Are you feeling overwhelmed by the looming tax deadline? You're not aloneâmany individuals and businesses find themselves in need of a little extra time to sort out their finances. Fortunately, requesting a tax extension can provide that much-needed breathing room to ensure everything is in order. Curious about how to navigate the process? Read on for a comprehensive guide!

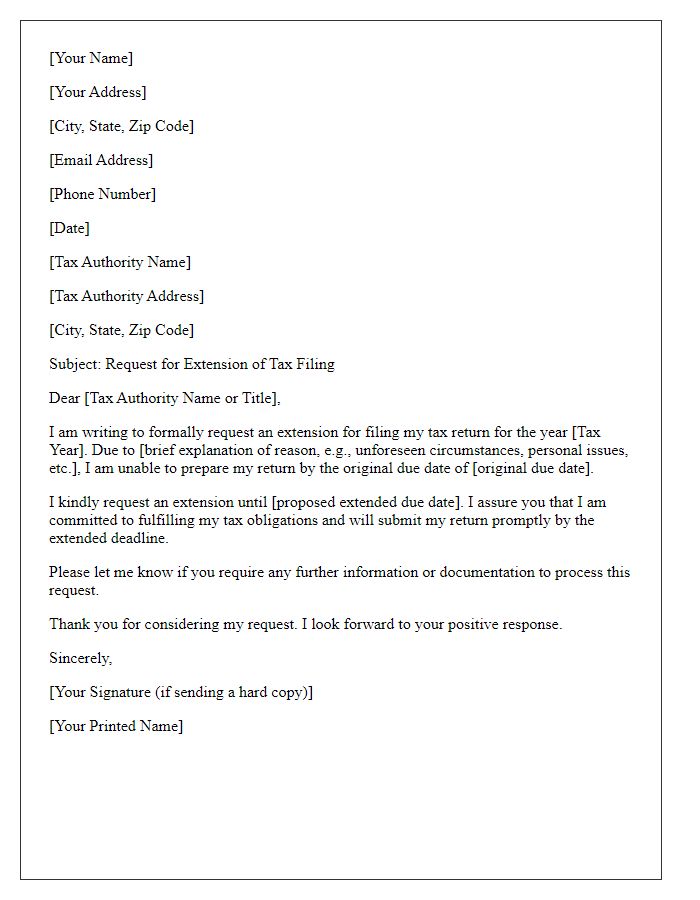

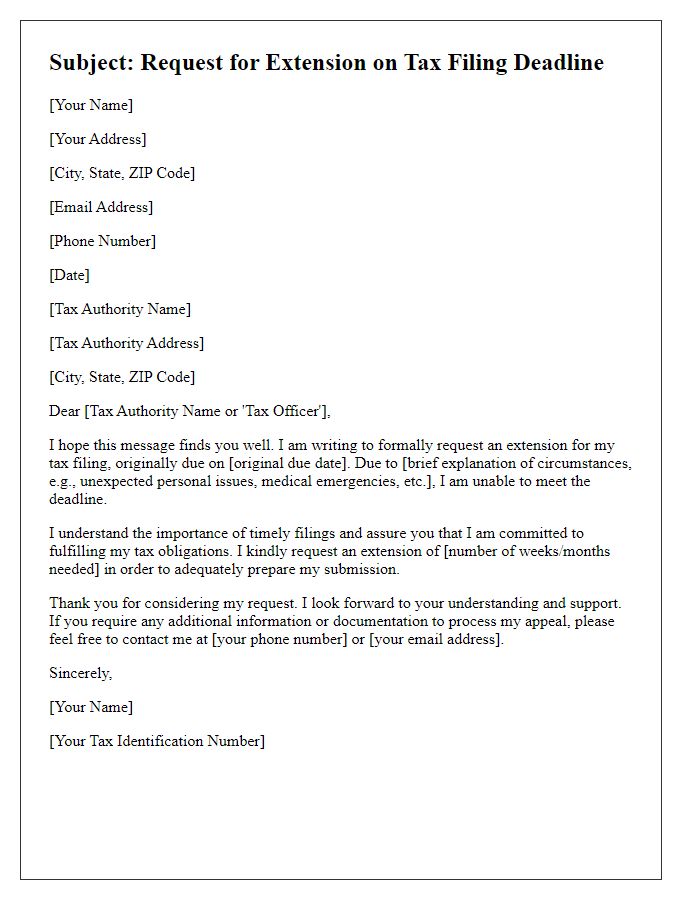

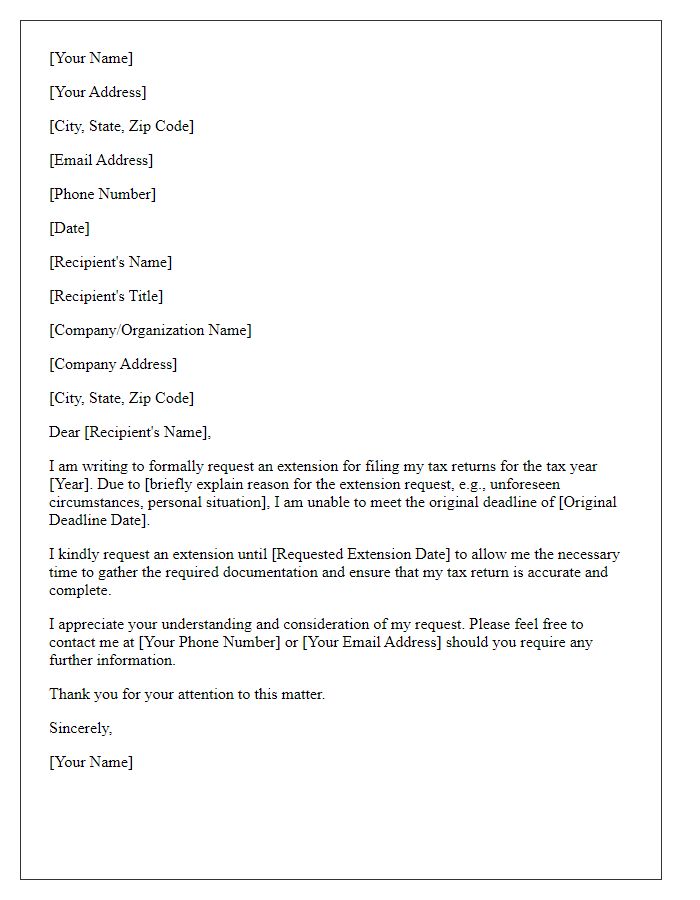

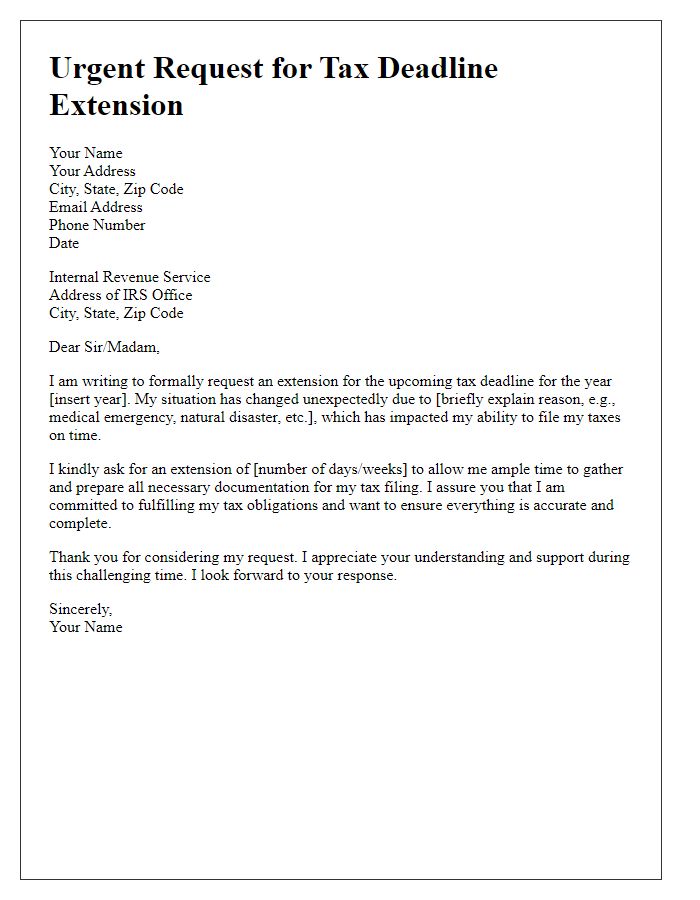

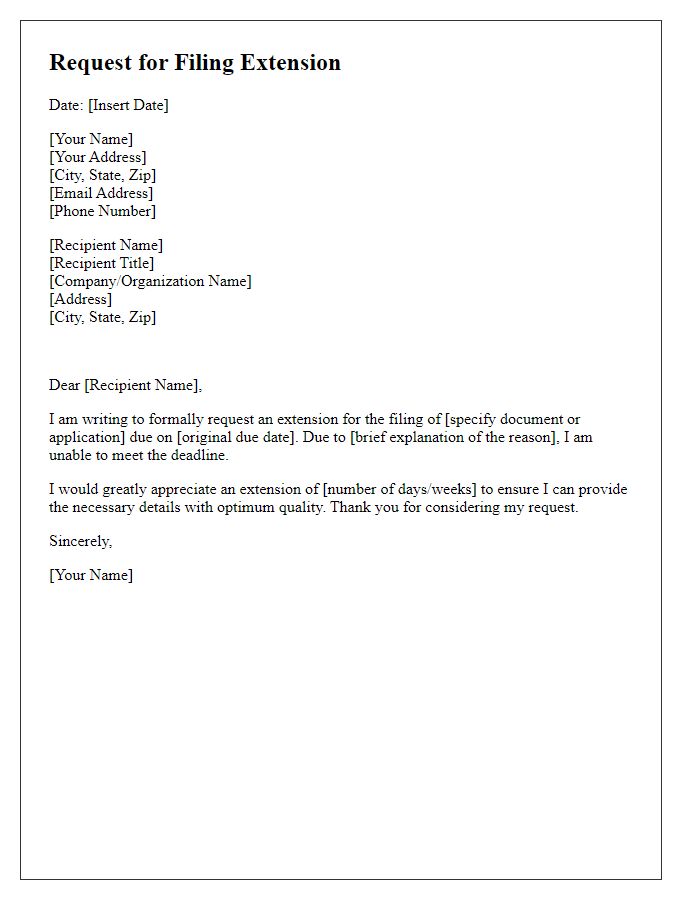

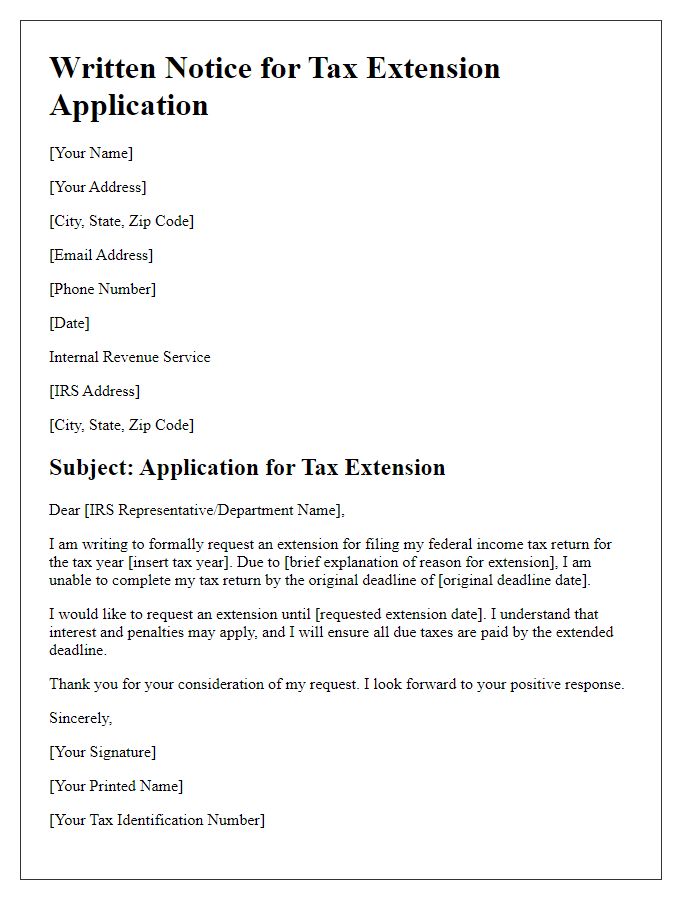

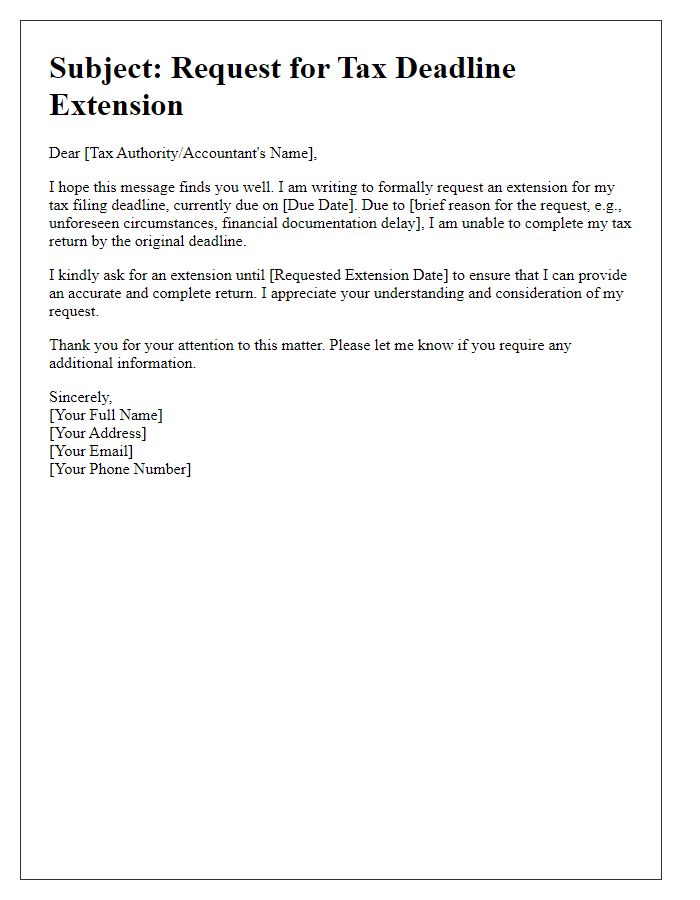

