Are you feeling overwhelmed by unexpected tax penalties and looking for relief? In this article, we'll guide you through a straightforward letter template designed to request a reduction in those pesky penalties. You'll learn how to articulate your situation clearly and persuasively, improving your chances of a favorable response. Keep reading to discover how you can effectively communicate your request and find a resolution!

Clear and Concise Introduction

Subject: Request for Reduction of Tax Penalties I am writing to formally request a reduction of the tax penalties assessed against my account, due to circumstances that affected my ability to meet tax obligations. The penalties in question relate to the tax year 2022 and were imposed by the Internal Revenue Service (IRS) on January 15, 2023. My tax identification number is [Your Tax ID Number]. I have reviewed my tax situation and believe that reducing these penalties would be a fair resolution, given the extenuating circumstances I faced during this period, including [specific details about the circumstances such as medical emergencies, loss of income, or other relevant events]. Thank you for considering my request.

Explanation of Circumstances

Tax penalties often arise due to late filings or payments, which can impose significant financial strain on individuals and businesses. In instances such as unexpected medical emergencies, natural disasters like hurricanes that disrupt normal financial operations, or unforeseen business downturns can lead to delayed tax submissions. For example, in Texas during Hurricane Harvey in 2017, many taxpayers faced hardships due to widespread flooding and infrastructure damage. Providing documentation, such as hospital bills or disaster recovery assistance records, can illustrate genuine circumstances that warrant a reduction in penalties. Furthermore, consistent compliance in previous years enhances credibility, stressing that penalties are not reflective of habitual negligence but rather exceptional situational challenges.

Evidence and Documentation

A well-structured request for tax penalties reduction often includes a solid outline of compelling evidence and documentation. Tax penalties imposed by the Internal Revenue Service (IRS), for unpaid taxes or late filings, can significantly impact individuals and businesses. When compiling your evidence, essential documents such as bank statements, pay stubs, or previous tax returns can illustrate financial hardship or inability to pay. Additionally, correspondence with the IRS or tax professionals can provide context and demonstrate attempts to resolve the tax issues. Highlight specific circumstances such as medical emergencies, unexpected job loss, or natural disasters that may have contributed to late payments. Presenting these factors clearly and concisely, along with all relevant documents, strengthens the case for penalty abatement.

Polite and Respectful Tone

Many individuals may find themselves facing tax penalties from the Internal Revenue Service (IRS) due to unforeseen circumstances. Tax penalties can arise from various situations such as late payments, underpayment of taxes, or filing errors. Filing history and timely payments are crucial factors to consider. Taxpayers who experience significant life events, like illness or financial hardship, may be eligible for penalty relief. The IRS offers a first-time penalty abatement policy for those who maintain a clean tax record over the past three years. Documentation, including financial statements and medical records, should be prepared to support the request. Crafting the request in a polite and respectful manner can enhance the likelihood of a favorable outcome. The appeal process involves submitting a written request with relevant details, referencing applicable IRS guidelines, and adhering to stated formats. Prompt action within a reasonable timeframe after receiving penalty notifications is vital to ensure consideration of requests.

Specific Request and Proposal

In a formal appeal for tax penalties reduction, individuals can present their specific circumstances compellingly. Taxpayers may reference Internal Revenue Service (IRS) policies regarding reasonable cause for penalty abatement. Clear documentation, such as financial records or health issues, supporting the request can enhance credibility. For instance, taxpayers might cite significant life events, such as a medical emergency (hospital stay exceeding 30 days), or unexpected financial hardships (unemployment lasting over six months) as justifications. Calculating total penalties incurred, including late payment and filing fees, alongside the taxpayer's overall tax history (e.g., a clean record prior to this incident), establishes a pattern of compliance and a basis for forgiveness. Acknowledging personal accountability while emphasizing the commitment to mitigate future issues signals responsibility and may strengthen the proposal.

