In today's fast-paced business landscape, clear communication between shareholders and corporate leaders is more crucial than ever. Engaging with the strategic direction of a company is not just a formality; it's an opportunity for shareholders to voice their insights and concerns. By addressing corporate strategy effectively, we can forge stronger relationships and ensure the long-term success of our investments. If you're eager to learn how to articulate your thoughts in a shareholder letter effectively, keep reading!

Professional tone and language

In the realm of corporate governance, shareholders often express concerns regarding strategic direction. A systematic approach to addressing shareholder queries is paramount. Engaging shareholders in discussions about corporate strategy fosters transparency and confidence in company leadership. Detailed financial reports, market analysis, and strategic projections can serve as valuable resources for shareholders to understand the rationale behind corporate decisions. Taking feedback from shareholders into account, particularly during annual meetings or after quarterly earnings calls, can influence future strategic initiatives. Clear communication of objectives, such as expanding market share or enhancing shareholder value, is essential. Historical performance metrics, like revenue growth rates or return on equity, can provide context for proposed strategies, aiding shareholders in grasping the company's trajectory. By valuing stakeholder insights, corporations can align their strategies with investor expectations, ultimately promoting long-term success.

Acknowledgment of corporate strategy

Shareholders recognize the corporate strategy outlined during the annual general meeting held on April 15, 2023, which emphasizes sustainable growth and technological innovation. The focus on expanding market share in emerging economies, particularly in Southeast Asia and Africa, presents significant opportunities for capitalizing on untapped consumer bases. Commitment to environmental, social, and governance (ESG) initiatives aims to improve brand reputation and stakeholder trust, aligning with modern investment trends prioritizing ethical considerations. Additionally, the projected increase in research and development (R&D) budget by 20% signals a proactive approach to enhancing product offerings and maintaining competitive advantage in the industry.

Shareholder concerns and suggestions

Shareholders often express concerns regarding corporate strategy, particularly about growth opportunities and sustainability initiatives. Engaging with stakeholders through transparent communication fosters trust in companies like Tesla, which aims for a leading position in electric vehicle (EV) innovation. Addressing issues related to inflation (which can affect product pricing) and competition from traditional auto manufacturers enhances strategic planning. Suggestions may include increased investor outreach programs or promotional campaigns to clarify long-term vision, while also emphasizing commitment to renewable energy sources, such as solar and wind, which align with the company's mission for a sustainable future.

Alignment with business goals and vision

Corporate strategies should articulate a clear roadmap for achieving long-term objectives while aligning with the overarching vision of the organization. Detailed market analysis, financial forecasts, and competitive positioning are essential components that support this alignment. Stakeholder engagement, particularly from shareholders, is crucial to ensure that the strategy reflects shared values and expectations. For instance, incorporating sustainability initiatives not only enhances corporate reputation but also responds to increasing consumer demand for environmentally responsible practices. Consequently, transparent communication regarding milestones and metrics fosters trust and confidence among shareholders, empowering them to support the strategic direction effectively.

Request for further discussion or clarification

Shareholder inquiries regarding corporate strategy often reflect concerns about fiscal performance and future growth. Detailed analysis can reveal significant influences, such as emerging market trends and competitive factors affecting the industry. A request for further discussion may arise after reviewing strategic initiatives like digital transformation plans or sustainability efforts that target carbon neutrality by 2030. Clarity on financial projections, specifically revenue growth targets or expected returns on investment for new projects, can greatly enhance understanding of corporate objectives. Addressing potential risks, such as regulatory changes or supply chain disruptions, is essential for informed investor engagement. Stakeholders typically seek a comprehensive examination of how the company's vision aligns with shareholder interests and long-term profitability.

Letter Template For Shareholder Reply To Corporate Strategy Samples

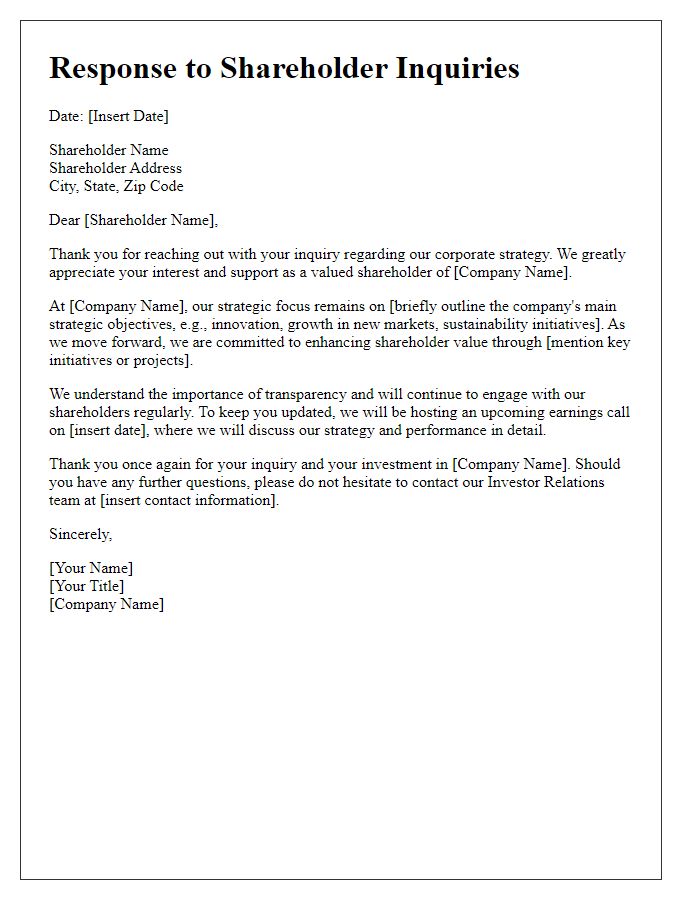

Letter template of response to shareholder inquiries on corporate strategy.

