If you've ever felt overwhelmed by the complexities of a mortgage deed, you're not alone! Navigating the legal jargon and ensuring every detail is accurate can be a daunting task. But fear notâcorrecting a mortgage deed is entirely manageable with the right guidance. Join me as we explore a straightforward letter template that can simplify this process and set you on the right path to ensuring your mortgage documents are accurate and up to date.

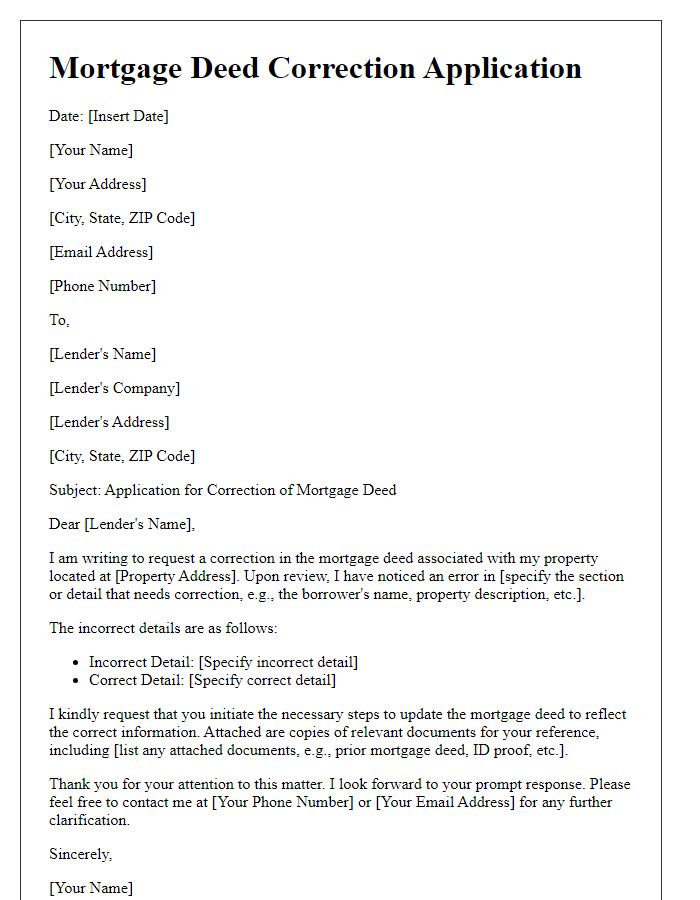

Corrected information details

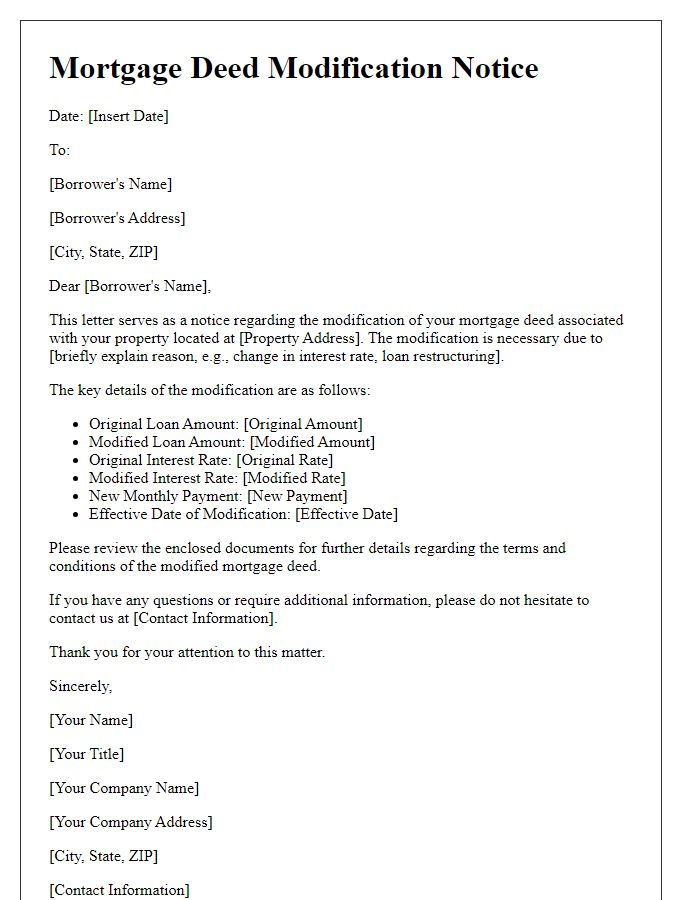

The mortgage deed correction process involves updating critical information to ensure accuracy within the official documents. Incorrect borrower names or addresses can lead to legal complications and affect property ownership rights. For instance, when a borrower's name, such as "John A. Smith," is mistakenly listed as "Jon A. Smith," this discrepancy needs to be rectified to reflect the correct legal identity. An accurate property address, including the street number, street name, city, and ZIP code, is also essential; for example, changing from "1234 Elm St, Springfield" to "1234 Elm Street, Springfield, IL 62701." These corrections typically require documentation to verify