Are you navigating the complexities of shared mortgage responsibility and seeking a way to communicate your thoughts effectively? Writing a letter to discuss this financial arrangement can feel daunting, but it's an important step to ensure everyone is on the same page. In our article, we'll break down how to draft a clear and respectful letter that conveys your intentions and outlines expectations. Join us as we explore the key elements of this process, and discover the perfect template for your situation!

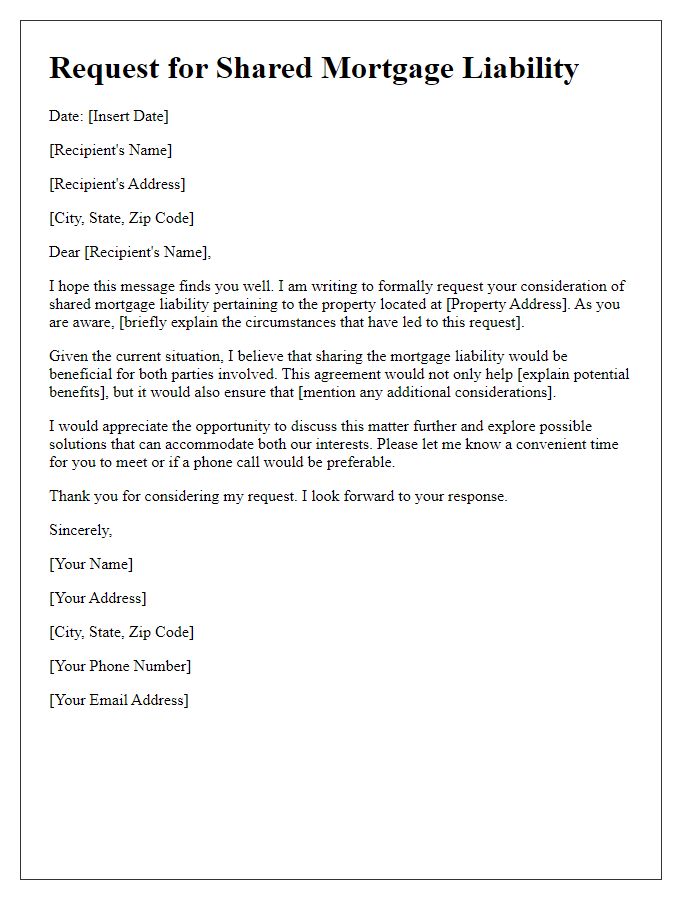

Parties and Property Details

A shared mortgage responsibility request involves parties such as co-borrowers or joint owners, typically relating to residential properties like single-family homes, condominiums, or townhouses. Each party's financial obligations, including credit scores, income levels, and liability percentages play crucial roles in the mortgage agreement. Specific real estate details, including the property's address, assessed value, mortgage amount, and lender information, are necessary to outline the intent clearly. Clarity regarding shared responsibilities in monthly mortgage payments, property taxes, insurance costs, and maintenance expenses also needs emphasis to ensure mutual agreement. Additionally, outlining consequences of default or property sale provides an essential framework for understanding shared financial commitments.

