If you've ever found yourself in the frustrating situation of losing important mortgage documents, you're not alone. Many homeowners face this challenge, and the good news is that retrieving these documents doesn't have to be a daunting task. With a few simple steps and the right approach, you can streamline the process and regain peace of mind. Curious about how to efficiently retrieve your lost mortgage documents? Read on for key insights and tips!

Borrower's Personal Information

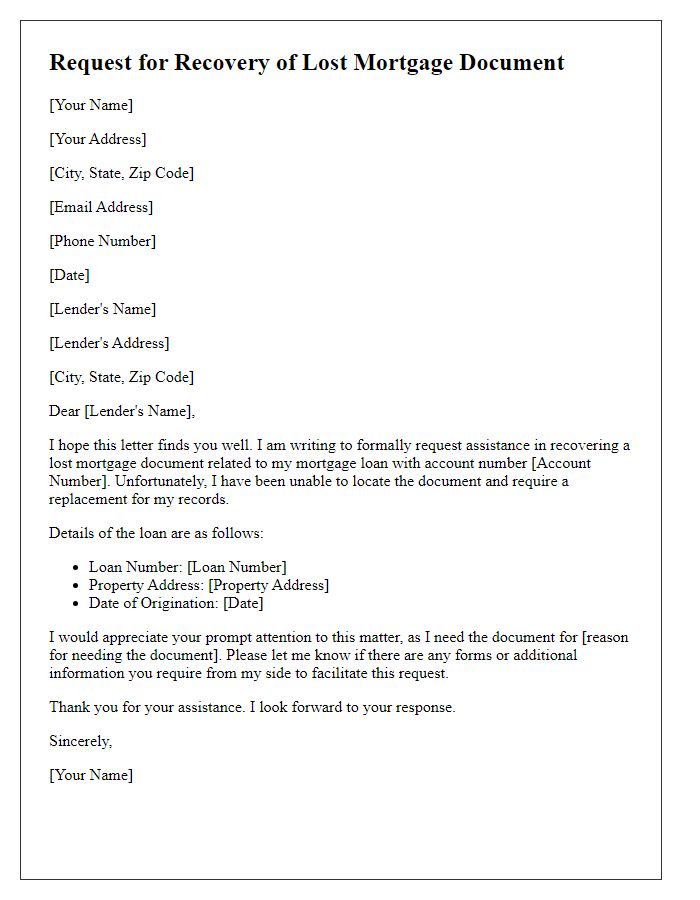

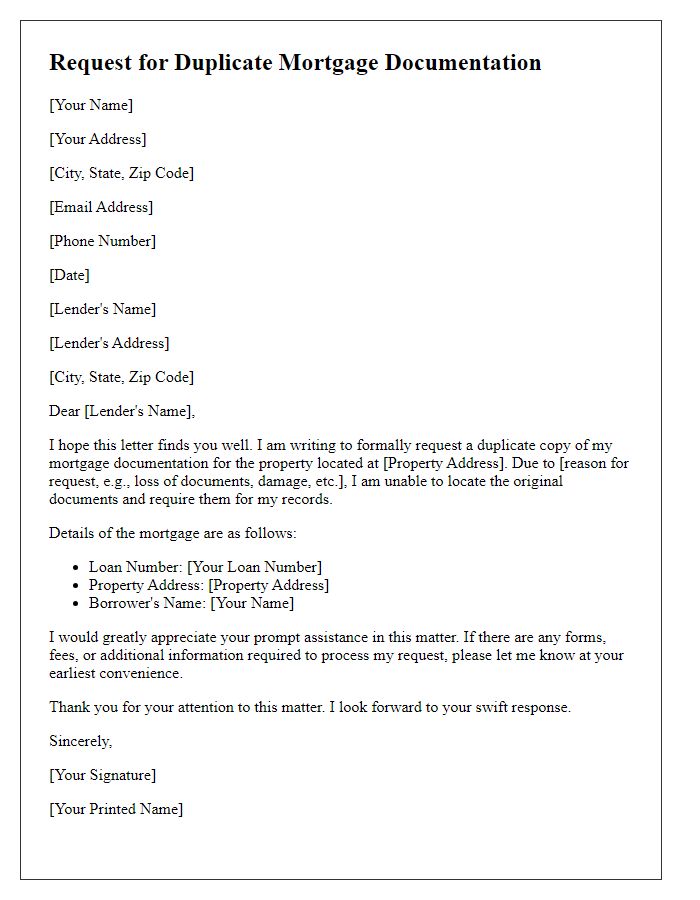

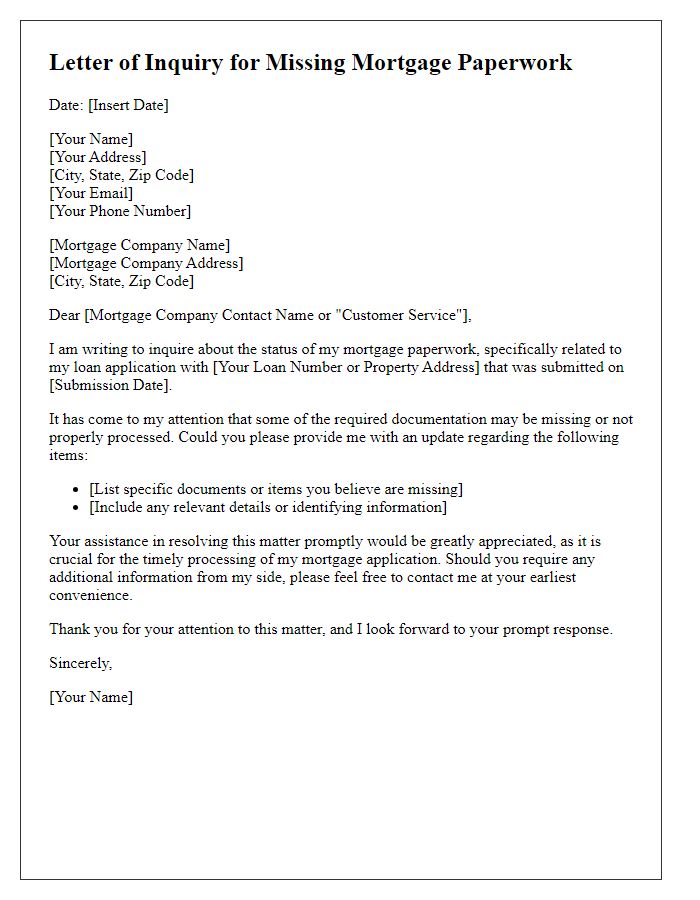

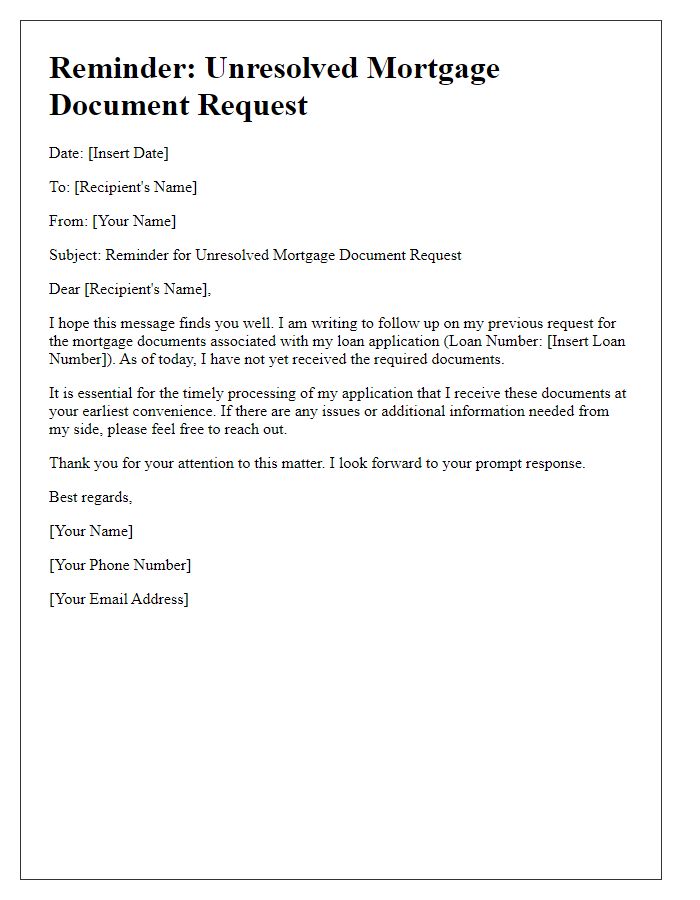

Lost mortgage documents can significantly hinder the loan process for property ownership, especially for individuals applying