the accurate details, including government-issued identification or utility bills, along with a formal request to the relevant governing body overseeing mortgage records. Ensuring these details are correct safeguards against potential future disputes regarding legal ownership, as well as ensuring the seamless execution of any future transactions related to the property.

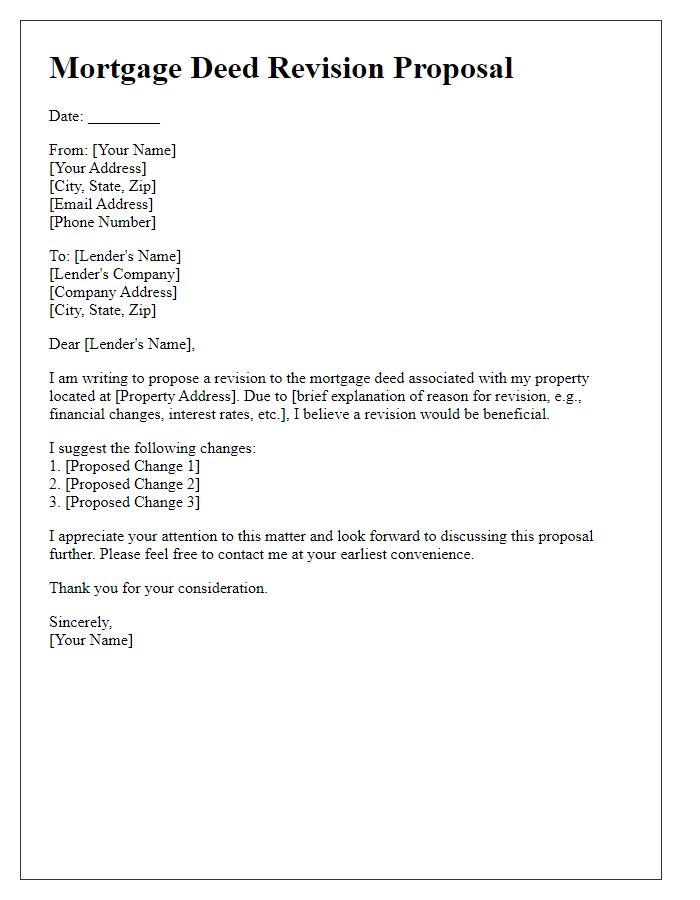

Original document reference

Mortgage deed corrections are critical for maintaining accurate property records, often involving original document references such as the property address (123 Maple Street, Springfield) and the mortgage identification number (MID 456789). Errors can include incorrect borrower names, property descriptions, or loan terms that need rectification to ensure legal and financial clarity. Proper documentation for the correction process may involve submitting forms to the county clerk's office or the relevant financial institution. A significant detail to note includes potential timelines as some jurisdictions may take weeks for processing, impacting the overall homeownership experience. Accurate record-keeping prevents future complications regarding property ownership and financial obligations.

