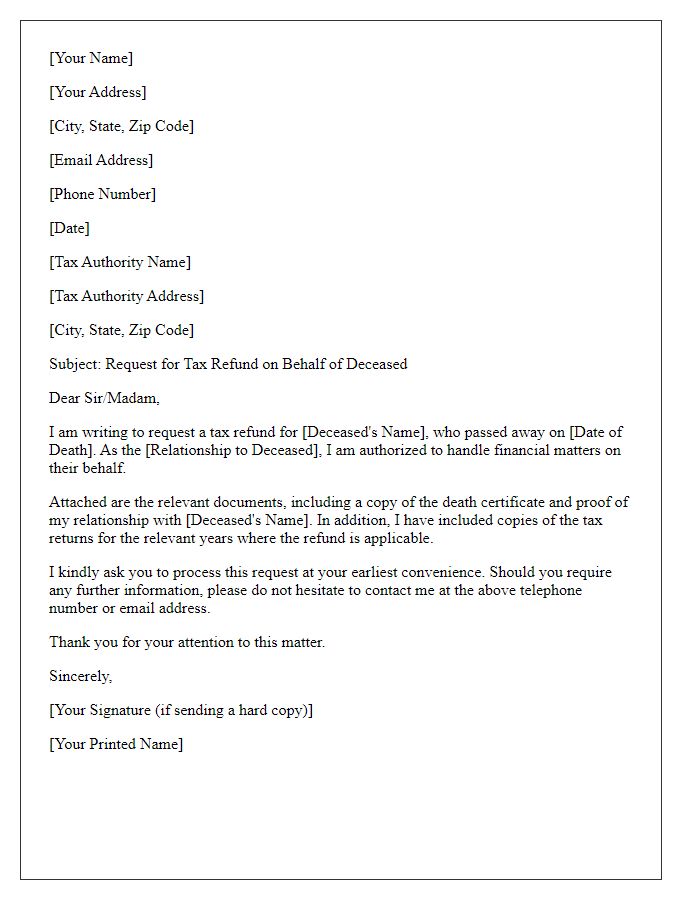

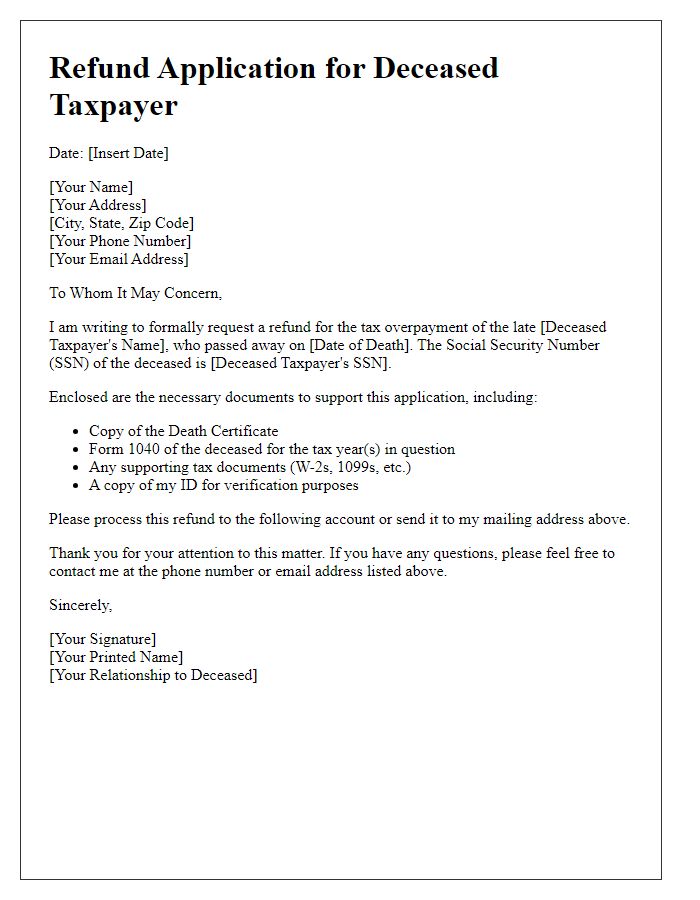

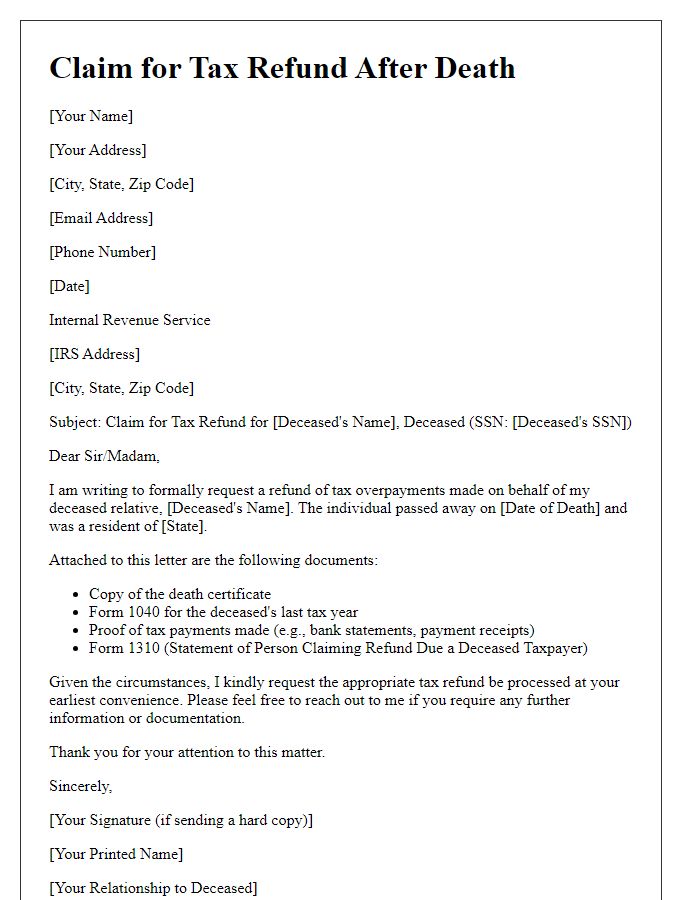

