Hey there! Have you ever wondered what happens to those unused tax credits? They can be a goldmine, waiting quietly in the wings for the right moment to shine. In this article, we'll explore how to effectively notify individuals or businesses about their unused tax credits, ensuring they don't leave any money on the table. So, stick around and let's dive deeper into the world of tax credits and how you can stay informed!

Recipient Information

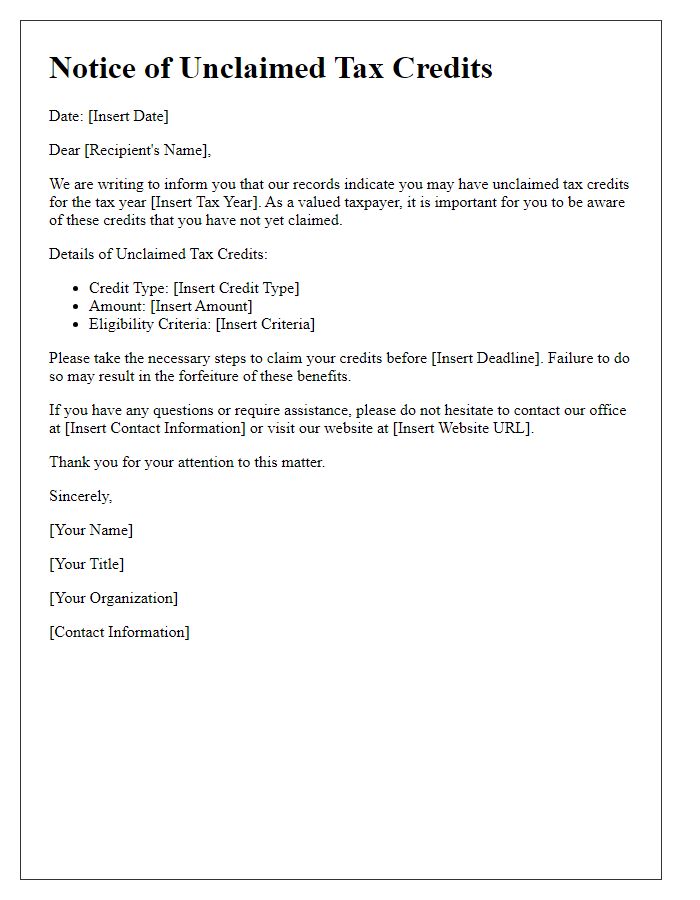

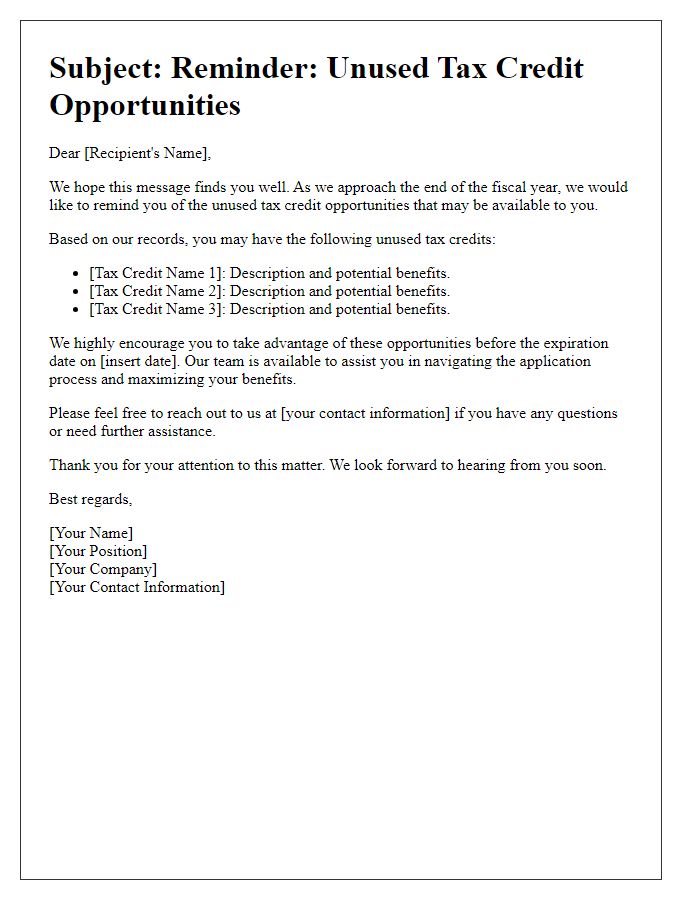

The unused tax credit notification serves as an essential communication to recipients, such as individuals or businesses, highlighting available financial benefits. This notification details the recipient's name, address, and taxpayer identification number, ensuring accurate identification. The document outlines the specific unused tax credits, including eligibility criteria and amounts--often reflecting tax jurisdictions like federal, state, or local levels. The notification emphasizes deadlines for utilizing these credits, which can significantly impact future tax liabilities, and may include contact information for tax advisory services to assist recipients in maximizing their tax benefits. Understanding these aspects can motivate recipients to engage with their tax planning proactively.

