Are you feeling overwhelmed by your mortgage payments and considering the possibility of deferment? You're not alone; many homeowners are seeking ways to ease their financial burden. In this article, we'll explore how to effectively communicate with your lender to request a deferment on your mortgage payments. So, if you're ready to regain some financial breathing room, read on for valuable tips and a helpful template!

Borrower's personal information

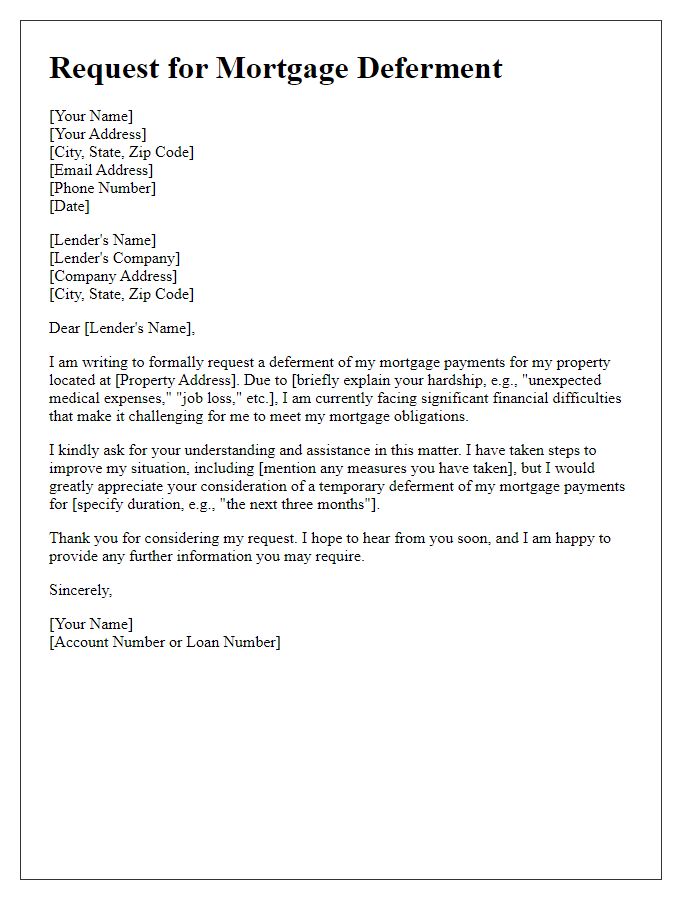

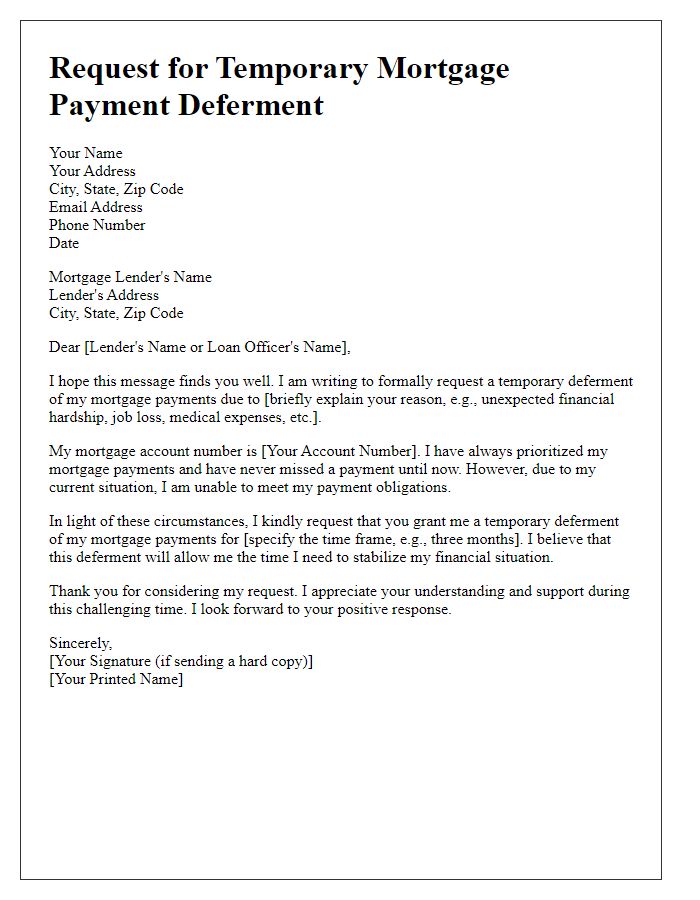

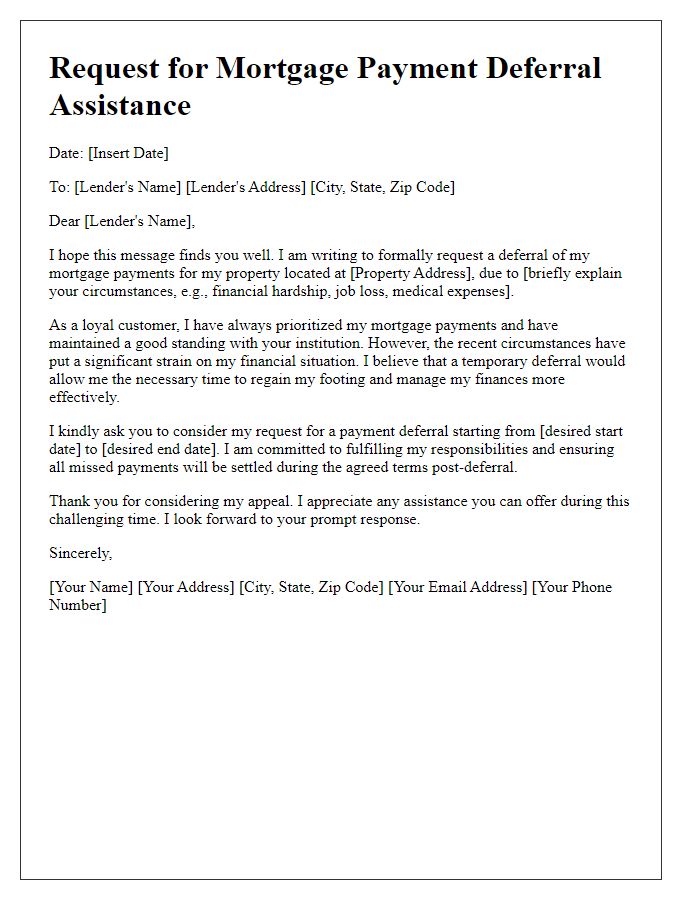

A deferment of mortgage payments request involves specific borrower's personal information, including name, address, phone number, and email. The borrower's unique identification number, such as Social Security Number or Tax Identification Number, may be necessary for verification. Current mortgage details include the loan number and lender's name, amount owed, and original loan date. Documentation supporting the financial hardship, such as recent pay stubs, bank statements, or unemployment letters, enhances the request's validity and urgency, ensuring the lender comprehends the borrower's situation comprehensively. The request should clearly state the desired deferment period, typically ranging from three to six months, depending on the lender's policies and the borrower's needs.

Lender's details

Mortgage deferment requests can provide essential relief for homeowners facing financial difficulties, especially during events like economic downturns or natural disasters. Lender details typically include the company name, address (including city, state, ZIP code), and contact information such as phone number and email. Homeowners must identify the specific loan number associated with their mortgage to ensure proper processing of the deferment request. Including the original loan agreement date can also help frame the context of the request. Providing supporting documentation, such as proof of unemployment or medical expenses, enhances the chances of a favorable response from the lender.

Reason for deferment request

Financial hardships, such as unexpected medical expenses or job loss, can lead to the need for mortgage payment deferment. The Mortgage Payment Deferment (MPD) program, offered by many lenders, assists homeowners facing temporary financial difficulties. This program allows borrowers to suspend or reduce payments for a specified period, typically ranging from three to twelve months, without affecting their credit score. Providing documentation, such as employment termination letters, medical bills, or tax returns, can support the deferment request. Homeowners must communicate directly with their mortgage servicer to understand eligibility criteria and the application process, ensuring they initiate the request promptly to avoid penalties.

