Navigating the intricate world of tax disputes can be daunting, but you're not alone in this journey. Many individuals and businesses face challenges when it comes to resolving tax issues, and understanding the process can make all the difference. In this article, we'll break down the key steps to effectively communicate your tax dispute resolution, ensuring that the information you provide is clear and comprehensive. So, let's dive in and explore how to craft a letter that will put you on the right path to resolution!

Taxpayer information and contact details.

Taxpayer information includes essential identification such as the individual's or entity's name, Tax Identification Number (TIN), and registered address that corresponds to the official government records. Contact details must provide a current phone number and email address for effective communication regarding the tax dispute resolution process. This information ensures that all correspondence can be efficiently managed and addressed, facilitating a streamlined resolution through the appropriate tax authority channels.

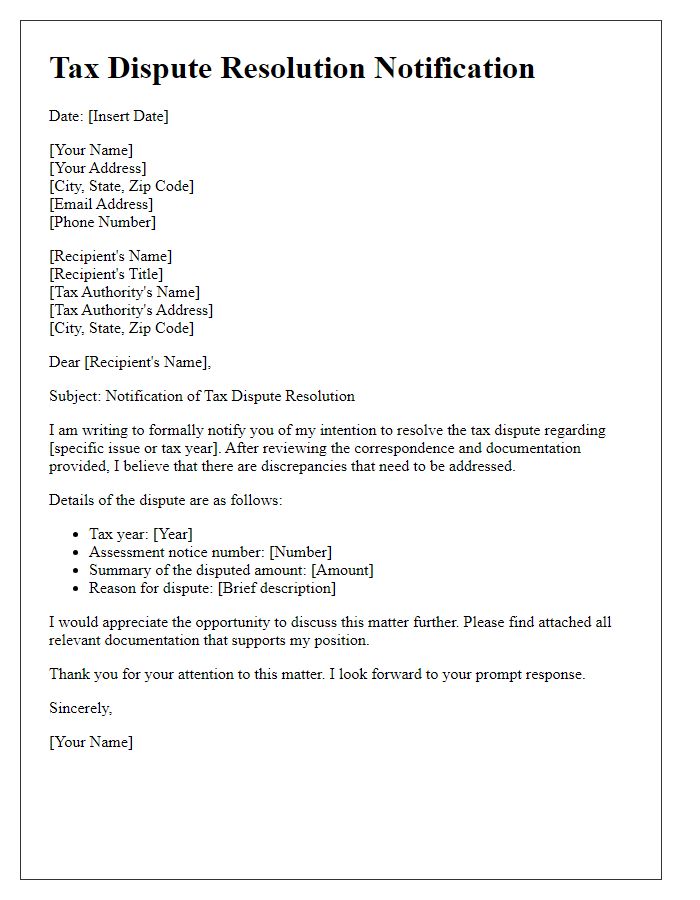

Clear statement of dispute resolution.

A tax dispute resolution process facilitates the resolution of disagreements between taxpayers and tax authorities. In the United States, the Internal Revenue Service (IRS) offers various methods such as mediation, appeals, and the Taxpayer Advocate Service. Mediation, a confidential process, allows both parties to negotiate through a neutral third party, while the appeals process enables taxpayers to contest tax determinations within designated timeframes. The Taxpayer Advocate Service supports taxpayers facing hardships related to tax disputes, ensuring fair treatment and guidance throughout the resolution process. Effective communication and documentation are essential during these proceedings to achieve a favorable outcome.

Reference to tax periods and specific issues resolved.

The recent resolution of the tax dispute for the periods spanning from January 2020 to December 2021 involved several critical issues related to income reporting discrepancies and unclaimed deductions. The Internal Revenue Service (IRS) made adjustments totaling $15,000, which included a focus on Schedule C earnings and allowable business expenses. These adjustments clarified the misinterpretations previously held regarding the treatment of certain expenditures, specifically regarding travel and equipment purchases. The resolution process, completed in October 2023, adhered to the guidelines set forth by the IRS, concluding a two-year dialogue aimed at rectifying the taxpayer's obligations and ensuring compliance with federal regulations.

