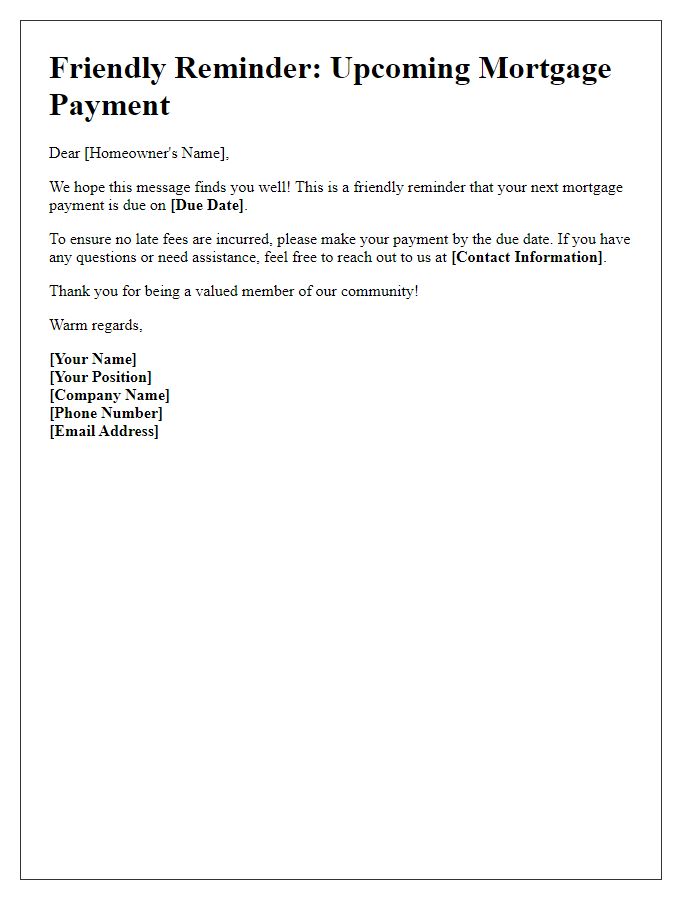

Hey there! If you've ever found yourself juggling bills and deadlines, you know how easy it is to let a mortgage payment slip your mind. That's why having a friendly reminder can be a lifesaver, helping you stay on track and avoid late fees. In this article, we'll walk you through a simple yet effective letter template for reminding someone about their mortgage payment. So, let's dive in and make those reminders a breeze!