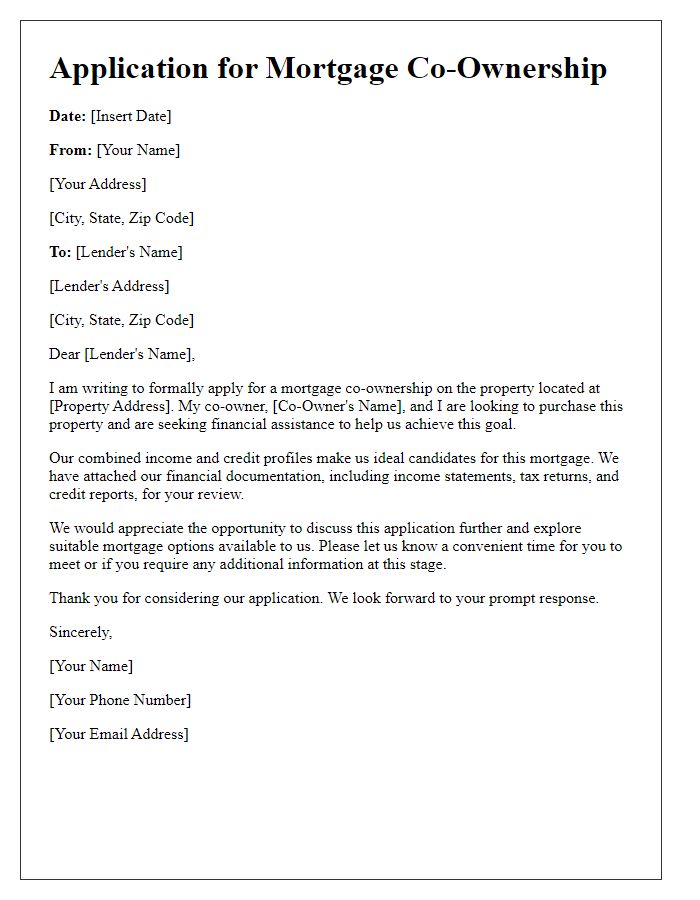

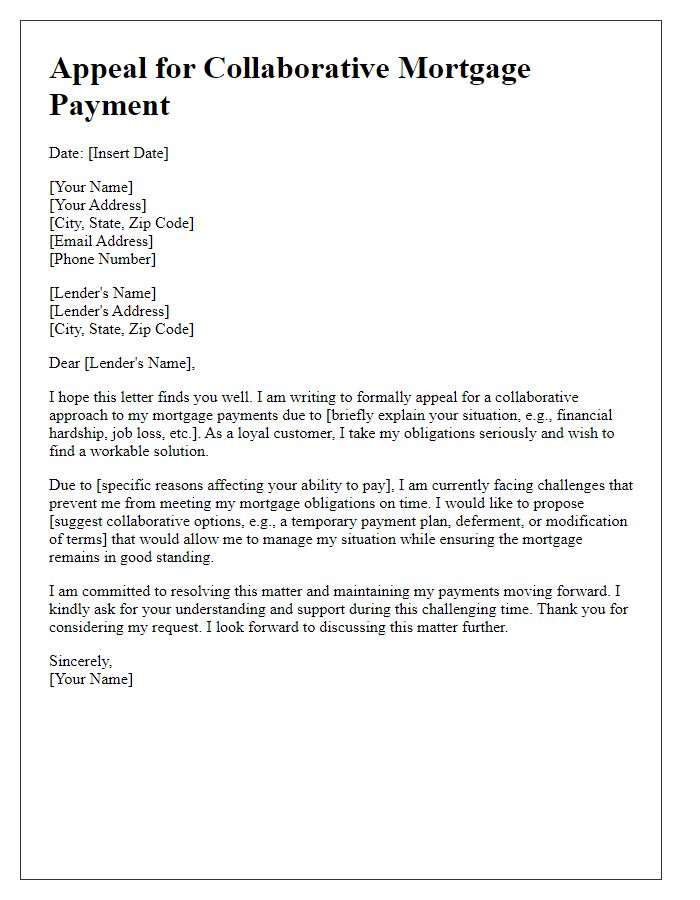

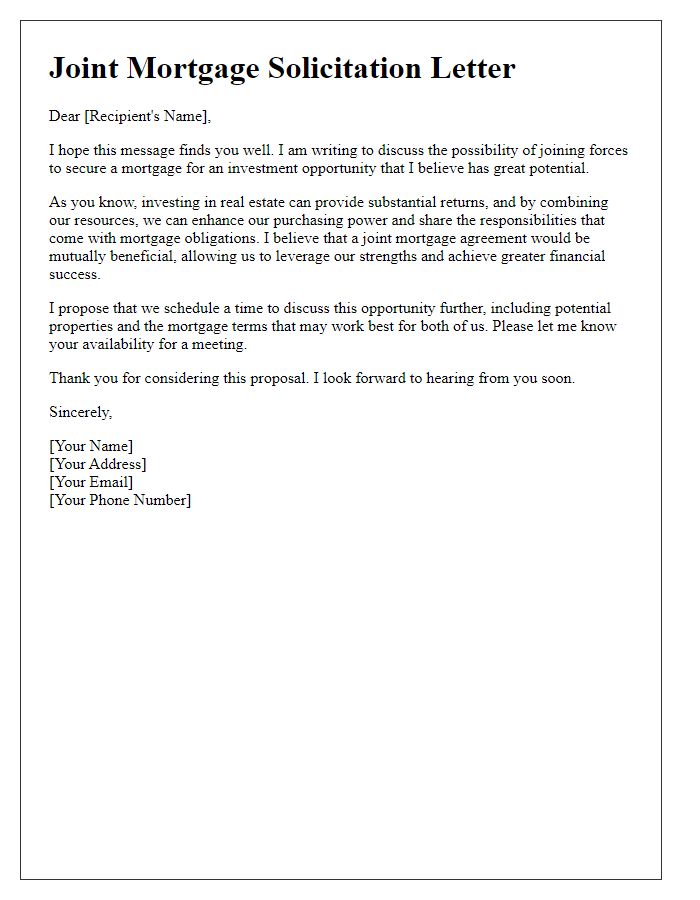

Purpose and Justification

In a shared mortgage responsibility arrangement, co-borrowers collaborate on mortgage payments for properties, typically offering more financial flexibility. This agreement can enhance creditworthiness, allowing individuals with varying credit scores to secure better loan terms from financial institutions. Properties involved could encompass residential homes in urban areas, such as San Francisco, where market demands drive up prices significantly. Individuals may justify shared responsibility by emphasizing the advantages of pooling resources, which enables each party to finance a higher-value property or manage monthly expenses effectively. Other aspects may include the need for shared investment in property maintenance, which ensures long-term value preservation and mitigates potential financial strain that may arise from sole ownership.

