Hey there! If you've been wondering about your tax compliance status, you're not alone. Many individuals and businesses often find themselves in need of clarity when it comes to taxes. In this article, we'll break down the key elements of an effective update letter regarding your tax compliance, ensuring you stay informed and organized. So, stick around and let's dive into the details!

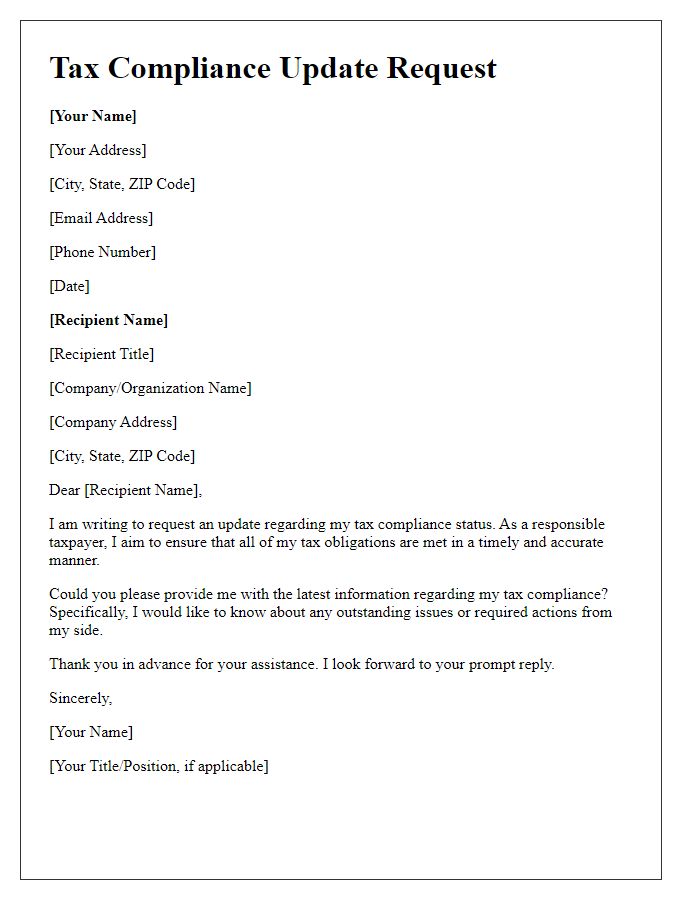

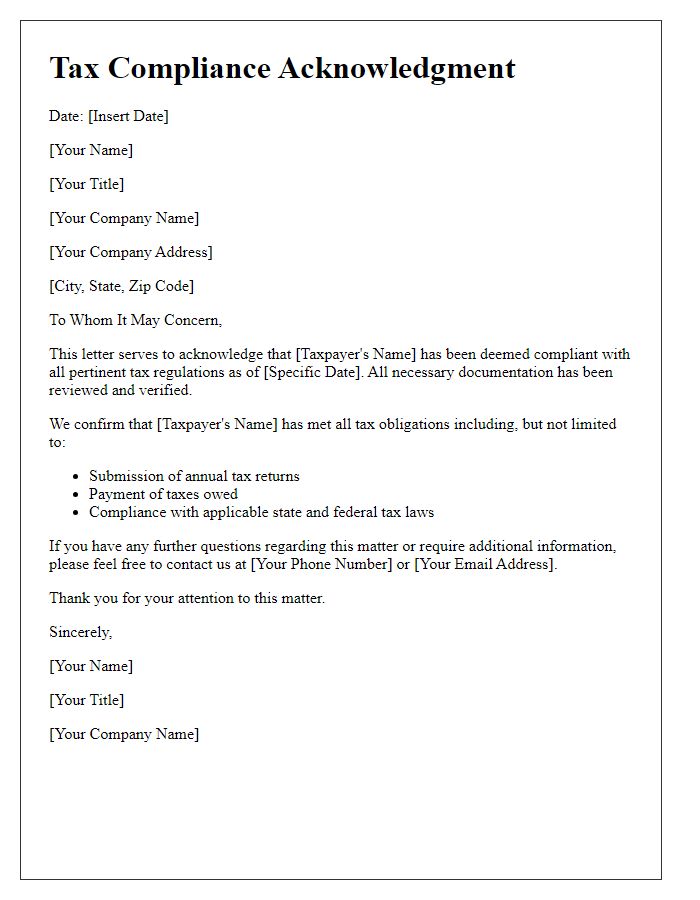

Introduction and purpose of the letter

Tax compliance updates are essential for individuals and businesses to maintain transparency with the Internal Revenue Service (IRS). This letter's objective is to inform stakeholders about the current status of tax compliance measures, ongoing assessments, and any upcoming deadlines or requirements. Such updates may include information about filings, payments, and potential audits, ensuring that recipients remain informed and prepared to meet regulatory obligations. Keeping abreast of tax compliance developments helps in avoiding penalties and fosters good standing with tax authorities.

