Are you feeling a bit anxious about your upcoming balloon mortgage payment? You're not alone; many homeowners face the challenge of planning for that significant payment on the horizon. Understanding the ins and outs of how a balloon mortgage works can make all the difference in ensuring you're financially prepared. Let's dive deeper into some effective strategies and tips for successfully managing your balloon mortgage payoff.

Accurate Loan Details

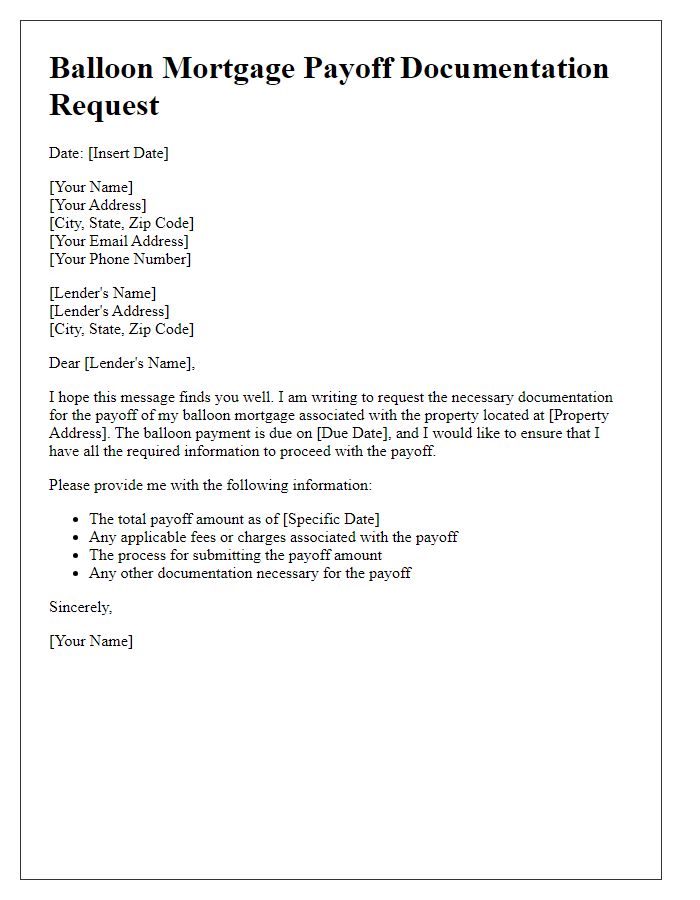

A balloon mortgage, commonly encountered in real estate financing, typically features a short loan term (often 5 to 7 years) with fixed monthly payments based on a longer amortization schedule (such as 30 years). At the end of the term, a substantial lump sum payment, known as the balloon payment, is required to pay off the remaining principal balance. Accurate loan details, including the original loan amount, interest rate (often fixed or variable), payment schedule, and maturity date, are vital for effective payoff planning. Borrowers should also consider the potential impact of interest rate fluctuations on refinancing options prior to the balloon payment due date, thereby ensuring that adequate resources are allocated for the final settlement. Additionally, understanding local real estate market conditions can influence decisions regarding property appreciation or refinancing strategies.

Current Financial Status

A balloon mortgage represents a loan type with a large final payment due at the end of the loan term, commonly five to seven years, after a series of smaller monthly payments. Homeowners need to carefully assess their current financial status, including income sources, monthly expenses, and savings to plan the payoff effectively. Interest rates, which can fluctuate based on market conditions, play a crucial role in determining overall repayment costs. Additionally, it's essential to consider the current property value, as real estate markets can vary significantly, impacting refinancing options. Planning a payoff may involve seeking alternative financing, such as refinancing into a fixed-rate mortgage, or creating a savings strategy to ensure sufficient funds are available for the balloon payment when it comes due. Expert financial advice from professionals, like certified financial planners or mortgage brokers, can provide valuable insights tailored to individual circumstances.

