In today's ever-changing financial landscape, understanding your home mortgage conditions is crucial for maintaining a stable financial future. Whether you're looking to refinance, adjust your payment plan, or simply clarify your current terms, being informed empowers you to make the best decisions for your situation. With so many factors at play, it can sometimes feel overwhelming, but rest assured that you're not alone on this journey. Ready to dive deeper into how to effectively reaffirm your mortgage conditions? Let's explore the details together!

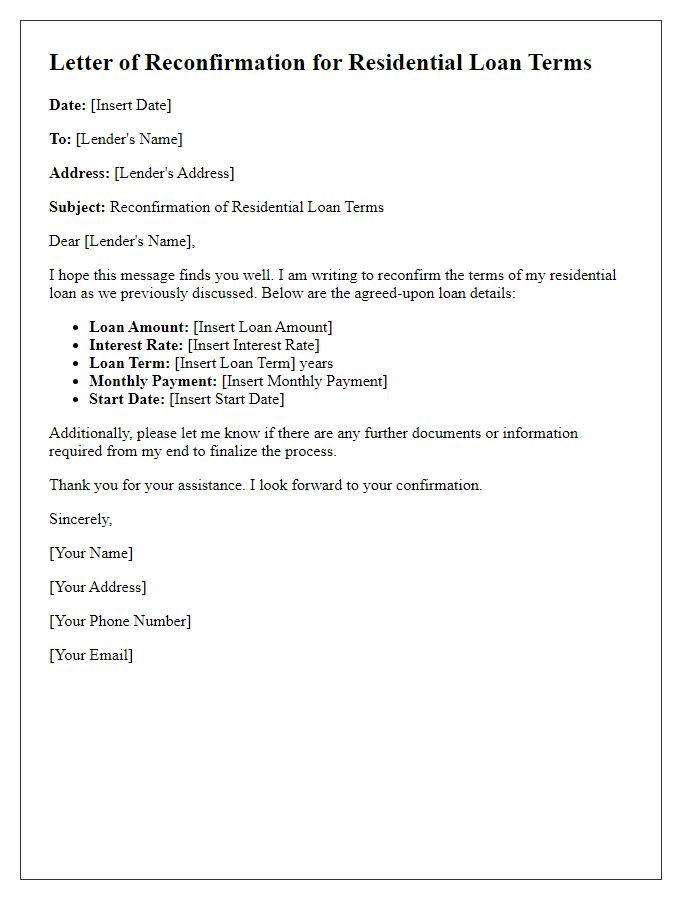

Loan terms

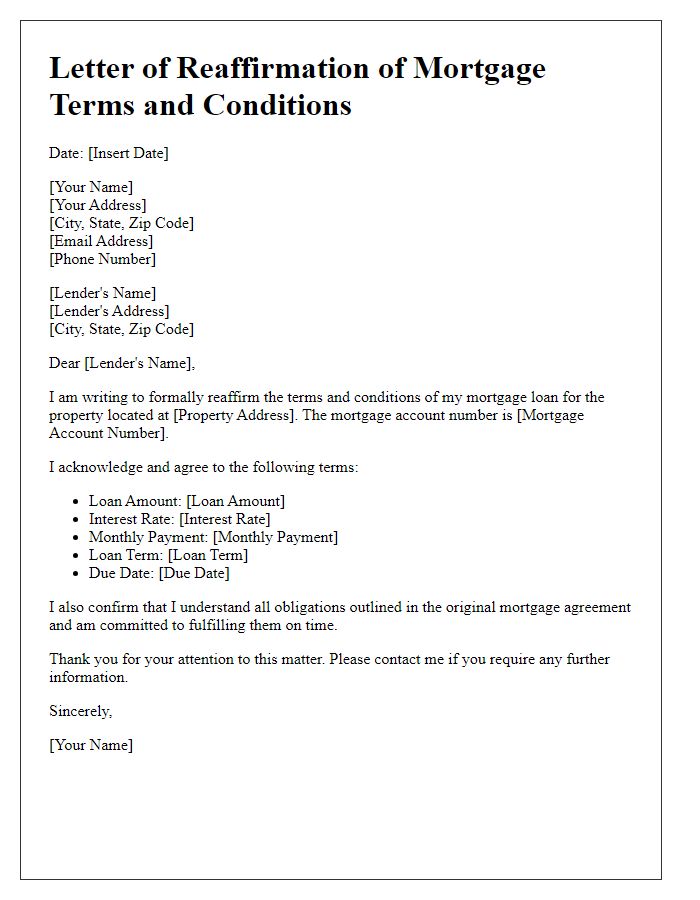

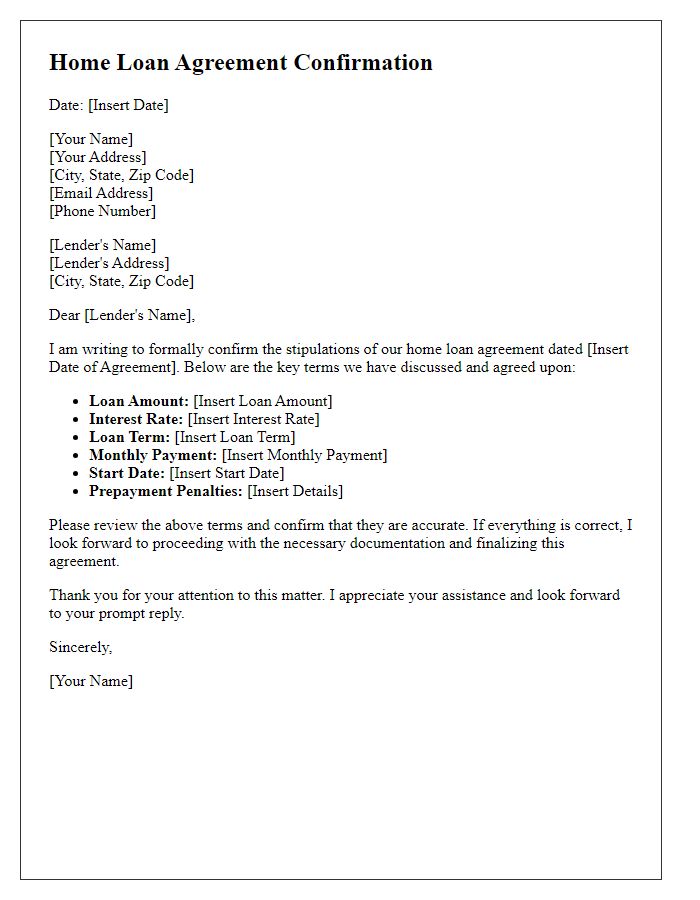

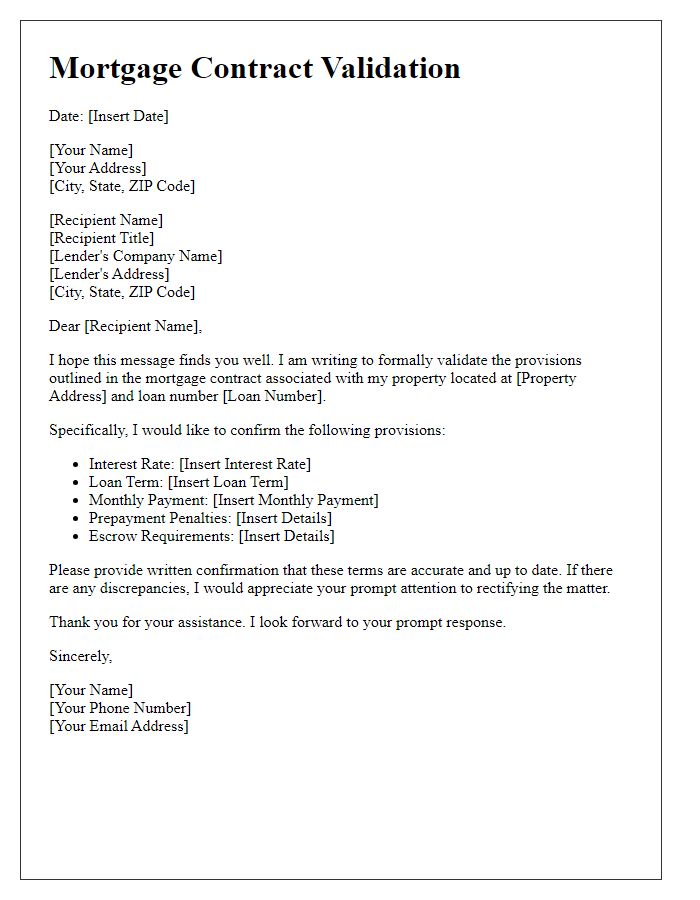