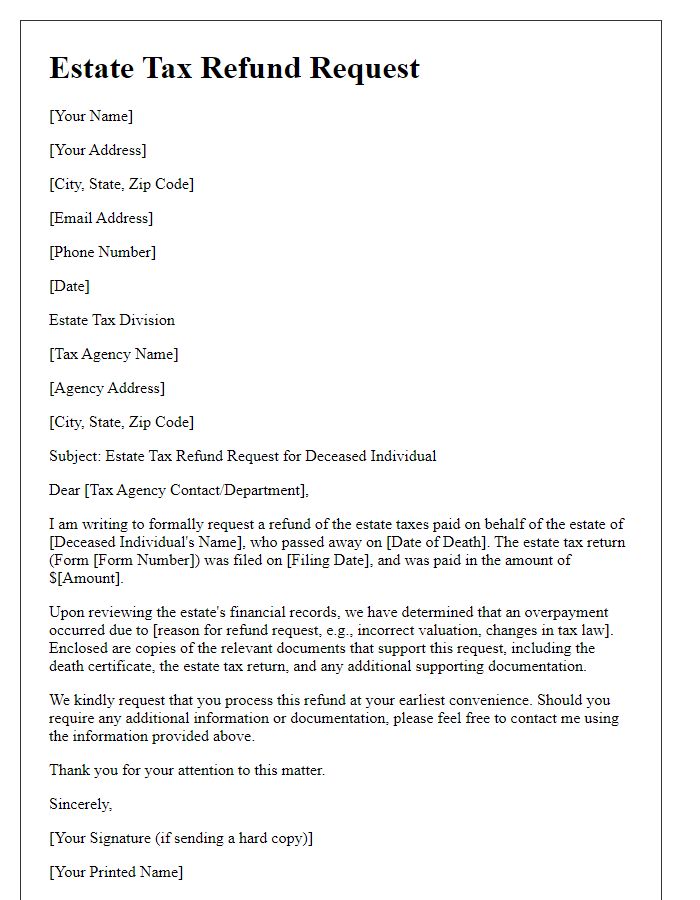

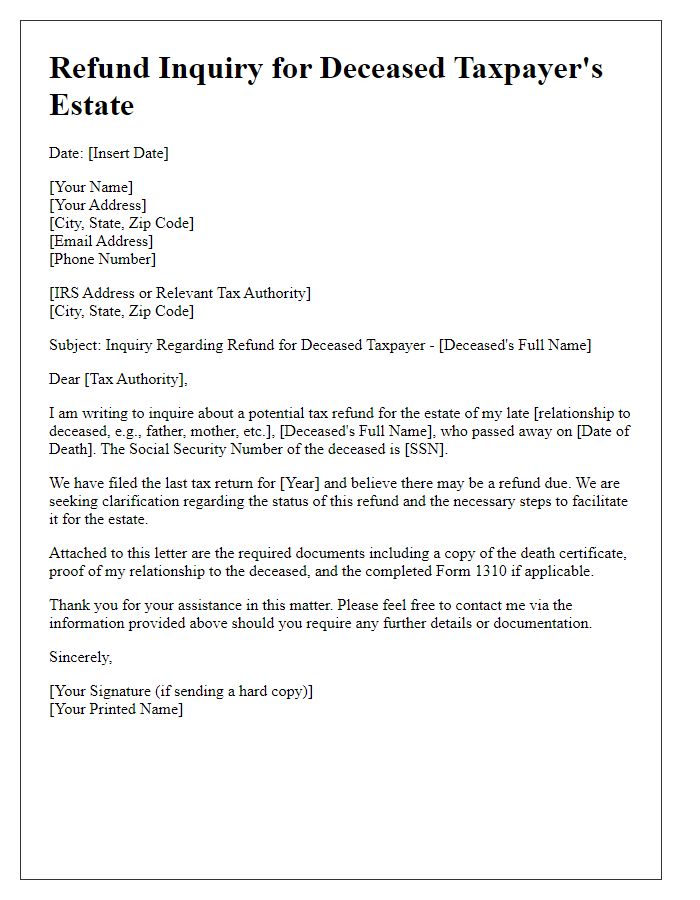

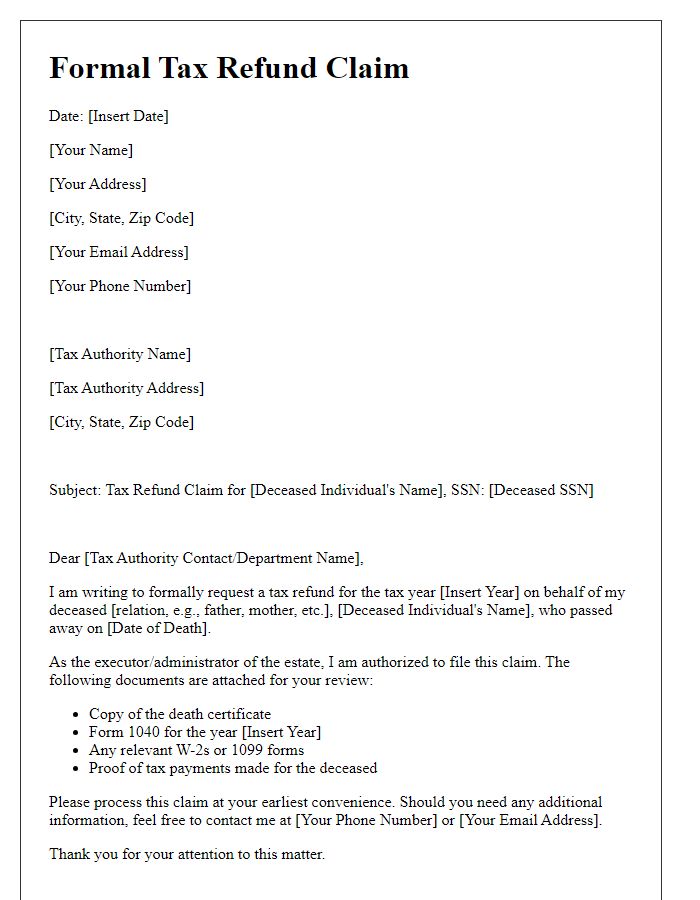

