Have you recently received a notice about a mortgage escrow shortage? Don't worry; you're not alone in this unexpected turn of events. Understanding the implications of this notice can help you navigate the situation with more clarity and ease. Stick around as we dive deeper into what an escrow shortage means for you and how to address it effectively.

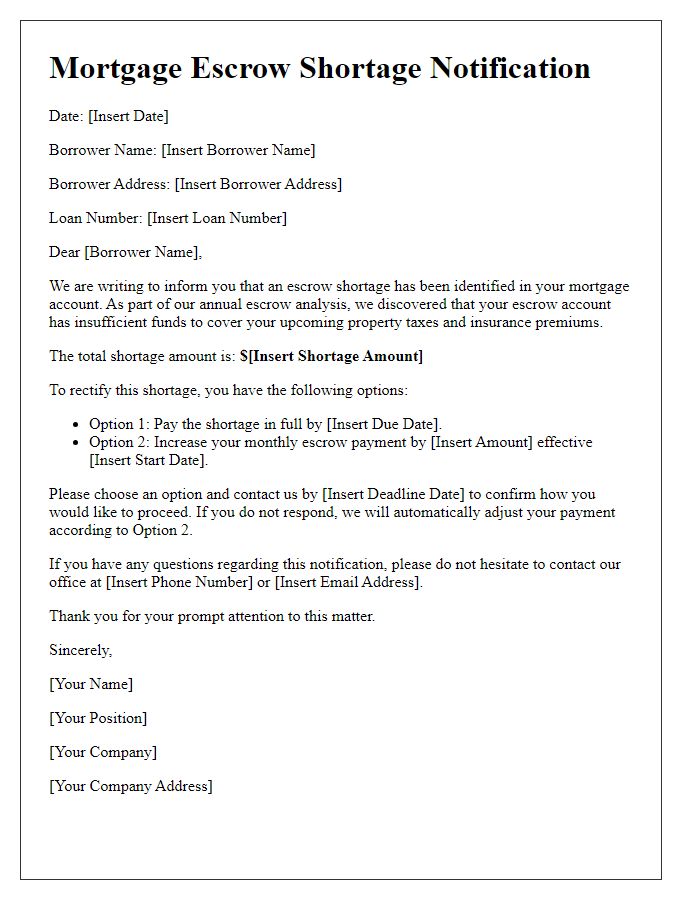

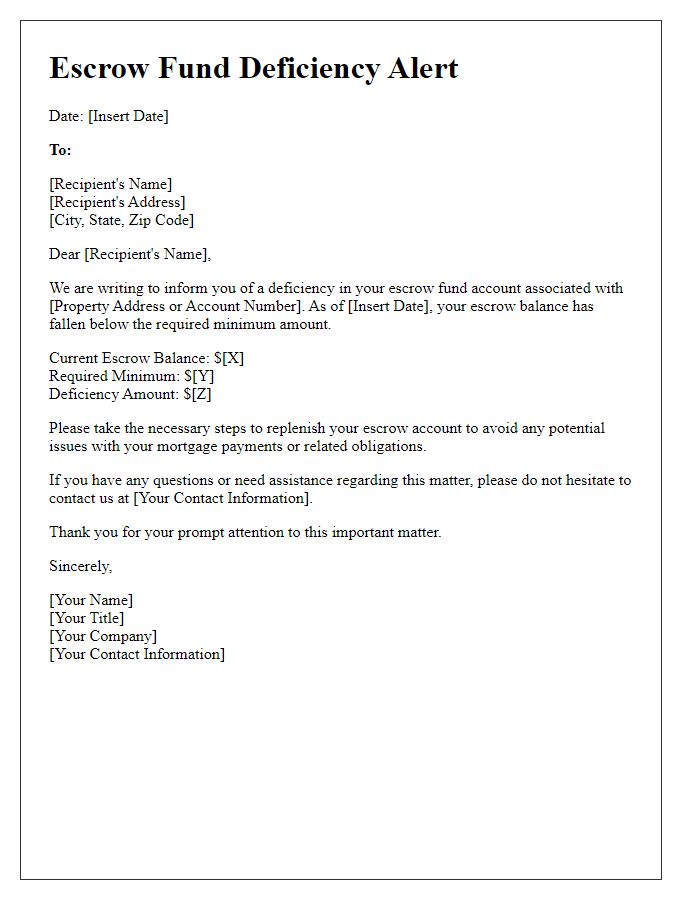

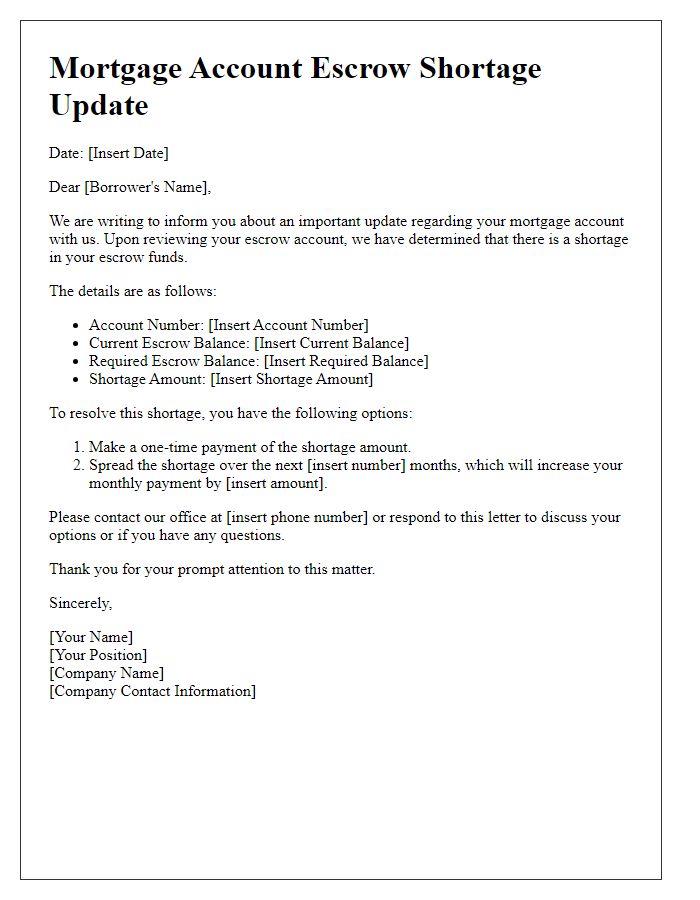

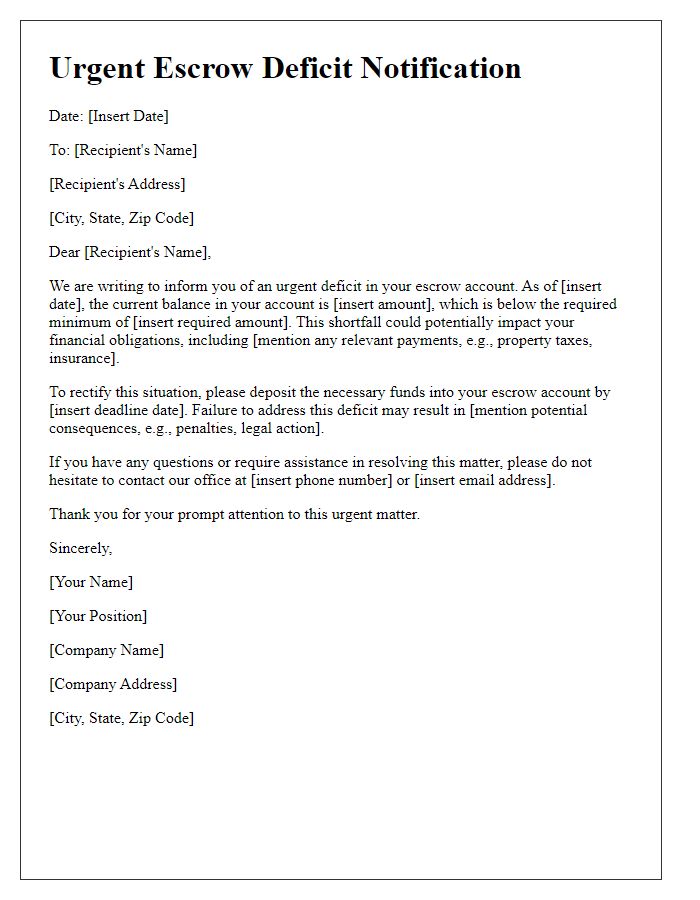

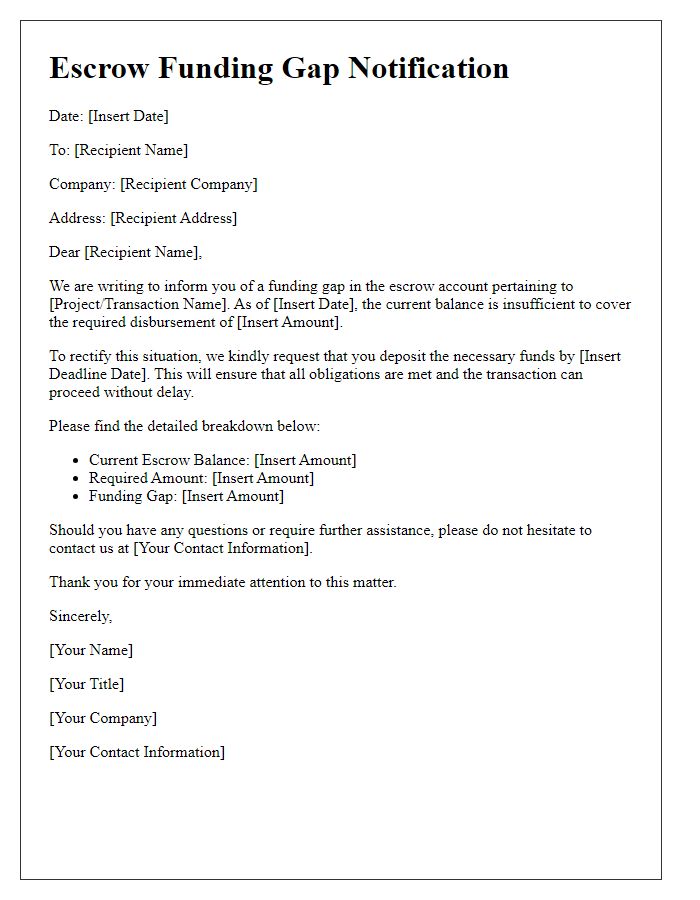

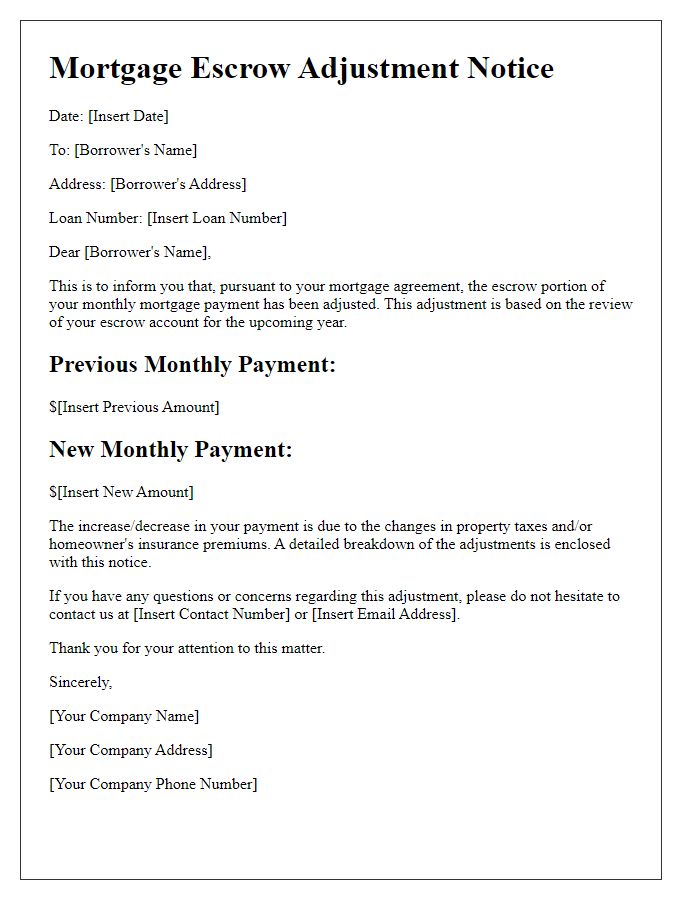

Borrower's account information

Mortgage escrow shortage notices alert borrowers to insufficient funds in their escrow accounts, which manage property taxes and insurance payments. Critical details include the borrower's account number, loan number, and the total escrow shortage amount, often calculated based on annual disbursements from the account. Events such as tax increases or changes in insurance premiums may contribute to shortages. Borrowers may need to address these shortages by adjusting monthly payments, typically through a recalculated escrow payment schedule, which may increase the monthly mortgage payment by a specific amount. Immediate attention is important to avoid penalties or lapses in property coverage.

