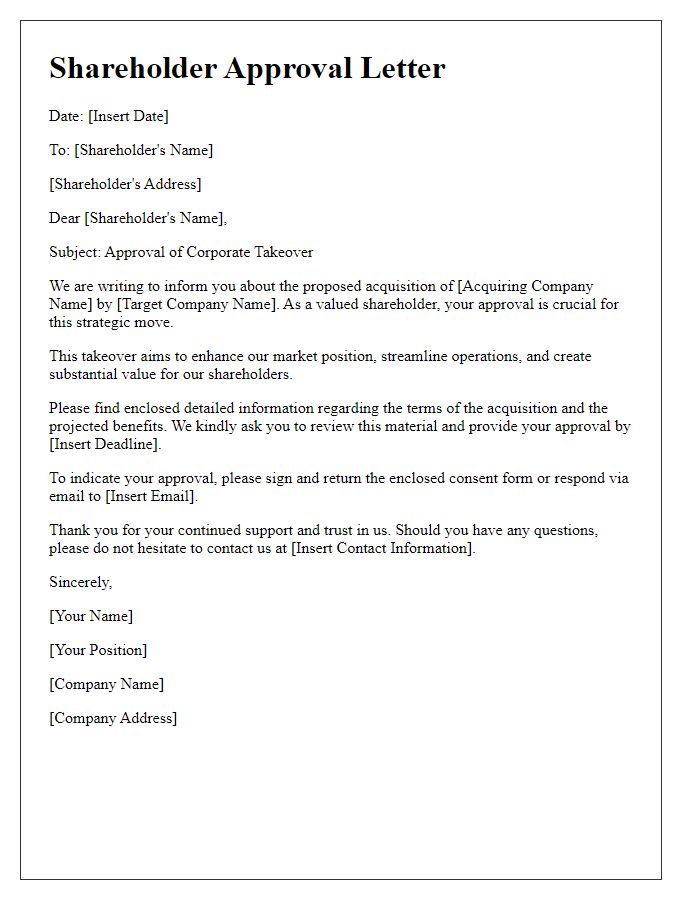

Are you navigating the complex waters of a takeover offer and seeking the perfect way to communicate your acceptance as a shareholder? Crafting a clear and professional letter is essential to convey your decision and assure all parties involved. In this article, we'll guide you through creating a compelling letter template that not only highlights your acceptance but also fosters a positive relationship with the acquiring entity. So, let's dive in and explore how to effectively express your acceptance in a way that meets both your needs and those of your fellow shareholders!

