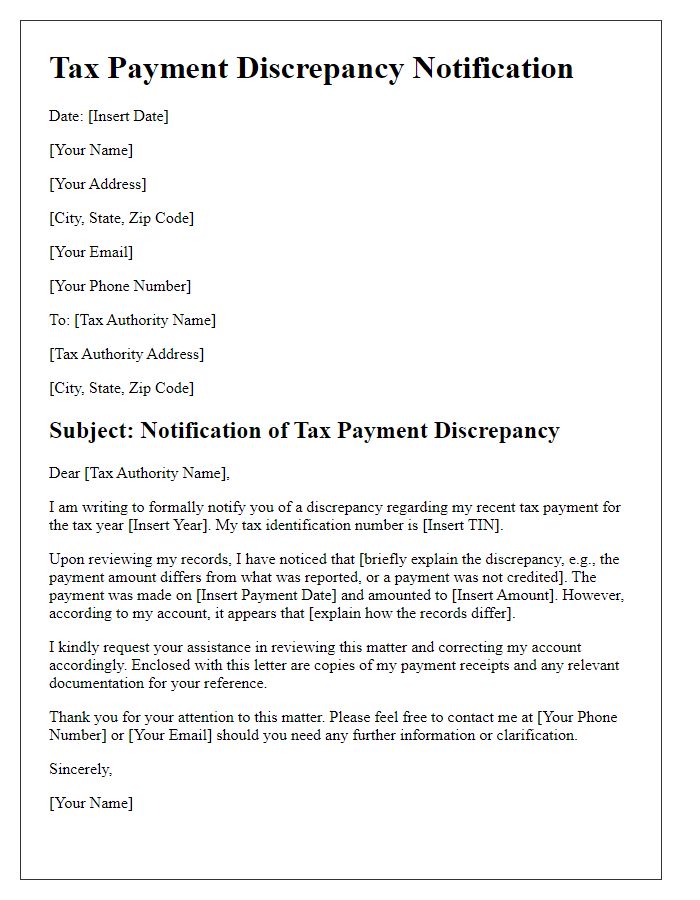

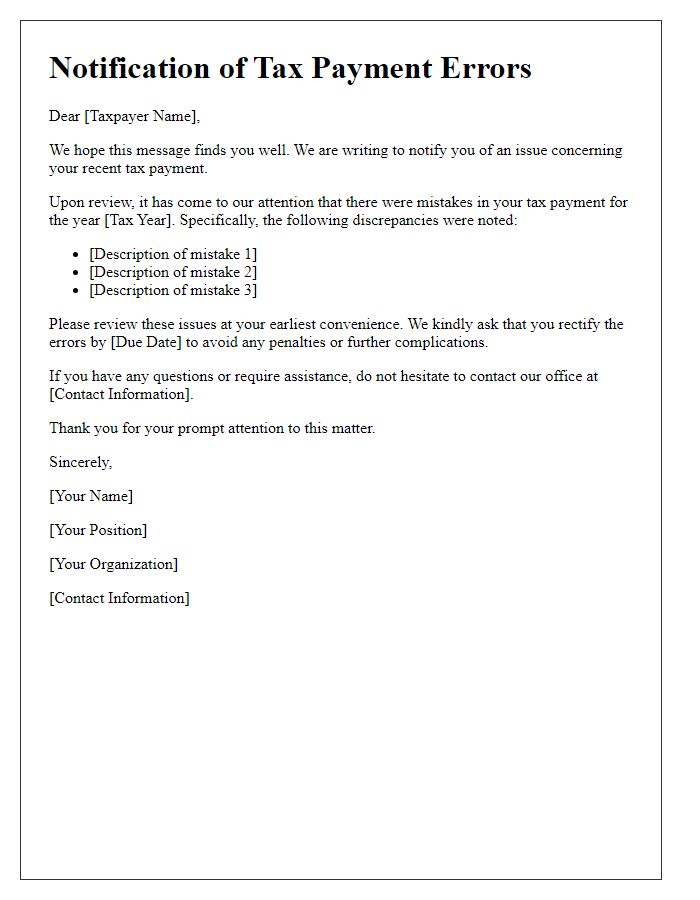

Hey there! Tax season can be a bit stressful, and the last thing anyone wants is to deal with a payment error. It's crucial to address these issues promptly to avoid any penalties or complications in the future. In this article, we'll guide you through a comprehensive letter template to notify the tax authority about any discrepancies in your tax payments. So, let's dive in and make this process as smooth as possible!

