Hey there! If you've ever experienced the unsettling wait for a mortgage closing, you're not alone. In today's bustling real estate market, delays can happen for various reasons, leaving buyers at a crossroads. But don't worry; understanding the process can ease some of that stress, and we're here to help guide you through it. Let's dive into the essential information you need to know and what steps you can take moving forward!

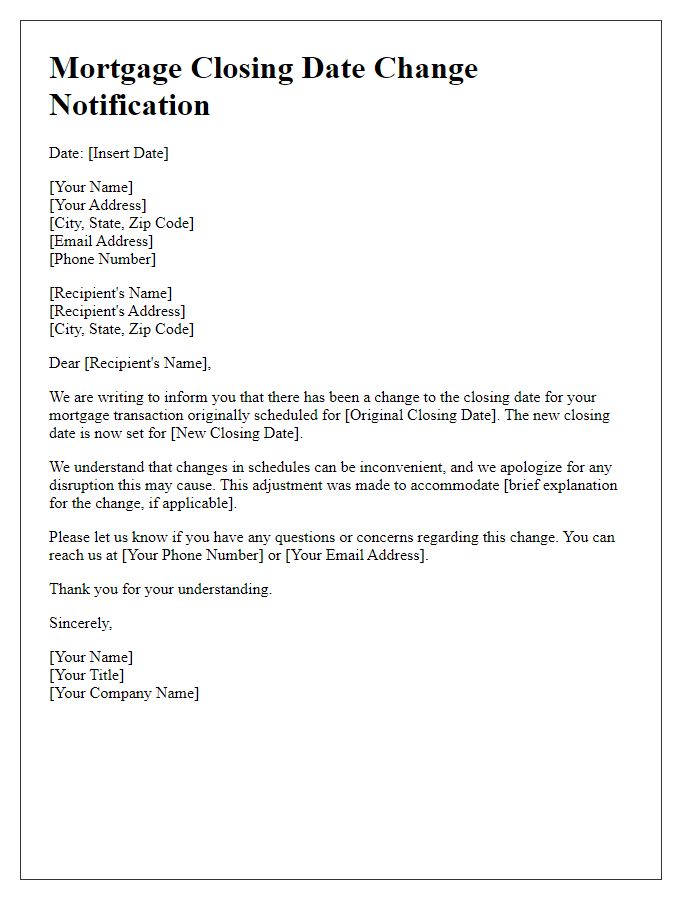

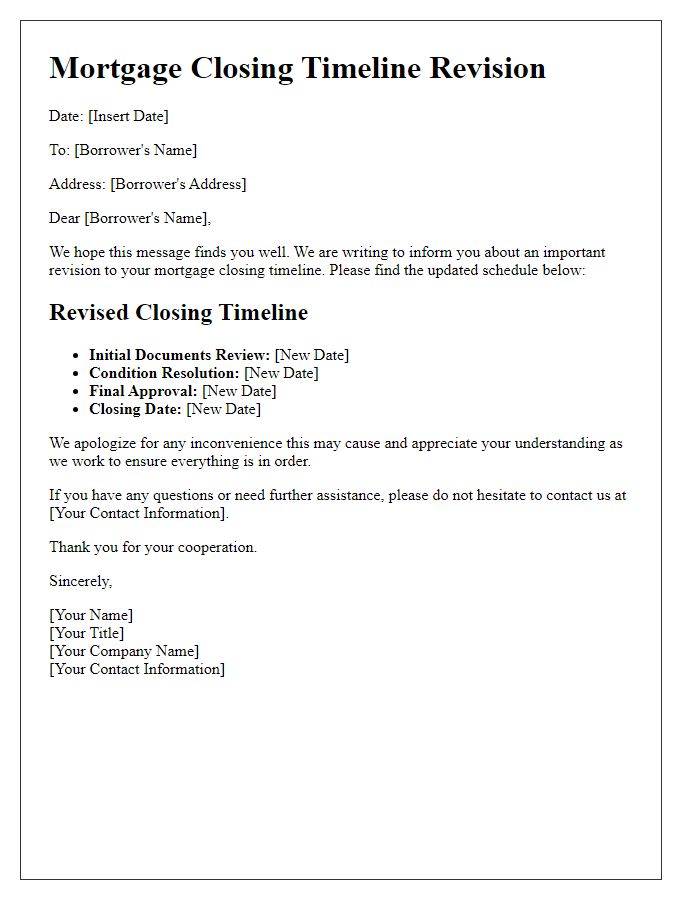