Tax Credit Details

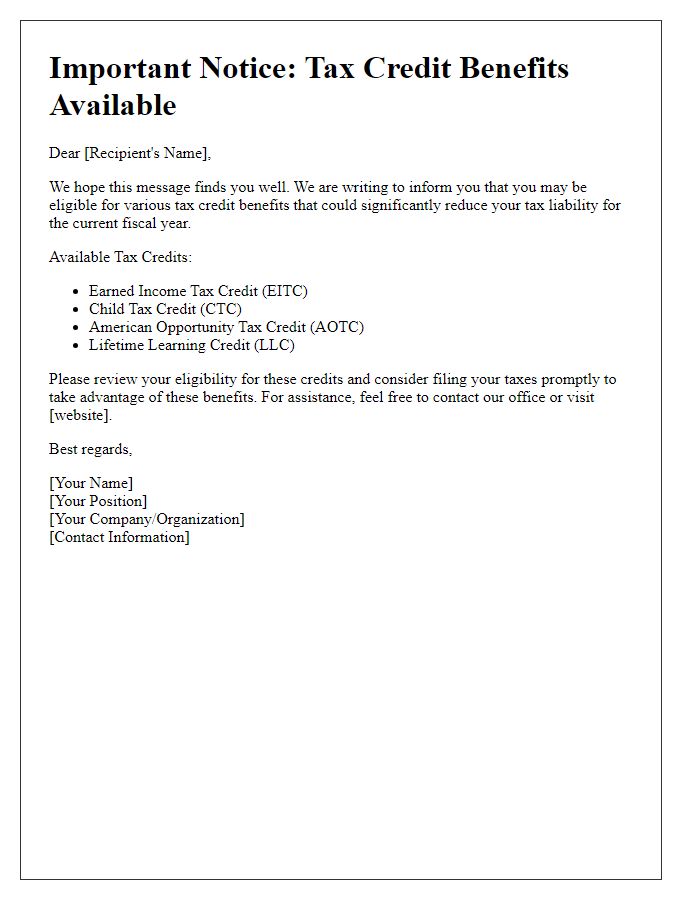

Tax credits represent a significant financial incentive provided by governments to encourage specific behaviors or investments. In the case of unused tax credits, these credits, often linked to renewable energy investments or education expenses, offer potential relief on tax liabilities. For example, in the United States, the Solar Investment Tax Credit (ITC) allows taxpayers to deduct a percentage of solar system installation costs from their federal taxes. If a taxpayer opts not to utilize these credits, they forfeit potential savings, which can accumulate considerable amounts, especially in high-cost investment areas. Timely notification of unused tax credits can lead to strategic financial planning, enabling individuals and businesses to reassess eligible expenditures and claim benefits in future tax periods. Awareness of deadlines associated with tax credit redemption enhances the opportunity to capitalize on these valuable fiscal tools, particularly in areas like green energy or education partnerships.

Expiration Date Notice

Unused tax credits can significantly impact individual finances and government revenue. The expiration date notice typically addresses tax credits such as the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC), which may lapse after a specified duration, often one year from the tax filing deadline. In 2023, for instance, individuals who qualified for these credits in previous tax years may find their benefits expire if not utilized within the defined timeframe. Taxpayers residing in states like California or New York should be particularly aware of their local regulations, as state-specific credits may have different expiration parameters. Adequate notification helps ensure informed decisions regarding tax filings and potential benefits.

Instructions for Use

Unused tax credits, such as those from renewable energy investments or education expenses, represent financial benefits that taxpayers can strategically utilize. To effectively notify recipients of their eligibility, provide clear guidelines regarding the specific tax credit program, including the effective tax year, applicable state regulations, and the required documentation for claiming credits. Include details on the deadline for usage, such as the end of the calendar year, and instructions for applying the credit to future tax returns, ensuring that recipients understand how to integrate the credit into their financial planning. Highlight the importance of preserving forms like IRS Form 8888 for record-keeping purposes, as well as any potential implications for future tax liabilities if the credits remain unclaimed.

Contact Information

Unused tax credits represent a financial opportunity for individuals and businesses, often linked to specific jurisdictions like state governments. Tax credits such as those for renewable energy installations can accumulate if not claimed, potentially reaching thousands of dollars. The notification process typically involves the tax department or a relevant authority informing taxpayers of their eligible unused credits, providing vital details like the credit amount and expiration dates. Accurate contact information, including phone numbers and email addresses, ensures that recipients can follow up for clarification or application processes, emphasizing the importance of being proactive in utilizing these financial benefits before they expire.

Comments