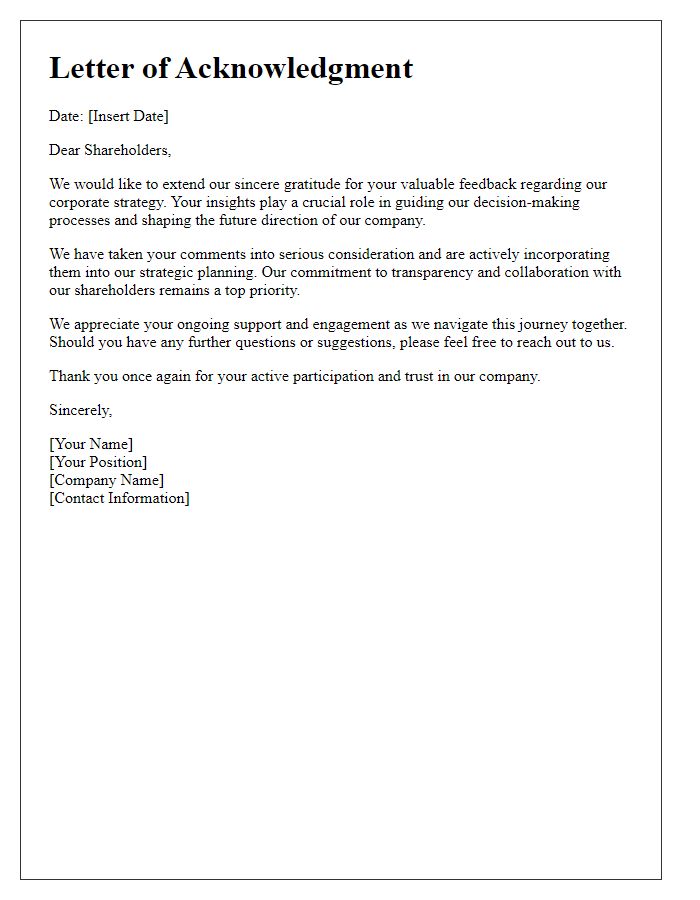

Letter template of acknowledgment to shareholders regarding corporate strategy feedback.

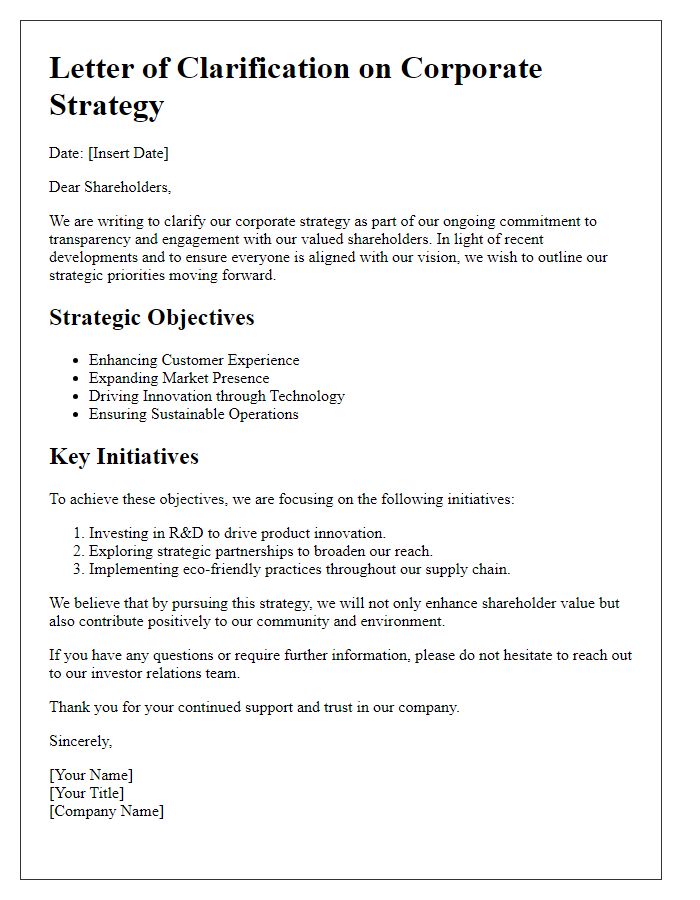

Letter template of clarification on corporate strategy for shareholders.

Letter template of appreciation to shareholders for their thoughts on corporate strategy.

Letter template of detailed shareholder update on corporate strategic initiatives.

Letter template of addressing shareholder concerns about corporate strategy.

Letter template of invitation for further discussion on corporate strategy with shareholders.

Letter template of summary of amendments to corporate strategy based on shareholder input.

Letter template of outlining future corporate strategy directions to shareholders.

Comments