Are you looking to update your child tax benefit application but don't know where to start? Navigating the world of tax benefits can feel overwhelming, but with the right guidance, it can be a straightforward process. In this article, we'll break down the key steps you need to take to ensure your application is updated correctly and efficiently. Keep reading to discover everything you need to know to get the benefits you deserve!

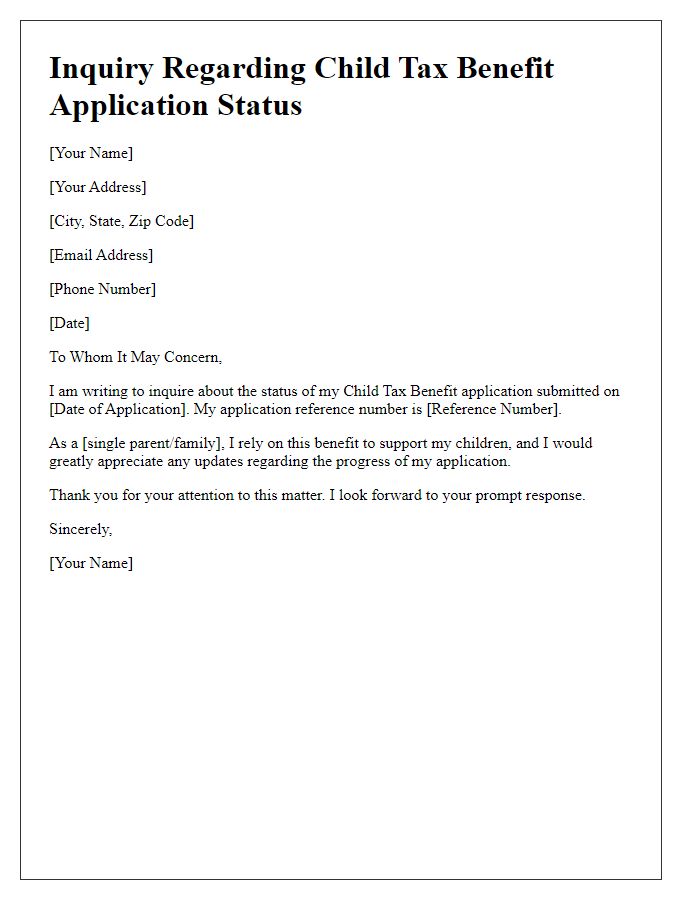

Personalized Greeting

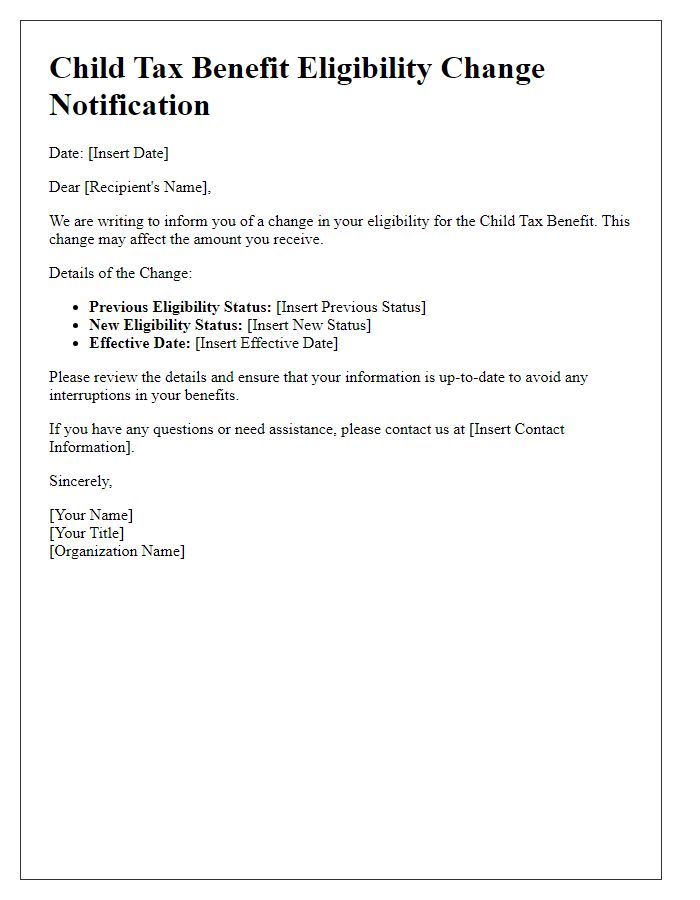

The Child Tax Benefit program offers crucial financial assistance to families with dependent children under 18 years old in Canada, providing monthly payments designed to alleviate the costs associated with raising children. This program, administered by the Canada Revenue Agency, adjusts payment amounts based on family income levels and the number of children, with a maximum annual benefit that can reach thousands of dollars. Families must submit specific documentation, including proof of income and details about their children, to ensure they receive the appropriate assistance. Regular updates to personal information are essential to maintain eligibility and accuracy of benefit calculations, ensuring that families receive the necessary support to foster their children's growth and development.

