Are you feeling overwhelmed by the news of tax fraud charges? You're not aloneâmany individuals find themselves facing unexpected challenges when it comes to taxes. Understanding the implications and navigating the legal landscape can be daunting, but knowledge is power. Join us as we explore the intricacies of tax fraud and how to protect yourselfâread more to arm yourself with the information you need!

Professional Tone

Tax fraud charges may arise when individuals or corporations deliberately misrepresent their financial information to tax authorities. This illegal activity can lead to severe penalties, including substantial fines and imprisonment. In the United States, the Internal Revenue Service (IRS) actively investigates suspected cases of tax fraud, with a focus on discrepancies in reported income, inflated deductions, or failure to report income altogether. Affected parties may receive formal notifications outlining the nature of the allegations and potential consequences. Addressing tax fraud allegations requires maintaining thorough documentation and potentially engaging legal counsel to navigate the complexities of tax law.

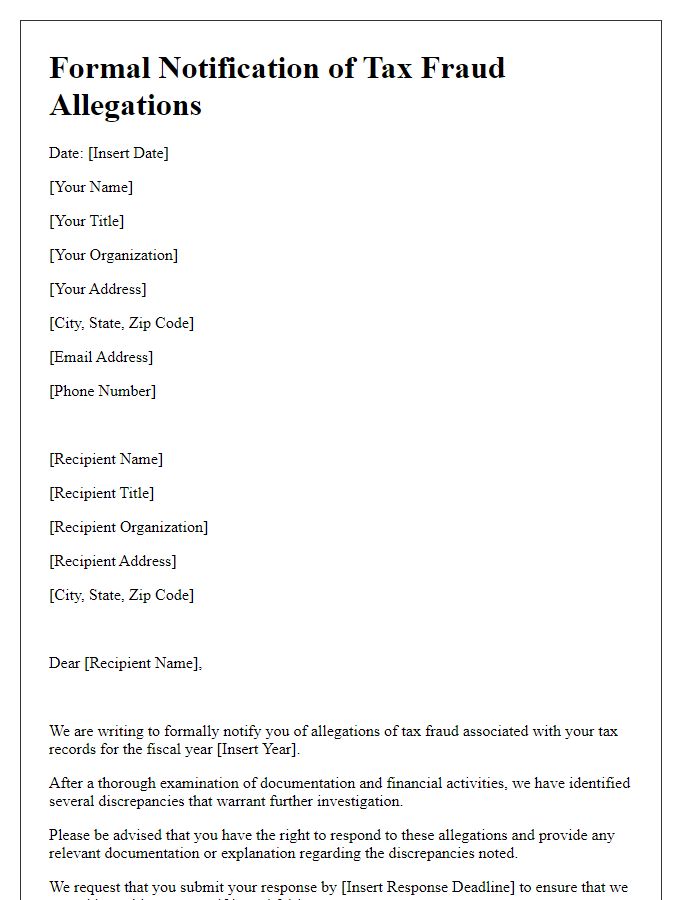

Clear Identification of Allegations

In recent reports, allegations of tax fraud have emerged against certain individuals and organizations in connection with the Internal Revenue Service (IRS) investigations. Specific cases involve fraudulent claims exceeding $200,000 that misrepresented income sources and expenses. For instance, in the New York area, several tax returns submitted over the past three years have raised red flags due to discrepancies in reported figures compared to actual earnings documented through W-2 forms. The allegations suggest systematic evasion of tax responsibilities, which could result in significant penalties, including potential fines up to 75% of the underpayment and criminal charges leading to imprisonment of up to five years. The category of fraud includes underreporting income levels, inflating deductions, and using fictitious companies to disguise financial activities. Transparency and compliance with tax laws are critical to maintaining the integrity of financial systems.

Legal References

Tax fraud charges can significantly impact individuals and businesses, with severe legal implications under laws such as the Internal Revenue Code (IRC Section 7201). Allegations may arise from improper reporting of income, failure to report foreign bank accounts (FBAR violations), or inflating deductions. Legal proceedings typically follow a structured path including investigations by the Internal Revenue Service (IRS) or state tax authorities, potentially leading to criminal charges. Convictions can result in substantial fines, restitution payments, or even imprisonment, with sentences varying based on the severity of the offense. Taxpayers often seek legal counsel to navigate the complexities of tax law and defend against these serious accusations, ensuring their rights are protected.