Explanation of the resolution outcome and next steps.

Tax disputes often arise from assessments made by the Internal Revenue Service (IRS) or other tax authorities, which may involve discrepancies in income reporting or deductions claimed. After thorough examination, the resolution outcome may indicate that the original assessment was upheld, modified, or fully overturned. If the dispute reached a conclusion where your initial claims are validated, you may receive a refund or credit, while a denial could necessitate payment of any outstanding taxes. Next steps may include formal written notification of the resolution, potential appeal options, or instructions for payment arrangements if applicable, depending on the specific jurisdiction's regulations and procedures. This process ensures compliance with established tax legislation and maintains transparency throughout the resolution of the dispute.

Contact information for further inquiries or assistance.

Resolving a tax dispute requires meticulous attention to detail and clear communication of necessary information. Taxpayers may need to refer to specific agencies such as the Internal Revenue Service (IRS) or local tax authorities, which operate under legal guidelines established by the U.S. tax code. Professional assistance may be sought from certified public accountants (CPAs) or tax attorneys, who provide expertise in navigating complex regulations and ensuring compliance. Tax resolution professionals often suggest gathering critical documents such as previous tax returns, payment records, and correspondence related to the dispute, which can streamline discussions with representatives. Contact information for inquiries typically includes direct phone lines and official email addresses, ensuring prompt support during the resolution process.

