Are you a small business owner feeling the pinch from rising costs? You're not aloneâmany entrepreneurs are navigating similar financial waters and may qualify for tax relief to ease their burdens. In this article, we will explore the essential steps to craft a compelling letter requesting tax relief for your small business. So, grab a cup of coffee and let's dive into how you can make your case and improve your financial standing!

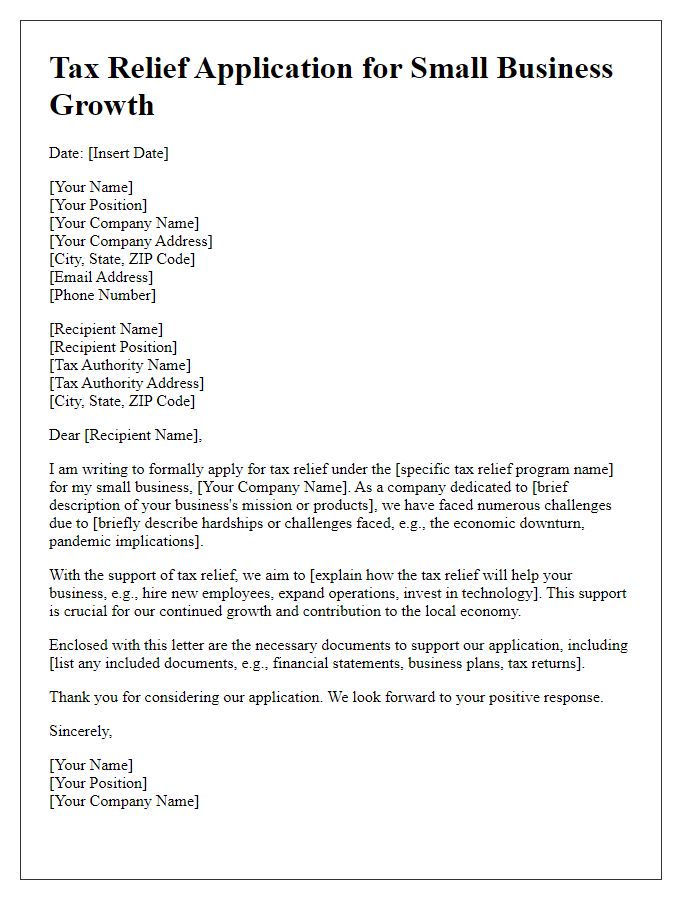

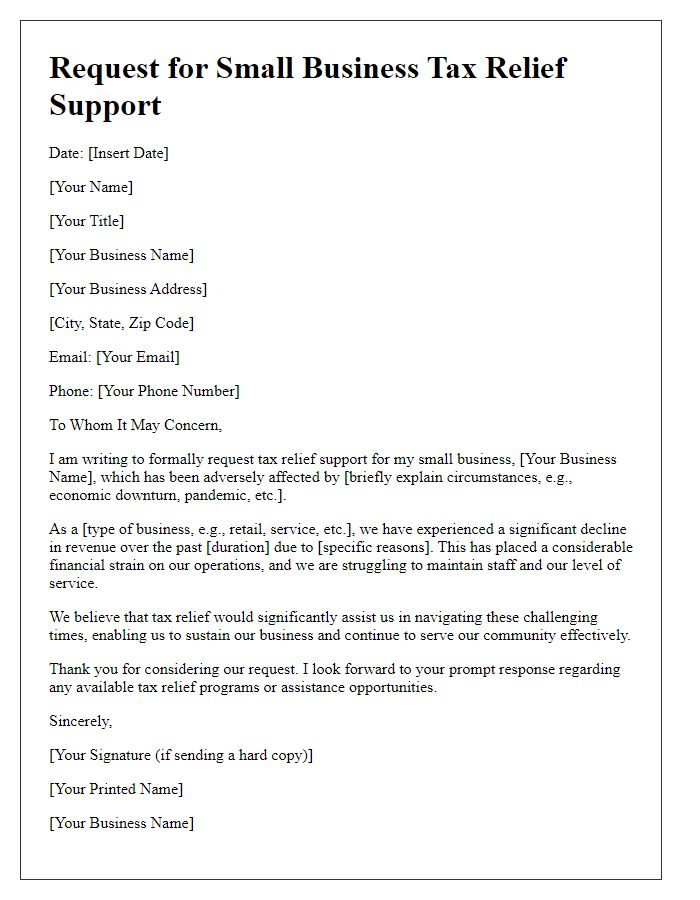

Business Information and Introduction

Small businesses play a crucial role in the economy, often facing unique financial challenges. In the context of tax relief requests, their operational details are essential for appropriate consideration. Business information pertains to the business name, registered address, and employee count, numbering typically between one to fifty in small enterprises. Introduction includes a brief overview of the business's industry sector, such as retail or service, alongside the significance of relief measures for maintaining viability. Emphasizing the impact of recent events, such as economic downturns or natural disasters, can illustrate the necessity for support. The request should reflect a genuine need for assistance to navigate fiscal hurdles and sustain ongoing employment opportunities.