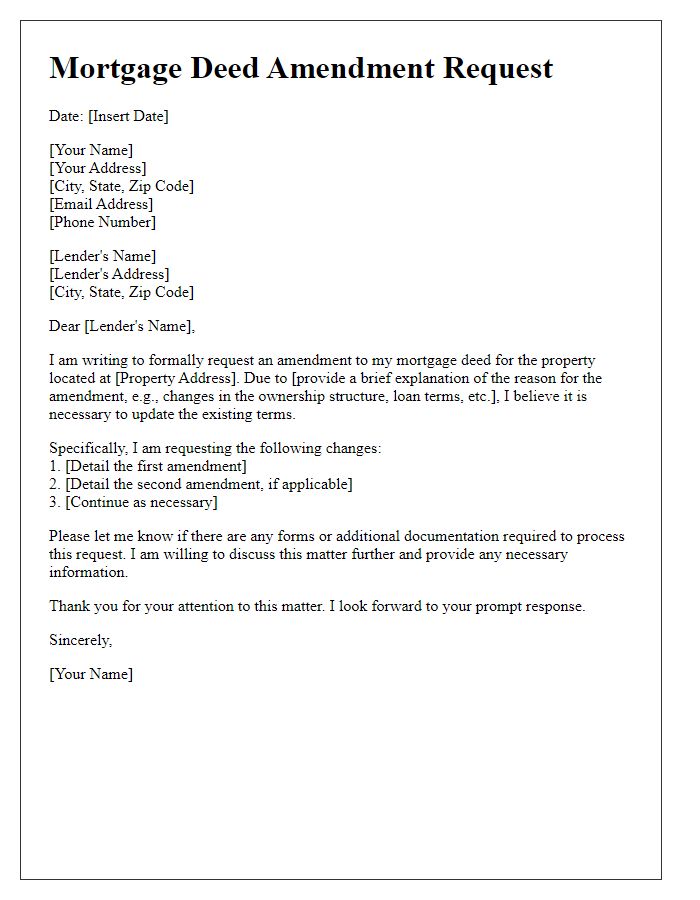

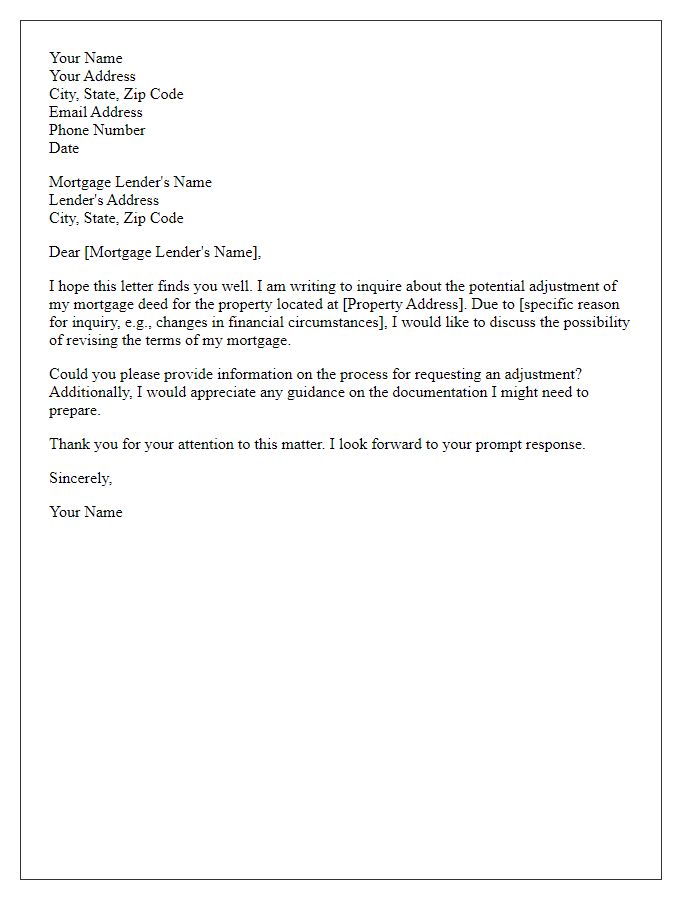

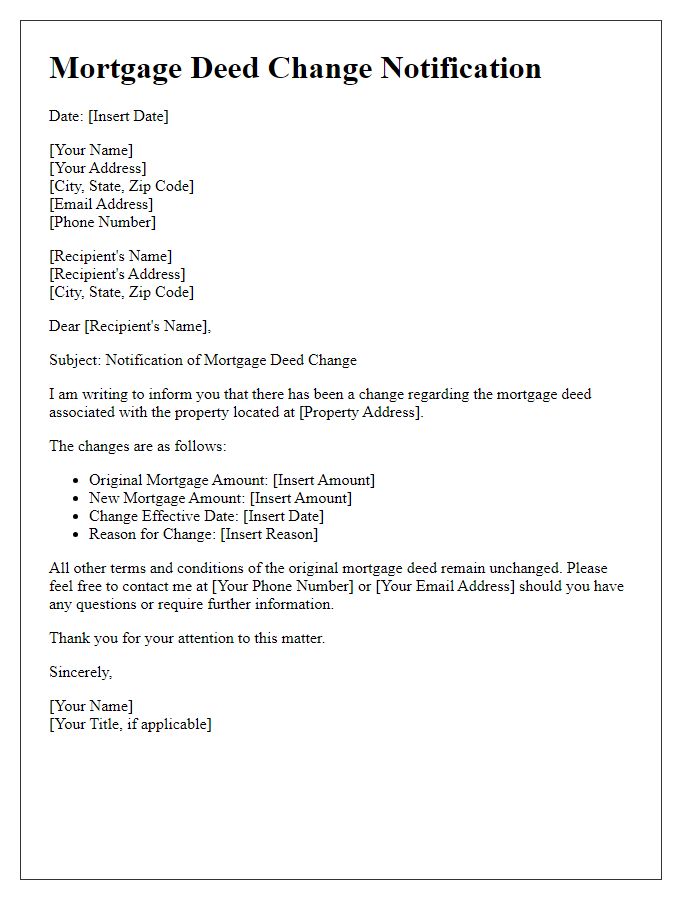

Borrower's contact information

Borrower's contact information plays a crucial role in the mortgage deed correction process. Complete address details, including street number, city, zip code, and state, ensure accurate identification of the property involved (often associated with significant financial investments). The inclusion of a valid phone number (typically a mobile number for ease of contact) allows for prompt communication with lenders or legal representatives. Furthermore, an email address (often used for electronic correspondence) is important for sending updates or documentation related to the correction. Providing these details can facilitate a smoother and more efficient correction process, minimizing potential delays in legal proceedings.

