When it comes to securing your dream home, understanding mortgage interest rates is crucial, and we're here to help clarify that journey for you. In today's ever-changing financial landscape, knowing how to confirm your rates can save you both time and money. A well-crafted confirmation letter not only provides reassurance but also establishes a clear communication channel with your lender. So, let's dive deeper into the process and explore some practical tips to help you navigate your mortgage options effectively!

Borrower's Full Name and Address

Mortgage interest rates greatly impact the overall cost of home financing. Borrowers should be aware that current mortgage rates fluctuate based on market conditions. For example, rates can vary significantly between 2.5% and 4.5% for a 30-year fixed mortgage in the United States. Lenders assess various factors, including the borrower's credit score (typically ranging from 300 to 850), loan amount, and property location (such as urban versus rural settings). A higher credit score can lead to more favorable interest rates, potentially saving thousands over the loan term. Additionally, economic indicators like the Federal Reserve's decisions regarding benchmark interest rates can influence mortgage rates, making timely confirmation essential for borrowers considering a fixed-rate mortgage.

Lender's Contact Information

Mortgage interest rates play a crucial role in determining the overall cost of home loans. Current mortgage rates, which fluctuate based on economic conditions, can vary significantly between lenders. Leading financial institutions like Bank of America or Wells Fargo offer competitive rates, often influenced by factors such as credit scores, loan types, and down payments. For example, a 30-year fixed mortgage may present an interest rate around 3.5%, while a 15-year fixed mortgage could offer rates as low as 2.9%. Potential borrowers should contact lenders directly to confirm the most accurate rates and learn about any applicable fees. Utilizing tools like online mortgage rate calculators can help in visualizing the long-term financial impacts. Engaging with a mortgage broker could also streamline the process of finding the best deals tailored to individual financial situations.

Confirmed Interest Rate and Type

Mortgage interest rates play a crucial role in determining the overall cost of borrowing for home buyers. For example, a fixed-rate mortgage with an interest rate of 3.75% over a 30-year term can greatly influence monthly payments, amounting to approximately $1,847 for a $400,000 loan. Conversely, adjustable-rate mortgages (ARMs) might start with a lower initial rate, like 2.5%, but could change periodically, exposing borrowers to potential rate increases later. Lenders also consider factors such as credit scores, down payment amounts, and loan-to-value ratios when determining eligibility for these rates. By confirming these details, home buyers can make informed decisions on their financing options and better plan for long-term financial commitments.

Loan Amount and Terms

The confirmation of mortgage interest rates is essential for potential homeowners; specifically, details regarding the loan amount and terms can significantly influence financial planning. For instance, a loan amount of $250,000 typically spans 30 years, allowing for monthly payments that fit within the borrower's budget. Interest rates can fluctuate; as of October 2023, rates hover around 6.5% for fixed-rate mortgages, impacting the overall cost of the loan. A variable-rate mortgage might start lower at 5.8% but can increase based on market conditions, affecting monthly repayment amounts and total interest paid over time. Such nuances are critical for those navigating home financing in areas like California, where property prices can be exceedingly high, necessitating cautious analysis of mortgage options.

Expiration Date of Rate Offer

The expiration date of a mortgage interest rate offer plays a crucial role in the home-buying process, especially for prospective buyers in competitive real estate markets, such as San Francisco, California. Lenders typically establish a rate lock period, often lasting between 30 to 60 days, during which the offered interest rate remains unchanged regardless of market fluctuations. Understanding that the average mortgage rate as of October 2023 stands at approximately 7.5 percent for a 30-year fixed loan helps potential borrowers gauge their financial commitments. It's vital for buyers to confirm the expiration date of their rate offer to secure favorable terms and avoid sudden increases in monthly payments, which can occur if the rate lock expires before closing the sale. Savvy buyers should remain proactive, reaching out to lenders well before the deadline to discuss any potential extensions or changes to their mortgage terms.