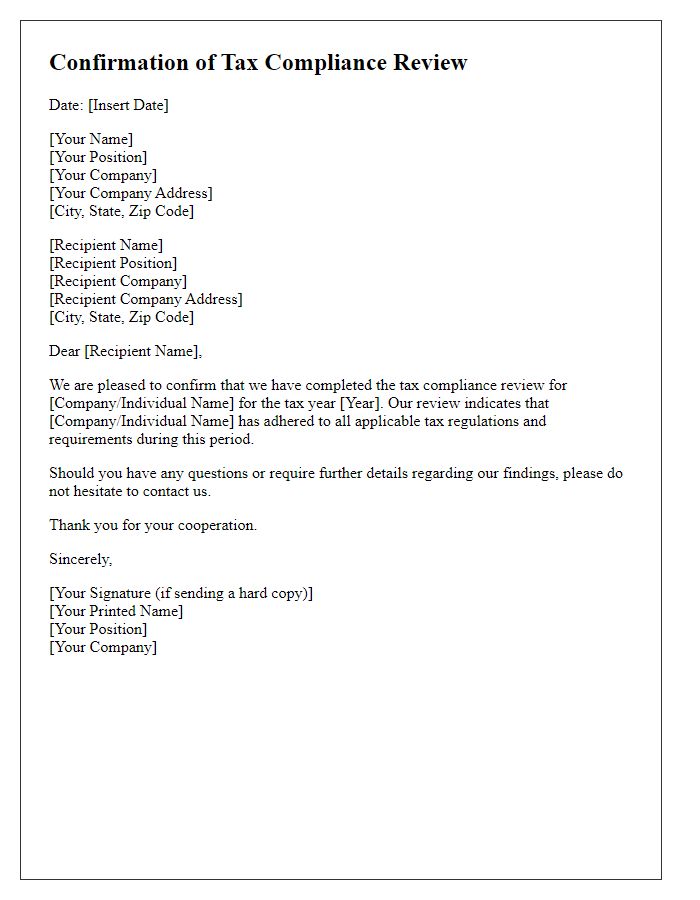

Current compliance status

Tax compliance status reflects an entity's adherence to regulatory obligations regarding tax filings and payments. Regular assessments are crucial for corporations (with revenues exceeding $10 million) and small businesses (annual earnings below $10 million) alike, ensuring alignment with local, state, and federal laws. The IRS (Internal Revenue Service) mandates that businesses file tax returns annually, keeping deadlines such as April 15th for individual income tax returns in mind. Compliance reviews often include evaluating outstanding liabilities, such as unpaid taxes over 90 days, which can lead to penalties. Additionally, states like California and New York have their own regulatory requirements, impacting compliance strategies. Engaging with tax consultants or legal advisors can enhance understanding of evolving tax codes and mitigate risks of non-compliance.