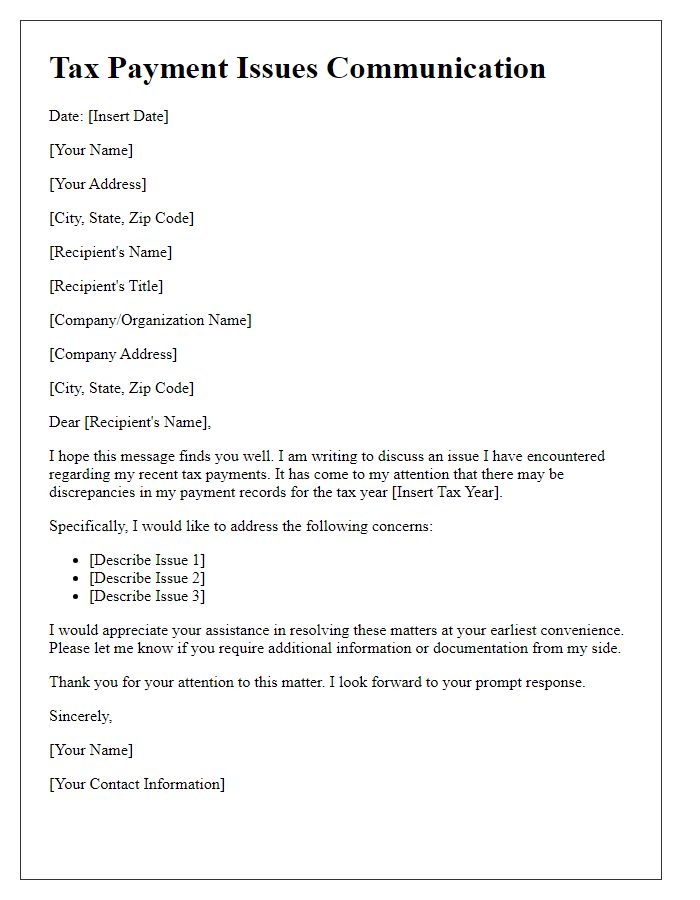

Clear Identification of Taxpayer Information

Clear identification of taxpayer information is crucial for effective communication regarding tax payment errors. Each taxpayer, registered with the Internal Revenue Service (IRS) or local tax authority, possesses unique identifiers such as Social Security Number (SSN), Employer Identification Number (EIN), or tax account number. Accurate representation of this information is essential for clarity and prevents misidentification. Additionally, taxpayers should include their full name (first and last), mailing address (including city, state, and zip code), and contact details (phone number and email address) in correspondence. This thorough identification aids tax authorities in locating records rapidly, facilitating prompt resolution of any discrepancies related to tax payments or filings.