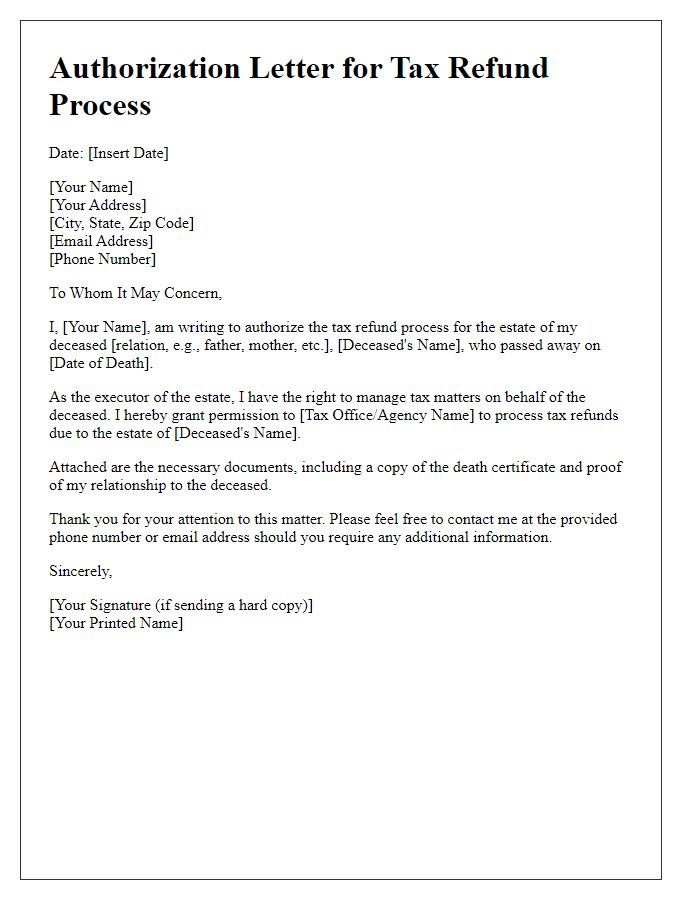

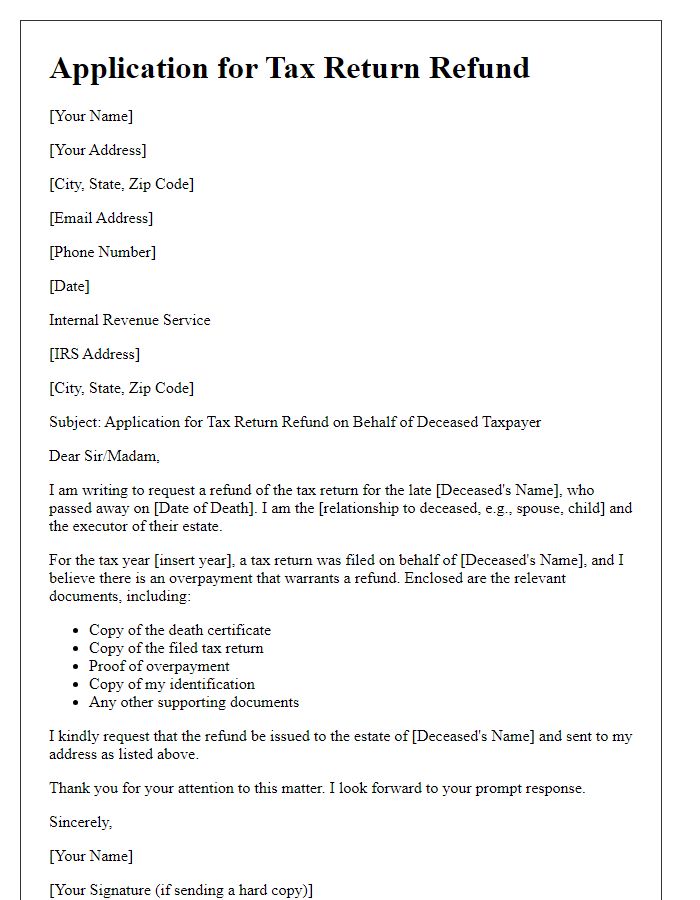

Letter Template For Deceased Person'S Tax Refund Claim Samples