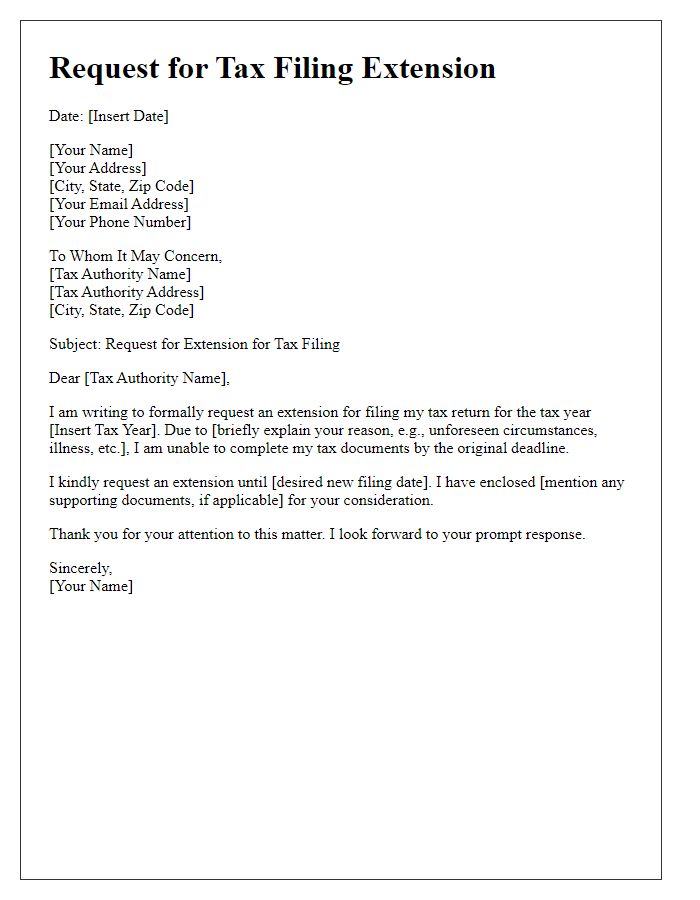

Personal Information (Name, Address, Contact Details)

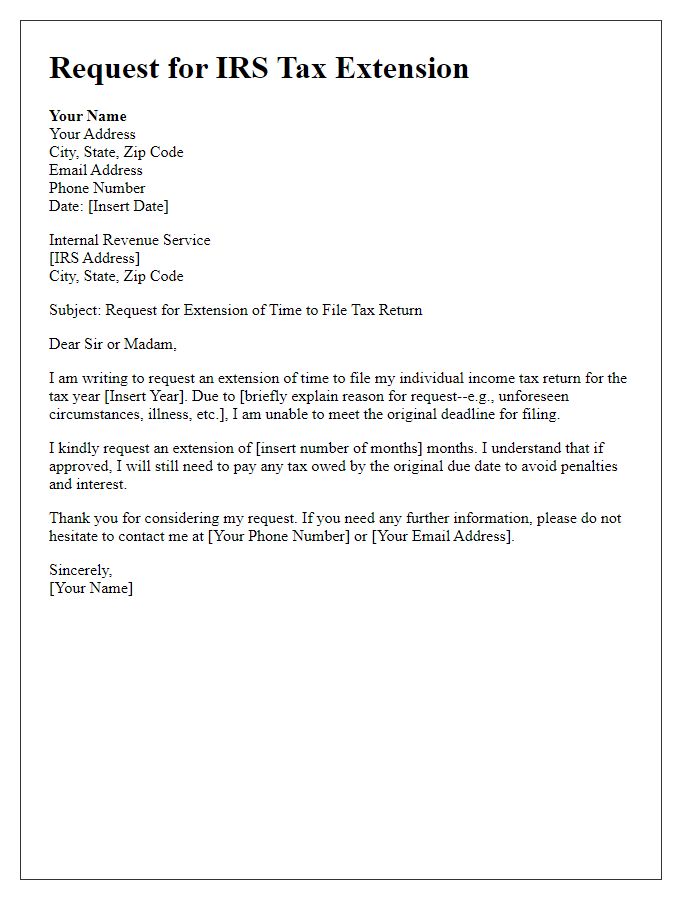

Tax extension requests are common among individuals and businesses facing unexpected financial complications. Submitting a request for an extension must be done before the April 15 deadline to avoid penalties from the Internal Revenue Service (IRS). Taxpayers must include essential personal information such as full name, residential address (including city, state, and ZIP code), and contact details (phone number and email address) to ensure the IRS can respond accurately. Form 4868 is typically utilized for this purpose, providing an automatic six-month extension to file federal tax returns for individuals who qualify, allowing additional time to correctly report income, deductions, and credits. The IRS encourages taxpayers to estimate their tax liability and pay owed taxes to avoid interest accumulation.