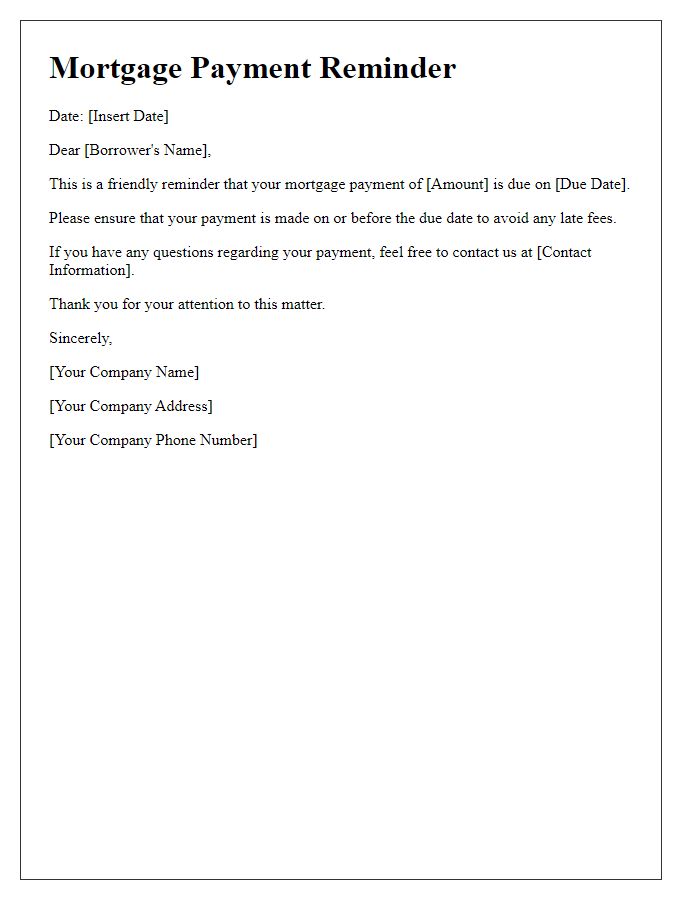

Personalized greeting

Mortgage payments due on the first of each month prompt the obligation to stay current on financing for homes, often held through institutions such as banks or credit unions. Missing a deadline can incur late fees, which typically range from 5% to 10% of the unpaid amount. Maintaining a good credit score, essential for future loans or refinancing, depends on consistent payment history. Homeowners in states like California or Texas should note that local regulations may offer protections against excessive late charges. These details reinforce the importance of timely mortgage payments to ensure financial stability and ownership security.