for home loans with lenders like Bank of America or Wells Fargo. Borrowers often face challenges such as delays in closing dates or increased interest rates due to incomplete paperwork. Essential documents include the Loan Estimate and Closing Disclosure, which provide crucial financial information; losing these can complicate negotiations with loan servicers. It is vital for borrowers to promptly communicate with their lender's customer service, typically available Monday through Friday during business hours, to initiate the replacement procedure and clarify any impacts on their mortgage application status.

Mortgage Loan Details

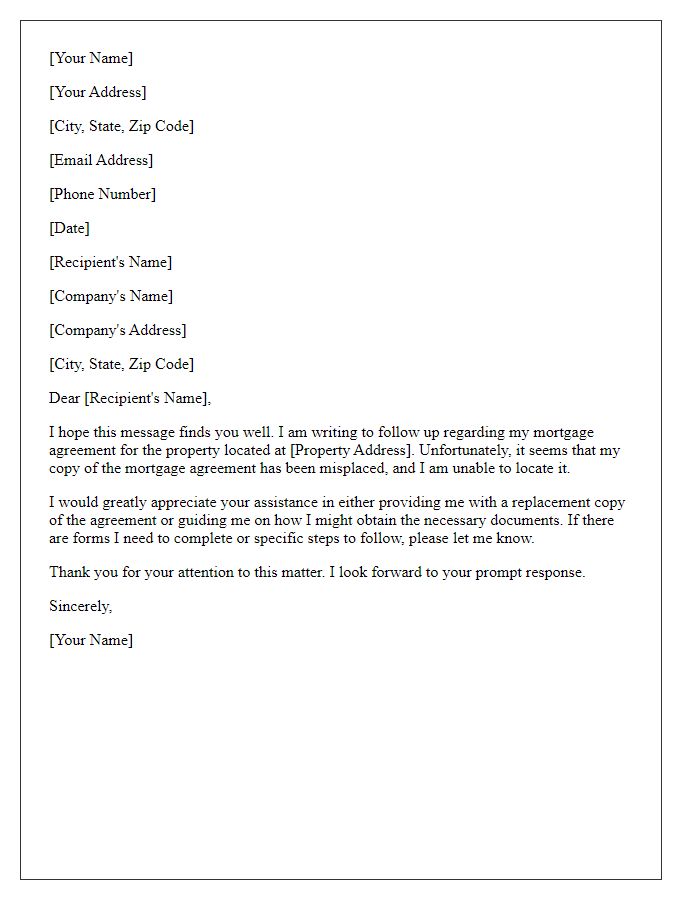

Lost mortgage documents can create significant obstacles in the homeownership process, especially for loans under the Federal Housing Administration (FHA). Essential documents, such as the original mortgage agreement and proof of payment history, play a critical role in refinancing opportunities and loan modifications. Homeowners dealing with lost documents often contact financial institutions, such as Bank of America or Wells Fargo, to request duplicates. Important identification details, including a Social Security number and property address, must accompany any retrieval requests to validate ownership. Additionally, state-specific requirements may apply; for example, California requires notarization of certain forms, increasing processing times. Prompt retrieval of these documents is vital to maintain favorable mortgage rates and ensure eligibility for government programs.