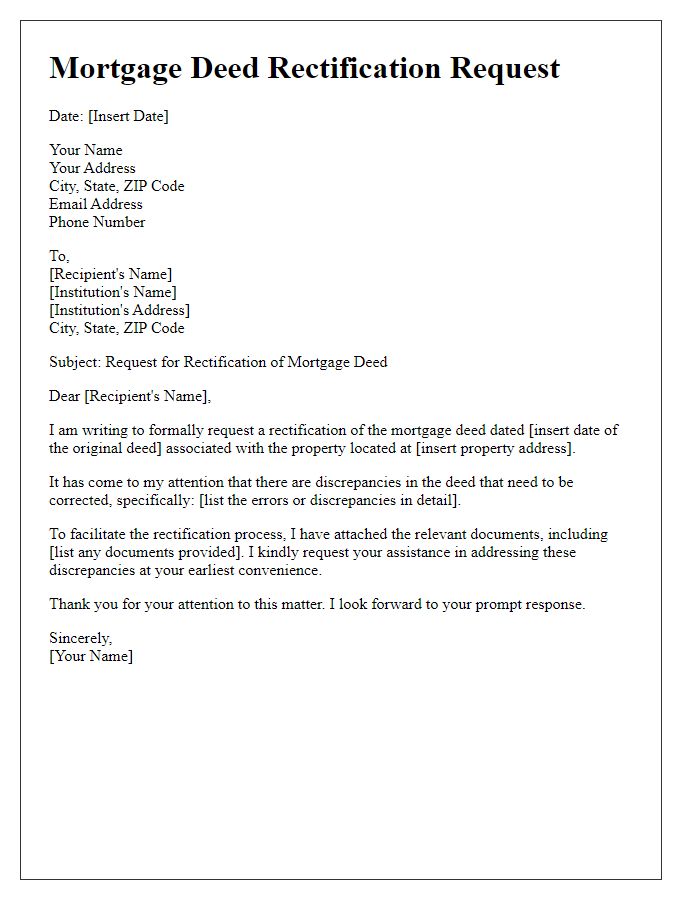

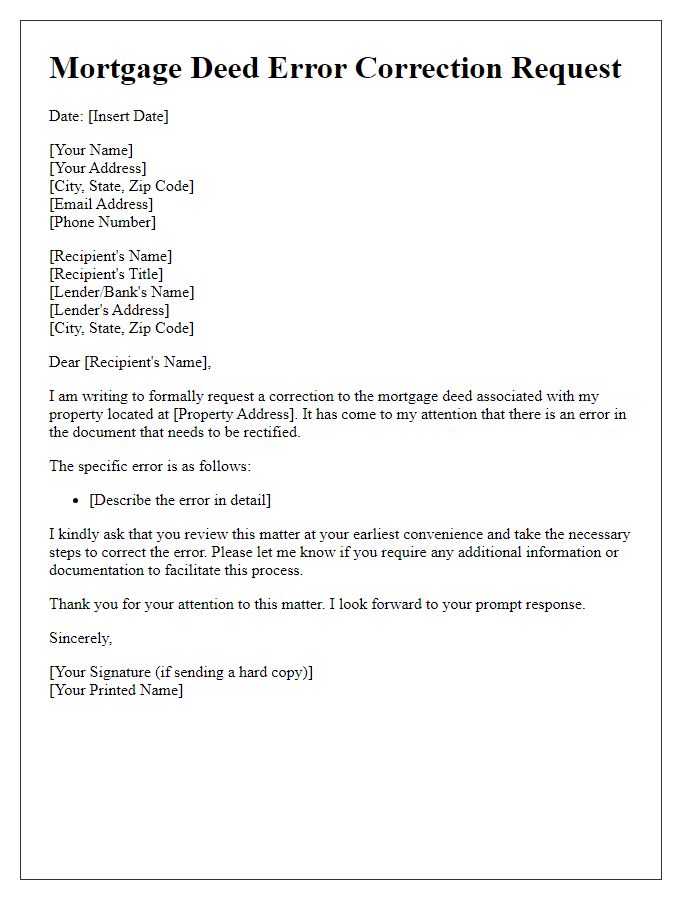

Clear explanation of the error

Errors in mortgage deeds can lead to significant legal and financial complications for homeowners. A common mistake involves inaccurate property descriptions, such as incorrect land lot numbers or misplaced boundaries that can cause disputes during property transactions. Another frequent error relates to misspelled names, where the borrower's name may be incorrectly documented, potentially complicating future refinancing or sale processes. Additionally, dates of agreement may be incorrectly listed, causing confusion about the start of the mortgage term. Addressing these inaccuracies promptly is essential for ensuring that the legal document accurately reflects the intent of all parties involved and complies with local housing regulations.