Clear Subject Line

Child Tax Benefit Application Update: Important Information Required. The Child Tax Benefit program, administered by the Canada Revenue Agency (CRA), provides financial assistance to families with children under 18 years of age. In addition, updated information may be needed regarding your household income, changes in family circumstances, or additional dependents. Documentation such as tax returns, custody agreements, or proof of residency may also be required to ensure continued eligibility. Timely updates help maintain seamless benefits, ensuring families receive necessary financial support.

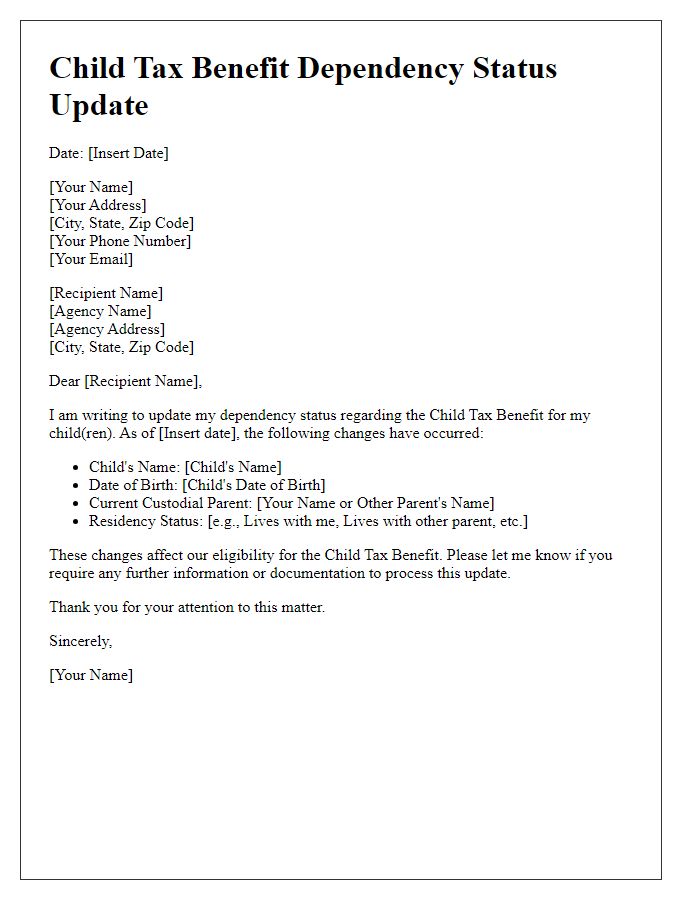

Applicant Information

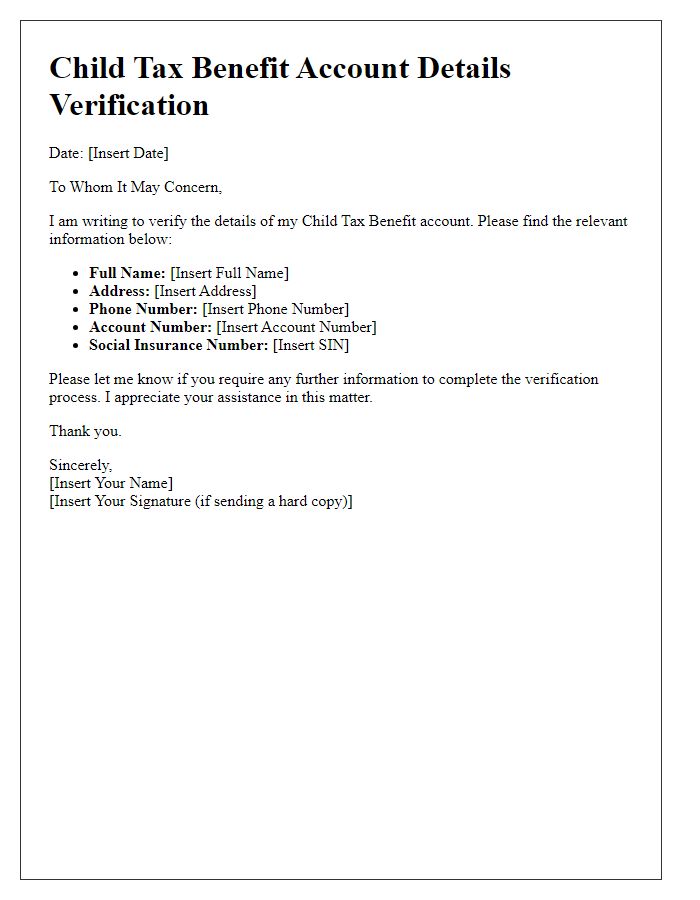

The Child Tax Benefit application process requires comprehensive applicant information, including personal details such as full name, date of birth, and Social Security Number (SSN). Residential address plays a crucial role in determining eligibility based on local regulations and residency requirements, often needing verification through utility bills or official documents. Financial information, including annual income and household size, is critical for assessing