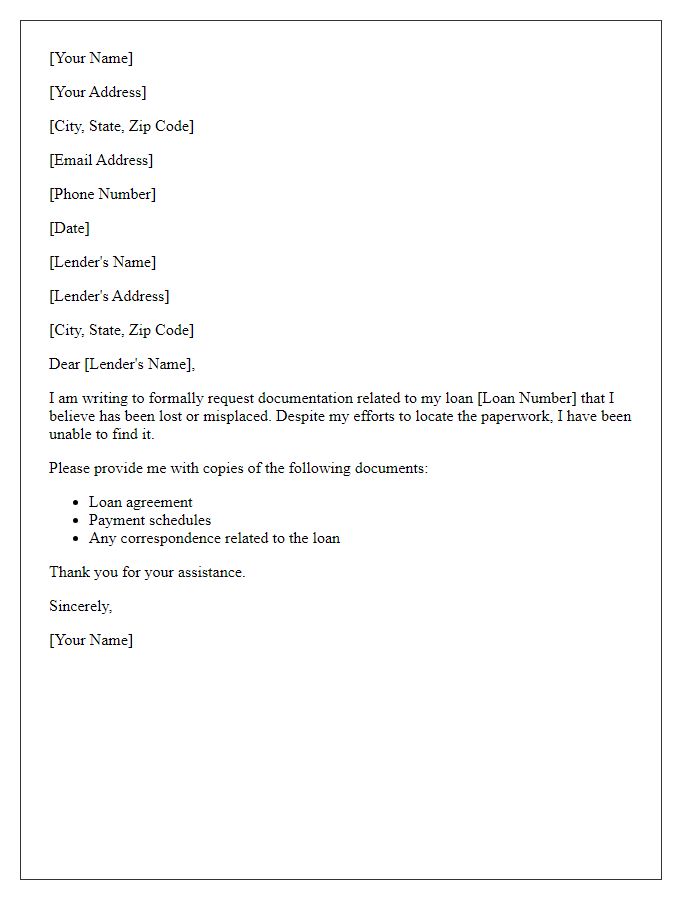

Description of Lost Documents

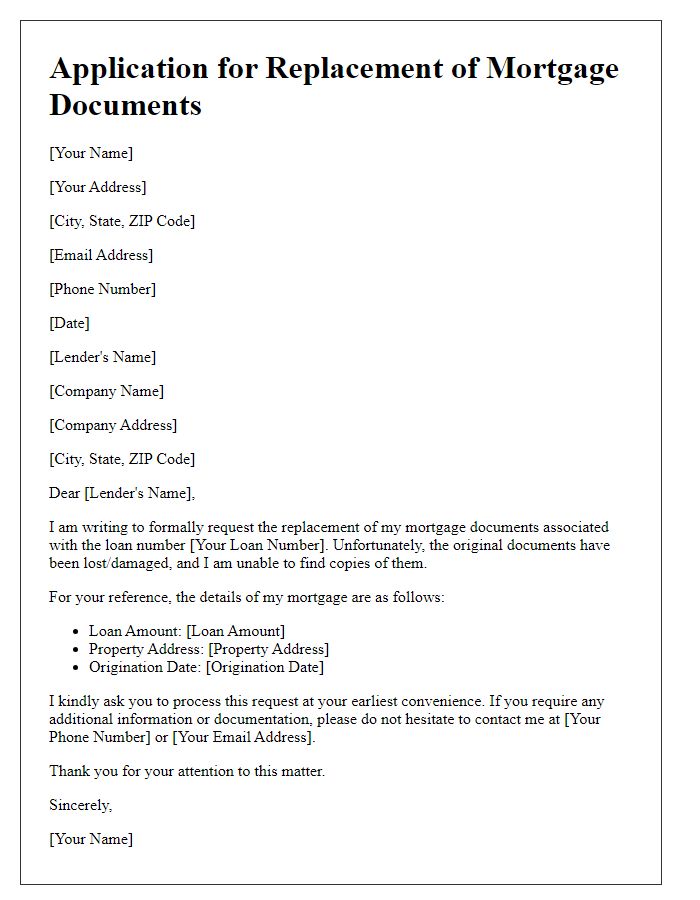

Lost mortgage documents can include crucial papers such as the promissory note, mortgage deed, and loan application forms. These documents, typically held by financial institutions like banks or credit unions, detail borrower obligations and property descriptions. The promissory note outlines the borrowing terms, while the mortgage deed signifies the lien on the property, usually recorded at local county offices. In particular, missing documentation may lead to complications, including inability to refinance, sell, or review loan terms effectively. Such occurrences can create significant delays in real estate transactions and may necessitate legal assistance to reconstruct lost information for regulatory compliance and personal records.