Clear Subject Line

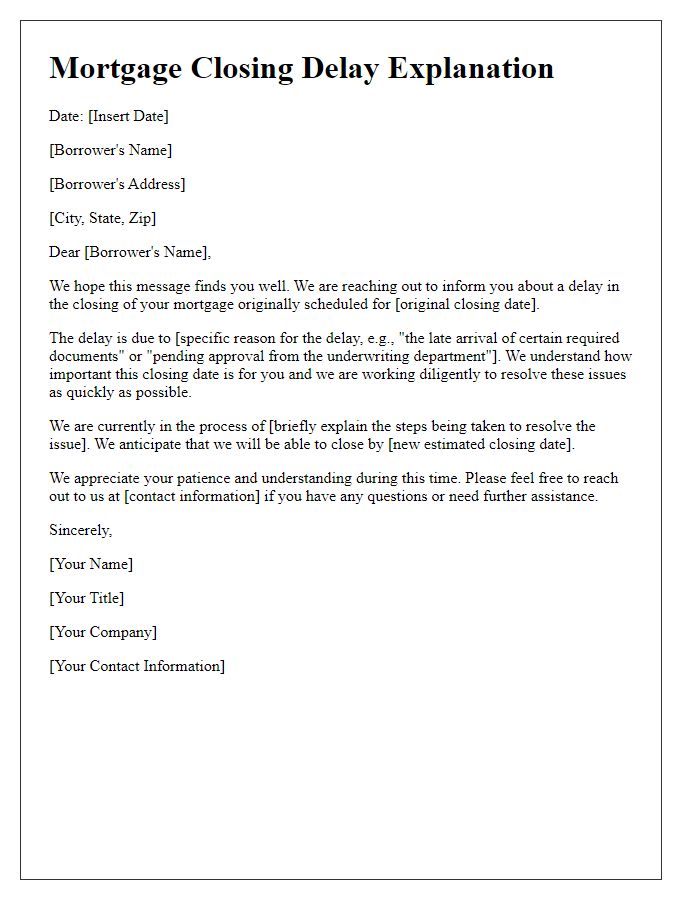

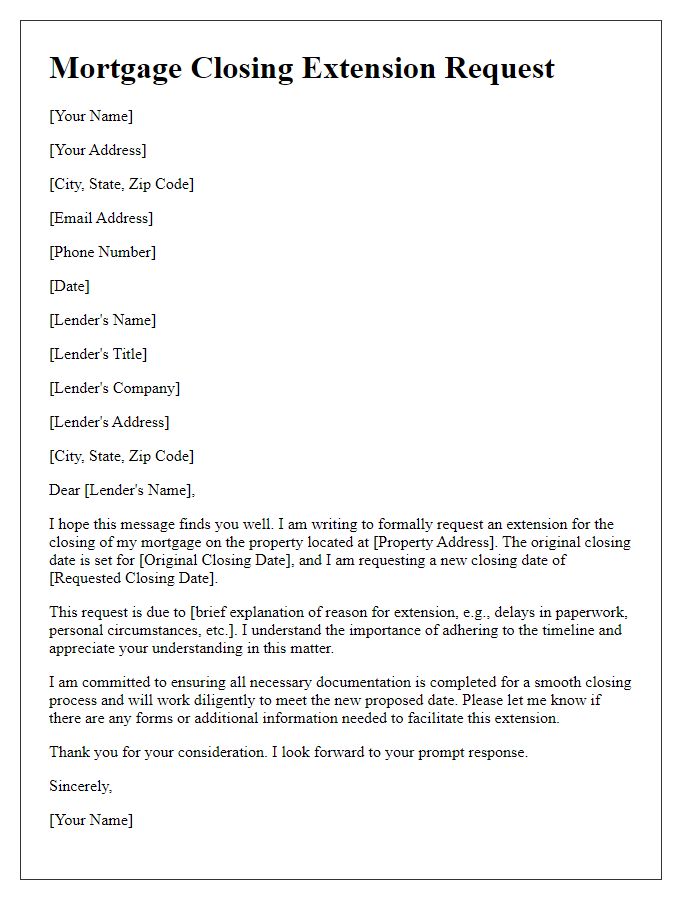

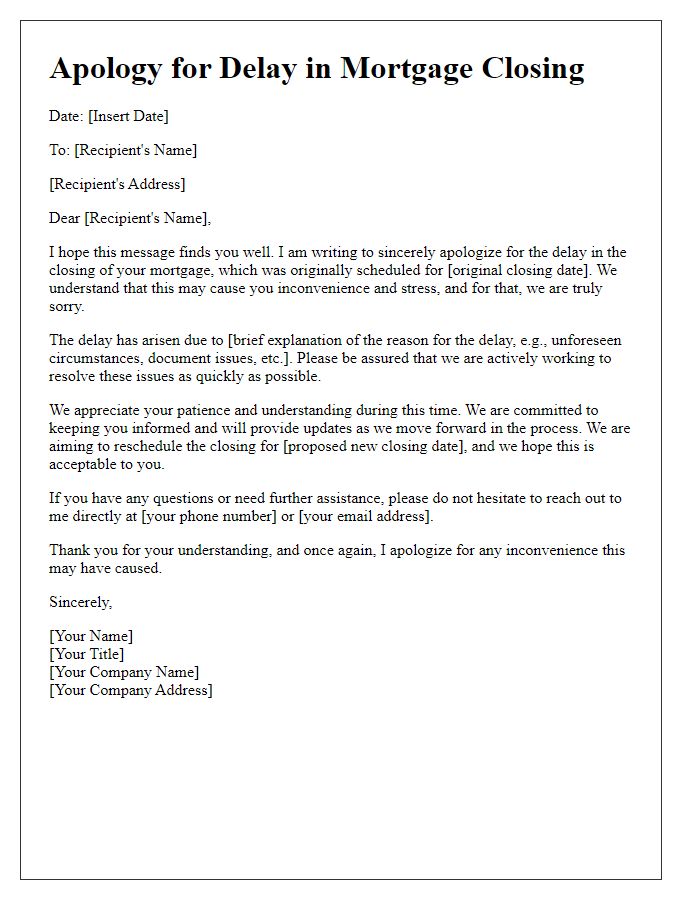

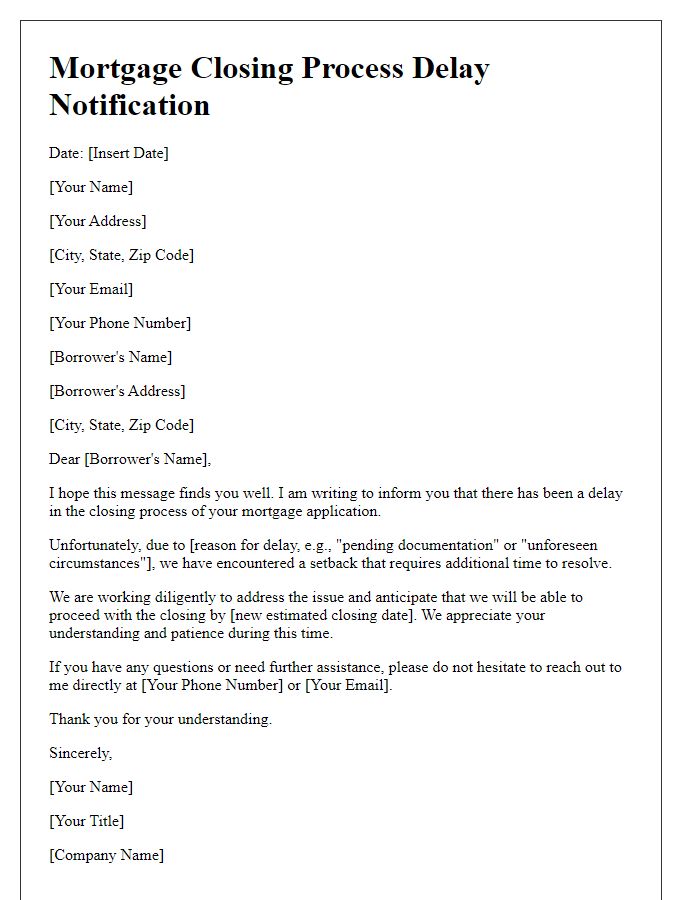

Mortgage closing delays can impact borrowers' plans significantly, often due to unforeseen circumstances. Common causes include missing documentation, appraisal issues, or title problems. Communication is essential to keep all parties informed. For instance, notifying borrowers about a delay should include a revised