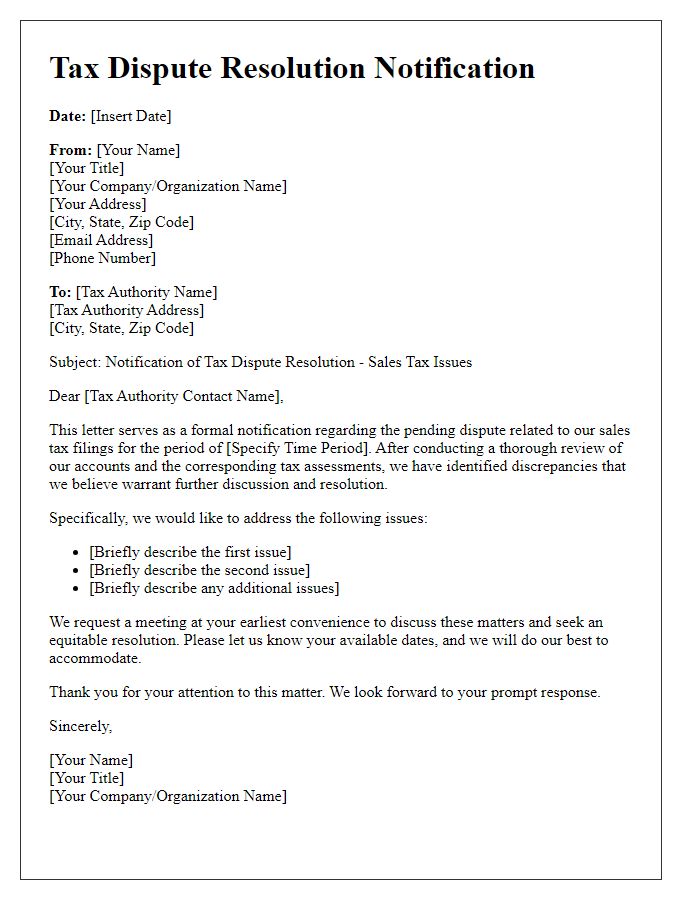

Letter Template For Notification Of Tax Dispute Resolution Samples

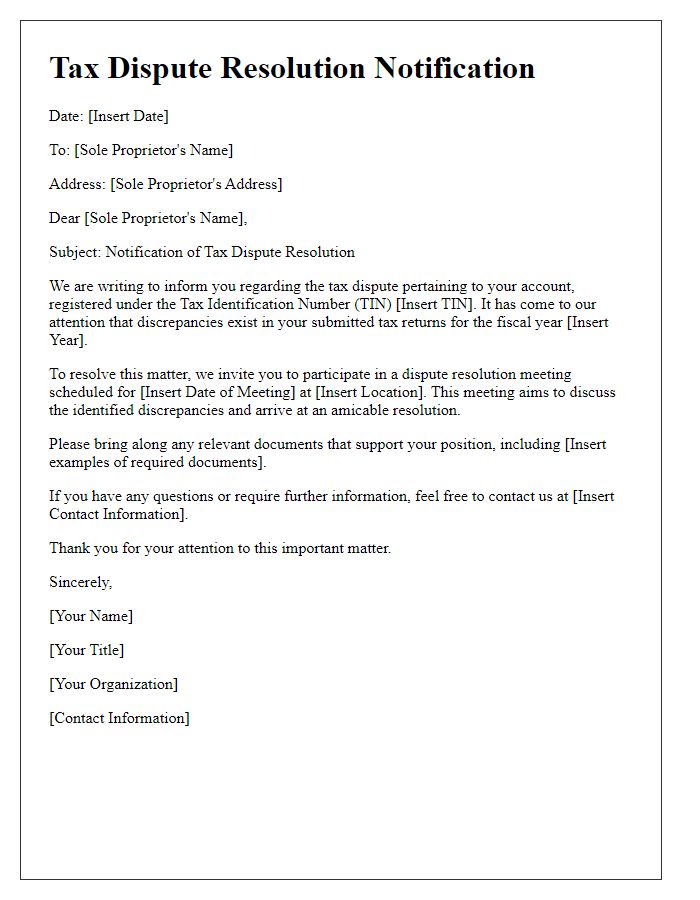

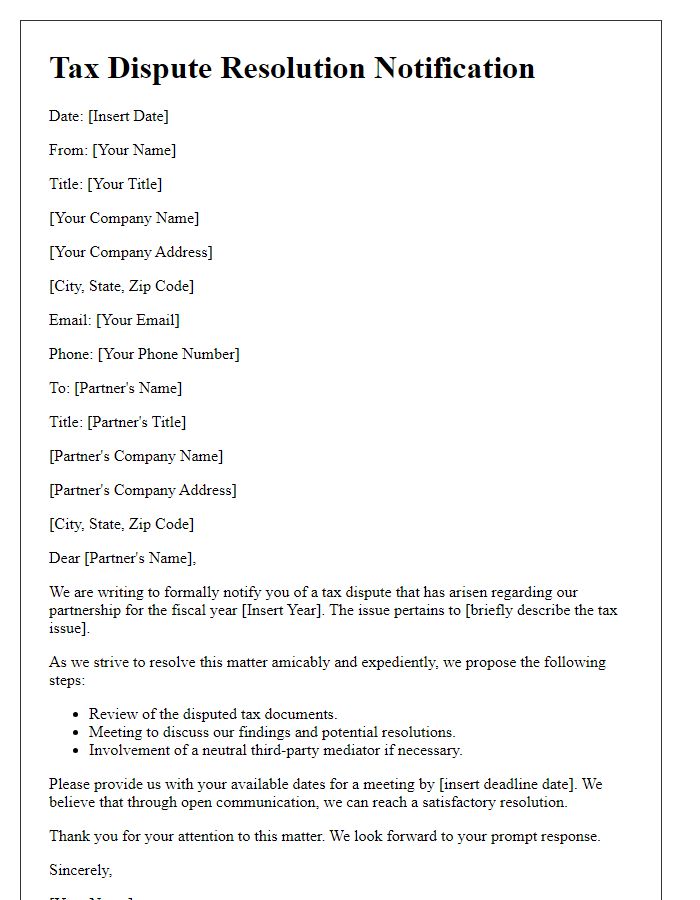