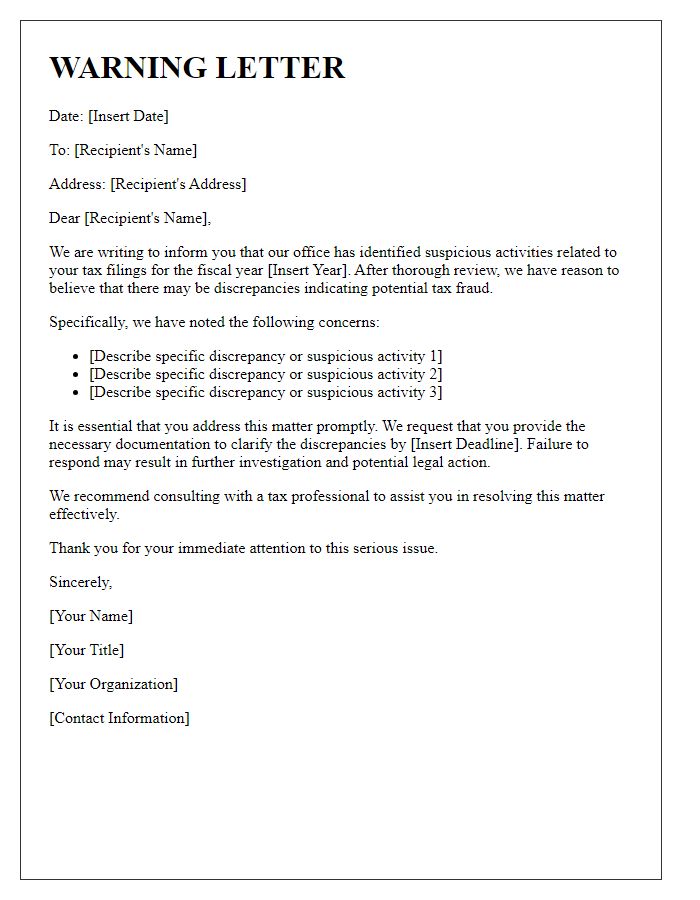

Consequences and Penalties

Tax fraud charges can lead to severe consequences and penalties, impacting individuals and businesses. Criminal charges may result in imprisonment, often lasting several years, depending on the severity of the fraud. Financial penalties may include significant fines, potentially ranging from thousands to millions of dollars, based on the amount of unpaid taxes and intent to defraud. Additionally, civil penalties can impose interest on unpaid taxes, increasing the total financial burden. Reputational damage can occur, affecting future employment opportunities and business relations. The Internal Revenue Service (IRS) enforces these actions rigorously, often following investigations that uncover discrepancies, such as falsified income statements or unreported earnings. Compliance with tax obligations is crucial to avoid these severe ramifications.

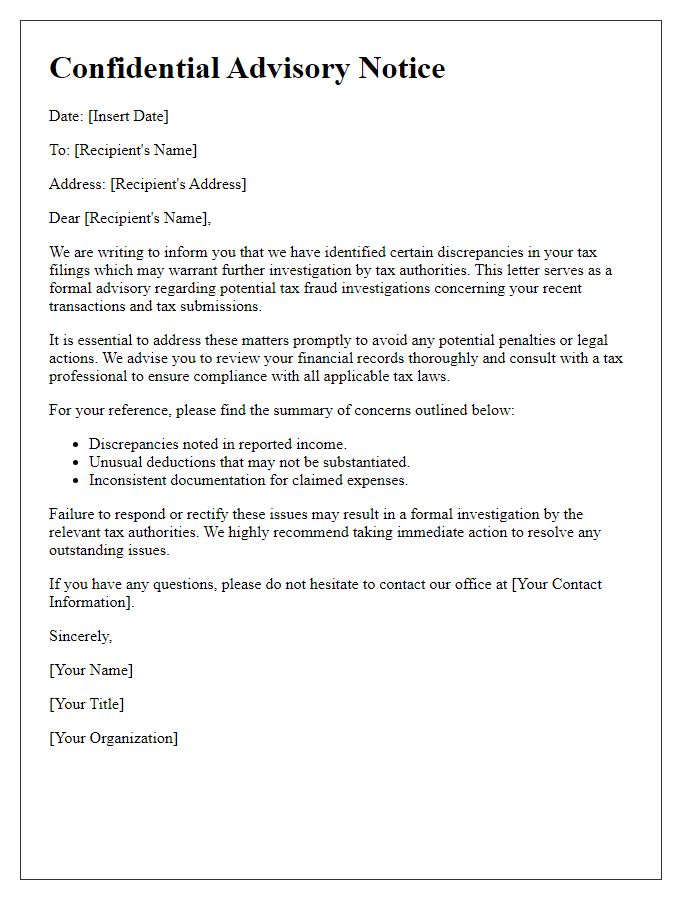

Contact Information for Resolution Guidance

Tax fraud charges can lead to serious legal consequences for individuals, such as potential fines and criminal charges. Authorities like the Internal Revenue Service (IRS) in the United States investigate cases of tax evasion, which often involve underreporting income or claiming false deductions. Individuals facing such charges must seek resolution guidance promptly to understand their rights and potential defenses. Legal representation may be essential, often requiring consultation with a tax attorney who specializes in fraud cases. Understanding local tax laws and regulations, such as deadlines for filing appeals and nuances in state tax codes, is crucial for effective resolution. Accurate record-keeping and revisiting past tax returns may also aid in addressing discrepancies and formulating an appropriate response to the allegations.

Comments