Are you ready to take a big step towards homeownership? Confirming your mortgage funding is an exciting milestone that opens the door to your dream home. In this article, we'll guide you through the essential elements of a letter template that confirms your mortgage funding, ensuring you have everything you need for a smooth transaction. So, let's dive in and explore this process together!

Loan Details

Confirming mortgage funding details involves critical components, such as loan amount, interest rate, and repayment terms. The loan amount specifies the total funds borrowed, crucial for home buyers in markets like San Francisco, where median home prices exceed $1 million. Interest rate typically ranges from 3% to 5% in 2023, impacting monthly payments significantly. Repayment terms, often 30-year fixed or 15-year fixed, dictate the duration over which borrowers repay the mortgage. Lenders also detail any additional costs, such as closing costs, ranging from 2% to 5% of the loan amount, important for budgeting. Understanding these components is essential for borrowers navigating the complexities of home financing, particularly in competitive regions.

Borrower Information

Borrower information is crucial in the mortgage funding process, encompassing key details such as the full legal name, Social Security Number (SSN), and current address of the applicant. Additionally, it requires specifics on employment status, including the employer's name, position held, and annual income, typically verified through pay stubs or tax documents. Other pertinent data involves credit score evaluations, which often use credit reporting agencies like Experian, Equifax, and TransUnion, frequently referenced during loan underwriting. Moreover, documentation related to assets--bank statements, retirement accounts, or property titles--is also essential for assessing the borrower's financial stability. Accurate borrower information influences loan approval decisions and ultimately the funding process for mortgages.

Property Description

The confirmed mortgage funding pertains to a residential property located at 123 Maple Street in Springfield, a highly sought-after neighborhood. This single-family home spans approximately 2,000 square feet, featuring four bedrooms and three bathrooms, ideal for families seeking space and comfort. Built in 2015, the property showcases modern amenities, including an energy-efficient HVAC system and stainless steel appliances. Situated on a quarter-acre lot, the landscaped yard includes a deck, offering an inviting outdoor area for gatherings. The property is valued at $350,000, reflecting current market trends that indicate a 5% increase in home values in the Springfield area over the past year.

Funding Amount

Mortgage funding confirmation typically involves the precise verification of the amount being released for a property purchase. The confirmed funding amount may involve substantial figures, such as $250,000, to cover the cost of a residential property located at 123 Elm Street in Springfield. This transaction often requires meticulous documentation from financial institutions such as banks or credit unions, ensuring compliance with regulatory standards set by agencies like the Consumer Financial Protection Bureau (CFPB). The confirmation process usually includes details about the loan term, interest rates, and monthly payment calculations, emphasizing the importance of transparency for both the lender and the borrower in the mortgage funding agreement.

Terms and Conditions

The mortgage funding confirmation provides essential details regarding the financial agreement between the borrower and the lender. Key components include the interest rate (fixed or variable), typically ranging from 3% to 7% depending on the market conditions and creditworthiness, the loan amount, often between $100,000 to $1 million, and the loan term, which usually lasts 15 to 30 years. Additional terms encompass the down payment requirement, commonly set at 20% of the property value, and monthly payment schedules, which itemize principal and interest payments. The confirmation also outlines potential fees, including origination fees (generally around 1% of the loan amount) and closing costs, which can total 3% to 5% of the property price. Understanding these terms is crucial for borrowers to ensure compliance and avoid potential penalties or defaults.

