Are you feeling a bit overwhelmed with tax season approaching? You're not alone! Many individuals find themselves in need of a little extra help when it comes to filing their taxes. In this article, we'll provide a handy letter template for requesting tax filing assistance, ensuring you can approach the situation confidently. So, let's dive in and make tax season a breeze together!

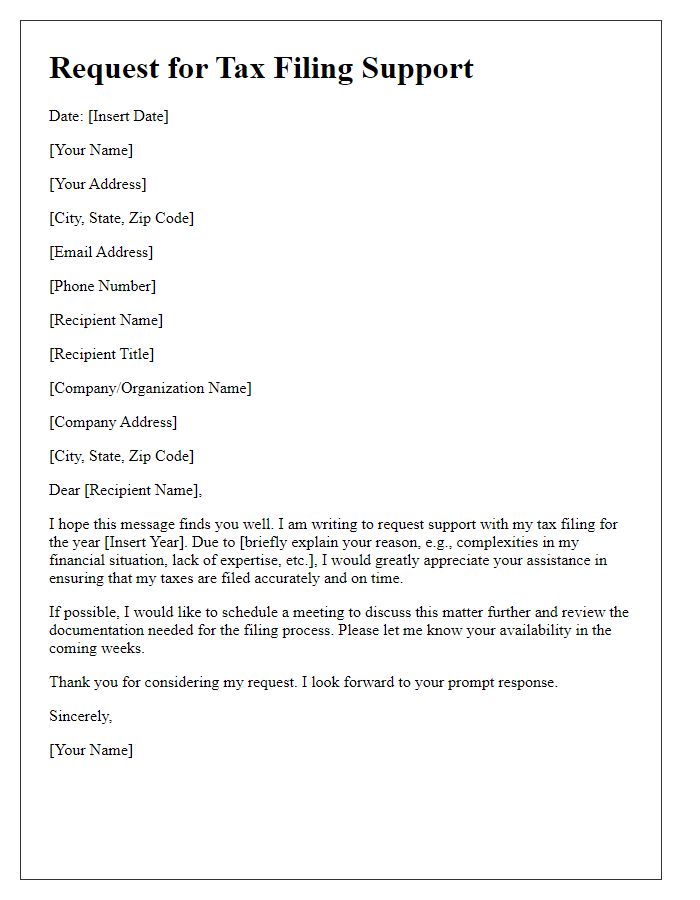

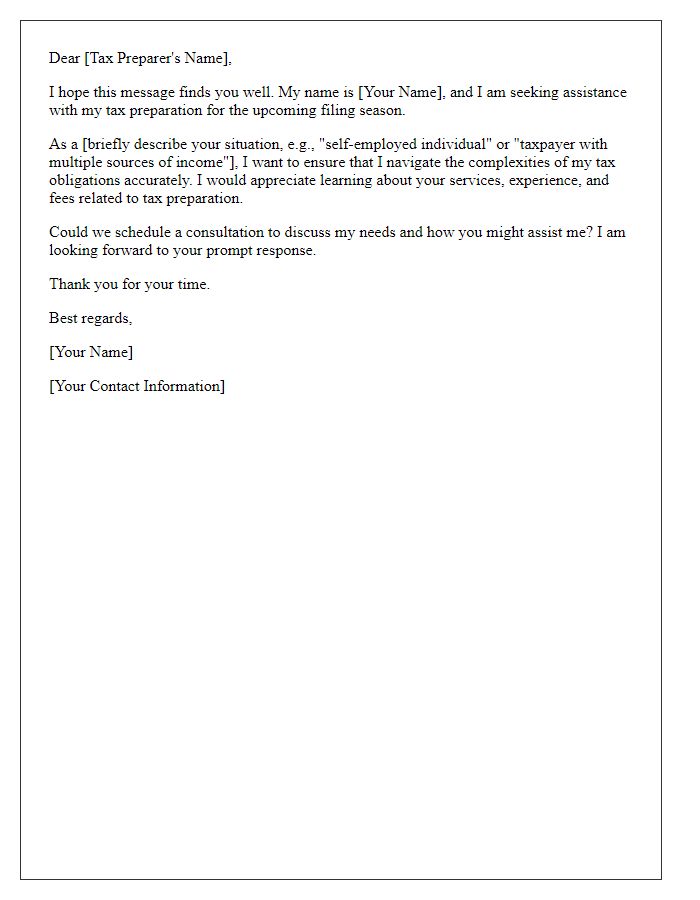

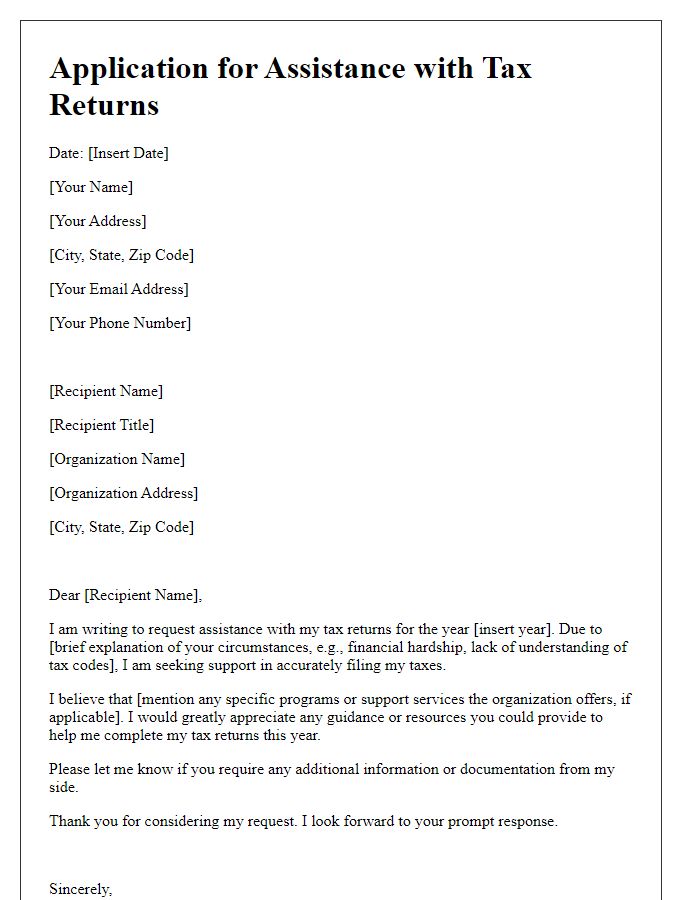

Proper Salutation

Tax filing assistance can be essential for individuals and businesses navigating complex financial regulations. The Internal Revenue Service (IRS) sets annual deadlines, typically April 15, for individual filings in the United States, prompting many to seek help. Professional tax preparers, enrolled agents, and certified public accountants (CPAs) provide expertise in maximizing deductions, ensuring compliance with tax laws, and avoiding costly mistakes. Commonly used forms include 1040 for personal income and 1120 for corporate income, which require accurate reporting of income, expenses, and credits. Tax preparation software also offers support, guiding users through the filing process, while organizations like the Volunteer Income Tax Assistance (VITA) program help low-income families access free filing services.

Clear Request Statement

Tax filing assistance is crucial for individuals and businesses navigating the complex United States tax code. Professional services, such as those offered by certified public accountants (CPAs), can help maximize deductions and ensure compliance with regulations. The Internal Revenue Service (IRS) has specific guidelines and deadlines, making expert guidance invaluable. Utilizing tax preparation software (like TurboTax or H&R Block) can also streamline the process, providing step-by-step instructions tailored to varying financial situations, from personal income tax returns to corporate filings. Accessing reliable resources is essential for effective tax management and minimizing potential liabilities.

Personal Tax Information