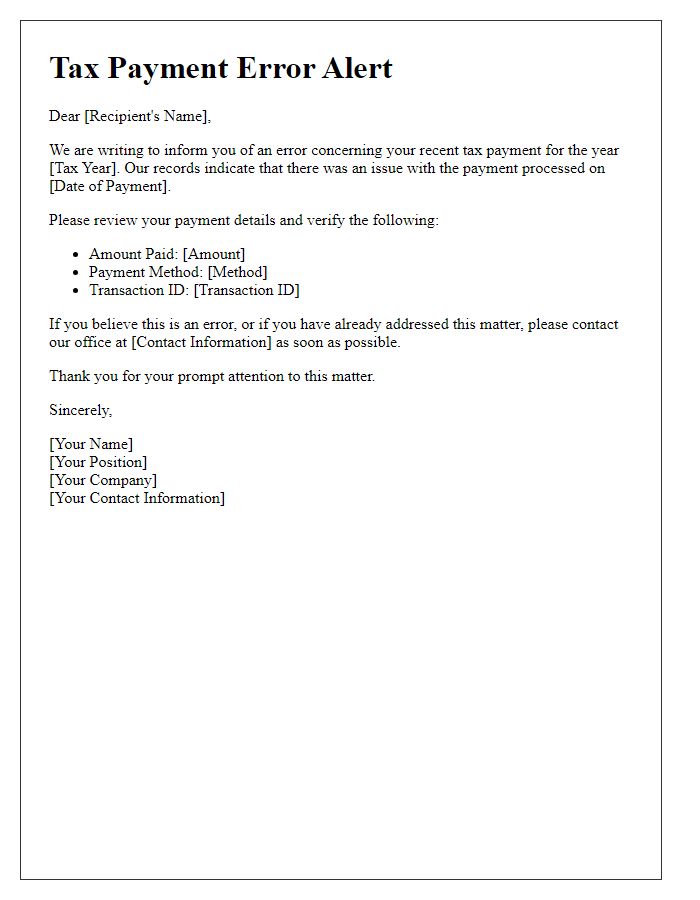

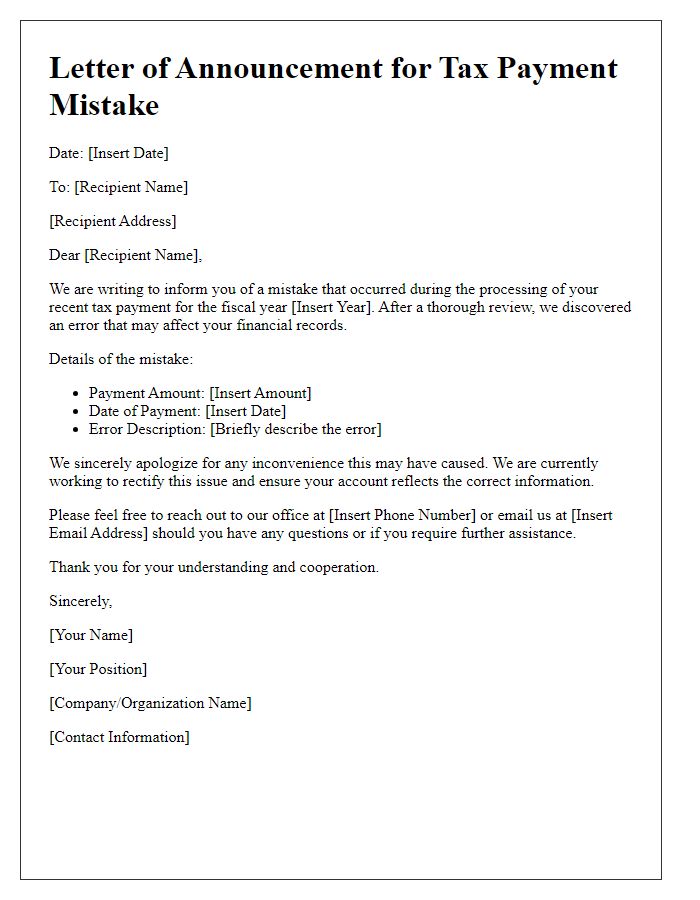

Detailed Description of the Error

Tax payment errors can arise from a variety of sources, including incorrect calculations on forms such as the IRS Form 1040 or calculating estimated tax payments based on the previous year's income. For instance, an individual's reported taxable income might include missed income sources, such as freelance work or rental income, leading to an underpayment of tax liabilities. Common mistakes involve entry errors, where figures are transposed or misplaced, significantly impacting the final amount owed. Additionally, the application of tax credits, such as the Child Tax Credit (up to $2,000 per qualifying child) or deductions like mortgage interest, may have been improperly claimed, further complicating the total tax owed. Tax software errors or misinterpretation of tax law changes can also contribute to discrepancies in filing. Accurately identifying and addressing these issues is crucial to prevent penalties, interest, and potential audits from tax authorities, such as the Internal Revenue Service.