Letter template of tax dispute resolution notification for sole proprietors

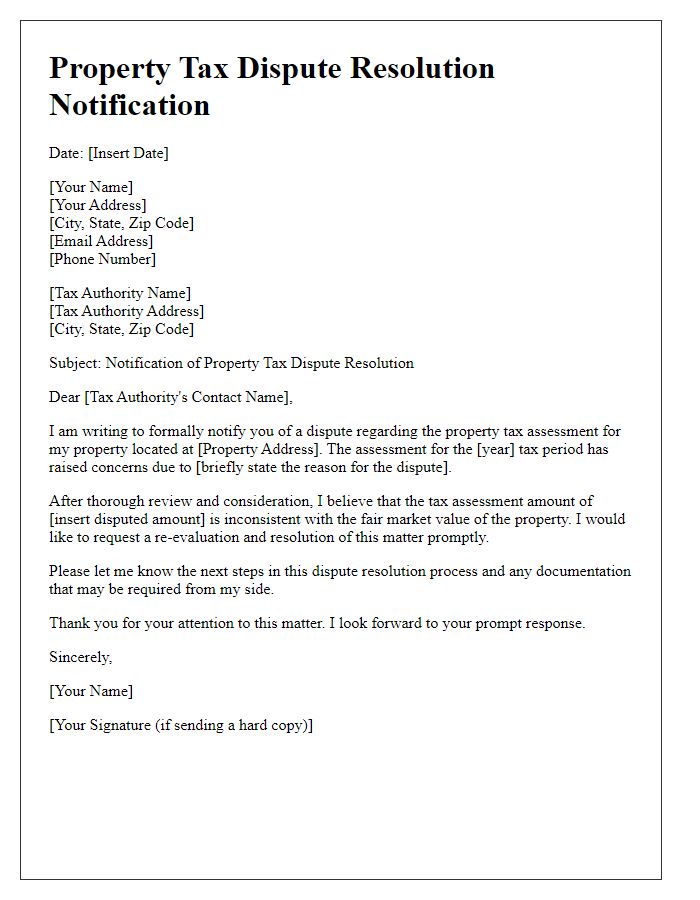

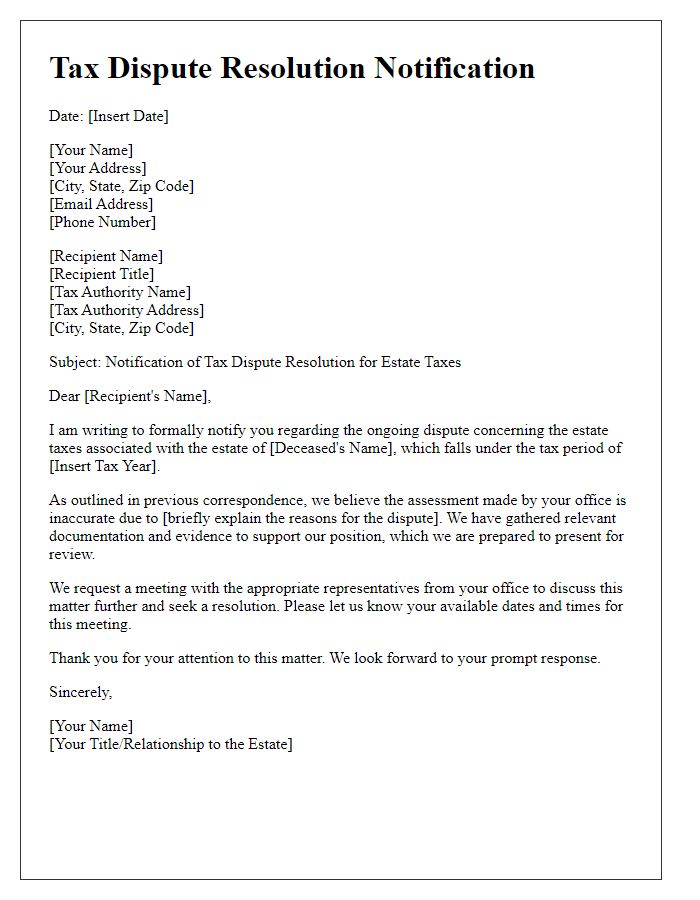

Letter template of tax dispute resolution notification for property taxes

Comments