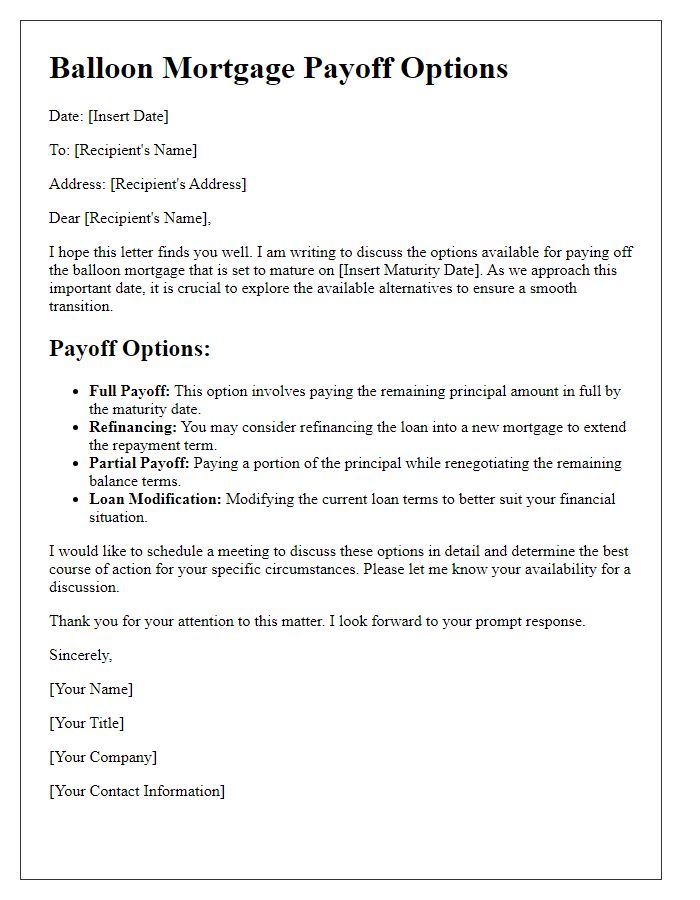

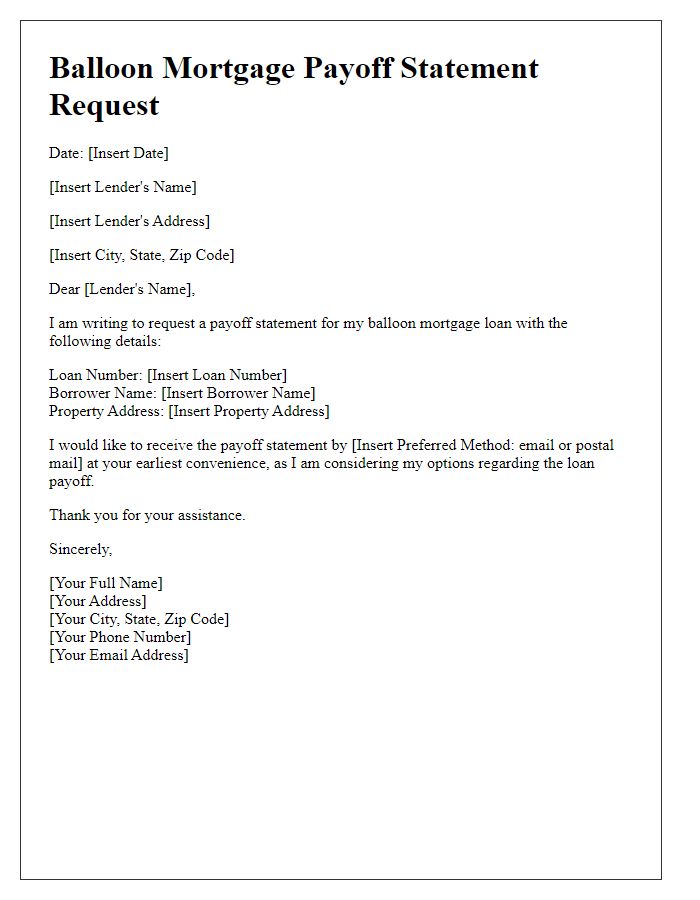

Payoff Amount Strategy

A balloon mortgage requires careful planning due to its unique structure, typically featuring a lower interest rate and monthly payments over a shorter period, such as five or seven years, culminating in a large final payment, known as the "balloon payment." Understanding the payoff amount is crucial for homeowners, especially for those in high-cost regions like California, where property values fluctuate dramatically. Strategies include saving aggressively in a high-yield savings account, refinancing options that may reduce overall debt, or considering home equity lines of credit (HELOCs) as necessary funds to cover the balloon payment. Consulting with financial advisors or mortgage specialists who can provide insights tailored to individual circumstances, such as current market trends and personal credit scores, can greatly enhance the effectiveness of a payoff strategy.