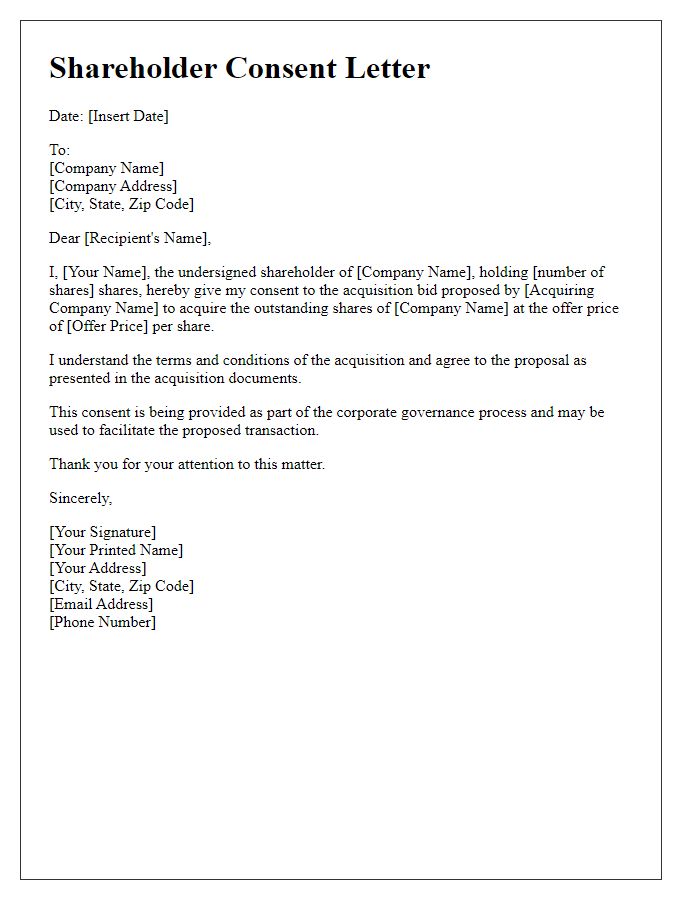

Shareholder's Name and Contact Information

Shareholders play a vital role in corporate governance, especially during significant events like takeover offers. A shareholder's acceptance of a takeover bid, usually initiated by a larger company seeking to acquire control, is critical for the successful completion of the transaction. The takeover process often involves complex negotiations and due diligence, with shareholders needing to assess offers based on premiums offered over the current market value of shares. In a typical scenario, shareholders receive detailed information about the terms of the offer, including the offer price per share, the timeline for acceptance, and any conditions that must be met, such as regulatory approvals. Understanding the implications of acceptance is essential, as it can impact ownership stakes and potential financial outcomes for shareholders in the future.

