Are you tired of noticing discrepancies in your mortgage escrow account? Many homeowners face this frustrating issue, often feeling overwhelmed by the complexity of financial statements. Thankfully, contesting these discrepancies doesn't have to be a daunting task. Join us as we unpack an easy-to-follow letter template that can help you effectively address these concerns with your mortgage lender.

Accurate property details and account information

Mortgage escrow discrepancies can lead to financial inaccuracies that impact homeowners significantly. Detailed property information such as the address (e.g., 123 Main St, Springfield) and account number (e.g., 456-789-654) should be included to ensure clarity and traceability. Escrow accounts are typically used for property taxes and homeowners insurance, requiring precise calculations and adjustments. Homeowners must pay close attention to discrepancies in the monthly escrow payment amounts, annual tax disbursements, and changes in the homeowners insurance premiums. Documentation such as previous payment statements (e.g., January 2023 - December 2023) and calculation breakdowns from the mortgage lender (e.g., ABC Mortgage Co.) should be referenced to substantiate any claims made to rectify inconsistencies. Immediate communication with the mortgage servicer can prevent further complications and ensure resolution.

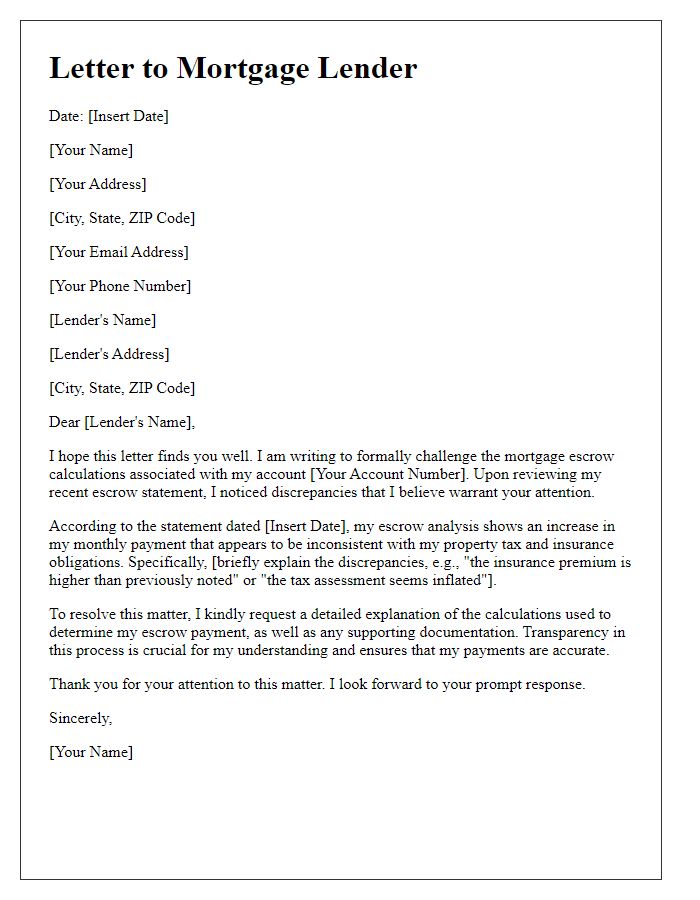

Clear explanation of discrepancy

Mortgage escrow discrepancies can arise from various factors related to property taxes or homeowner's insurance. A common issue involves an unexpected increase in property tax assessments, which can impact monthly escrow payments. For instance, if local government assessments in a region, such as California, raised property taxes by 15% due to increased funding for public schools, this would generate an unexpected balance in the escrow account. Additionally, insurance premiums may fluctuate based on changes in coverage or rates set by providers in response to increased claims in specific areas, like Florida, where hurricanes have raised overall risk assessments. It is essential to thoroughly review the escrow analysis statement, comparing the predicted disbursements to actual amounts paid, ensuring that all calculations are accurate and aligned with the contractual agreement from the mortgage lender. Any errors identified require prompt discussion with the loan servicer to rectify the discrepancy and restore balance to the escrow account.

