Have you ever wondered what happens to unclaimed funds that seem to vanish into thin air? It's a surprisingly common situation where money is left sitting in accounts just waiting to be discovered. Whether it's uncashed checks, forgotten savings, or stale estate accounts, you might be surprised at the amount of unclaimed funds that might belong to you or someone you know. Read on to find out how to track down these potential treasures and reclaim what's rightfully yours!

Clear Recipient Identification

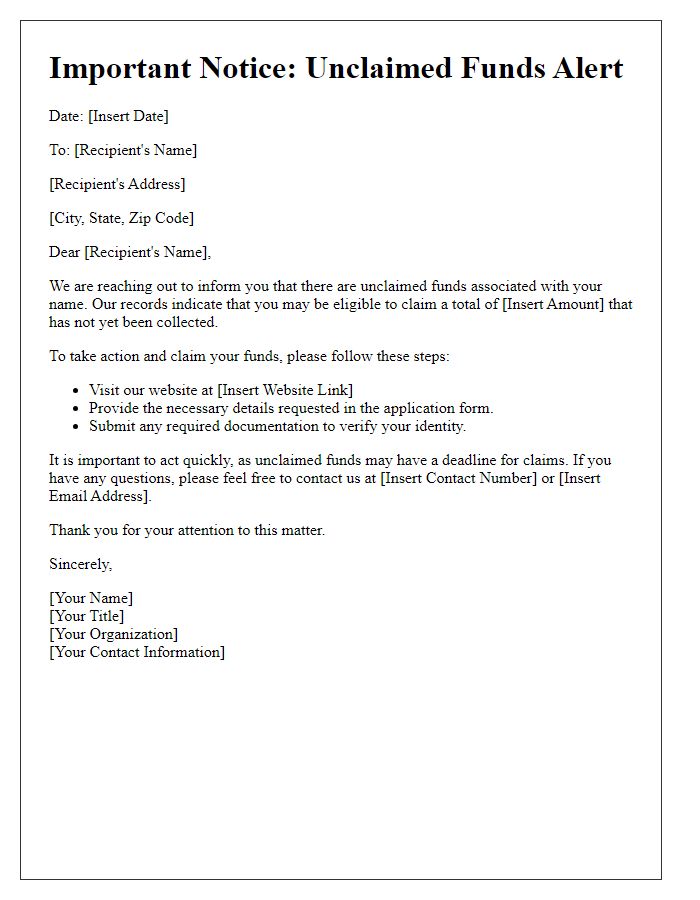

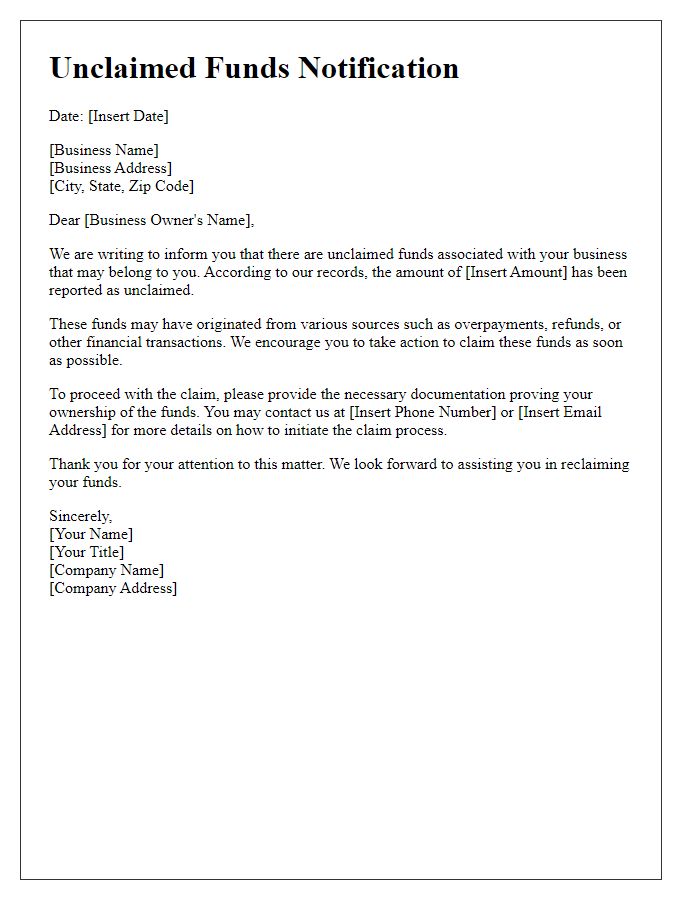

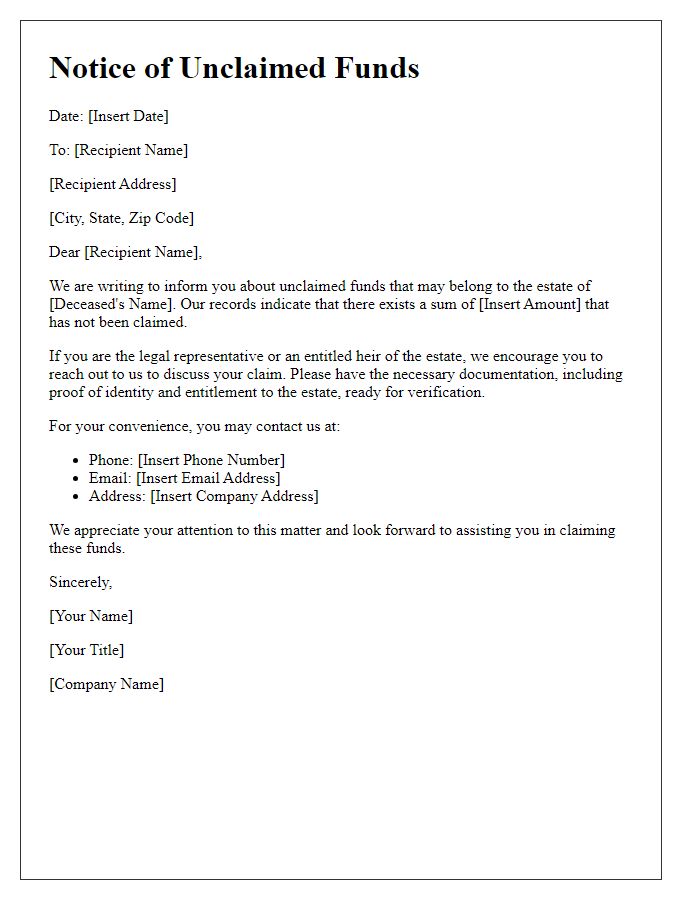

Unclaimed funds notification typically involves a detailed identification process to ensure the rightful recipient is accurately recognized. This can include gathering personal data such as full name, Social Security number, and last known address (including city and state) to confirm identity. It may also require additional verification, such as previous account numbers or transaction records associated with the unclaimed funds, which can number in the thousands across various entities. Frequently, these funds originate from banks, insurance companies, or government agencies, each having distinct reporting periods which can range from three to five years before assets are classified as unclaimed. Promptly detailing this information can facilitate the retrieval process for entities involved in holding unclaimed property.

Precise Claim Details

Unclaimed funds often represent amounts owed to individuals that have not been accessed or claimed. In the United States, various states manage these financial assets, with a significant number totaling billions of dollars. These funds may arise from sources such as uncashed checks, forgotten savings accounts, or dormant insurance policies. For example, the State of California holds over $10 billion in unclaimed money as of 2023, belonging to citizens who may not be aware of their entitlements. Notification of unclaimed funds usually includes precise claim details, such as names, social security numbers, and amounts owed, allowing individuals to verify their identities and claim their rightful money efficiently. The process is typically handled by the State Controller's Office, which frequently publishes online databases for easy public access and claims submission.

Explicit Instructions for Claim