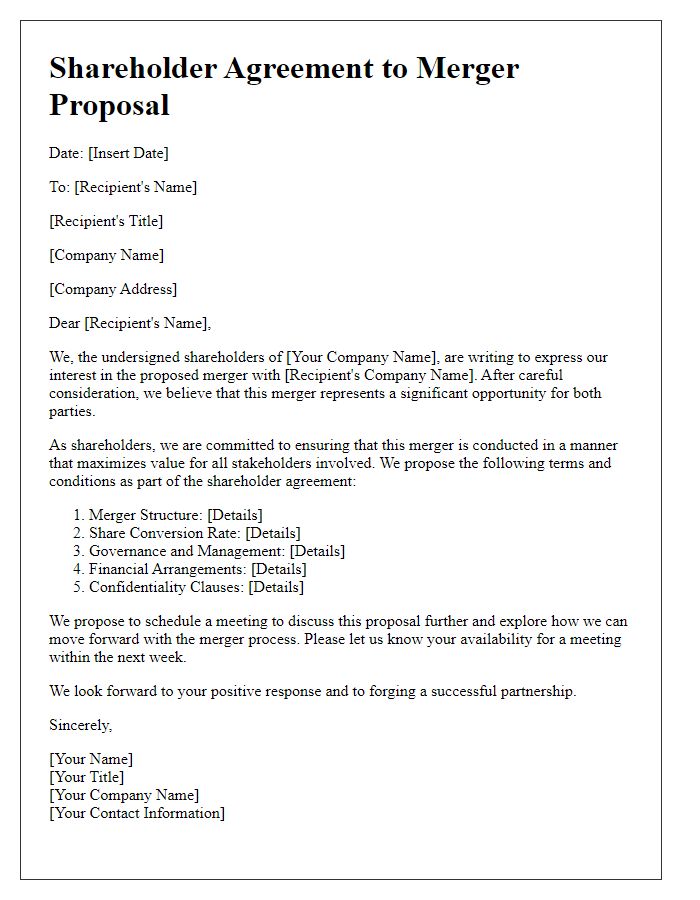

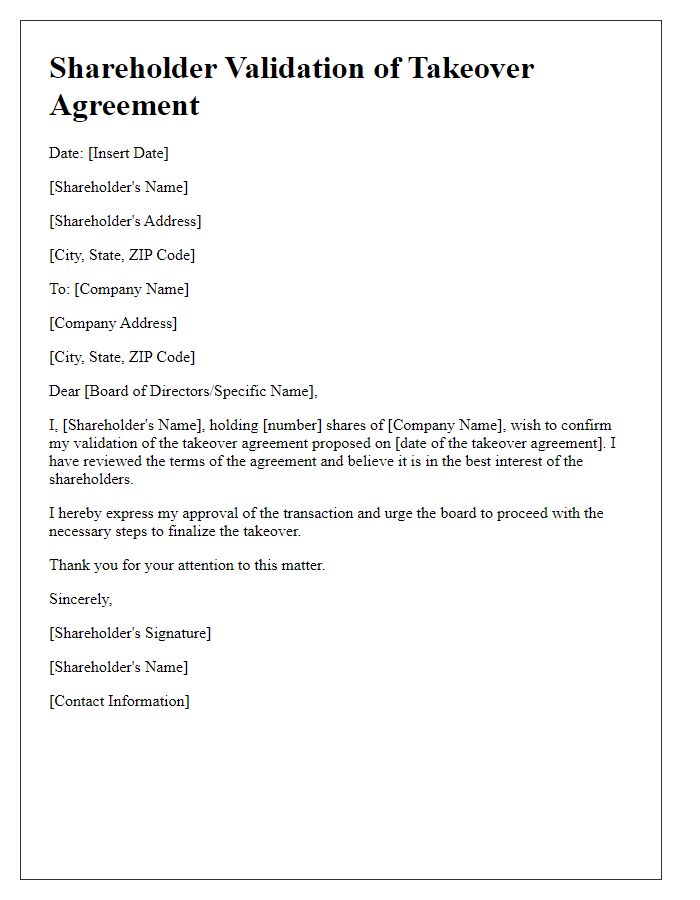

Addressing the Offeror and Reference Details

A shareholder acceptance of a takeover offer serves as a formal notification to the offeror, detailing the acceptance of the proposed acquisition terms. The document includes the names of the parties involved: the offeror (the acquiring company) and the offeree (the company being acquired). Relevant references such as the offer document date (usually marked as "Date of Offer") and any identification number associated with the takeover bid are crucial for accurate processing. The acceptance specifies the number of shares held by the shareholder (for instance, "500 shares of XYZ Corp") and may express satisfaction with the offer price, highlighting the financial aspects of the deal. Additionally, it addresses required formalities, such as submission deadlines, further documentation needed (like proof of share ownership), and coordinates for communication, ensuring a smooth transaction process in accordance with regulatory requirements.