Supporting documentation and evidence

Mortgage escrow discrepancies can lead to significant financial complications for homeowners. Accurate documentation is critical to rectify any misunderstandings. Essential materials include the original mortgage agreement outlining escrow terms, monthly statements showing the escrow balance and disbursements, and proof of property tax payments, such as receipts. Detailed records of homeowners insurance premiums are also necessary, highlighting any variance from expected amounts. Additionally, communications with the mortgage servicer, including emails or letters detailing previous inquiries, can provide a comprehensive view of the issue. Gathering and presenting this supporting evidence will strengthen the case for resolving discrepancies effectively.

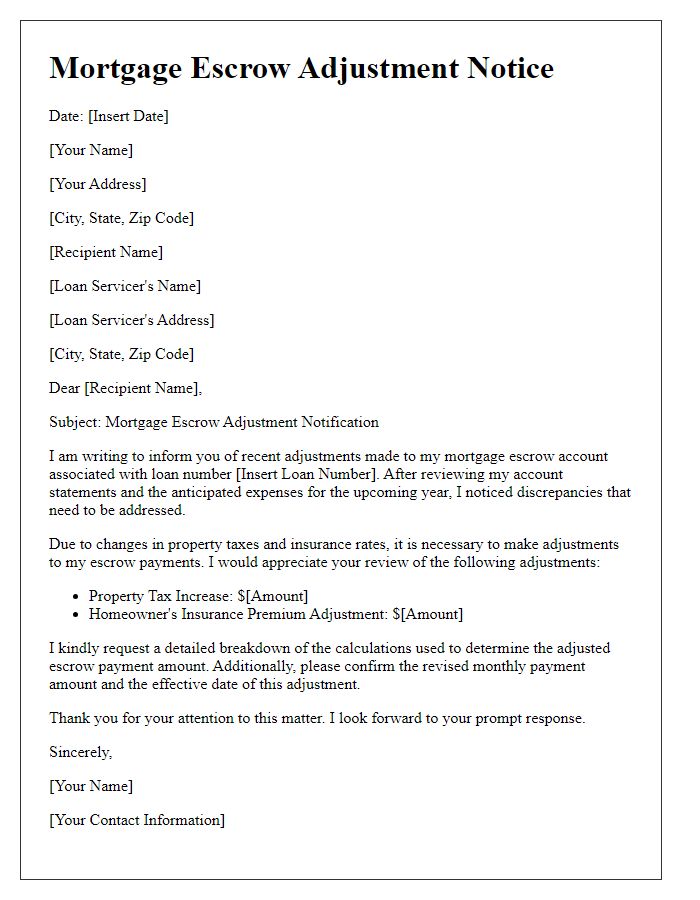

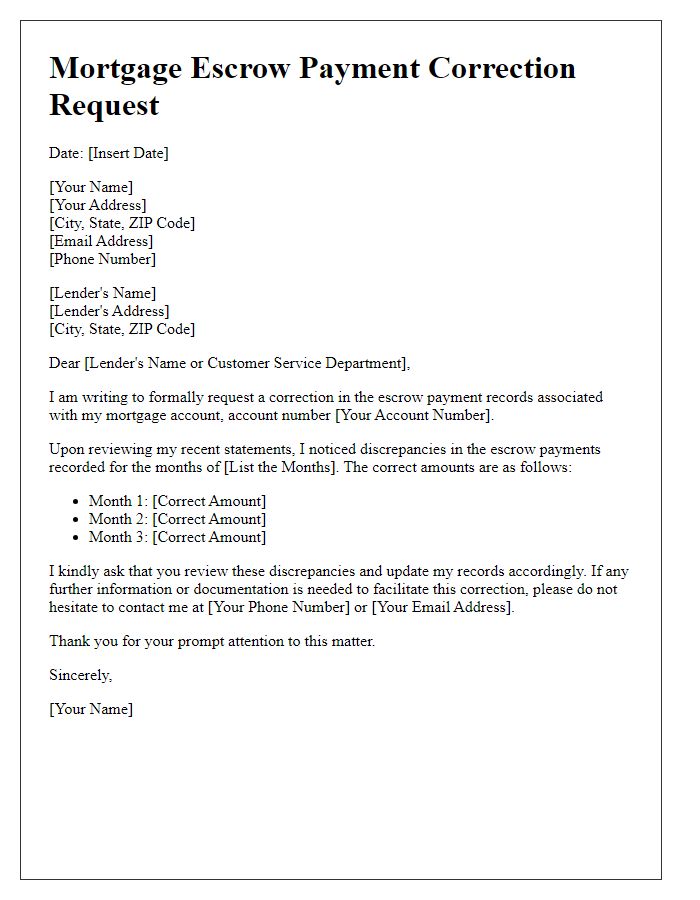

Specific correction request

Discrepancies in mortgage escrow accounts can cause significant financial strain and confusion for homeowners. Thorough examination of monthly statements reveals inconsistencies, such as erroneous charges or incorrectly calculated property tax (which can vary by locality). In particular, a recent escrow analysis showed a surplus