timeline, specific reasons for the delay, and steps being taken to resolve the situation. Ensuring transparency in communication helps maintain trust, and understanding can alleviate borrower concerns about the closing process, which typically occurs in a specified timeframe often marked by legal obligations.

Recipient Information

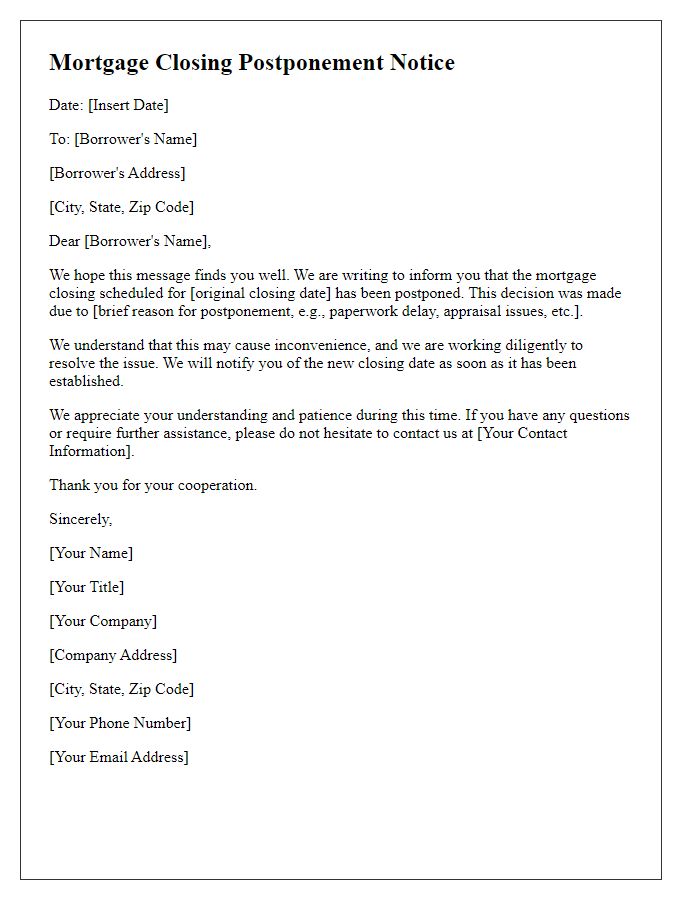

Mortgage closing delays can create significant stress for homebuyers and lenders alike. Notifications must be clear and concise, providing essential details about the postponement. Common reasons include missing documentation, appraisal issues, or compliance checks. Affected parties, such as buyers and real estate agents, should be informed promptly, ideally via email or certified mail. Important information includes the original closing date, new proposed dates, reasons for the delay, and any required actions by the recipients to expedite the process. This transparency helps maintain trust and keeps all parties aligned amid potential frustrations.