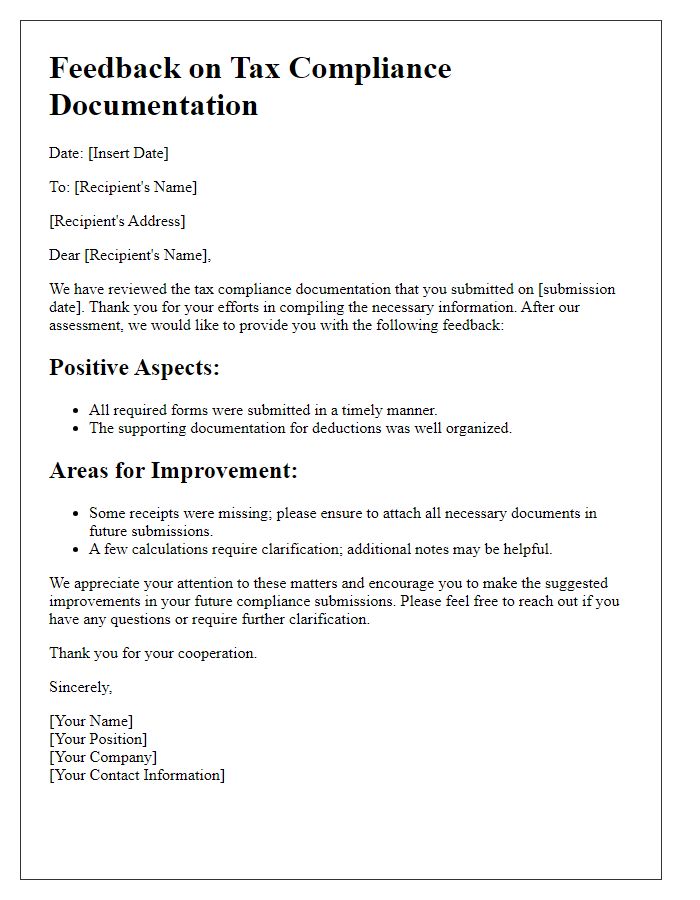

Actions taken to maintain compliance

Regular audits have been conducted to ensure adherence to tax regulations established by the Internal Revenue Service (IRS). Tax filings, including forms 1040 and 1065, have been accurately submitted before deadlines to meet compliance requirements. The implementation of a robust accounting software (like QuickBooks) has streamlined transaction tracking, reducing discrepancies. Staff members have attended seminars hosted by the American Institute of CPAs to stay updated on changing tax laws. Additionally, a comprehensive review of financial records has been performed quarterly, ensuring that all deductions and credits, particularly for business expenses, are appropriately claimed. Continuous training on compliance best practices has been provided to all finance team members, ensuring awareness of potential tax liabilities.