the benefit amount, influenced by factors like the federal poverty guidelines or specific state programs. Furthermore, banking details facilitate direct deposit, ensuring timely benefit disbursements, while contact information aids in communication throughout the application process. Complete and accurate documentation enhances the likelihood of a smooth application experience and maximizes potential benefits.

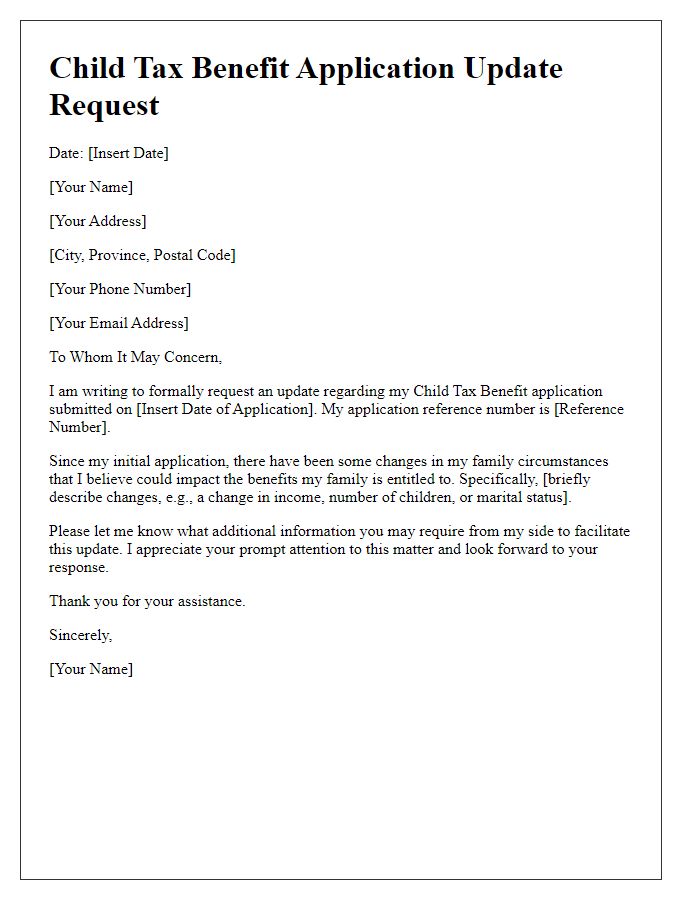

Updated Financial Details

Updating financial details for a Child Tax Benefit application is crucial for ensuring accurate support calculations. The Child Tax Benefit, administered by Revenue Canada, assists families with children under 18 years old, offering monthly payments that help offset child-rearing costs. Financial details such as annual income, employment status, and number of eligible children can impact benefit amounts significantly. Timely updates are essential, especially when family income changes due to job loss, pay raises, or additional dependents coming into the household. Accurate reporting ensures compliance with regulations and helps families receive the correct financial support for their children's needs.