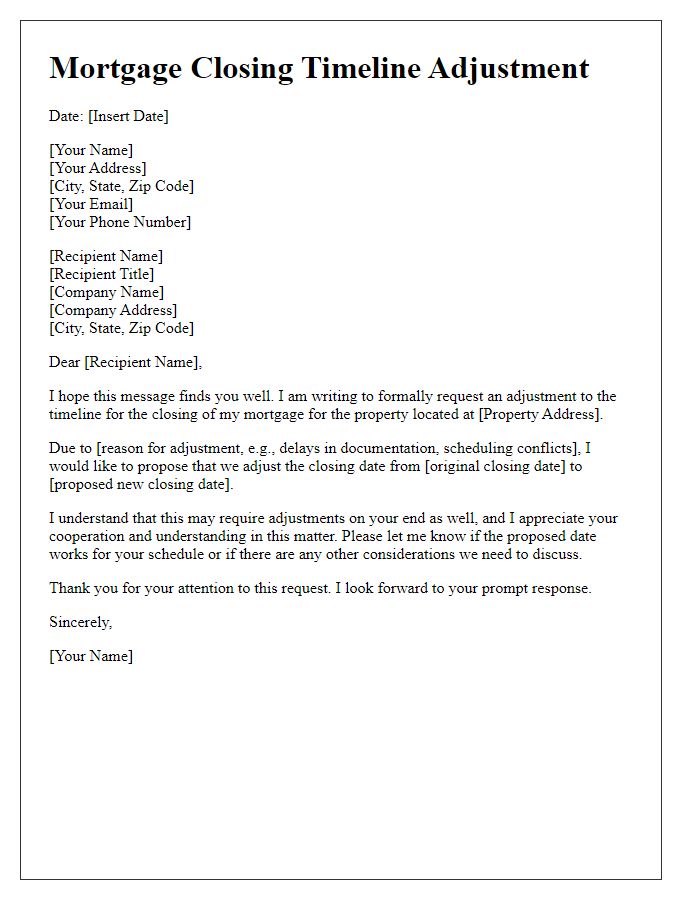

Explanation of Delay

Mortgage closing delays can occur due to various factors, such as incomplete documentation or title issues. For instance, a missing tax return could delay processing for weeks. Additionally, property appraisals may result in unforeseen setbacks, especially if discrepancies arise in value assessments. Underwriting complications are common, particularly if a borrower's credit history presents challenges. Communication from financial institutions like banks or mortgage companies must be clear and timely to prevent frustration for involved parties. Furthermore, external factors like market trends or economic shifts can influence timelines unexpectedly, necessitating adaptability from borrowers and lenders alike. Proper notification and explanation of these delays can maintain trust between stakeholders.