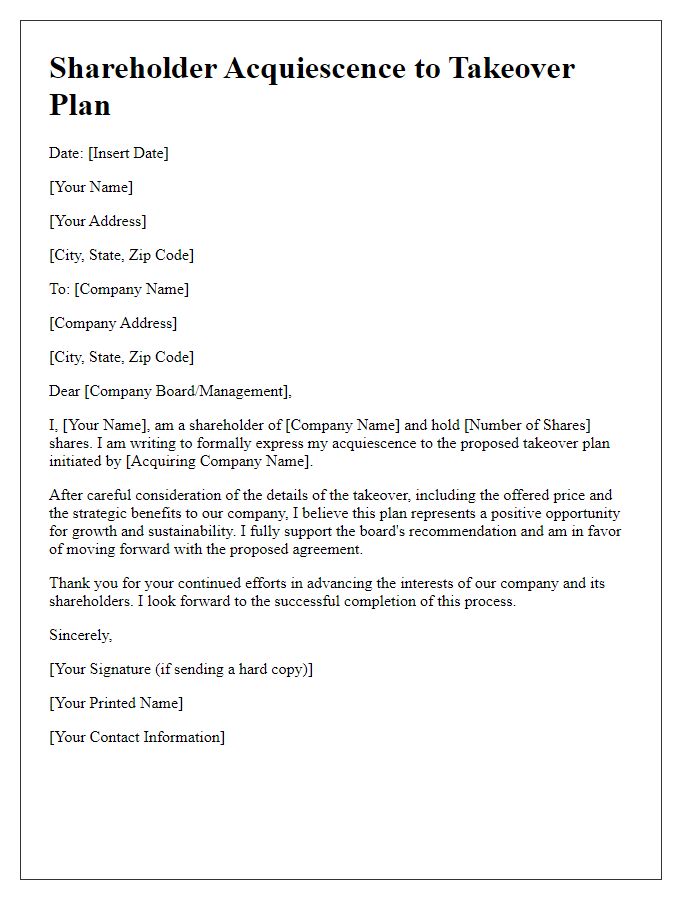

Statement of Acceptance and Offer Details

In a proposed takeover offer, a shareholder's acceptance plays a crucial role in the process, particularly in corporate mergers. Shareholders of the target company, such as ABC Corporation, must review the offer details presented by the acquiring company, XYZ Holdings. The offer usually includes the exchange ratio, typically expressed in shares or a cash amount, and any premium offered over the current trading value of ABC shares. As of the offer date, ABC's shares are priced at $50, while XYZ has proposed a price of $60 per share, representing a 20% premium. Shareholders should also consider the total number of shares outstanding, approximately 10 million, to gauge the total valuation of the deal. Additionally, critical deadlines for acceptance, often set within a few weeks of the offer announcement, are imperative, as missing these can lead to forfeiting the opportunity. A thorough assessment of any regulatory approvals required from government entities is also essential to ensure compliance and avoid potential pitfalls during the acquisition process.

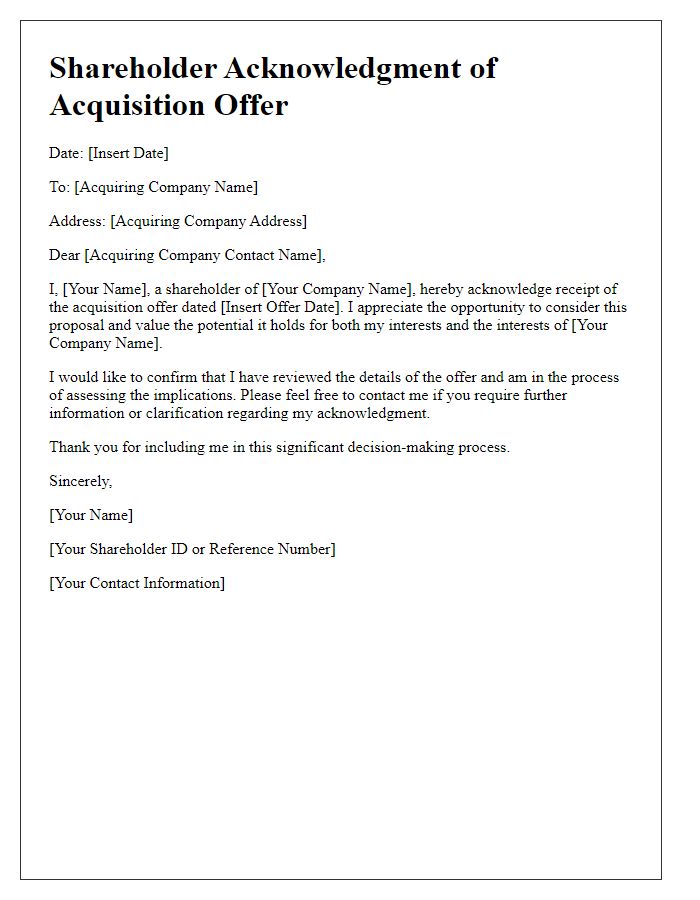

Acknowledgment of Terms and Conditions

Shareholders must carefully evaluate the terms and conditions of takeover offers, as these details significantly impact investment outcomes. Specific offers may include cash payments, stock swaps, or hybrid arrangements that require careful consideration of market values and future forecasts. Regulatory bodies such as the Securities and Exchange Commission (SEC) often oversee these transactions to ensure compliance with legal mandates. Shareholders are advised to review financial statements, independent assessments, and potential synergies that the merger might create. Additionally, understanding the implications for dividends, corporate governance, and operational changes post-takeover is crucial to making informed decisions.

Signature and Date of Acceptance

Shareholders play a crucial role in the business landscape, particularly during significant corporate events like a takeover offer. A shareholder's acceptance of a takeover bid typically requires a formal notification process. Important components include the signature of the shareholder, which serves as a legal acknowledgment of the terms laid forth in the offer document, and the date of acceptance, which signifies the official timeline for the acceptance. These elements hold paramount importance, as they not only initiate the transfer of shares but also influence the regulatory compliance and future obligations toward the acquiring entity. The document must ensure clarity in terms, such as share price, method of payment, and stipulated timelines, ensuring that the shareholder's rights are preserved within the legal framework governing mergers and acquisitions.

Comments