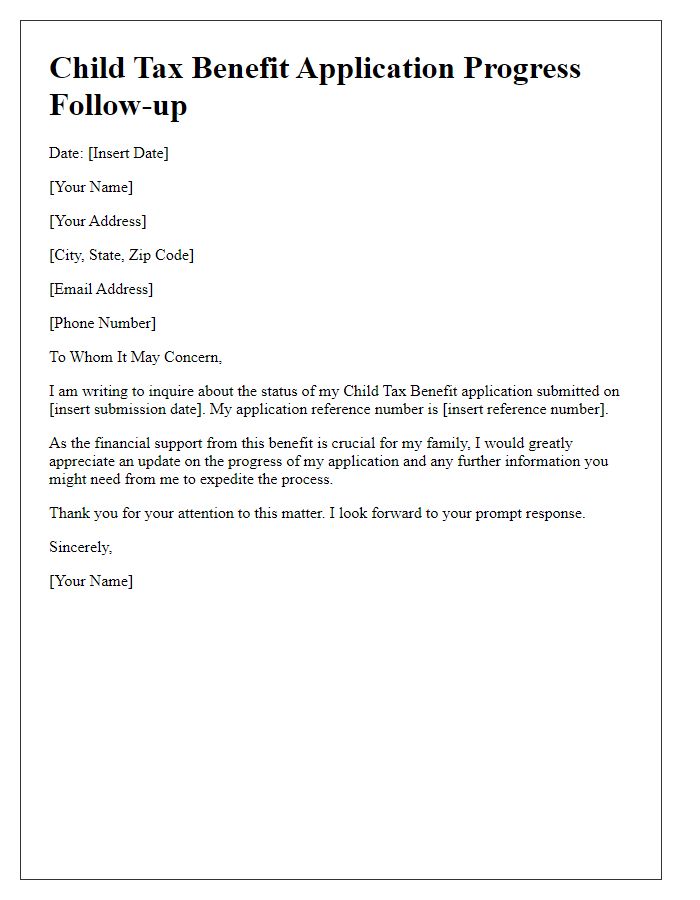

Request for Confirmation

To apply for the Child Tax Benefit, individuals must submit up-to-date documentation and required forms to the Canada Revenue Agency (CRA). This benefit, aimed at supporting families with children under the age of 18, can significantly aid in reducing the overall financial burden and promoting child welfare. The most critical aspect involves providing accurate information, such as the number of qualifying children, income details from the previous tax year, and proof of residency in Canada. To ensure timely processing, families should regularly check the status of their application and may seek confirmation from the CRA regarding any updates or changes to their benefit status, especially after submitting new information. The CRA maintains a dedication to addressing queries promptly, ensuring families receive the support they need for their dependent children.