Unclaimed funds notifications often involve significant amounts of money, occasionally reaching thousands of dollars. Recipients must follow detailed instructions to claim assets, typically held by government agencies or financial institutions for periods exceeding five years. Key steps include completing a claim form, providing identification documents such as a government-issued ID or Social Security number, and submitting evidence of ownership, like bank statements or legal documents. The claim must be sent to designated offices, for instance, the State Treasurer's Office, within specified timeframes to avoid expiration. Additional verification processes may involve background checks to confirm rightful ownership of the unclaimed funds. Timely and accurate submission ensures potential recovery of dormant assets.

Contact Information

Unclaimed funds notifications often involve significant amounts of money that may belong to individuals or organizations. Unclaimed funds, such as refunds, dividends, or deposits, can result from transactions in banks, utility companies, or government agencies. The Federal Trade Commission (FTC) provides guidelines to ensure proper handling of such notifications, emphasizing transparency and protection against fraud. Contact information should include the official name of the organization responsible for the unclaimed funds, a dedicated phone number, email address, and physical address to facilitate inquiries. Additionally, including a web address to an official state or national database may help individuals verify the legitimacy of the notification. Compliance with privacy laws is essential to protect sensitive information.

Legal and Authorization Disclosures

Unclaimed funds notifications, involving financial assets like dormant bank accounts or uncashed checks, require careful legal and authorization disclosures. Entities like state treasurers or financial institutions must follow local regulations (such as the Uniform Unclaimed Property Act in the U.S.) to notify the rightful owners. These notifications may detail the amount of unclaimed funds, methods for claiming the assets, and deadlines for claims submission, often governed by time limits (typically three to five years) based on jurisdiction. Additionally, disclosures should outline any necessary identification and authorization documents (like government-issued ID or proof of address) required for the claims process, ensuring compliance with identity verification protocols. Such notifications also emphasize the importance of maintaining up-to-date contact information to prevent future unclaimed situations.

Comments