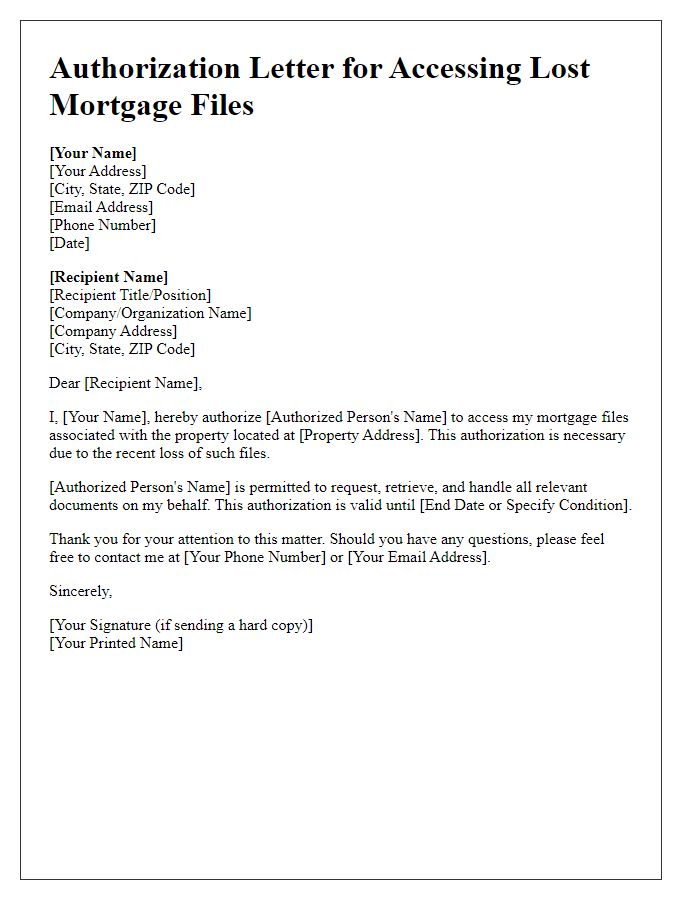

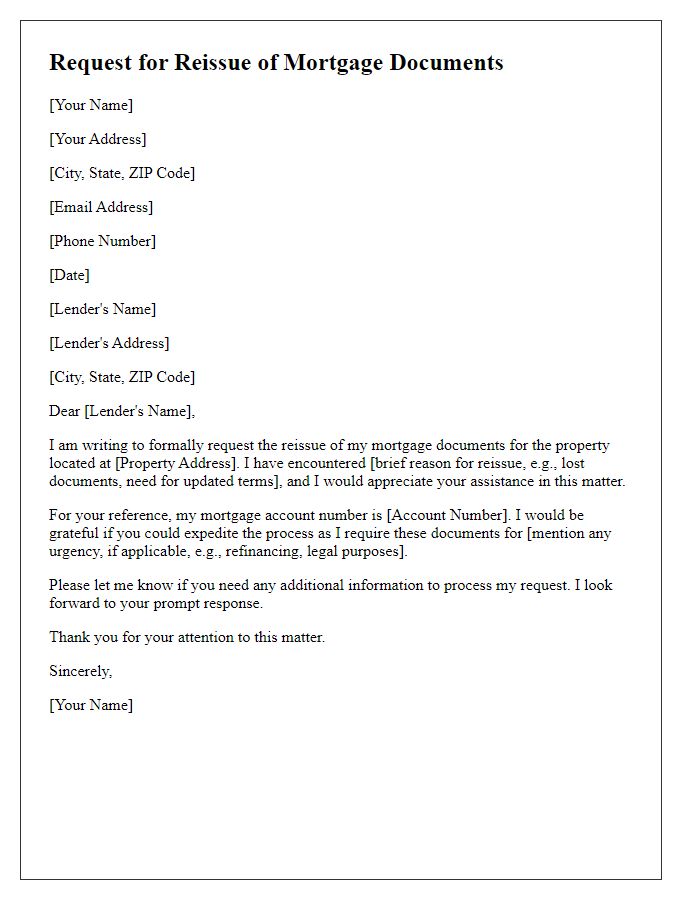

Request for Replacement Documents

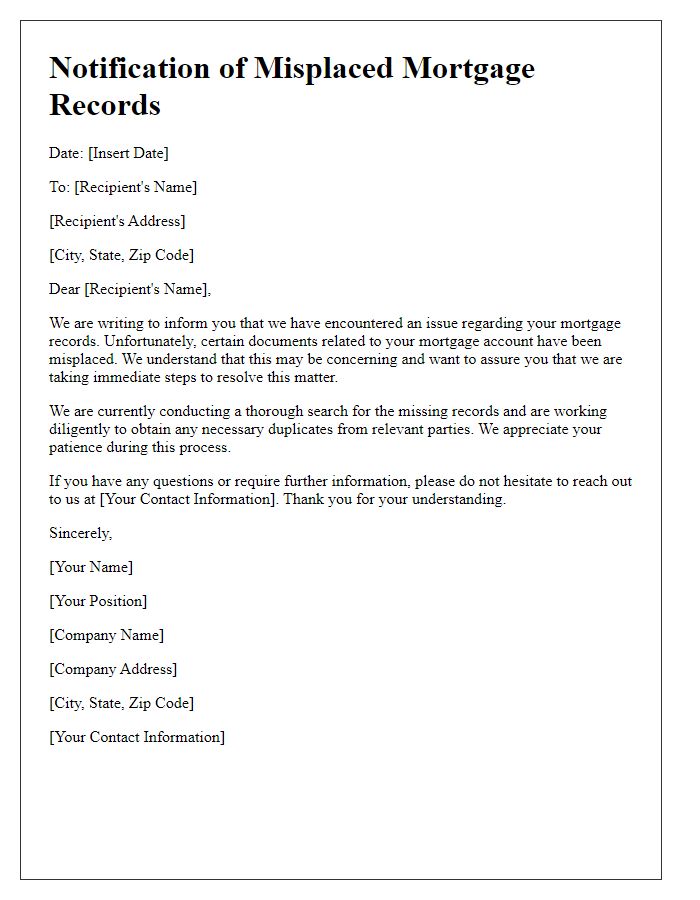

Lost mortgage documents, such as the original loan agreement and property deed, can complicate financial transactions related to real estate ownership. In situations involving a mortgage from lenders like Wells Fargo or Bank of America, it becomes crucial to retrieve replacement documents for legal and financial clarity. To initiate the process, a formal request must be submitted, typically including specific details such as the property address, loan number (often found on monthly statements), and personal identification information. Additionally, the request should clearly state the reason for the document retrieval and any supporting identification documents, such as a government-issued photo ID. Timely retrieval of these documents aids in maintaining clear ownership records and allows for seamless refinancing, selling, or other financial transactions related to the property.

Contact Information and Preferred Contact Method

Lost mortgage documents, essential for property financing records, create significant challenges for homeowners. Filing lost document requests typically involves paperwork submitted to lending institutions, often requiring detailed personal information (e.g., full name, address, loan number). Preferred contact methods, such as email or phone calls, facilitate prompt communication with mortgage servicers like Wells Fargo or Bank of America, ensuring efficient document retrieval processes. Scalability of these systems helps accommodate numerous requests, enabling faster resolutions for desperate clients seeking to return to normalcy. Timely access to these crucial documents improves homeowners' financial management and strengthens their security in ownership.

Comments