of over $300 that was not accurately reflected in the disbursement details, impacting future payment schedules. Additionally, changes in homeowners insurance premium amounts require immediate clarification, as they influence escrow contributions and overall mortgage payments. Prompt resolution of these discrepancies is crucial to ensure accurate budgeting and prevent future financial shortfalls.

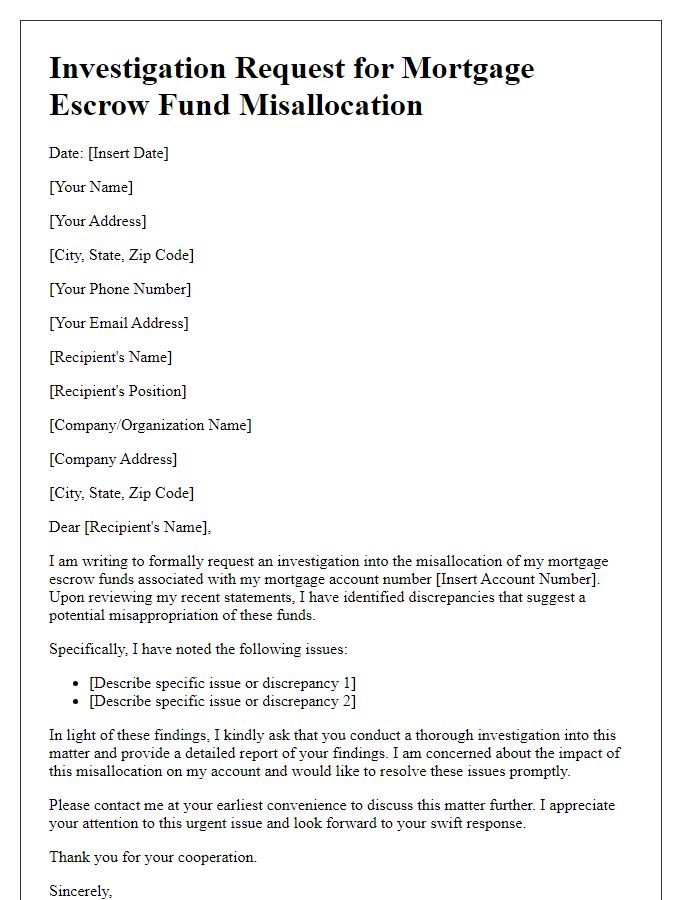

Formal contact information and request for written acknowledgment

Discrepancies in mortgage escrow accounts can lead to financial strain for homeowners. Escrow accounts, managed by lending institutions, often include property taxes and insurance premiums. A review of the account statements from January 2022 to October 2023 reveals inconsistencies in the disbursement amounts. For example, the property tax payment of $3,200 due in March 2023 was not reflected in the escrow analysis, resulting in an inflated balance. Furthermore, the insurance premium of $1,500 paid in July 2023 appears miscalculated, leading to potential overage assessments. A request for written acknowledgment of these discrepancies is necessary to ensure accurate account management and prevent future financial complications.