Letter Template For Mortgage Funding Confirmation Samples

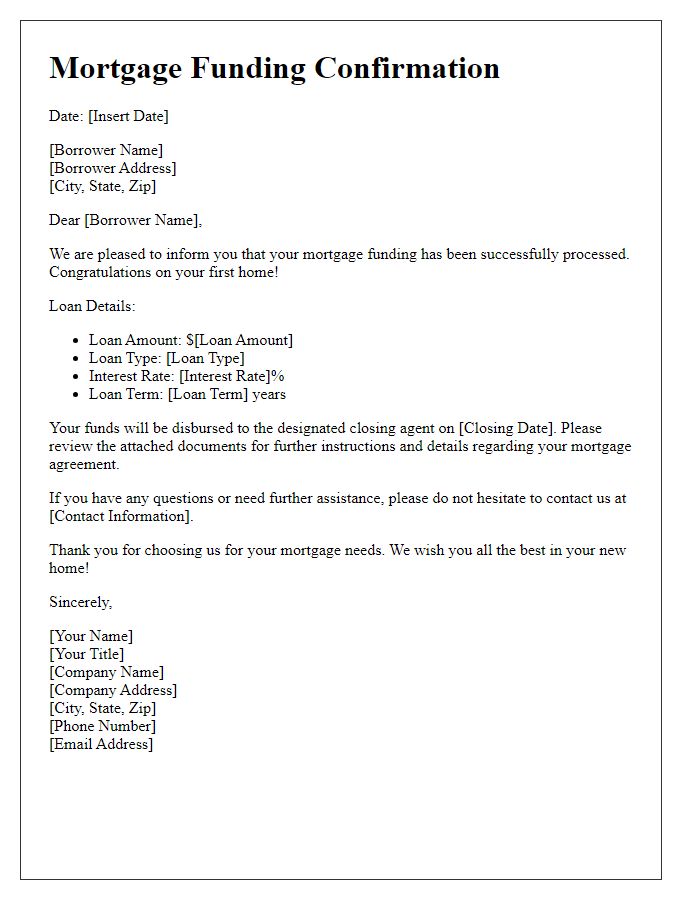

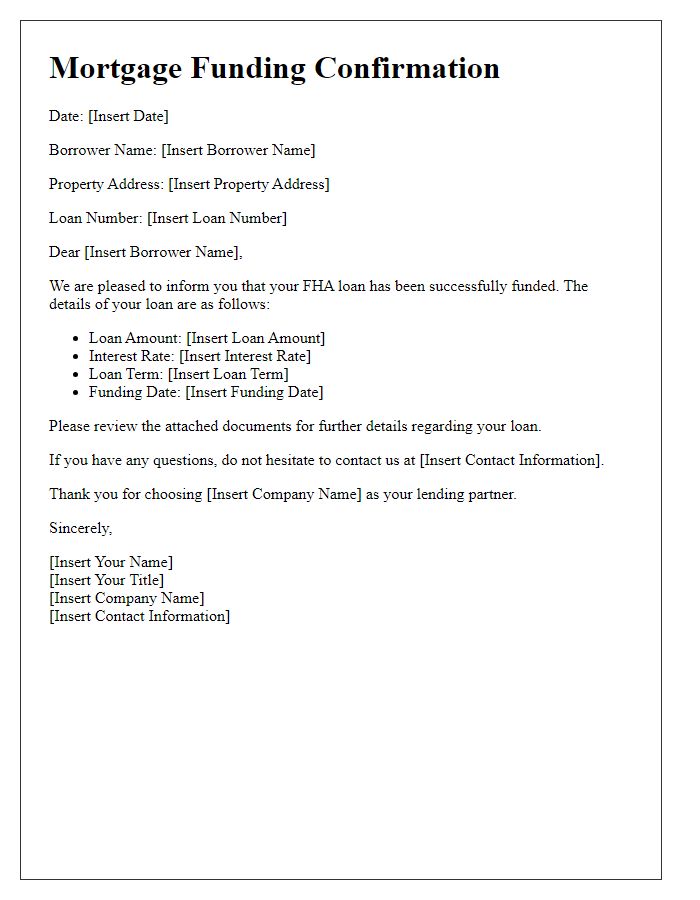

Letter template of mortgage funding confirmation for first-time homebuyers.