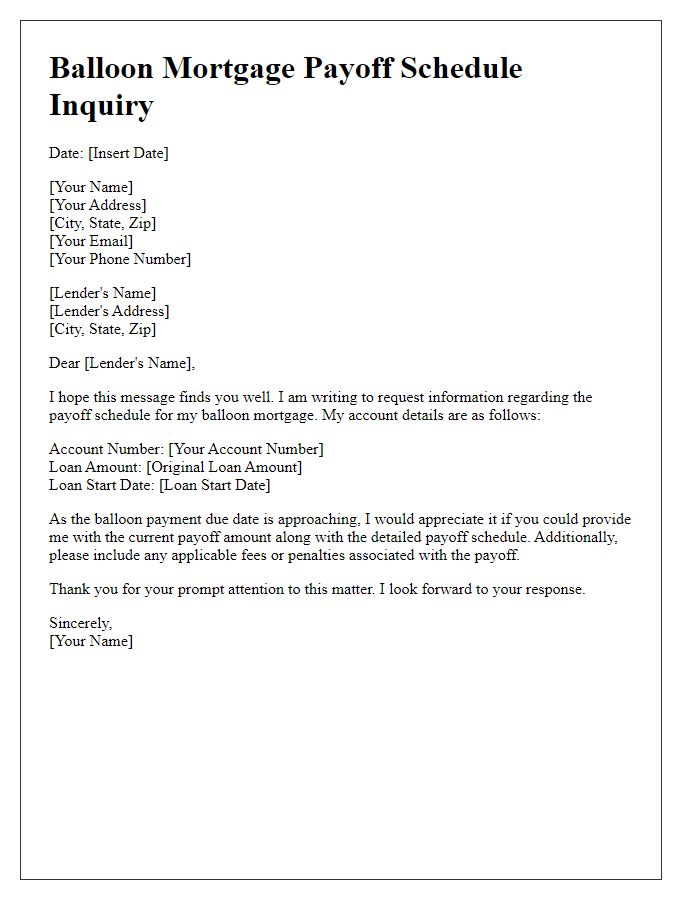

Timing and Deadlines

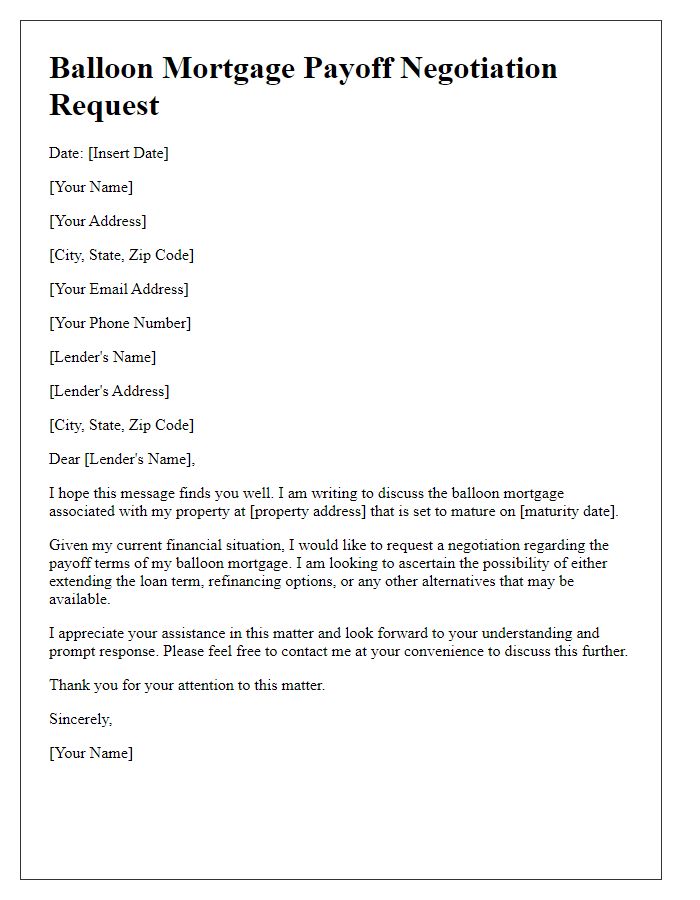

A balloon mortgage payoff plan involves a strategic timeline to ensure timely payment of the principal balance before the term ends. The balloon payment, often due five to seven years after origination, can significantly impact financial planning, necessitating early preparation. Homeowners should track critical deadlines, such as the loan's maturity date, which is typically specified in the mortgage agreement. Financial institutions may also require advance notice for payoff requests, often three to four weeks prior to the due date. Additionally, securing alternative financing, such as a conventional mortgage or refinancing options, should begin well in advance, ideally six months before the balloon payment is due. This proactive planning method can help avoid potential pitfalls, late fees, and the stress of sudden financial burdens.