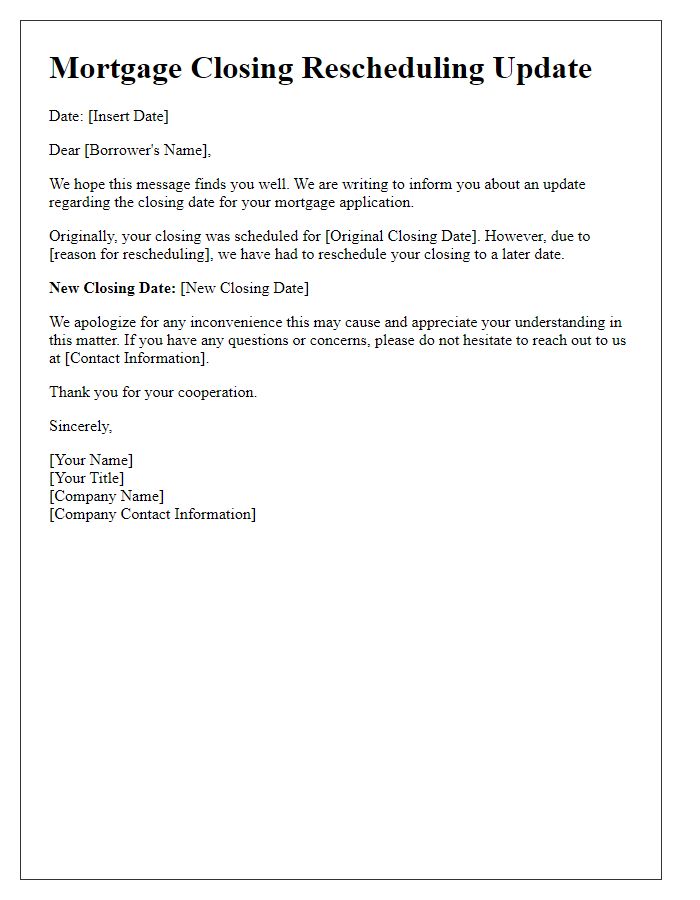

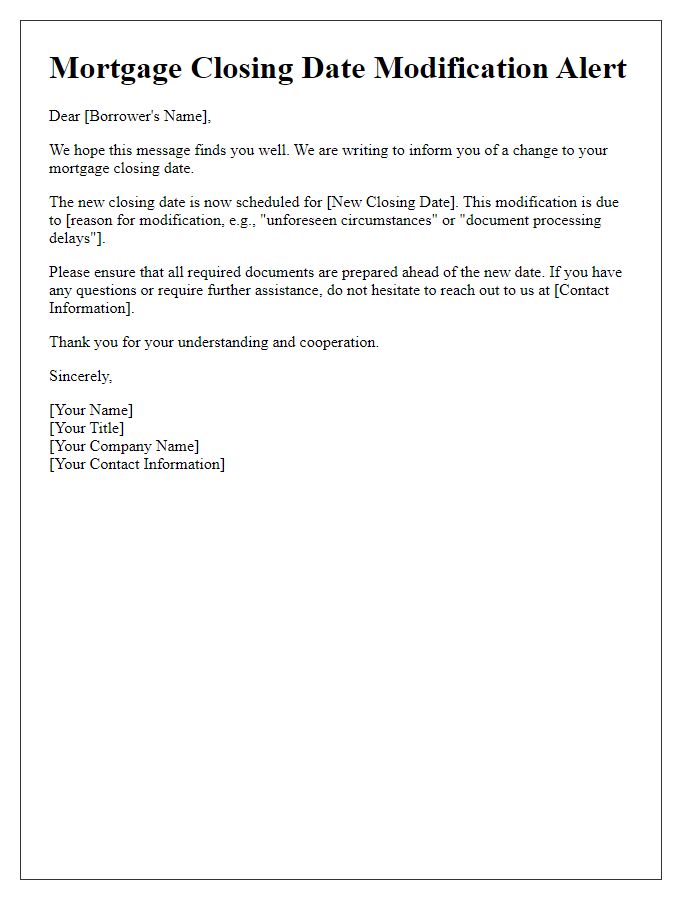

Revised Closing Date

Homebuyers often face unexpected delays during the mortgage closing process, which can shift the anticipated closing date significantly. For example, a buyer in Massachusetts expecting to close on a new property on August 15, 2023, may receive a notification stating the revised closing date has been pushed to August 30, 2023, due to pending documentation from the lender. Key factors causing these delays may include discrepancies in the appraisal report, additional requests for financial documentation, or unforeseen title issues that require resolution from local authorities. Communication from the mortgage lender is crucial during this period, providing updates and necessary steps for the buyers to follow, ensuring a smoother transition to homeownership despite the delays.

Contact Information

Mortgage closing delays can significantly impact home buyers and sellers. A notification regarding delays typically includes the contact information of the parties involved. Including specific details like the name of the mortgage company, the loan officer's contact number, and email address ensures clear communication. Referring to key dates such as the original closing date (e.g., April 15, 2023) and the expected delay period allows all parties to understand the timeline. Additionally, stakeholders may inquire about potential reasons for the delay, such as pending documentation or appraisal issues, which could further clarify the situation.

Comments