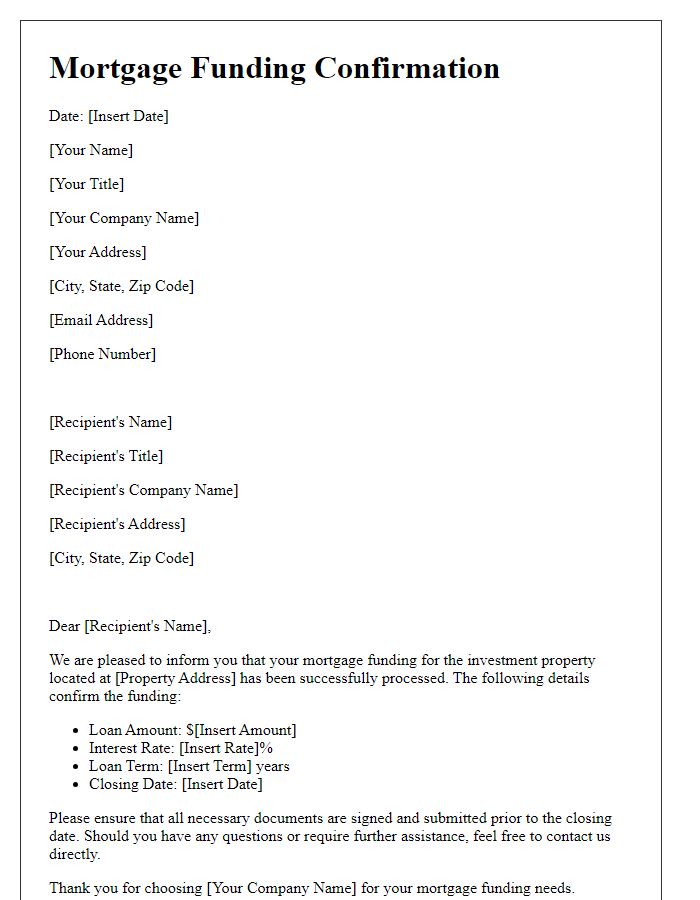

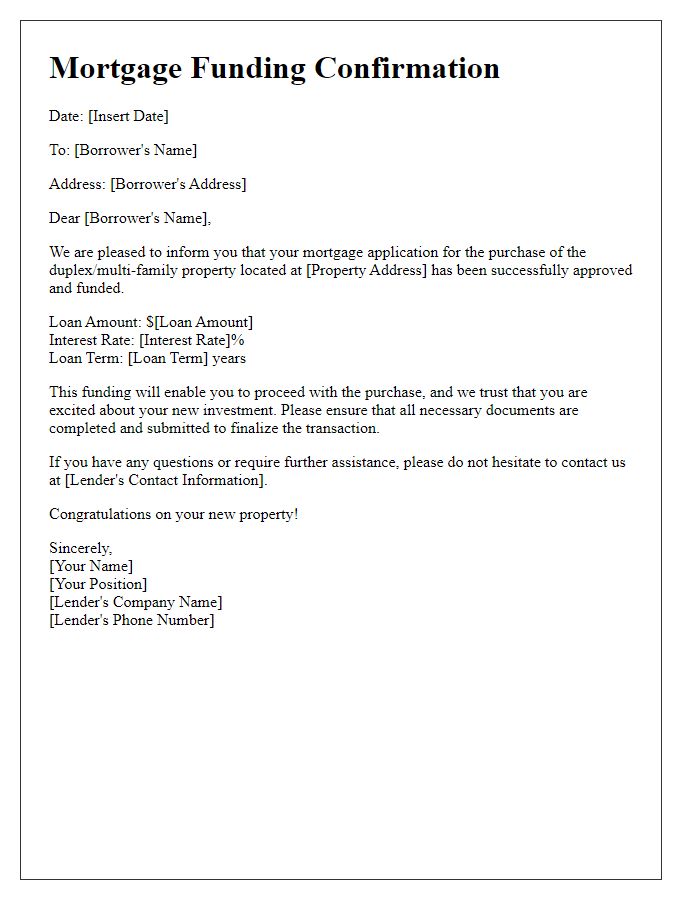

Letter template of mortgage funding confirmation for investment property purchases.