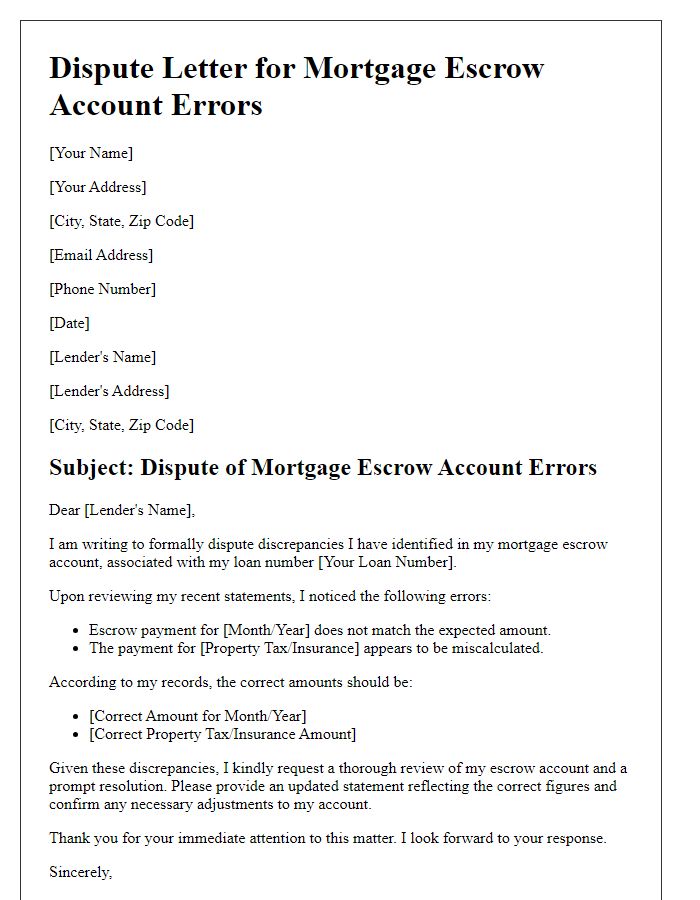

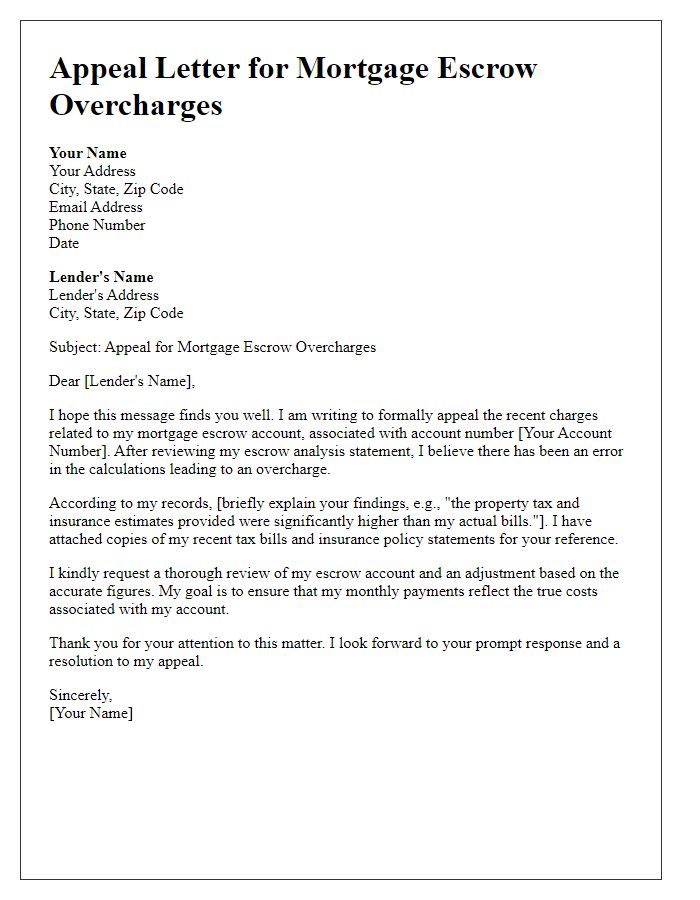

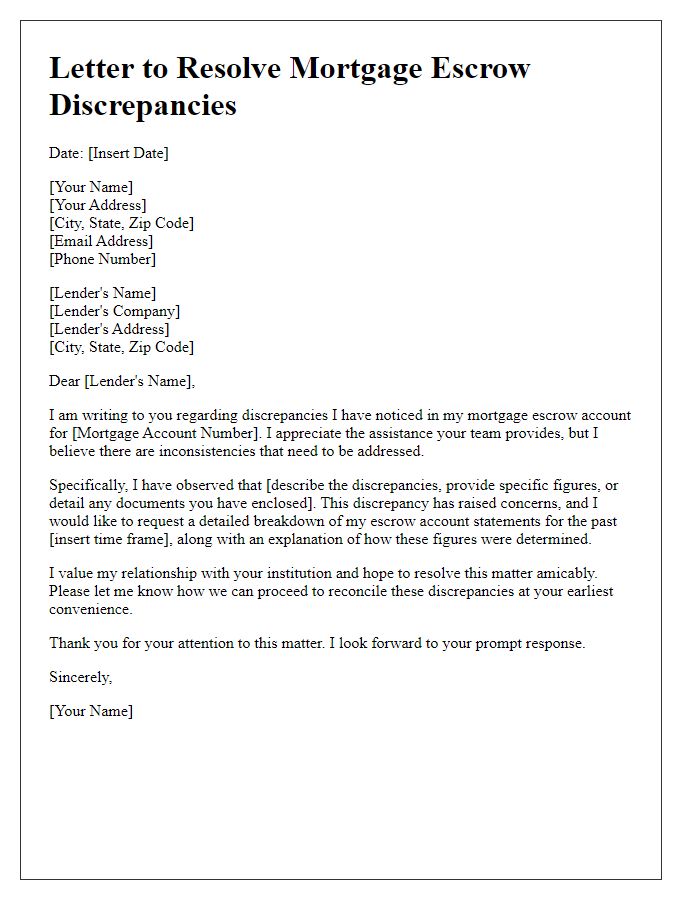