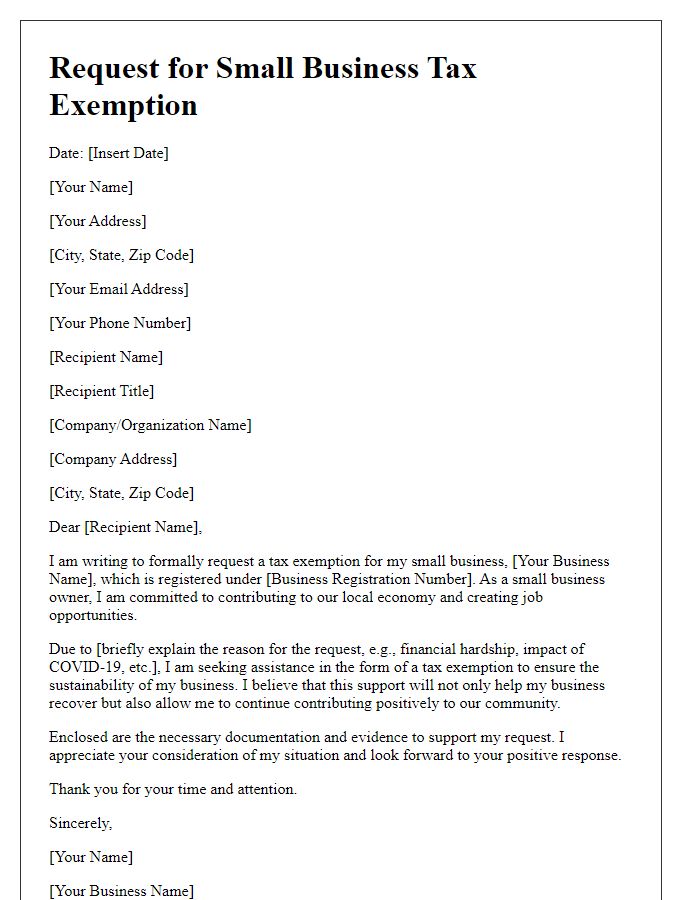

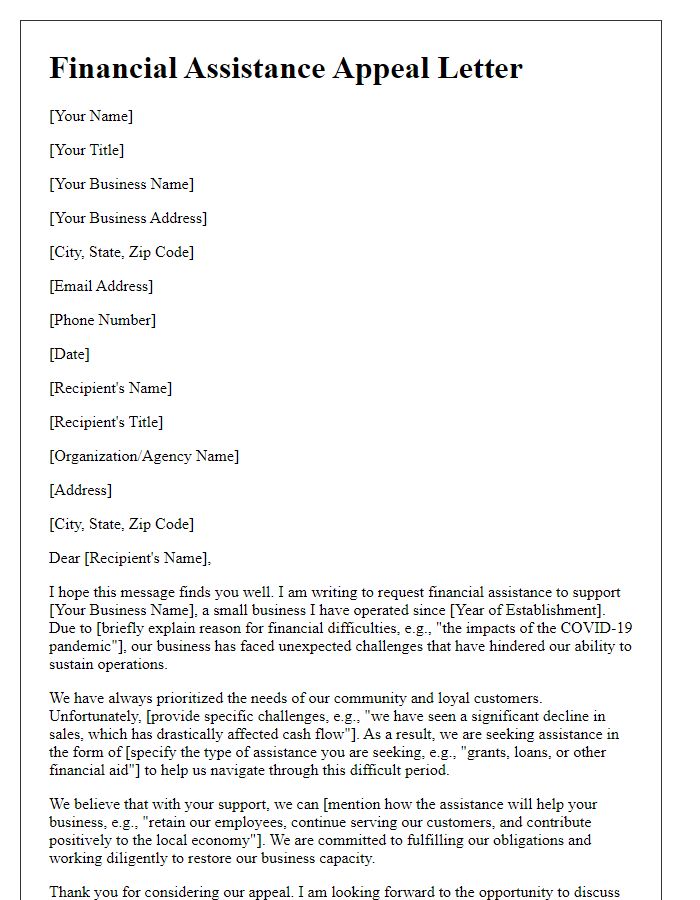

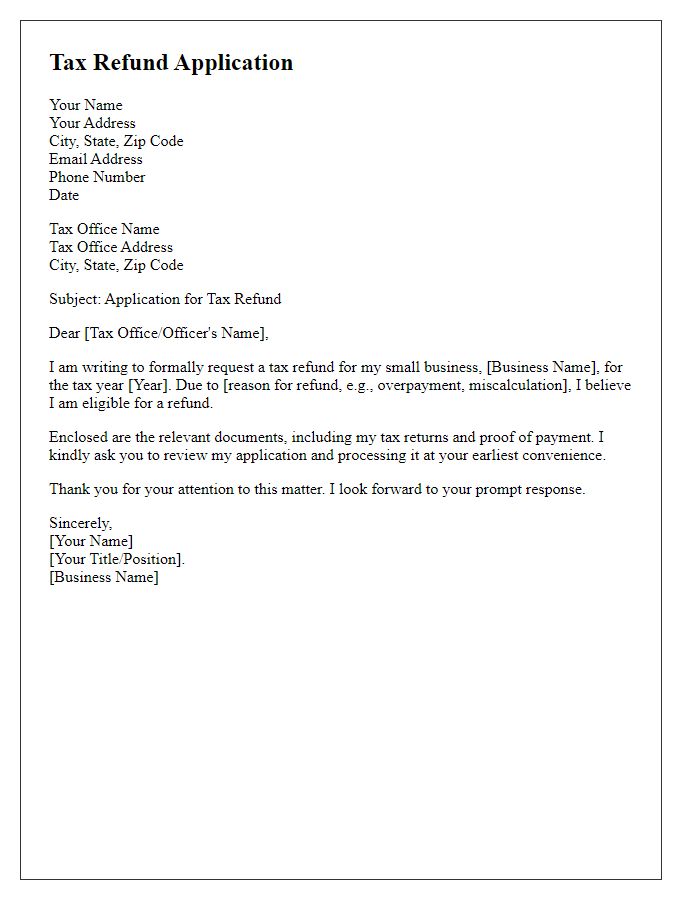

Explanation of Financial Hardship

Small businesses often face financial hardships, especially during economic downturns or unexpected events like the COVID-19 pandemic. During 2020, many enterprises saw revenue drops exceeding 50% due to lockdowns and reduced consumer spending. Increased operational costs, including payroll and rent, further strained finances. For instance, a cafe in New York City reported a 70% drop in revenue while still committing to monthly rent of $5,000. To alleviate financial burdens, tax relief programs can provide crucial support, allowing businesses to retain employees and cover basic expenses. Such assistance can be pivotal in enabling recovery and sustainability for small businesses across the country.