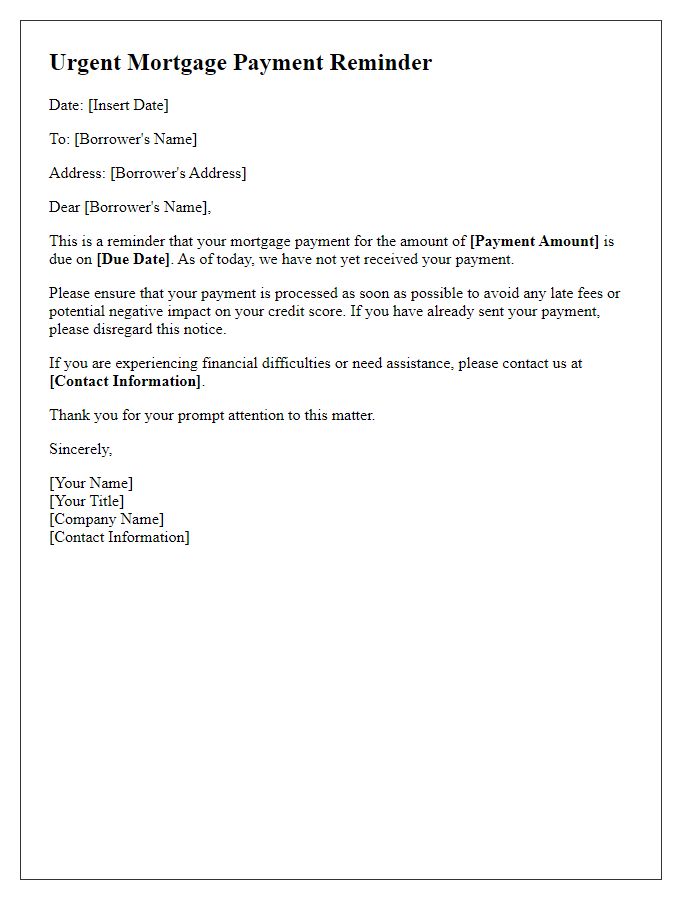

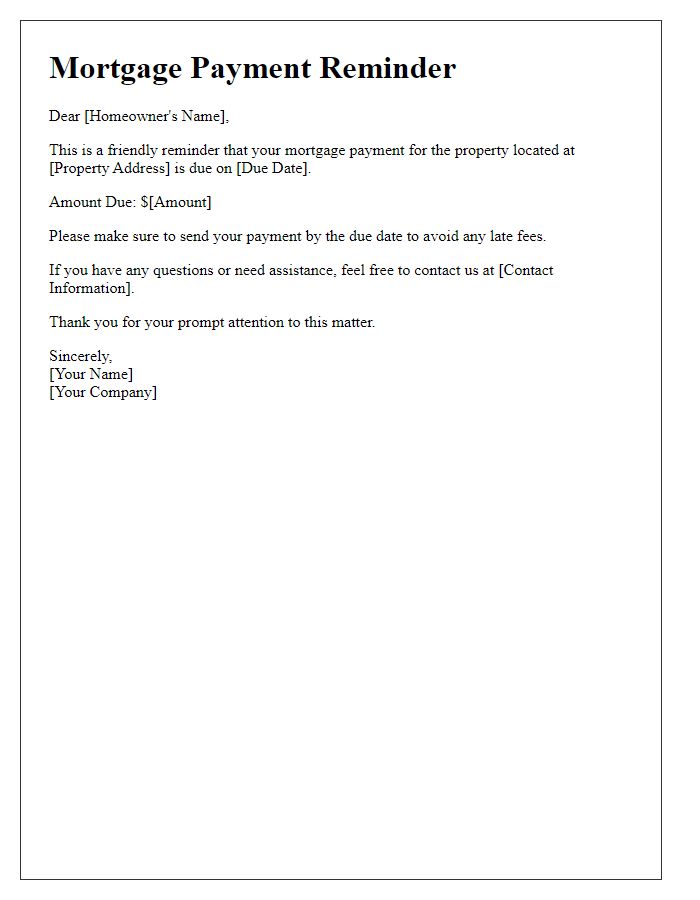

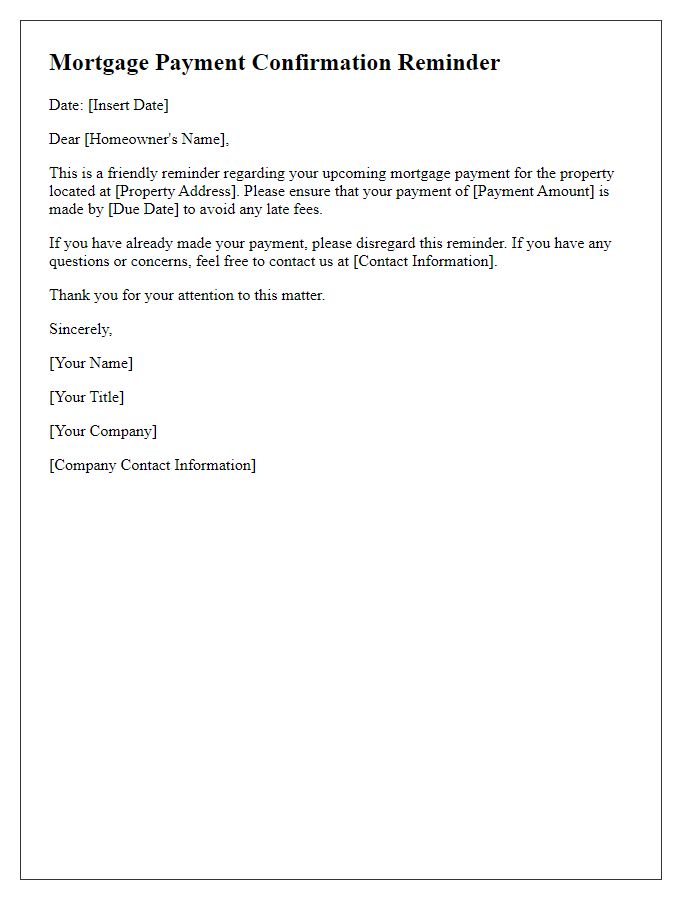

Loan account details

Mortgage payments are essential for maintaining loan accounts, ensuring timely transactions on scheduled dates (usually monthly). Homeowners typically receive reminders from lenders, often detailing loan account numbers, payment due dates (such as the first of each month), and the total amount due (which may include principal, interest, taxes, and insurance). Consistent payment behavior helps maintain credit scores, whereas missed payments can lead to penalties or foreclosure risks. Therefore, keeping track of loan account details, such as interest rates (fixed or variable) and remaining balance, is crucial for financial stability and homeownership security.