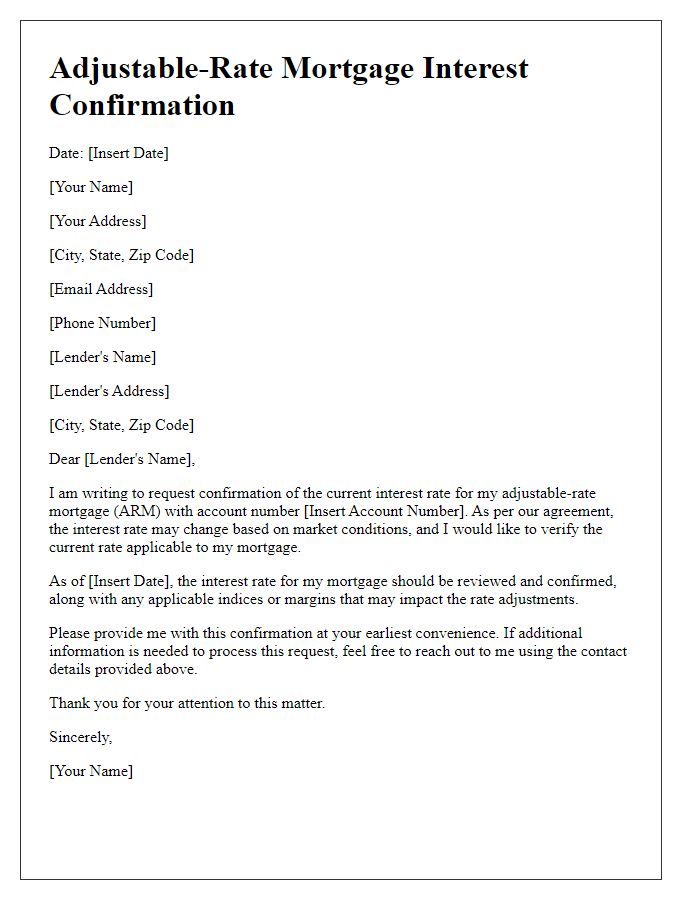

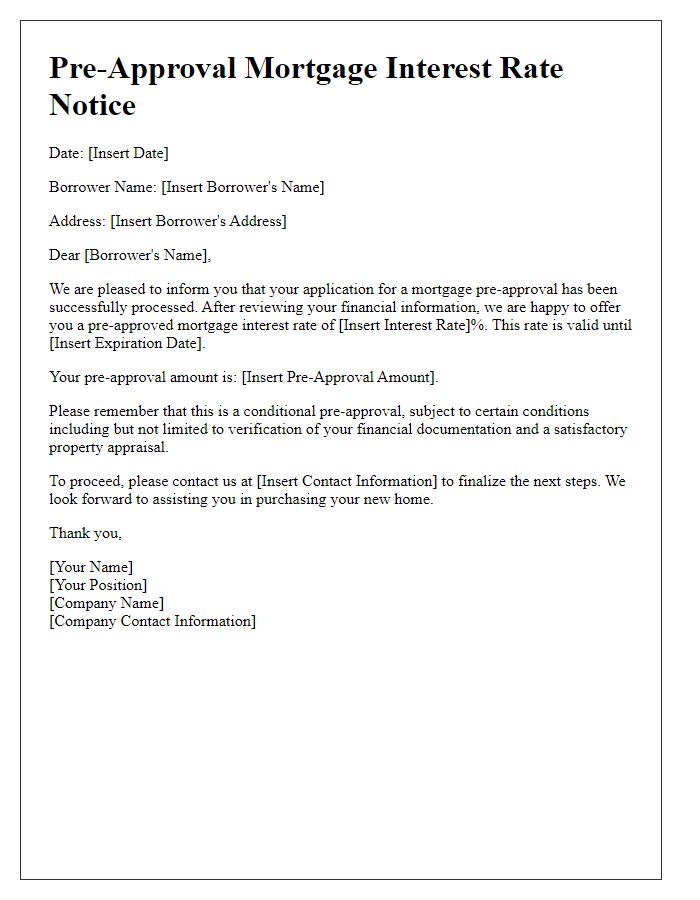

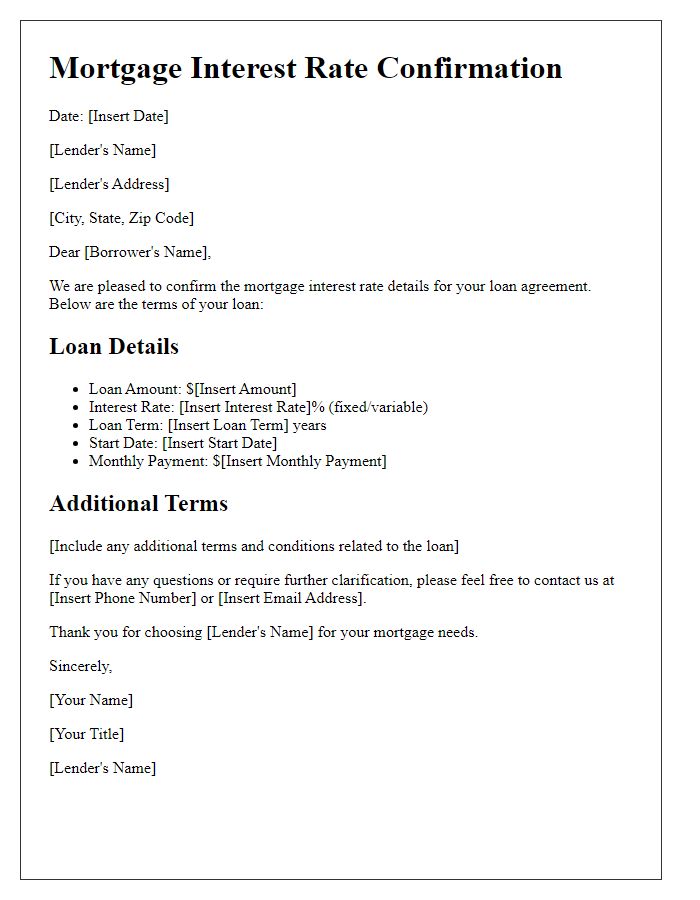

Letter Template For Confirming