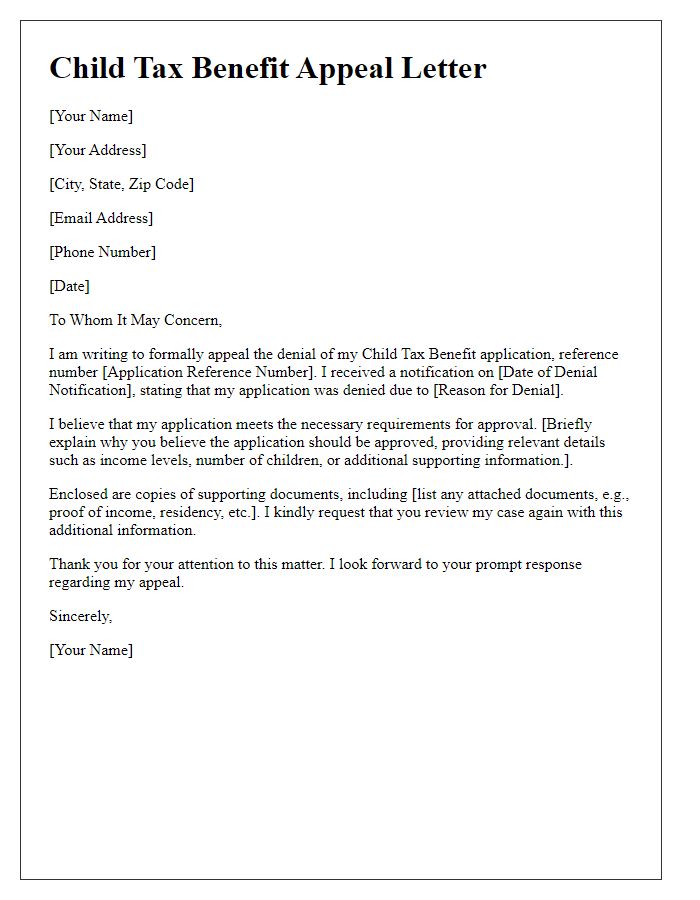

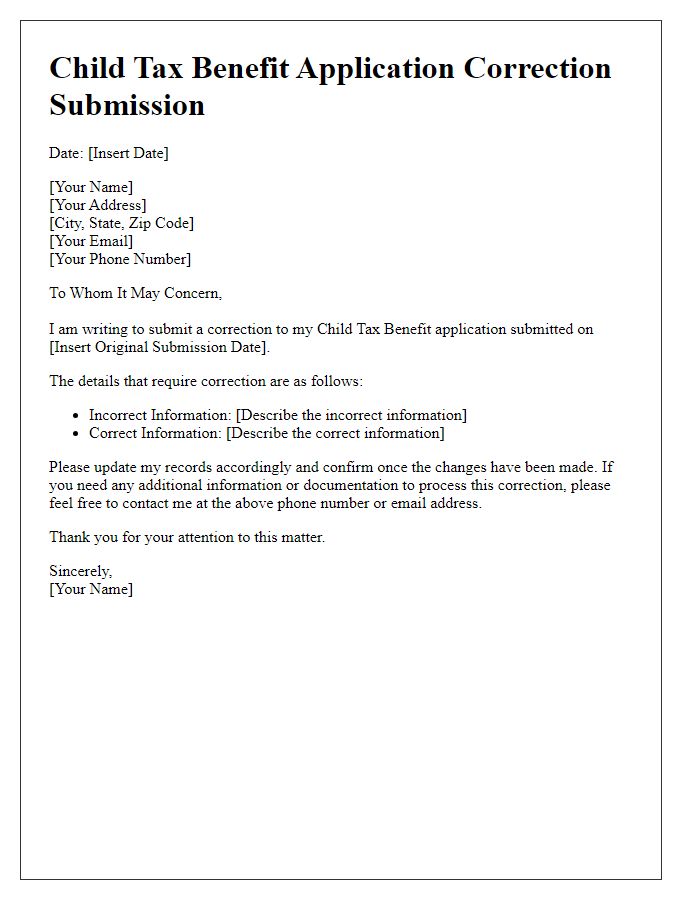

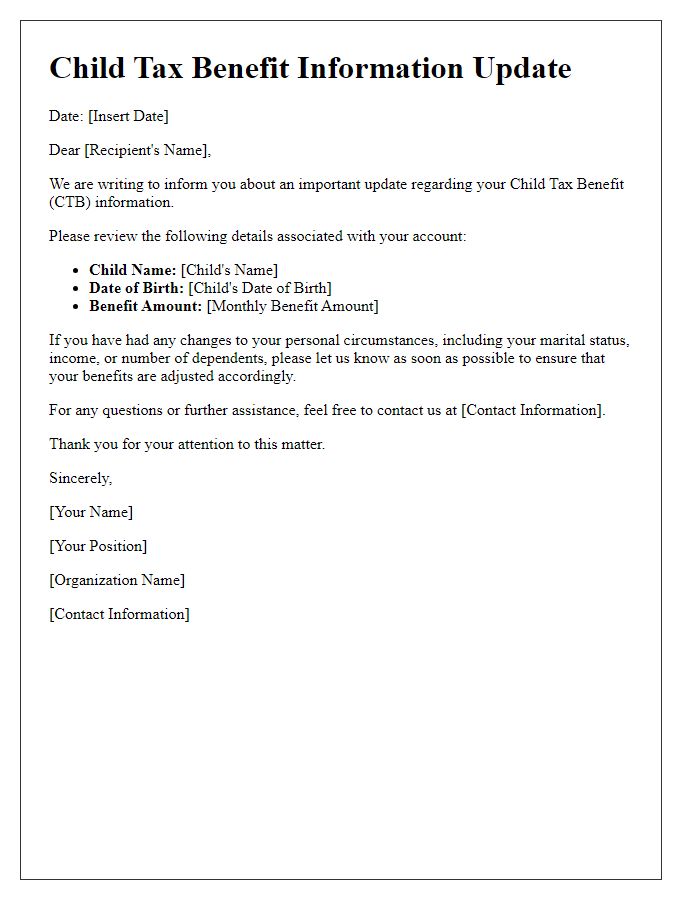

Letter Template For Child Tax Benefit Application Update Samples

Letter template of Child Tax Benefit Application Documentation Submission

Comments