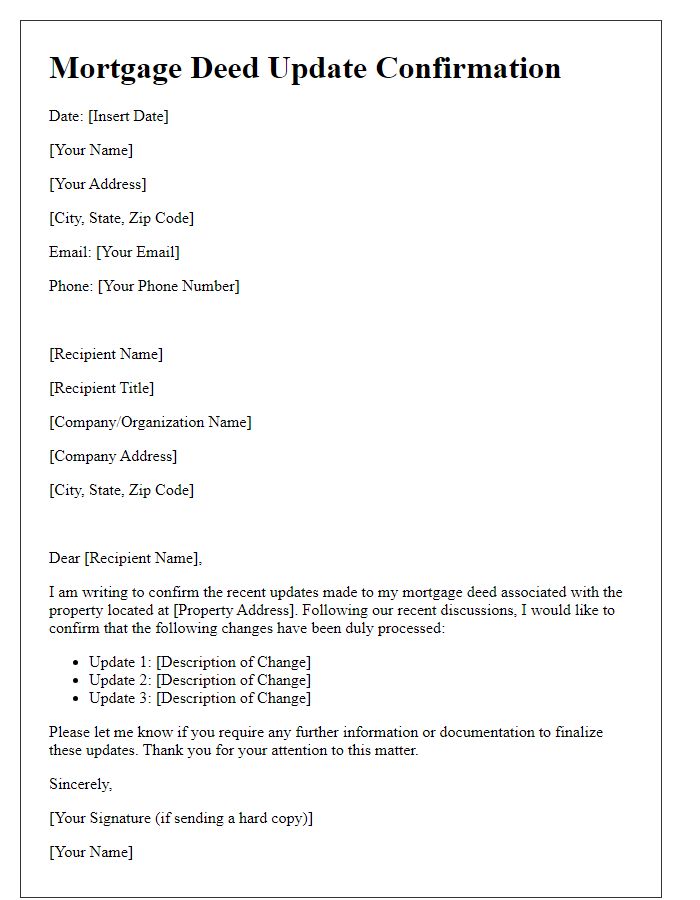

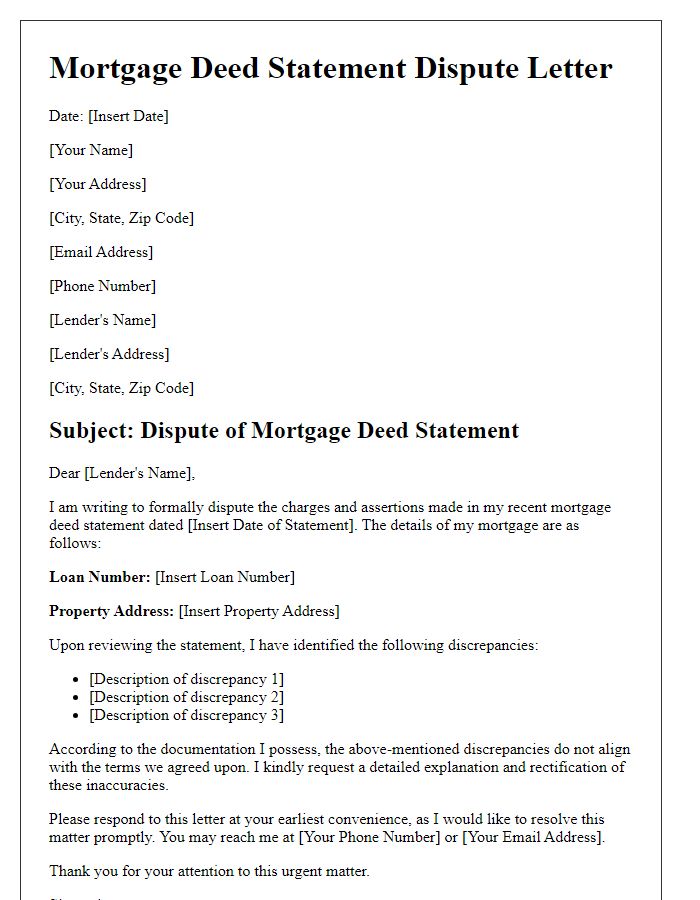

Request for acknowledgment and confirmation

A mortgage deed correction is a legal document that amends errors in the original mortgage deed, which is essential for ensuring accurate property records. It is crucial for maintaining clear title and avoiding future disputes regarding ownership. A request for acknowledgment and confirmation may include essential details such as the property address located in San Francisco, California, the mortgage account number, and specific corrections needed to accurately reflect the names of the parties involved, the loan amount, or the legal description of the property. Proper documentation supports the request, such as copies of identification and the original mortgage deed, reinforcing the legitimacy of the requested changes. Prompt acknowledgment from the lender ensures that both parties are aligned on the corrections, mitigating any potential confusion or legal complications in the future.

Comments