Letter Template For Request For Tax Penalties Reduction Samples

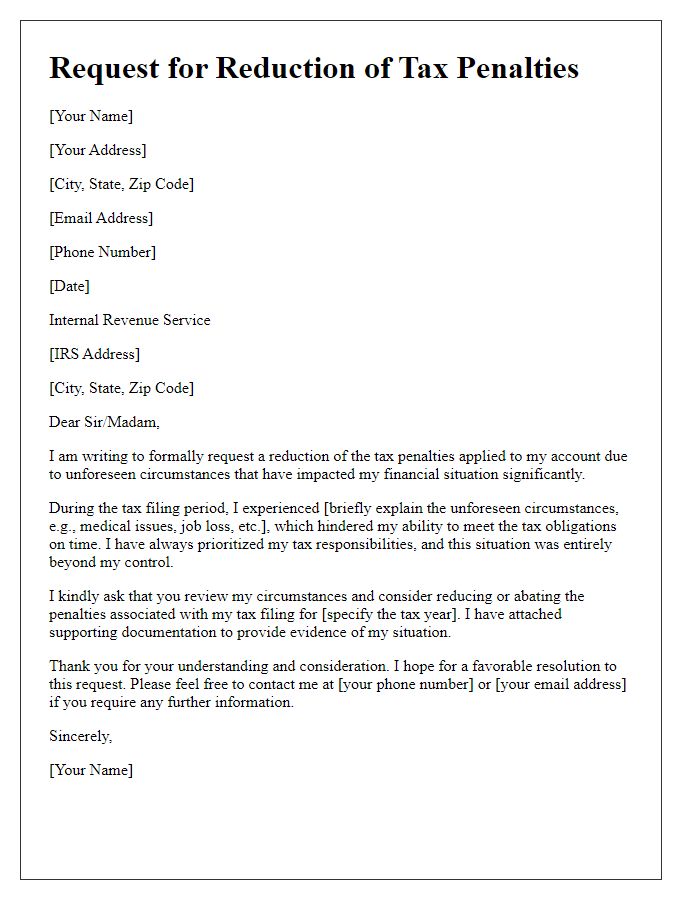

Letter template of request for tax penalties reduction due to unforeseen circumstances.