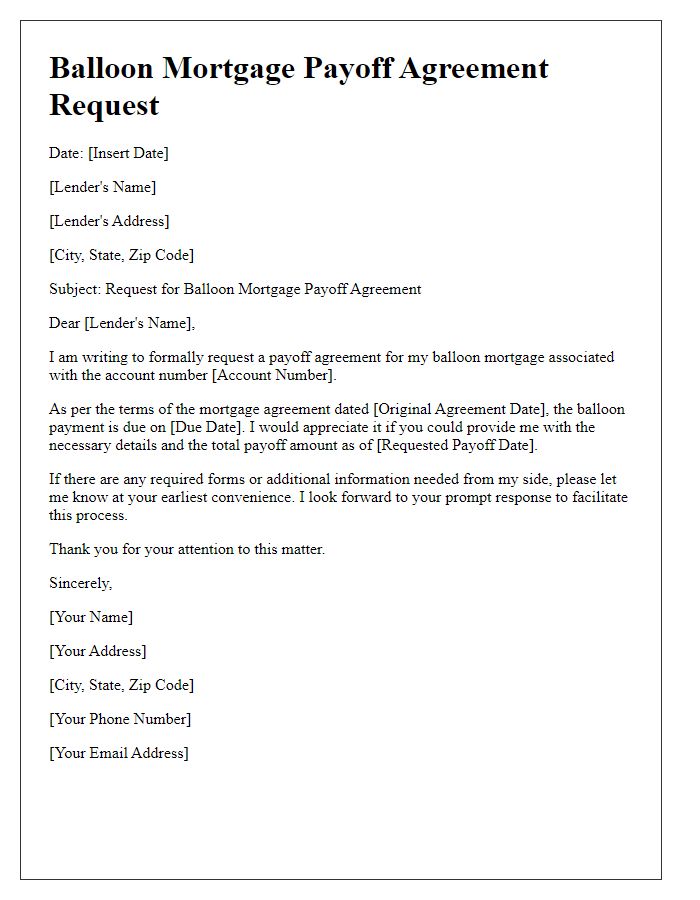

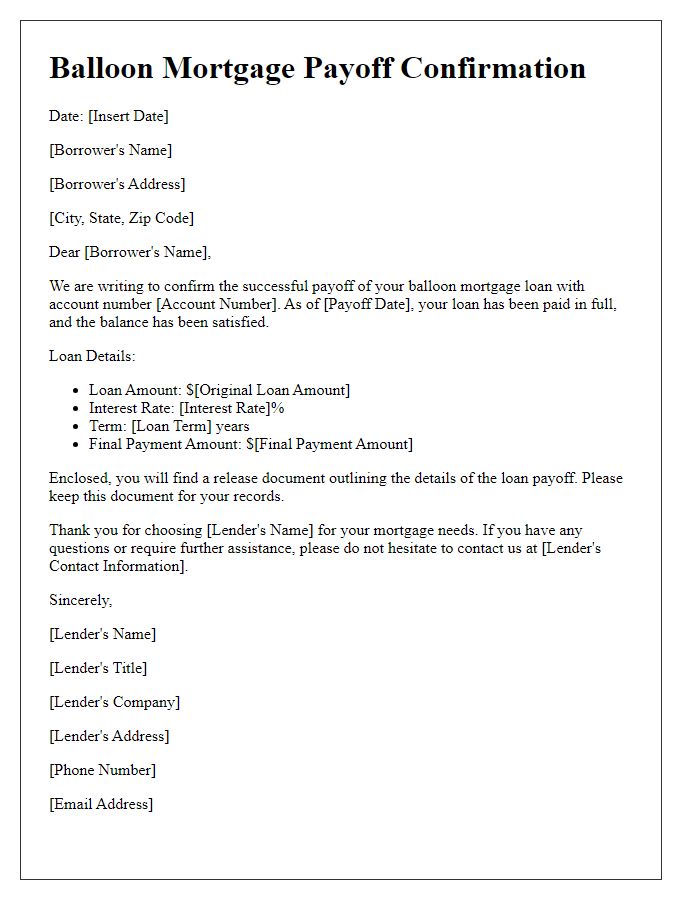

Contact Information for Assistance

Balloon mortgages require strategic planning for payoff, particularly when the final balloon payment is due. Understanding repayment terms and timelines is crucial for borrowers. Notable financial institutions offering balloon mortgage options include Wells Fargo and Bank of America, each featuring various terms ranging from five to seven years. Borrowers should calculate the balloon payment, which can sometimes exceed the original loan amount, necessitating careful financial management. Engaging financial advisors or mortgage specialists can provide personalized strategies, including refinancing options or savings plans, to meet payment obligations, ensuring a smooth transition at the end of the loan period.

Comments