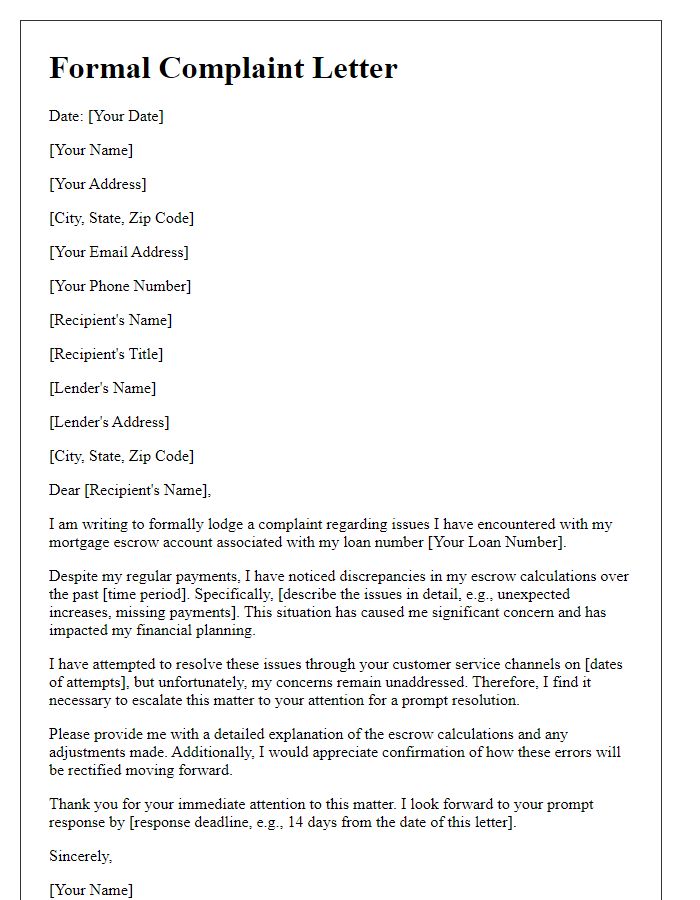

Letter Template For Contesting Mortgage Escrow Discrepancies Samples

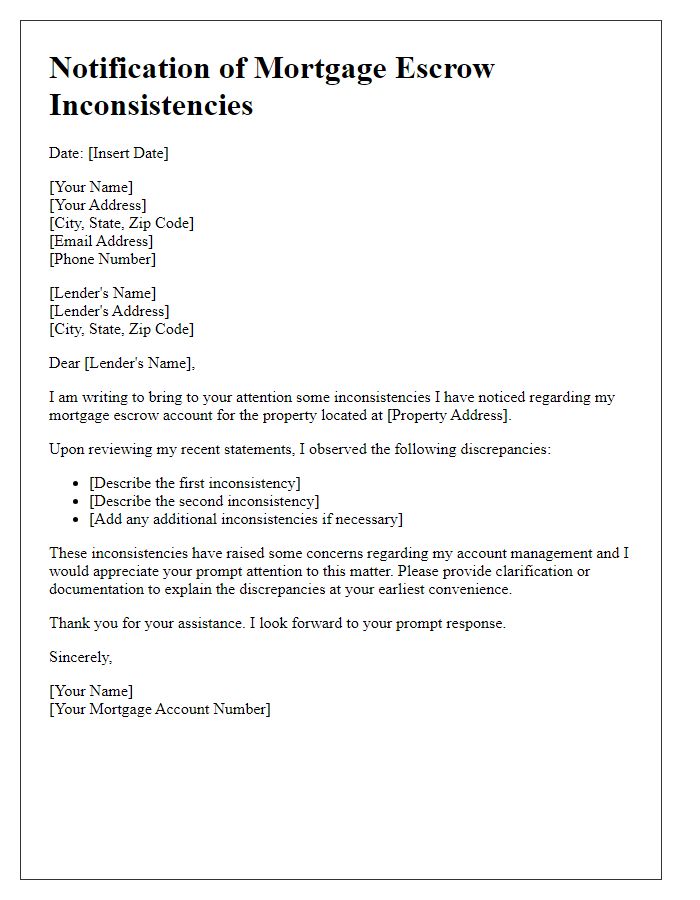