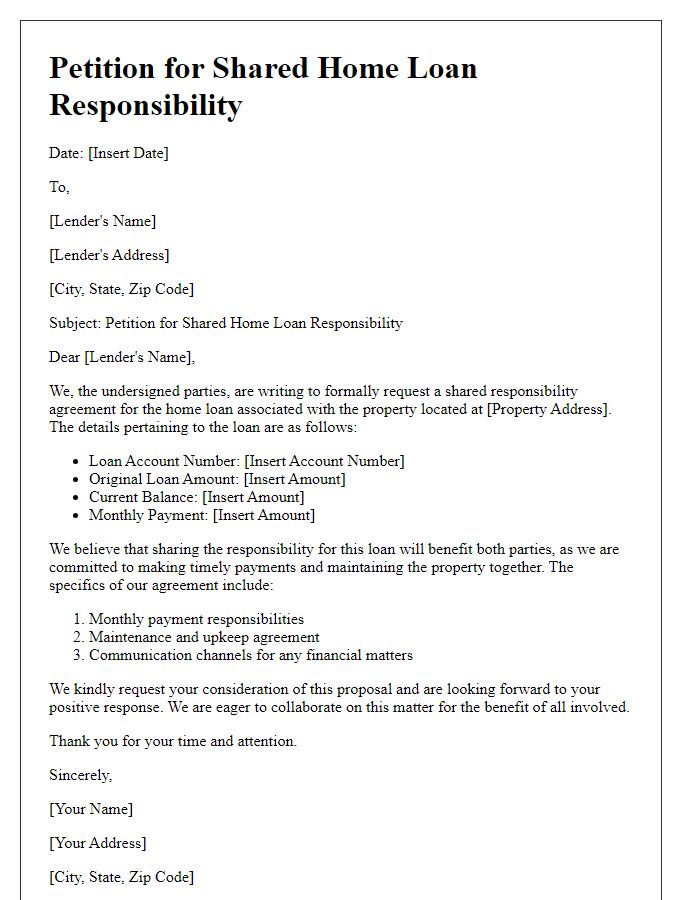

Financial Information and Contribution

Homeownership often involves shared financial responsibilities, particularly concerning a mortgage. In situations where multiple parties are involved in a mortgage agreement, it is crucial to clarify each party's financial contribution portions and obligations. Clear articulation of figures such as the total mortgage amount, down payment percentages (usually ranging from 3% to 20%), and monthly payment breakdowns can avoid miscommunication. Furthermore, highlighting expenses stemming from property taxes, homeowners insurance, and maintenance costs--averaging around 1% of the home's value annually--ensures a mutual understanding of financial commitments. Presenting these details in a structured manner can facilitate discussions among co-borrowers and promote transparency in shared mortgage responsibility, ultimately leading to a harmonious co-ownership experience.

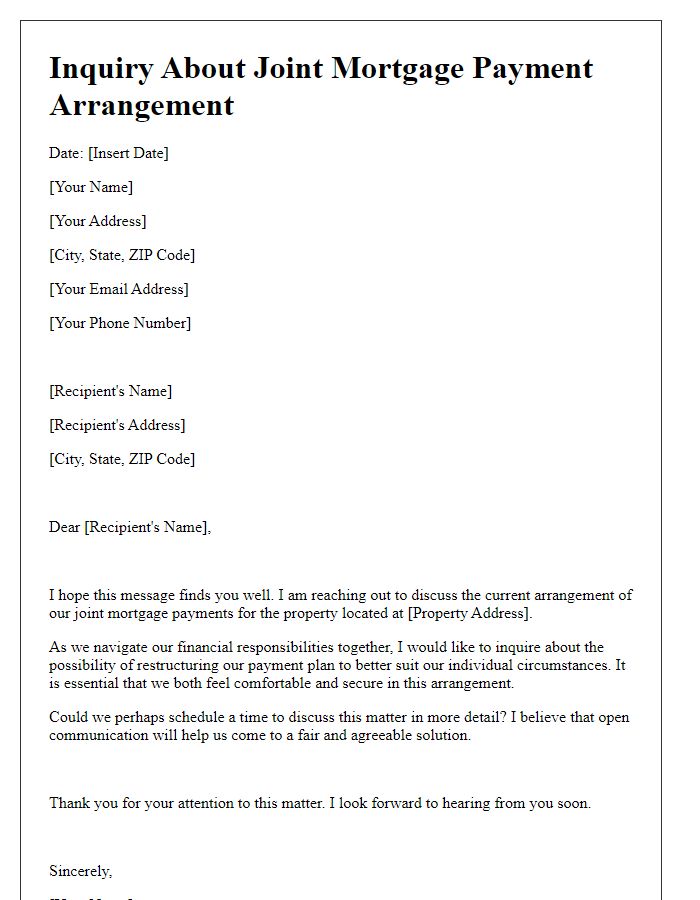

Agreement Terms and Conditions

Shared mortgage responsibility often involves multiple parties, creating joint financial obligations regarding the property located at 123 Maple Avenue, Springfield. Key terms typically include equal contributions to monthly payments, with the total mortgage amount assessed at $250,000 and an interest rate of 3.5%. Each party retains a 50% equity stake in the property, ensuring shared ownership. Any decisions related to property management or sale must require unanimous consent from all partners. In the event of default, liability falls equally among all responsible parties, protecting individual interests while ensuring financial accountability. Regular communication and scheduled reviews (suggested quarterly) will help maintain transparency and address any emerging issues effectively.

Contact Information and Next Steps

Shared mortgage responsibility requires clear communication and a detailed understanding of obligations. Outline contact information for all parties involved in the mortgage agreement, including full names, phone numbers, and email addresses. Detail the mortgage's terms, such as the total amount (e.g., $250,000), interest rate (e.g., 3.5%), and payment schedule (e.g., monthly installments on the 1st). Specify next steps for addressing shared responsibilities, which could entail a meeting date (e.g., April 15, 2024) to discuss contributions, potential adjustments, and filing necessary documents with financial institutions. Emphasize the importance of transparency in managing shared expenses and the potential legal implications of the agreement, ensuring both parties understand their rights and obligations.

Comments