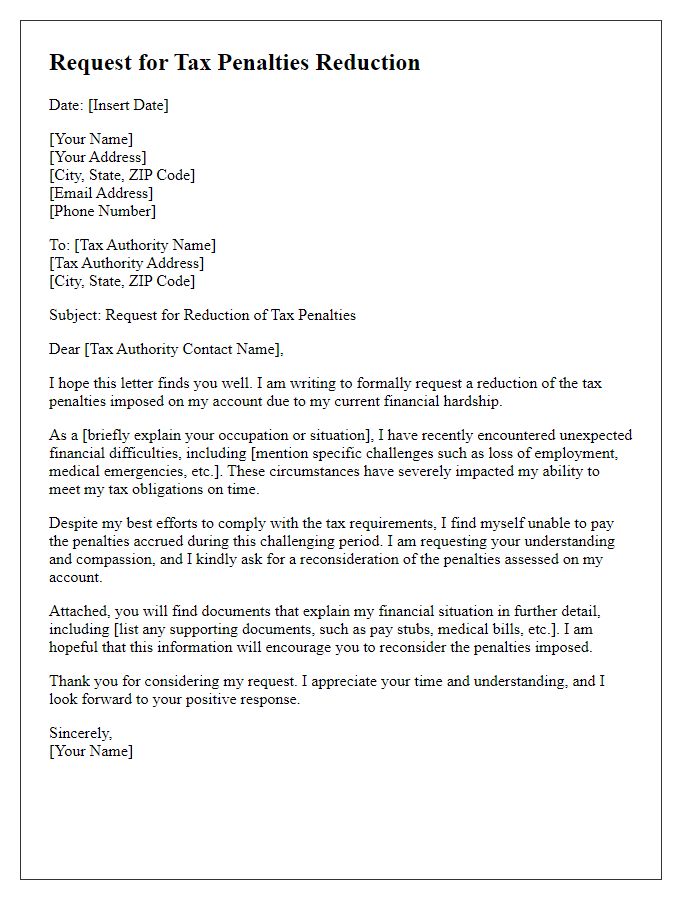

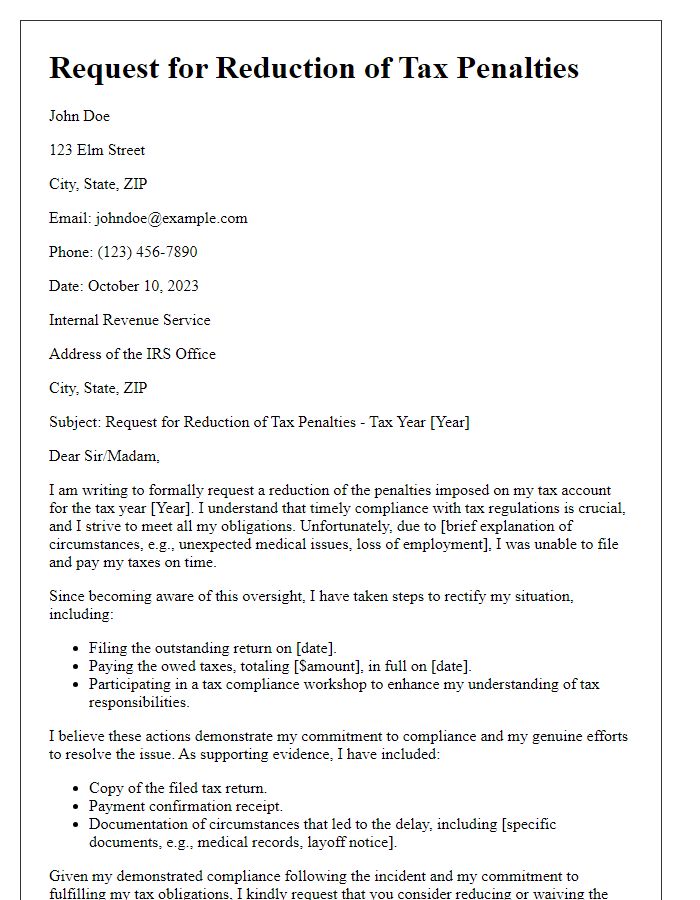

Letter template of request for tax penalties reduction for financial hardship.

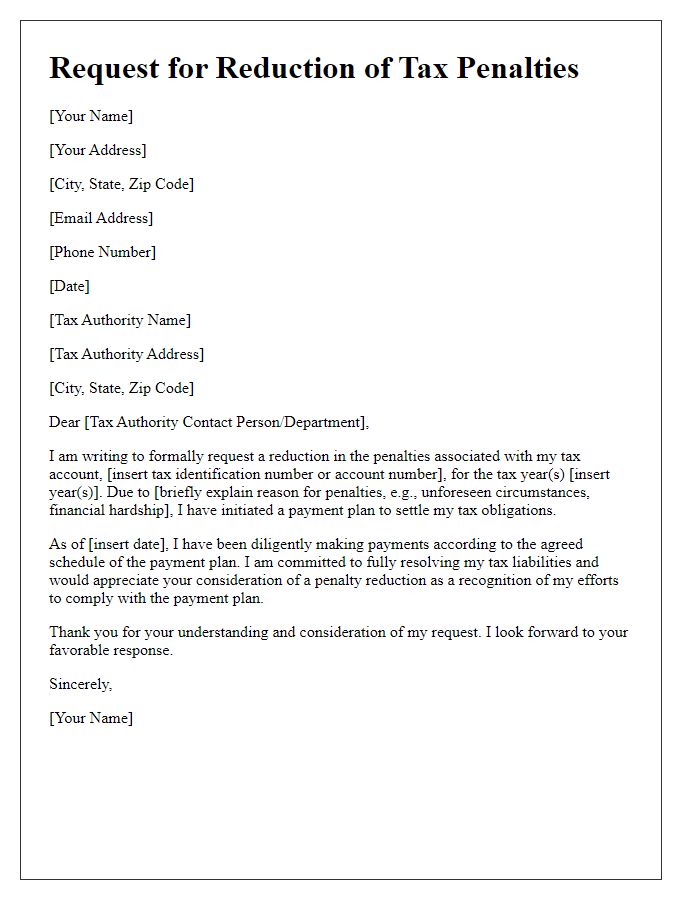

Letter template of request for tax penalties reduction based on a payment plan.

Letter template of request for tax penalties reduction after submitting missing documents.

Letter template of request for tax penalties reduction for first-time offenders.