Payment due date

Mortgage payment reminders are crucial for homeowners to avoid late fees and maintain good standing with their lenders. The due date, typically set on the first of each month, is a critical date for financial planning. Missing this date can lead to penalties of around 5% of the payment amount. Consistent reminders ensure timely payments and help maintain a positive credit score, which is vital for future lending opportunities. Regular communication between lenders and homeowners fosters financial responsibility and supports homeownership stability.

Amount due

Mortgage payment reminders serve as critical communication for homeowners, ensuring timely adherence to financial obligations. The payment amount due could range significantly based on factors such as property value, interest rates, and loan terms. For instance, a 30-year fixed mortgage of $300,000 at an interest rate of 4% results in a monthly payment approximately $1,432. Homeowners must be aware of the due date (often the first of the month), as missed payments can incur penalties and affect credit scores. Notifications can be sent via email or direct mail, ensuring homeowners across regions such as urban cities or rural settings remain informed. Additionally, platforms like online banking offer reminders and automated payment options, simplifying the process and minimizing the risk of late payments.

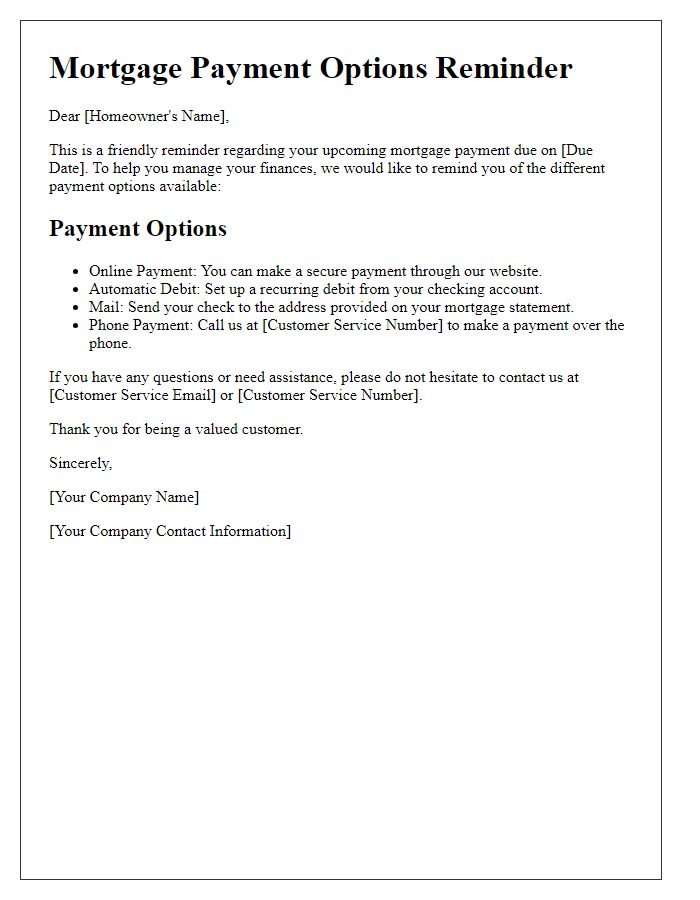

Payment methods available

Mortgage payment reminders play a crucial role in ensuring timely payments that maintain homeownership. Various payment methods are available for mortgage payments, including online banking services that facilitate direct payments from personal accounts, automatic bank transfers for seamless monthly transactions, and payment by check sent via postal service. Homeowners can also opt for phone payments through dedicated mortgage service lines, providing flexibility in managing dues. Additionally, some lenders offer mobile app features that allow customers to schedule or adjust payments conveniently. Ensuring clarity about these options helps borrowers stay informed and avoid late payment penalties.

Comments