Home mortgage conditions detail crucial financial obligations tied to the property located at the address [123 Main Street, Anytown, USA]. The loan amount of $250,000, secured through financial institution ABC Bank, specifies an interest rate of 3.5% over a 30-year term. Monthly payments amount to $1,125, which include principal, interest, property taxes, and homeowners insurance, ensuring timely mortgage management. Additionally, the loan stipulates a 20% down payment requirement, amounting to $50,000, underscoring the importance of equity in the home's value at the outset. Prepayment penalties are outlined, ensuring no financial penalties will incur if the borrower decides to pay off the mortgage early. Maintaining a suitable credit score of at least 720 is also recommended for favorable terms in the event of refinancing options in the future.

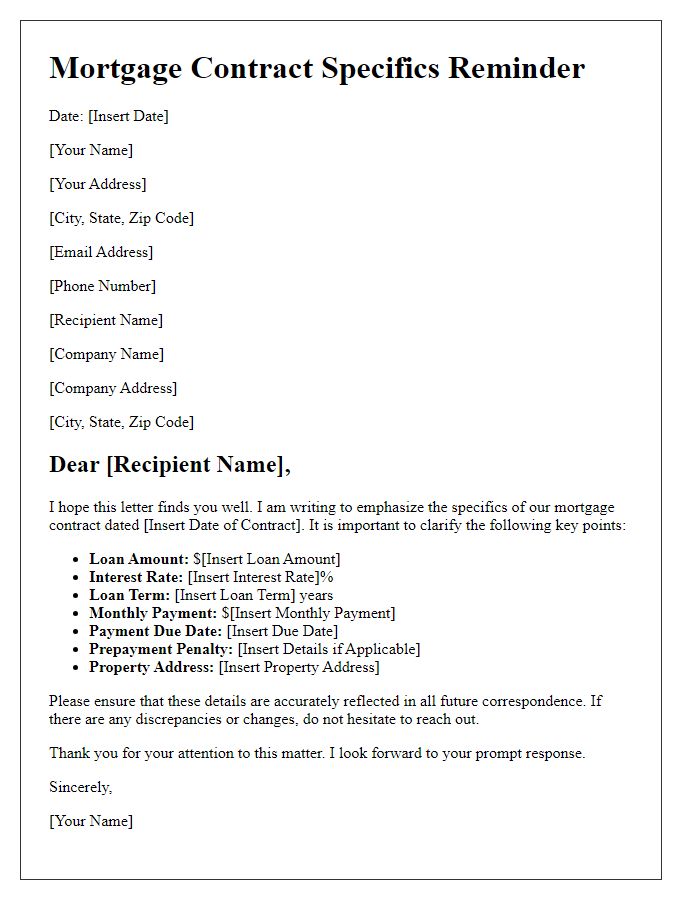

Interest rate

Interest rates play a crucial role in the overall cost of home mortgages, impacting monthly payments and total interest paid over the life of the loan. Fixed-rate mortgages, with an interest rate typically ranging from 3% to 4% for well-qualified borrowers, offer stability over the loan term, usually 15 to 30 years. Adjustable-rate mortgages (ARMs), starting around 2.5%, may initially offer lower rates but can fluctuate every year after an initial fixed period. Market trends, such as fluctuations in the Federal Reserve's benchmark rate, significantly influence these rates. Borrowers in areas like California or New York may experience higher average rates due to increased demand and home prices, which can exceed $800,000 in many neighborhoods. Understanding these conditions and their ramifications can help homeowners make informed decisions regarding mortgage reaffirmation.