Subject Line (Clear and Direct Purpose)

Taxpayers often seek an extension for filing federal income tax returns, specifically IRS Form 1040, due on April 15 each year. An extension allows for an additional six months, shifting the deadline to October 15. Reasons for requesting an extension vary widely, including personal emergencies, complex financial situations, or the need for additional documentation. To formally request this extension, taxpayers submit IRS Form 4868, which can be completed online or via mail, ensuring it is postmarked by the original deadline. Additionally, any estimated tax owed must be paid by April 15 to avoid penalties and interest, making the timely handling of the request crucial.

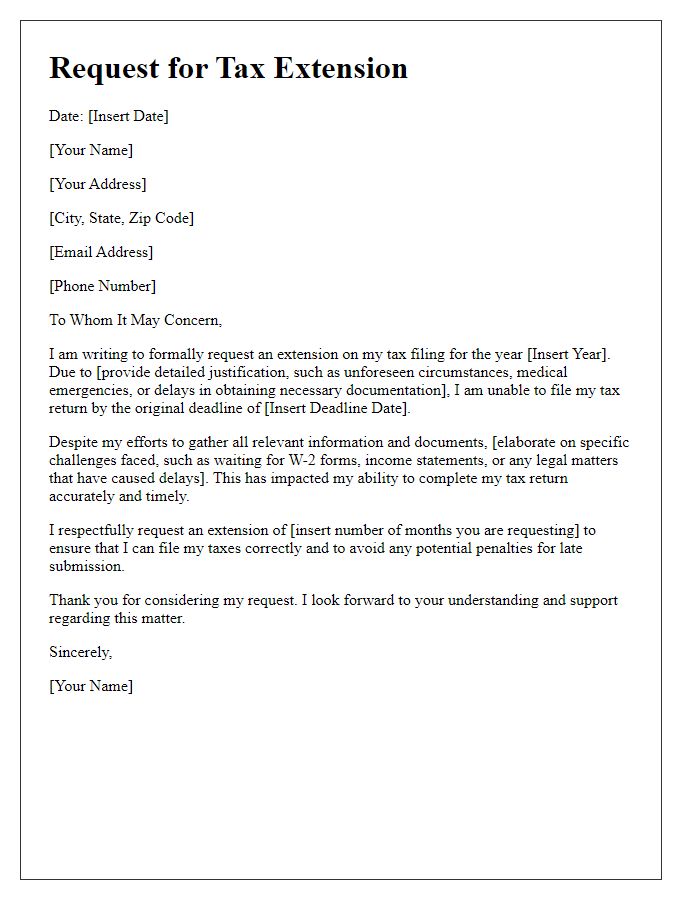

Reason for Extension Request (Concise Explanation)

Tax extension requests often arise from various circumstances, including unforeseen personal situations or professional obligations that hinder timely preparation. For instance, an unexpected medical emergency can lead to a delay in gathering necessary financial documents. Another common reason is an increase in filing complexity, which may involve multiple income sources or changes in financial status, such as a recent home purchase in 2023. Additionally, individuals launching new businesses or making significant investments might require more time to ensure accurate reporting of income and expenses. Ultimately, these factors can necessitate an extension to meet tax obligations efficiently while minimizing errors and potential penalties.

Specific Extension Date Requested

Taxpayers may request a filing extension with the Internal Revenue Service (IRS) if they need more time to complete their tax return, typically until October 15. Extensions can alleviate stress associated with preparing documents. Specific extension dates, such as April 15 or the first business day after the deadline, should be noted. Filing Form 4868 allows for a six-month extension; however, it does not extend payment deadlines, which remain set for April 15. Taxpayers in various states, including California and New York, may have additional provisions or varying deadlines for state tax extensions. Failure to request an extension may result in penalties, so understanding applicable regulations is vital.

Formal Closing and Signature (Professional Tone)

Requests for tax extension deadlines often require a formal tone and specific details to ensure clarity and professionalism. The closing should reflect respect and anticipation for a positive response. Typical examples include phrases like "Sincerely" or "Respectfully," followed by the sender's full name and title, if applicable. Ensure to include relevant identification numbers or account information associated with the tax request.

Comments