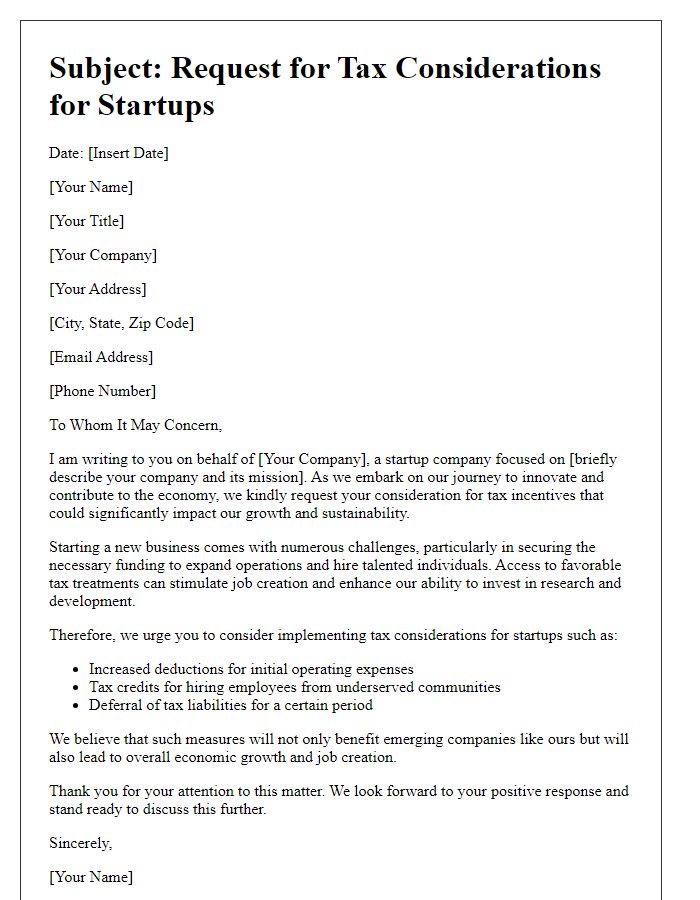

Justification for Tax Relief Request

Small businesses often face financial challenges, particularly in competitive markets where profit margins are slim. The request for tax relief centers around the need to alleviate some of the financial strain, enabling sustainable growth and job retention. In 2022, small businesses accounted for 99.9% of all U.S. businesses, showcasing their importance in driving economic development. By providing tax relief, local governments can ensure businesses continue to contribute to the local economy, fostering community employment rates, which is crucial in regions like the Midwest where unemployment rates were reported at 3.2% in early 2023. Moreover, tax relief can encourage investment in innovation, leading to advancements in products and services that ultimately benefit consumers in the long run. Supporting small businesses through strategic tax incentives can create a ripple effect of positive economic activity, bridging the gap between survival and growth in a fluctuating market landscape.

Proposed Plan or Terms for Payment

Small businesses often face financial challenges, especially during difficult economic periods. Tax relief becomes increasingly crucial for maintaining operations and supporting the local economy. Proposed plans for relief typically include structured payment terms, which may encompass a deferred payment schedule, allowing small business owners ample time to recover before resuming full tax payments. For example, staggered payments over six months or extended payment plans could alleviate cash flow pressures. Ensuring clear guidelines and deadlines for these payment arrangements provides needed clarity for business owners. Furthermore, eligibility criteria, such as revenue thresholds or time in operation, can help streamline the approval process for deserving small enterprises.

Contact Information and Request for Response

A small business tax relief request should include specific details to enhance clarity and encourage a prompt response. Include your business name and contact information such as phone number and email address. Specify the tax relief program, for example, the COVID-19 Economic Injury Disaster Loan (EIDL) from the Small Business Administration (SBA). Clearly state the purpose of your request, detailing financial hardships experienced, loss of revenue percentages, and any significant events affecting the business, such as natural disasters, economic downturns, or market disruptions. Request a timeline for response to maintain accountability in the process.

Comments