Mortgage Interest Rates Samples

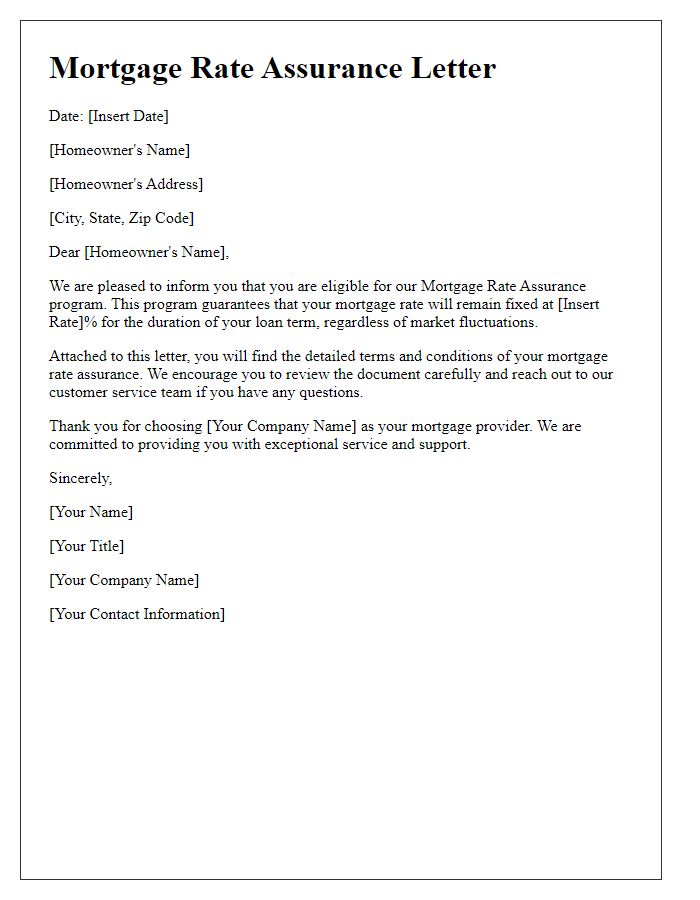

Letter template of verification of mortgage interest rates for applicants.