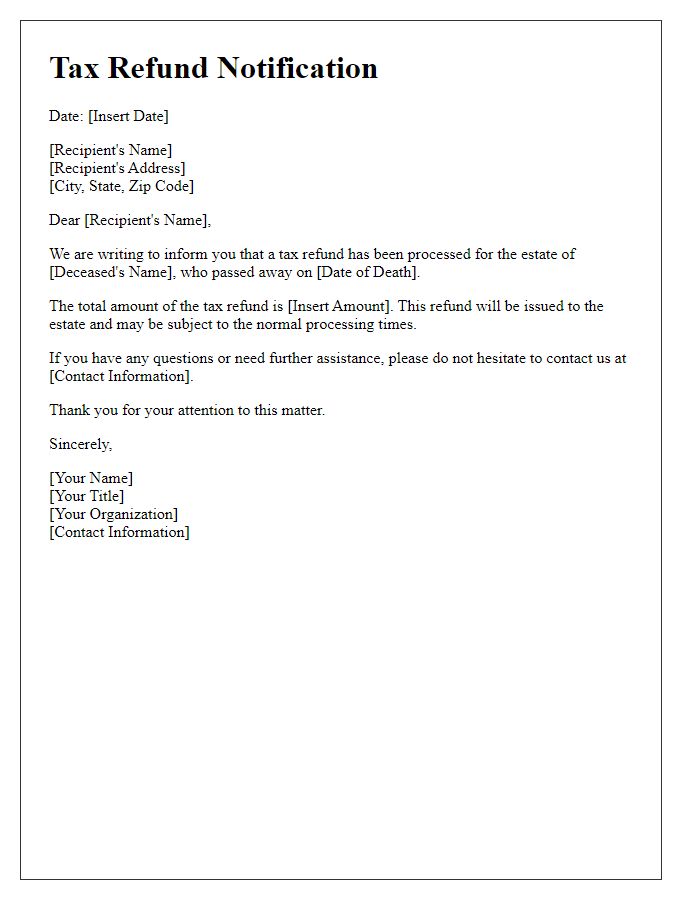

Letter template of notification for tax refund regarding estate of deceased

Comments