Are you considering refinancing your mortgage or paying it off early but worried about prepayment penalties? Many homeowners find themselves in a bind when it comes to unexpected fees that can diminish their savings. Fortunately, it's possible to request a waiver for these penalties, opening the door to financial flexibility. In this article, we'll guide you through the process of writing a mortgage prepayment penalty waiver letter so you can move forward confidently'read on to discover the steps you need to take!

Borrower's personal information

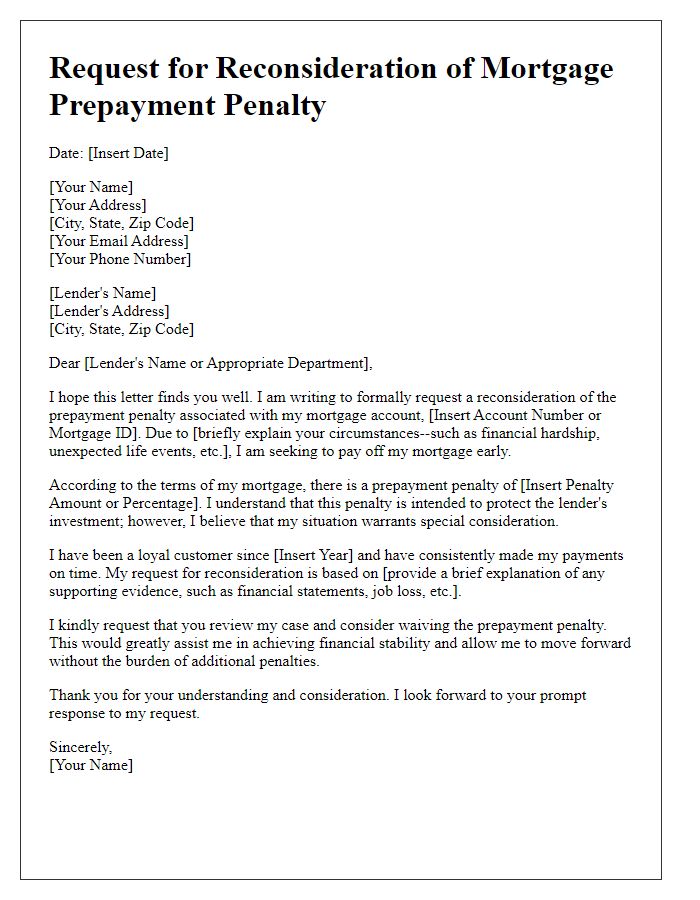

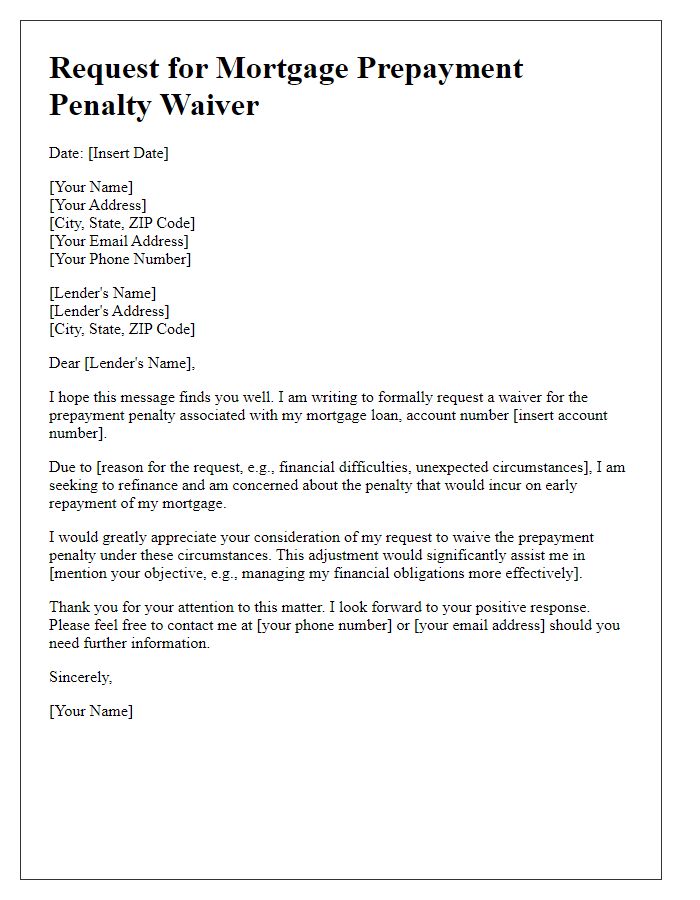

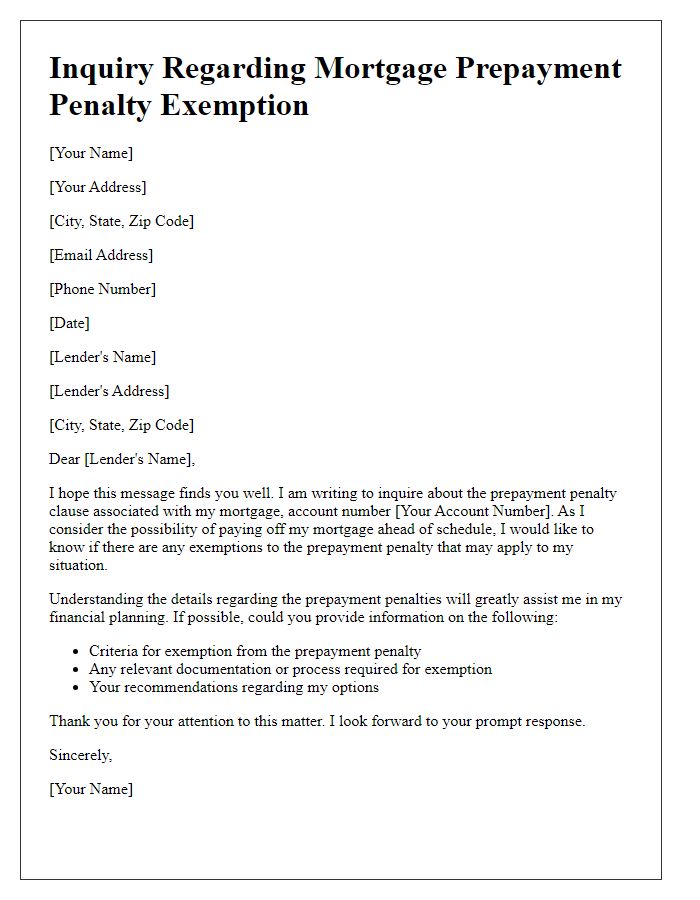

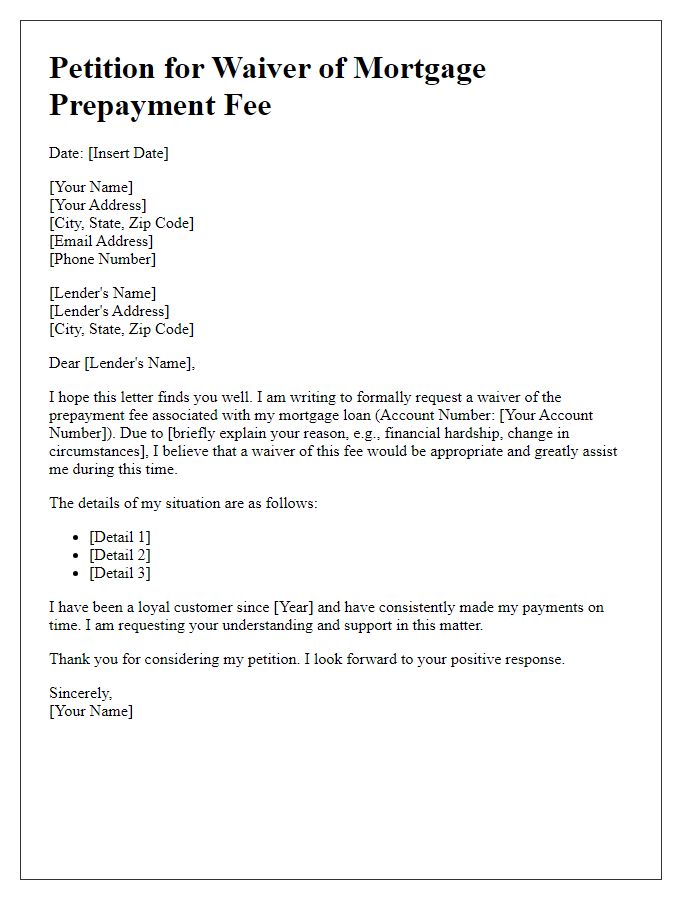

A mortgage prepayment penalty waiver can significantly ease the financial burden associated with early loan repayment. Homeowners considering this possibility must provide essential personal information, such as full name, current address including city and ZIP code, loan number associated with the mortgage, and contact details. Alongside these details, it is critical to include the lender's name and address, as well as the specific loan type. This information allows lenders to process the request effectively. Additionally, borrowers may benefit from attaching pertinent documents, such as a copy of the original mortgage agreement highlighting the prepayment penalty clause, and any correspondence related to previous discussions about the waiver.