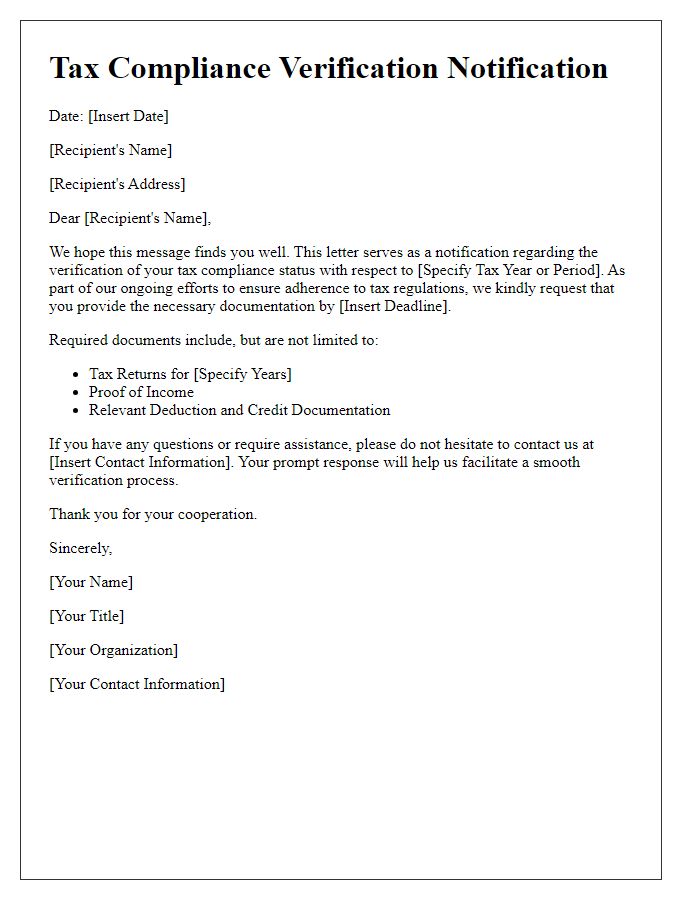

Next steps and deadlines

Tax compliance status updates are crucial for businesses aiming to maintain regulatory adherence. The Internal Revenue Service (IRS) outlines specific requirements that businesses must meet by designated deadlines, which can vary significantly depending on the type of tax (e.g., federal, state, or local). Key dates, such as April 15 for individual income tax returns and March 15 for certain business entities, are critical for timely submissions. Additionally, businesses must track estimated tax payments due four times annually to avoid penalties. Tax forms, like the 1040 for individuals or 1120 for corporations, must be carefully completed to reflect accurate financial data and deductions. Ignoring these requirements can lead to severe repercussions, including fines, audits, and damaged reputations, as compliance institutions continuously monitor registration statuses and financial activities. Timely communication with tax advisors is essential for navigating any changes in tax laws or compliance expectations.

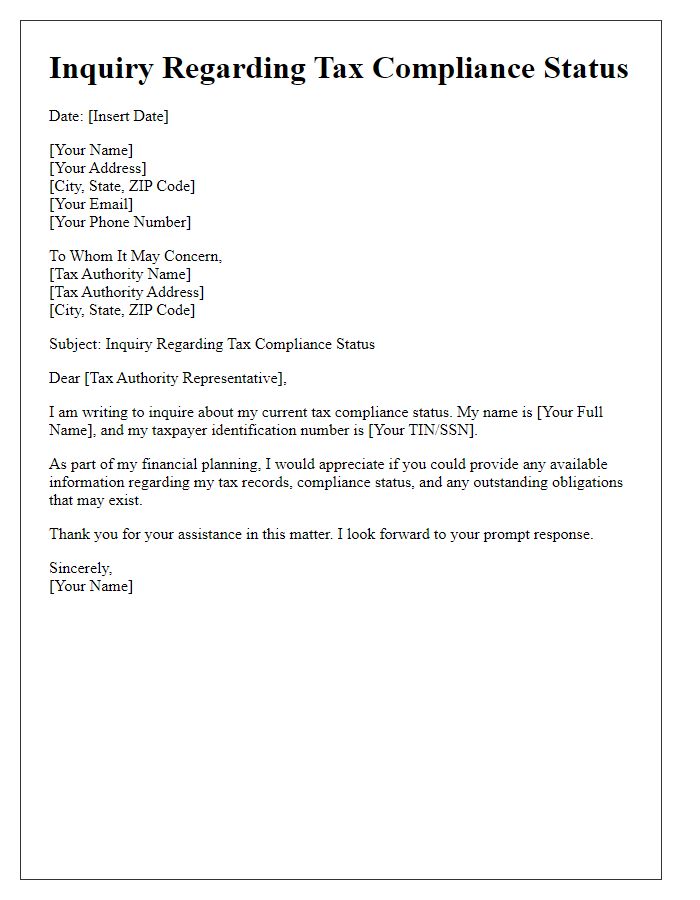

Contact information for assistance

Tax compliance status updates are crucial for individuals and businesses to track their obligations with the Internal Revenue Service (IRS) or other tax authorities. Compliance involves adhering to regulations regarding income reporting, deduction claims, and timely payments. Individuals may seek assistance by contacting local tax offices, certified public accountants (CPAs), or tax advisory services, which can offer guidance tailored to specific situations. For urgent inquiries, you may reach out to the IRS helpline, typically available during working hours, at 1-800-829-1040, or use online resources at the official IRS website for the latest news and forms related to compliance and filings. Additionally, numerous state tax agencies provide support via their dedicated hotlines or customer service email addresses, ensuring that taxpayers receive timely and accurate information throughout the year.

Comments