Detailed explanation of escrow shortage

An escrow shortage occurs when there are insufficient funds in the escrow account, which is typically used to cover property taxes and insurance premiums for homeowners. Escrow accounts are managed by mortgage lenders, who collect a portion of the annual tax and insurance costs through monthly mortgage payments. For example, if the estimated yearly property tax for a home in California is $3,600, the homeowner would contribute $300 monthly into the escrow account. If property taxes rise unexpectedly or insurance premiums increase significantly, the original monthly deposit may not cover the new costs, leading to a shortage. This deficit requires the homeowner to either make up the difference immediately or adjust their monthly payment to accommodate the additional necessary funds. To prevent future shortages, it's crucial for homeowners to regularly review their escrow account balance and stay informed about any changes in property taxes or insurance rates, which are often influenced by local market trends or legislative changes.

Payment options and deadlines

Mortgage escrow shortages occur when the funds in a borrower's escrow account fall below the required level to cover property taxes and insurance premiums. The shortage can result from changes in tax rates or increased insurance costs. Borrowers are typically notified about these shortages by their mortgage servicer. Payment options may include a one-time lump sum payment to cover the shortage or spreading the shortage amount over the next 12 months, increasing the monthly mortgage payment. Deadlines for making these payments often align with the end of the calendar year or the due date for property taxes, necessitating prompt action from the borrower to avoid potential lapses in insurance or property tax payment, both crucial for protecting the homeowner's investment.

Contact information for inquiries

Mortgage escrow shortages can lead to increased payment responsibilities for homeowners. An escrow account, used to collect and pay property taxes and homeowners insurance, may become deficient due to rising property tax rates or increased insurance premiums. The notice typically includes details like the mortgage company name, account number, and specific amounts needed to cover the shortage. Homeowners might be advised to contact customer service representatives at dedicated phone numbers or email addresses for assistance. Accurate tracking of expenses related to the escrow account is crucial to prevent future shortages.

Repercussions of non-payment

Receiving a mortgage escrow shortage notice can lead to significant repercussions for homeowners. When the escrow account, which facilitates property tax and homeowners insurance payments, falls short due to increased assessments or rising premiums, homeowners may face unexpected financial strain. This deficit must be addressed promptly; otherwise, it can result in penalties, late fees, or even foreclosure processes initiated by lenders, such as JPMorgan Chase or Bank of America. Additionally, failure to rectify the shortage may cause future escrow payments to spike significantly, potentially increasing monthly mortgage payments by hundreds of dollars. Property owners in areas like California or Florida, which often experience fluctuating property values, need to be particularly vigilant as rapid changes can create sudden shortages, emphasizing the importance of maintaining a sufficient buffer in escrow accounts.

Comments