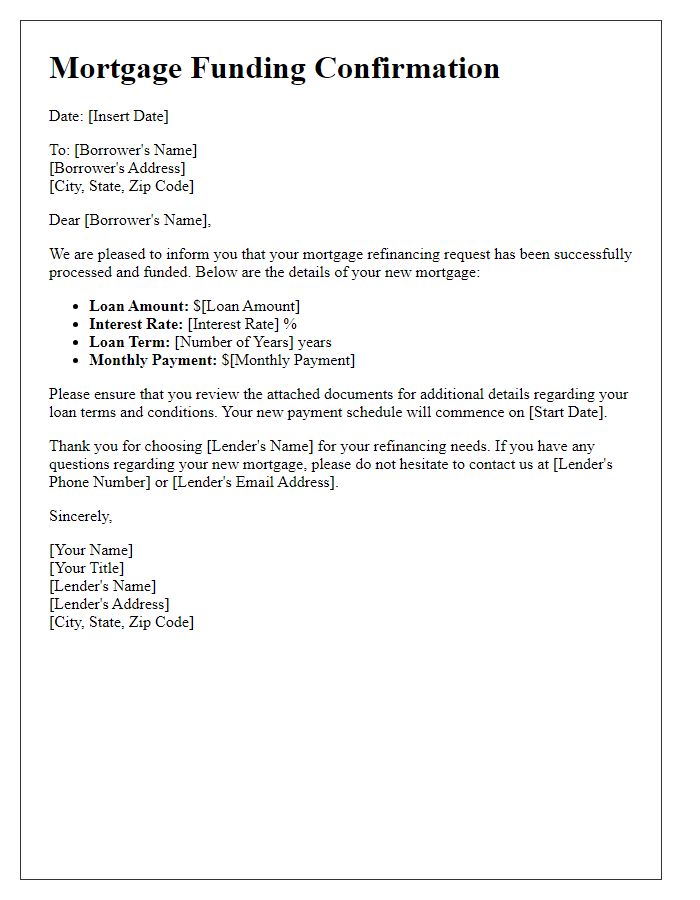

Letter template of mortgage funding confirmation for refinancing existing mortgages.

Letter template of mortgage funding confirmation for construction loans.

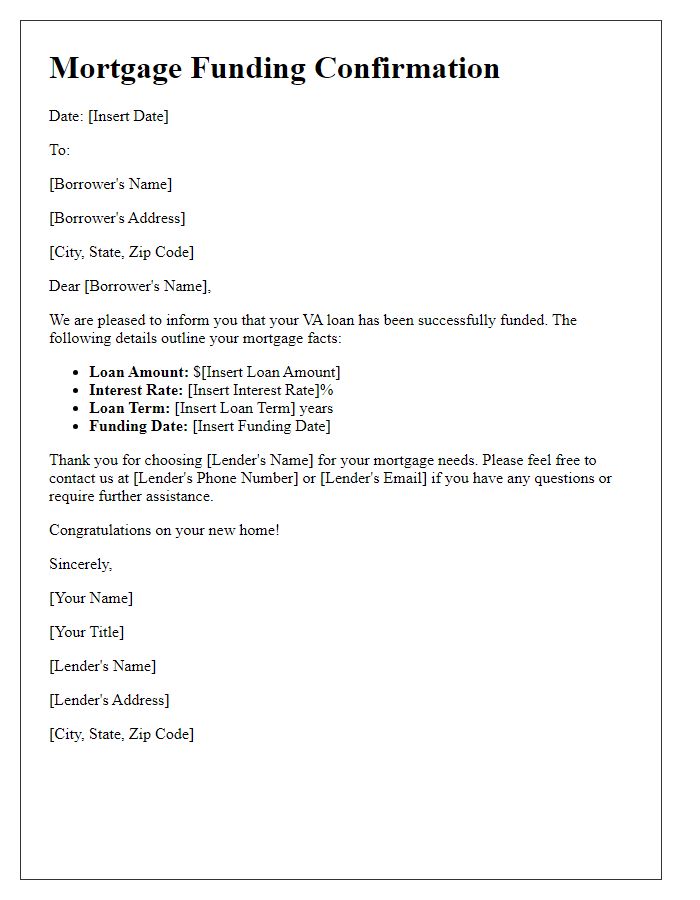

Letter template of mortgage funding confirmation for vacation home financing.

Letter template of mortgage funding confirmation for commercial property financing.

Comments