Proposal for revised payment plan

Homeowners experiencing financial difficulties due to unforeseen circumstances, such as job loss or medical emergencies, may seek a deferment of mortgage payments from lenders. A detailed proposal for a revised payment plan can outline a temporary reduction in payments or a forbearance period. Important elements include the borrower's account number, property address, and specific financial hardship details. Additionally, the proposal can suggest a timeframe for the deferment, typically ranging from three to six months, with an assurance to resume full payments thereafter. Including supporting documents, such as income statements and bank statements, can strengthen the request and provide lenders with a clearer understanding of the borrower's situation. Effective communication with mortgage servicers, whether located in regional offices or online platforms, is crucial in facilitating the request.

Supporting documents and evidence

Mortgage deferment requests provide crucial relief for homeowners facing financial difficulties. Borrowers must submit supporting documents such as income statements, unemployment letters, bank statements, or tax returns to demonstrate their current financial hardship. These documents assist mortgage lenders in assessing the borrower's eligibility for deferred payment plans or hardship programs. Commonly requested forms of evidence include pay stubs from recent employment, termination letters exhibiting loss of income, and any other relevant financial documentation that highlights an inability to maintain regular mortgage payments. Each supporting document reinforces the request, ensuring a comprehensive understanding of the borrower's circumstances.