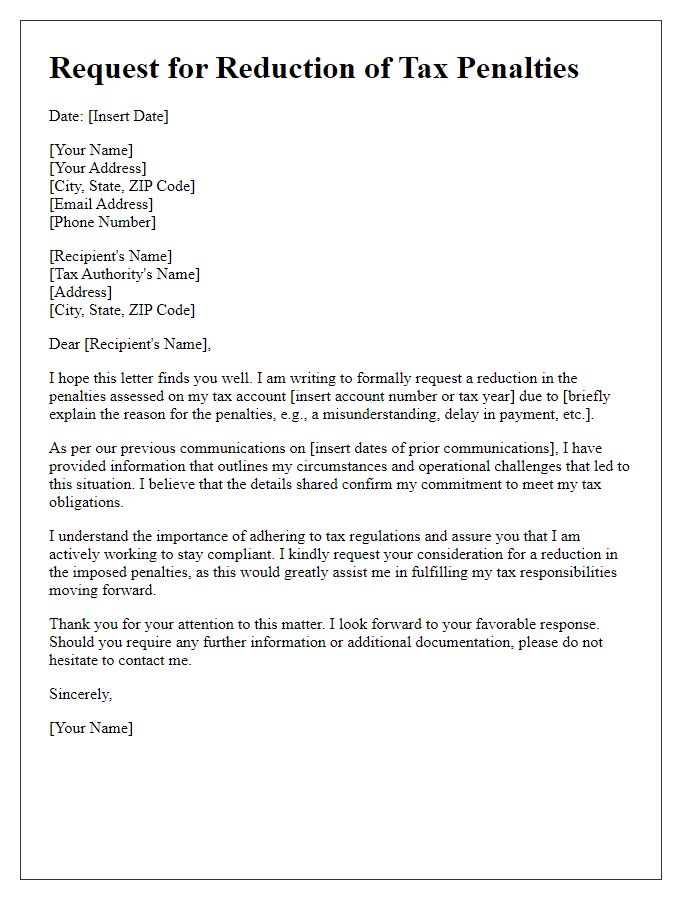

Letter template of request for tax penalties reduction due to incorrect tax advice.

Letter template of request for tax penalties reduction highlighting medical emergencies.

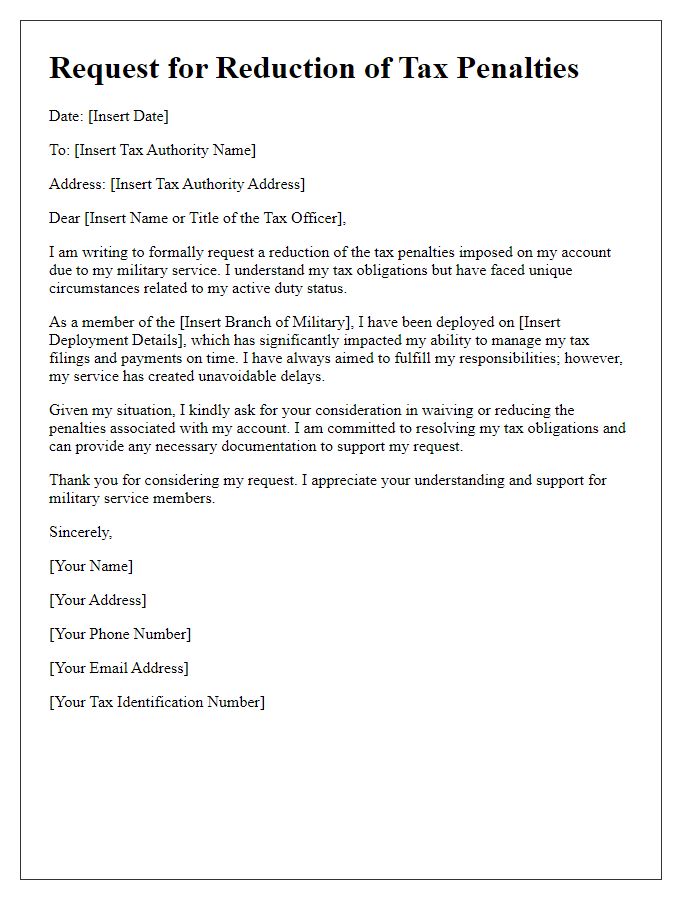

Letter template of request for tax penalties reduction for military service members.

Letter template of request for tax penalties reduction with supporting evidence of compliance.

Comments