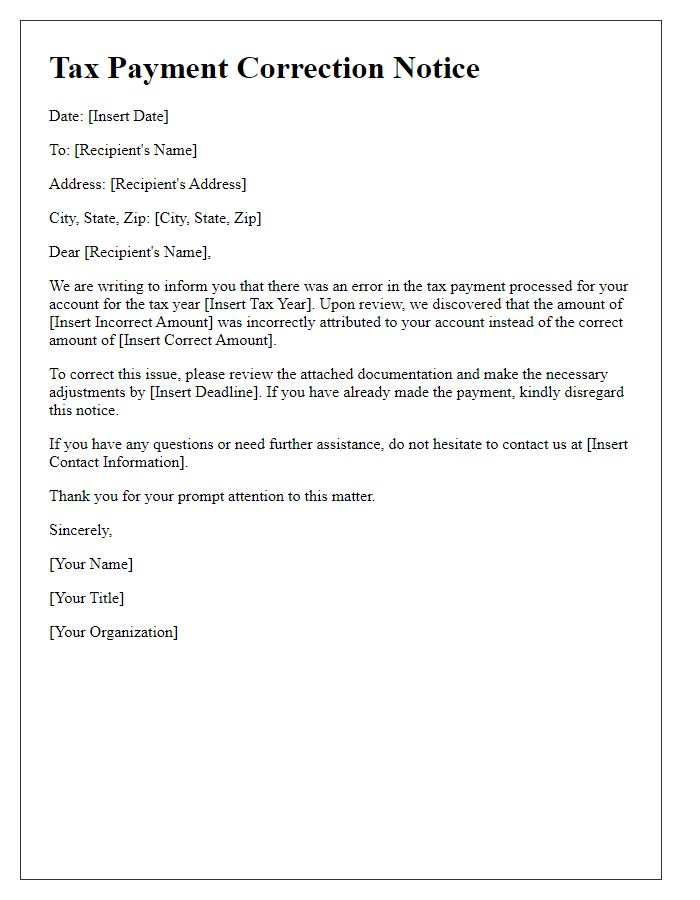

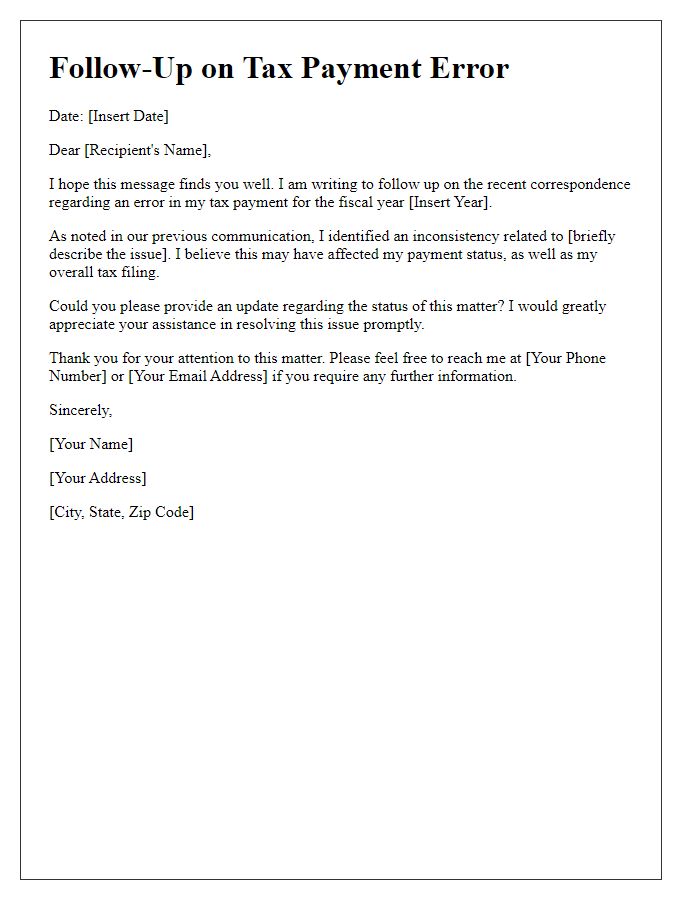

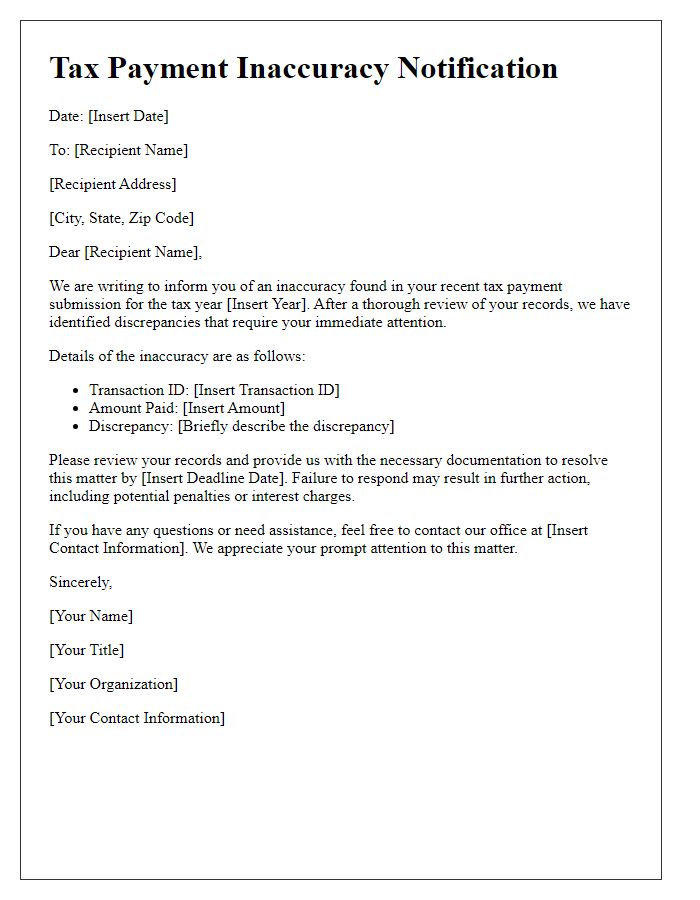

Corrected Tax Details and Calculations

Incorrect tax filings can lead to significant financial implications for individuals and businesses. The IRS (Internal Revenue Service) requires accurate submissions to avoid penalties. Upon reviewing tax documents for the fiscal year 2022, discrepancies were identified in reported income figures and deduction claims. In the previous filing, the total income was mistakenly reported as $75,000 instead of the accurate figure of $82,500. Additionally, the deductions for mortgage interest were overstated, leading to incorrect tax calculations. Prompt correction of these details is essential to comply with tax obligations and to ensure accurate assessments of any due refunds or liabilities. Failure to address these errors may result in delayed processing or audit triggers.

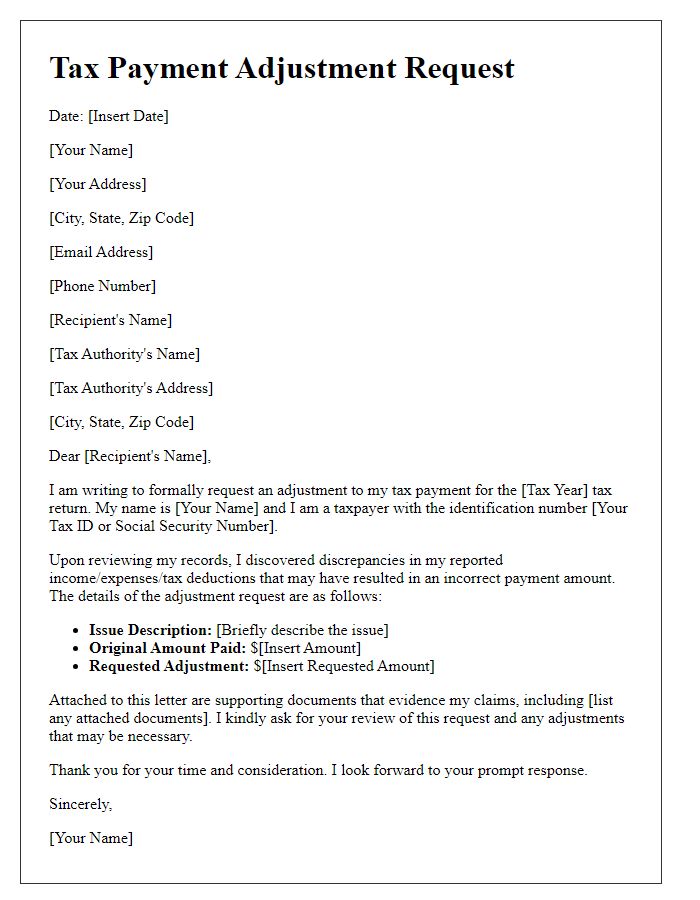

Reference to Relevant Tax Regulations

Tax payment errors can significantly impact personal and business finances, necessitating swift resolution according to relevant tax regulations. Common issues include incorrect amounts submitted, late payments due to administrative errors, or misapplication of tax credits. In the United States, for instance, the Internal Revenue Service (IRS) mandates compliance with tax payment deadlines outlined in the Internal Revenue Code (Title 26 of the U.S. Code). An incorrect payment could result in penalties or interest accruing at a rate of up to 3% annually. Furthermore, taxpayers may need to reference specific sections of the regulations, such as Section 6601 for underpayment penalties or Section 6404 for abatement requests. Addressing these issues promptly is crucial to avoid escalation into more severe financial consequences.

Contact Information for Queries or Clarifications

Incorrect tax payments may lead to financial discrepancies, affecting individuals and businesses alike. Tax authorities, such as the Internal Revenue Service (IRS) in the United States, have specific guidelines for resolving payment issues. Common errors include underreporting income, miscalculating deductions, or incorrect tax rates applied, which can alter the final tax liability. Taxpayer identification numbers (TINs) play a crucial role in addressing discrepancies, allowing for accurate tracking of payments. It is vital to provide clear contact information, such as a dedicated helpline or email address, for taxpayers needing assistance in rectifying their tax payment records, ensuring timely resolution before possible penalties are incurred.

Comments