Letter Template For Deferment Of Mortgage Payments Samples

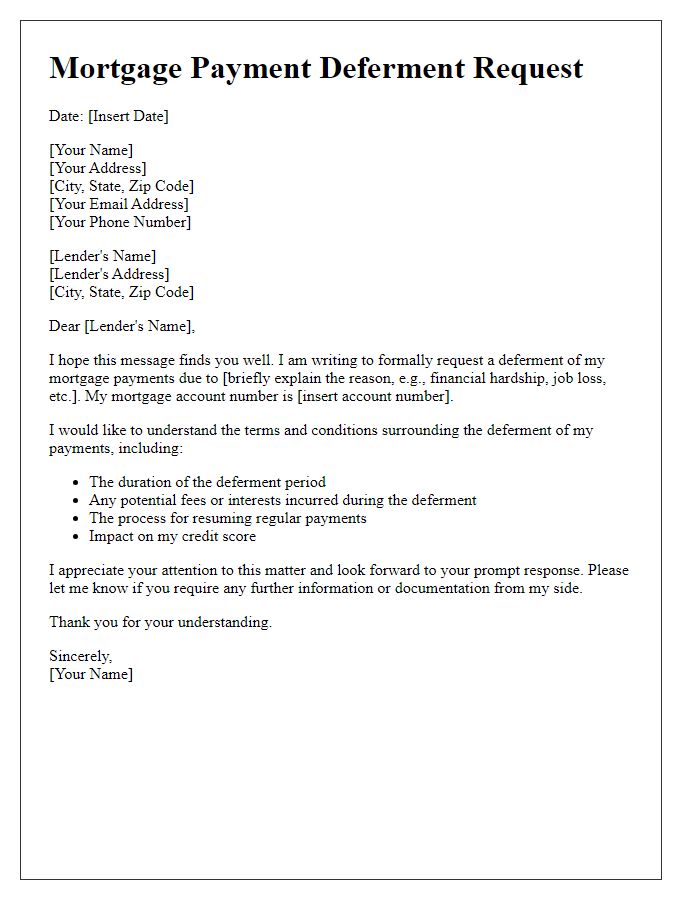

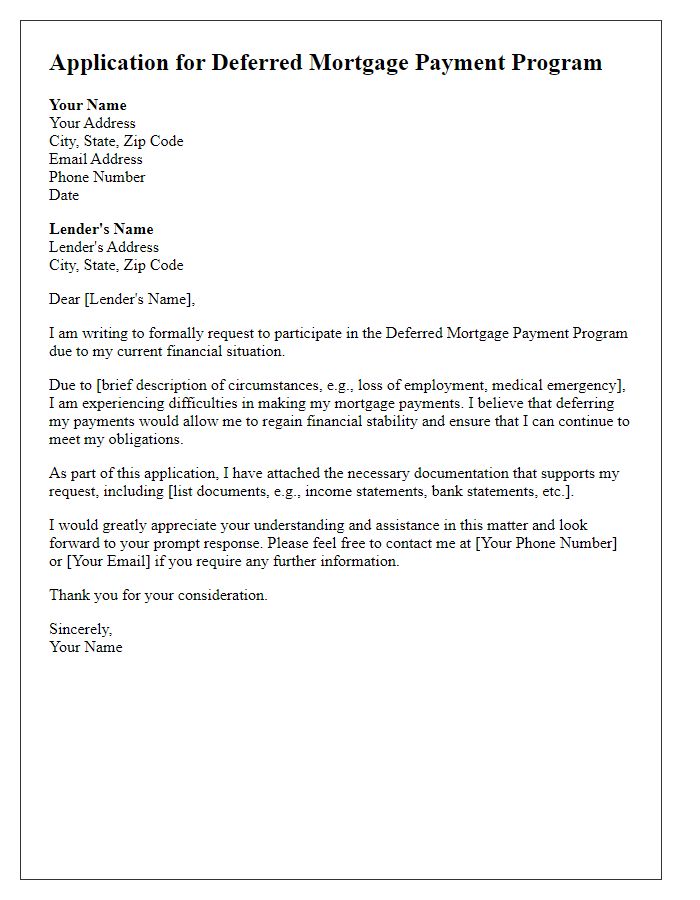

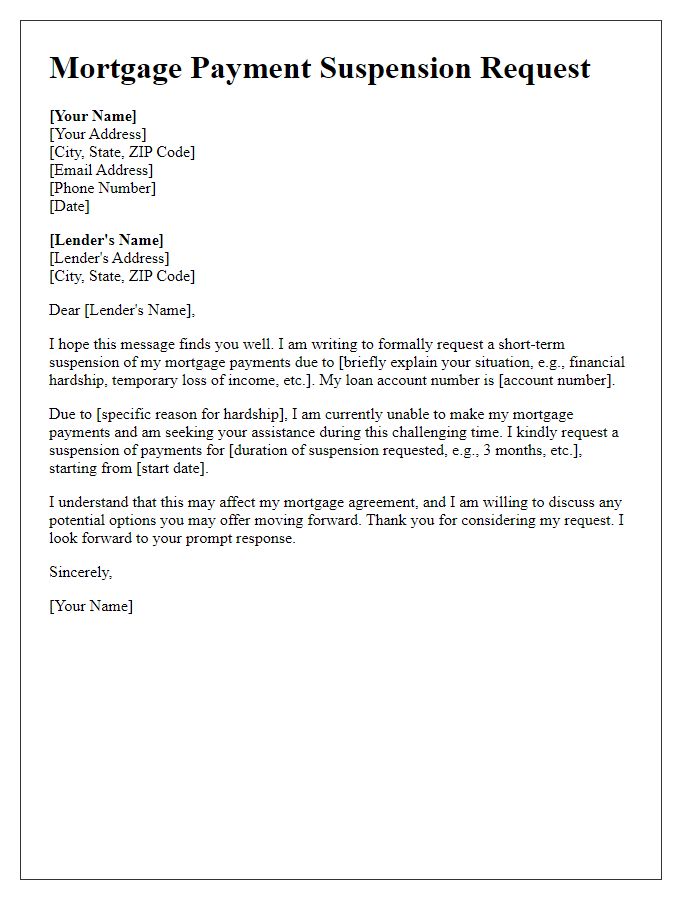

Letter template of formal request for mortgage deferment due to hardship.

Comments