Have you ever found yourself in a situation where a payment slipped your mind? It happens to the best of us, and that's precisely why we're reaching out. This letter serves as a gentle reminder about your missed payment, ensuring you stay on top of your financial commitments. Ready to find out how to get back on track? Read on!

Account Information

Missed payment alerts are crucial for maintaining financial accountability. An account holder typically receives notifications when a scheduled payment (such as a monthly mortgage or credit card bill) fails to process successfully. For instance, on May 15, 2023, a payment of $300 may have been due for a home loan with XYZ Bank, but due to insufficient funds or technical errors, the payment was missed. Accounts usually include details such as account number, due date, and payment amount, which are essential for tracking and rectifying missed obligations. Prompt notifications help account holders avoid late fees, potential damage to credit scores, and ensure timely assistance in resolving any issues.

Payment Due Date

A missed payment alert can significantly impact financial standing, particularly for loans or credit accounts. Payment due dates are often set at specific intervals, such as monthly (e.g., every 30 days) or quarterly (e.g., every 90 days), and missing these deadlines may incur late fees ranging from $25 to $50. Repeated late payments can negatively affect credit scores, with detrimental effects lasting up to seven years on a credit report maintained by agencies like Experian or TransUnion. Additionally, consistent missed payments can trigger increased interest rates, thereby raising the overall financial burden on borrowers, making it crucial to resolve any outstanding balances promptly to maintain financial health.

Outstanding Balance

An outstanding balance occurs when a payment is overdue, often from credit accounts or utility bills. Late payments may incur fees, such as a 5% charge on the total balance, which can increase the overall debt significantly. June 2023 marks a crucial date for many consumers, as overdue payments during this month can adversely affect credit scores, potentially falling below the 600 threshold. Regularly monitoring accounts, such as those from a local bank or service provider, helps avoid penalties. Timely resolution is essential, with options typically available each month for managing payment plans or arrangements, ensuring that debt does not accumulate further.

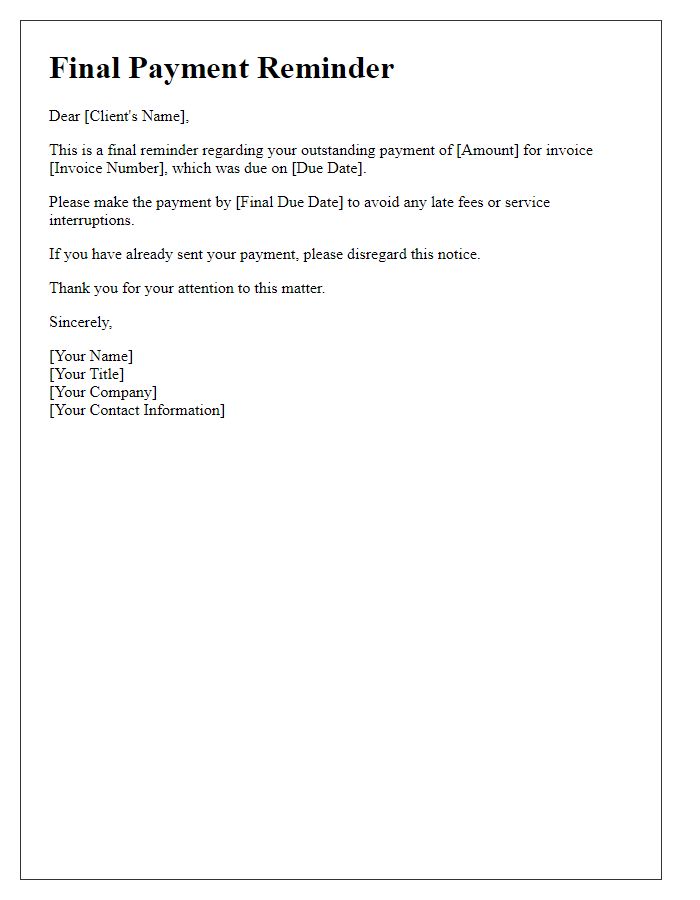

Payment Methods

Missed payments can have significant implications for services and products, such as credit cards and utility bills. When a payment due date (often on the 1st or 15th of the month) is overlooked, late fees may be applied, sometimes exceeding $30. Affected services, such as electricity or water, may also experience temporary disconnection if not addressed promptly. Businesses typically send out alerts via email or SMS, indicating the overdue amount and providing a link for online payment through platforms like PayPal or direct bank transfers. Communication is crucial; providing clear details helps customers resolve payment issues efficiently while maintaining account integrity.

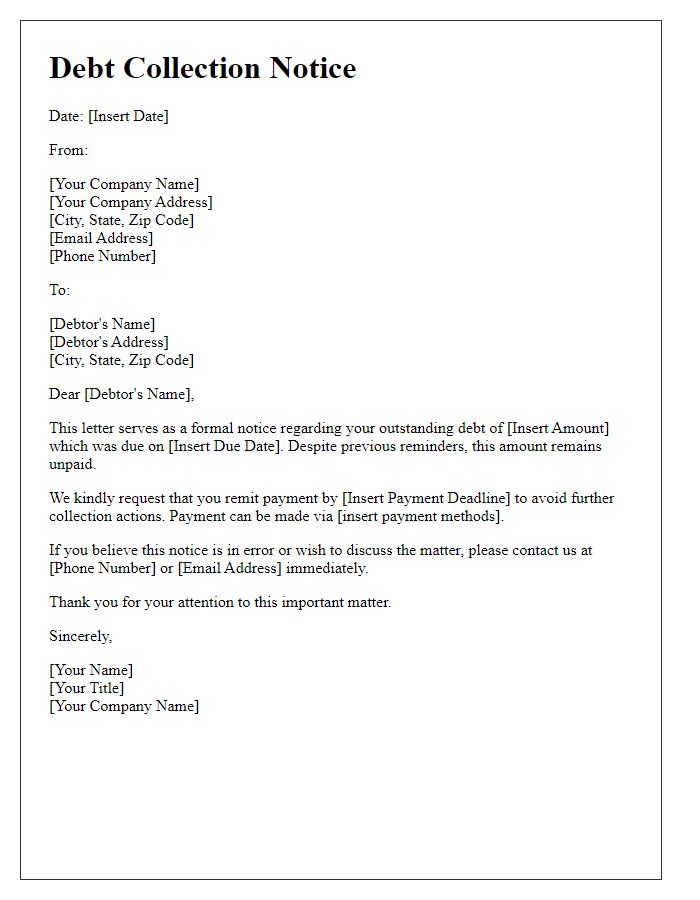

Contact Information

Missed payment alerts can significantly impact both individuals and businesses. Timely reminders regarding overdue amounts are essential for maintaining financial health and fostering accountability. Financial institutions typically utilize automated systems to flag missed payments, prompting contacts via email or text message for customers with outstanding balances. Accurate contact information, including name, phone number, and email address, ensures that notifications reach the intended recipient efficiently. Moreover, the use of formal templates can standardize communication and convey professionalism in addressing missed payments, thus preserving client relationships while encouraging prompt resolution of outstanding debts.

Comments