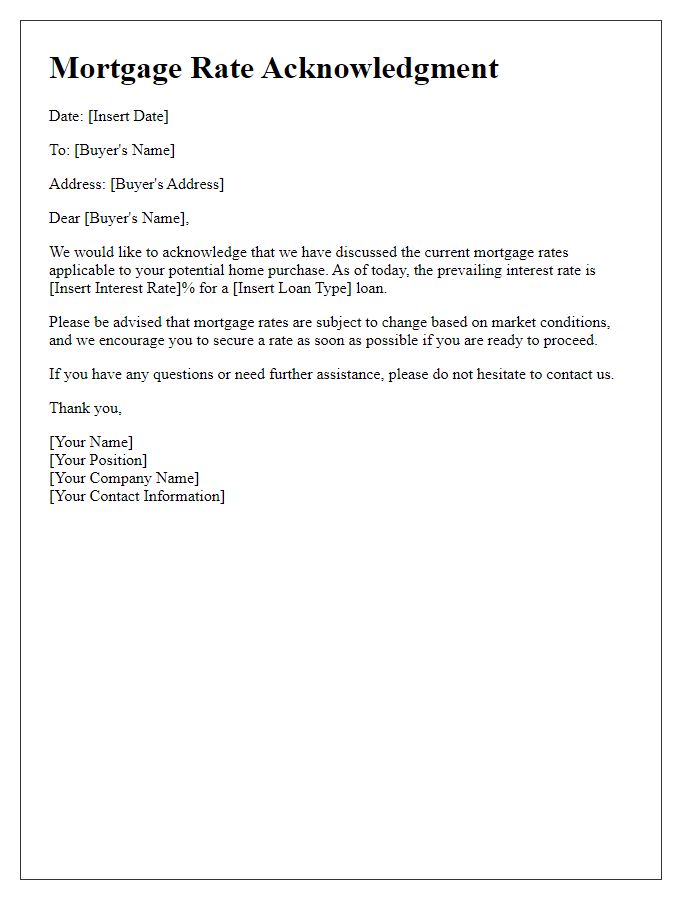

Letter template of interest rate confirmation for refinancing proposals.

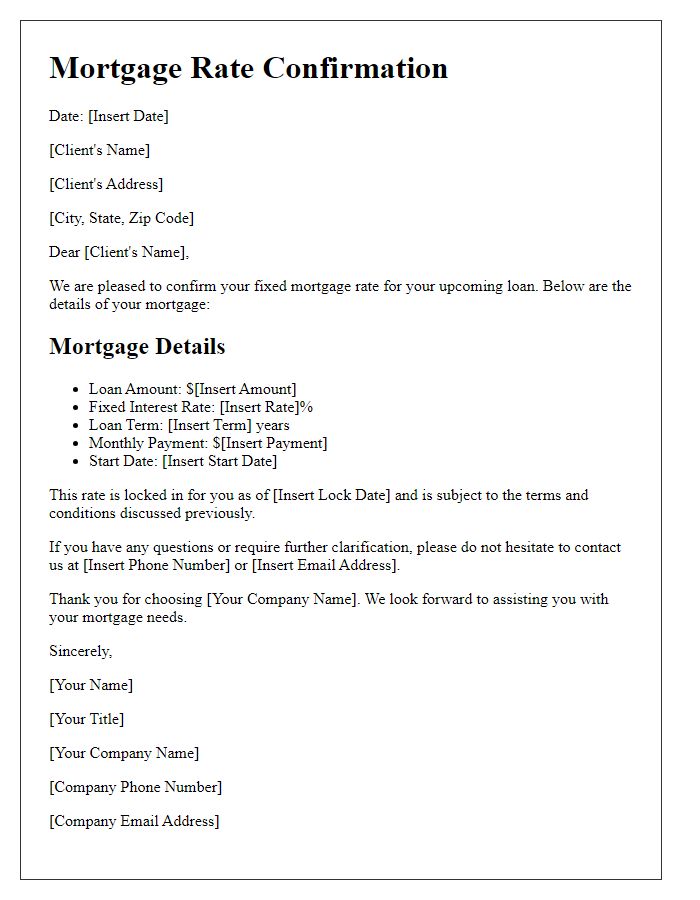

Letter template of official mortgage rate confirmation for real estate transactions.

Comments