Many individuals and businesses face challenges during tax filing periods, often requiring assistance to navigate complexities. Tax filing assistance can be essential for personal tax matters, especially considering various regulations affecting tax liabilities. Detailed information such as income amounts, deductible expenses, and credits available for individual situations can significantly streamline tax preparation. Utilizing specialized tax software or consulting certified public accountants can enhance accuracy. Understanding deadlines is crucial; for instance, the federal tax filing deadline in the United States typically falls on April 15. With the right help, taxpayers can ensure compliance with the Internal Revenue Service (IRS) regulations and optimize potential refunds.

Deadline Emphasis

Navigating the complexities of tax filing can be overwhelming, particularly as the critical deadline of April 15 approaches. Many individuals and businesses in the United States, including those in New York, find themselves in need of professional assistance to ensure compliance with Internal Revenue Service regulations. Key documents, such as W-2 forms from employers or 1099s for freelance work, must be meticulously organized and submitted by this date to avoid potential penalties or interest on unpaid taxes. Engaging a Certified Public Accountant (CPA) or tax professional with expertise in current tax laws can streamline the process and provide valuable insights on deductions and credits that could significantly impact financial outcomes. Proactive steps towards securing tax filing assistance, ideally weeks before the deadline, can alleviate last-minute stress and promote accuracy in returns submitted.

Contact Information

High-income households often seek professional tax filing assistance due to the complexity of tax laws and regulations. Tax preparation services, such as Certified Public Accountants (CPAs) or tax attorneys, provide expert guidance on deductions, credits, and tax compliance. In the United States, the tax filing deadline is typically April 15, with late fees accumulating for missed submissions. Essential contact information includes telephone numbers, email addresses, and mailing addresses, enabling seamless communication and timely responses to inquiries about tax documents and filing status. Additionally, understanding local tax codes, such as those implemented by state revenue departments, is crucial for accurate tax return preparation.

Comments