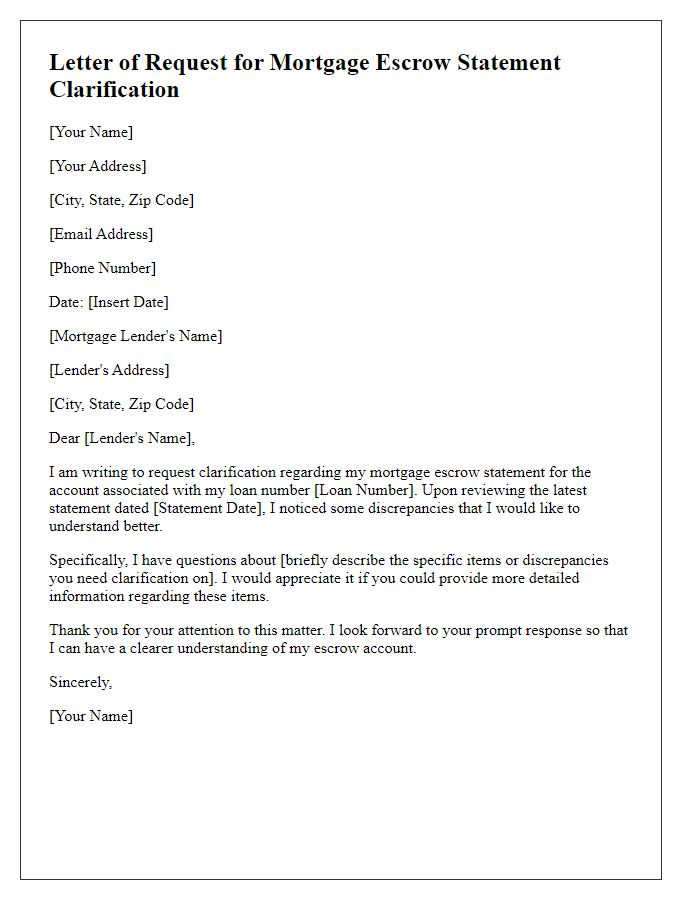

Letter template of notifying lender about mortgage escrow inconsistencies

Comments