Payment schedule

Home mortgage conditions often include crucial details regarding the payment schedule, such as monthly payments, interest rates, and loan duration. Payment schedules typically outline the specific amount due each month, which may vary based on factors like variable interest rates fluctuating across time. For conventional loans, a standard 30-year term usually sets payments fixed, while adjustable-rate mortgages may reset periodically, leading to changes in future payments. Maintaining awareness of these conditions helps homeowners avoid late fees and ensure compliance with their lender's terms. Regularly reviewing the payment schedule is essential to manage finances effectively and uphold the overall health of the mortgage agreement.

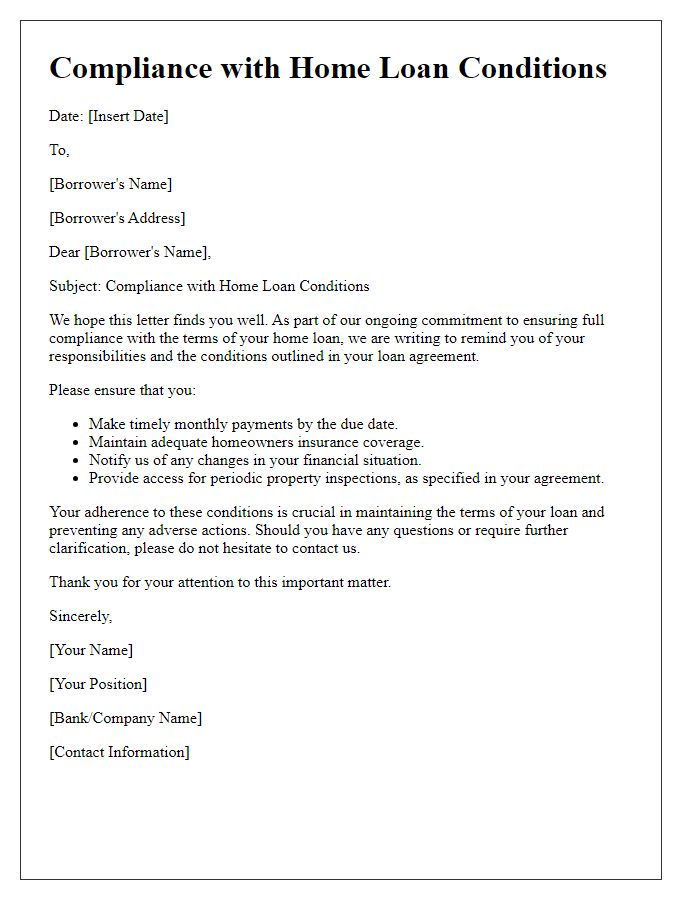

Insurance requirements

Home mortgage insurance requirements often dictate the conditions under which a homeowner maintains coverage for their property, particularly in situations involving Federal Housing Administration (FHA) loans. For those obtaining a mortgage exceeding 80% of the home's appraised value, private mortgage insurance (PMI) is typically mandated until the borrower has accrued at least 20% equity. During the mortgage term, homeowners must ensure that their property insurance meets lender specifications, including coverage limits, policy types, and additional endorsements for natural disasters, such as floods or earthquakes, especially for properties in high-risk areas. Failure to comply with these insurance stipulations may result in heightened risks for both lender and borrower, including potential default consequences or forced insurance placements at significantly higher costs. Regular reviews of insurance policies are vital to ensure continuity and adherence to mortgage agreements.

Escrow account details

Home mortgage agreements often include crucial details about escrow accounts, specifically designed for managing property-related expenses. An escrow account serves as a secure fund set aside for recurring costs, including property taxes and homeowners insurance, ensuring timely payments. The amount deposited monthly could vary based on local tax rates and insurance premiums, affecting overall mortgage payments. For example, a $200,000 home in a region with a 1.25% property tax rate would require approximately $208 monthly solely for taxes. Furthermore, adjustments may occur annually after reassessments, impacting the monthly escrow contributions. Clear communication about these details promotes transparency between lenders and homeowners, fostering a better understanding of financial obligations tied to the property.

Comments