Loan account details

Mortgage prepayment penalties can impact homeowners seeking to pay off loans early, potentially resulting in substantial fees. A typical mortgage agreement may specify penalties ranging from 1% to 3% of the remaining balance. Homeowners in various regions, such as California or New York, often encounter different regulations concerning prepayment penalties, influenced by state laws. Seeking a waiver for these fees involves providing detailed loan account information, including the loan number, lender's name, and outstanding balance. This waiver request should clearly outline the homeowner's intent to fully satisfy the loan, which may include reasons, such as refinancing or selling the property, thereby emphasizing the financial institution's potential to maintain customer satisfaction and foster goodwill.

Request for prepayment penalty waiver

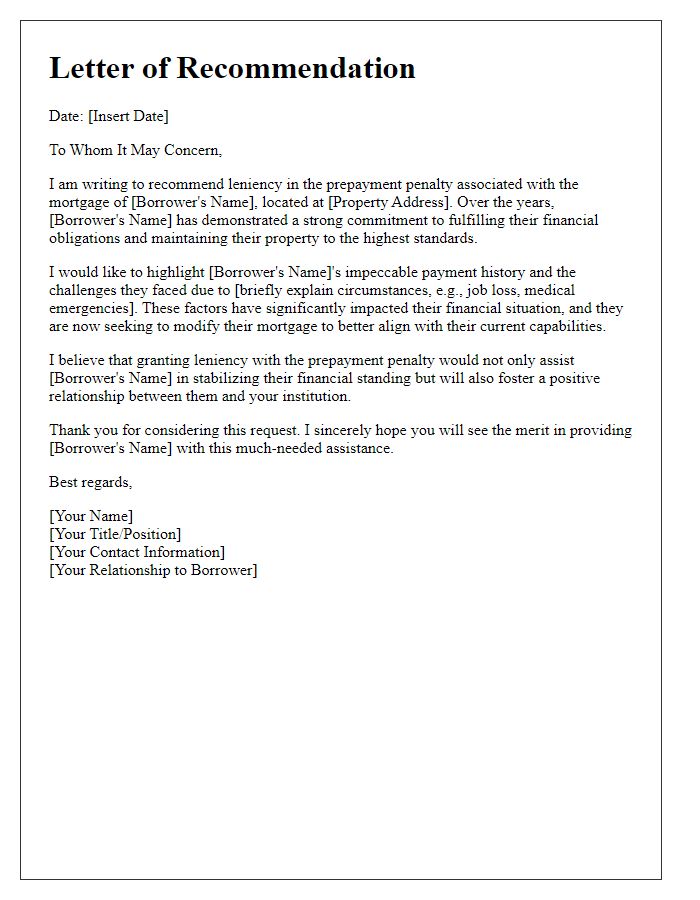

Mortgage prepayment penalties can significantly impact homeowners considering early repayment of loans, often leading to unexpected financial burdens. Many mortgage agreements, especially fixed-rate loans, include clauses that impose fees when borrowers pay off their loans earlier than the agreed term, typically within the first 3 to 5 years. In some cases, penalties can be as high as 2% of the remaining balance, depending on the lender's policies and local regulations. Waivers of these penalties, generally granted on a case-by-case basis, may be influenced by circumstances such as financial hardship or refinancing opportunities that could save the homeowner money over time. Homeowners should communicate their requests clearly to lenders, providing supporting documentation for consideration, and express their intention to maintain a positive relationship moving forward while seeking favorable terms that enable greater financial flexibility.

Justification or reason for waiver request

Mortgage prepayment penalties can pose significant financial burdens for homeowners, particularly when unexpected circumstances arise. Homeowners seeking a prepayment penalty waiver may find themselves in unique situations such as job loss, moving for job opportunities to cities like San Francisco or New York, or significant life events such as divorce or medical emergencies that necessitate selling their property. Economic fluctuations can further warrant prepayment, with rising interest rates making it advantageous to refinance loans to secure better terms. Moreover, adherence to a lender's policy regarding loan modifications, especially for those in financial hardship, can serve as justification for requesting a waiver. By analyzing these compelling factors, it can be established that forgiving the prepayment penalty aligns with both the homeowner's situation and the lender's long-term relationship with their clients.

Contact information for follow-up

Mortgage prepayment penalties can significantly impact homeowners seeking to pay off their loans early. Many lenders impose these fees, often as a percentage (typically 2-4%) of the remaining loan balance, to recover potential lost interest. Homeowners considering a waiver should gather contact information for negotiations, including the loan servicer's customer service number, email addresses of relevant departments, and physical addresses for formal correspondence. Documenting all communications is essential to ensure clarity and accountability in the discussion surrounding the waiver request. Timely follow-up can enhance the chances of obtaining a favorable response from the lender.

Letter Template For Mortgage Prepayment Penalty Waiver Samples

Letter template of explanation for mortgage prepayment penalty reconsideration

Comments