Are you feeling overwhelmed by the idea of a balloon payment coming due? You're not aloneâmany individuals find themselves in this situation and are looking for ways to manage their financial obligations without undue stress. Thankfully, there are several payoff options available that can help alleviate this burden and pave the way for a smoother financial transition. So, if you want to explore these strategies further, keep reading to discover how you can effectively tackle your balloon payment!

Recipient Information

Recipient information plays a crucial role in the communication regarding balloon payment payoff options. Accurate details include the recipient's full name, preferred title, and mailing address, often including the city, state, and zip code for precise delivery. Additionally, contact numbers such as a mobile or home phone enhance direct communication. Email addresses provide alternative methods for follow-up and documentation. Including the loan or account number linked to the balloon payment can streamline reference checks, ensuring clarity and contextual relevance in financial discussions. Proper formatting and organized presentation of this information can foster professionalism in financial correspondence.

Loan Account Details

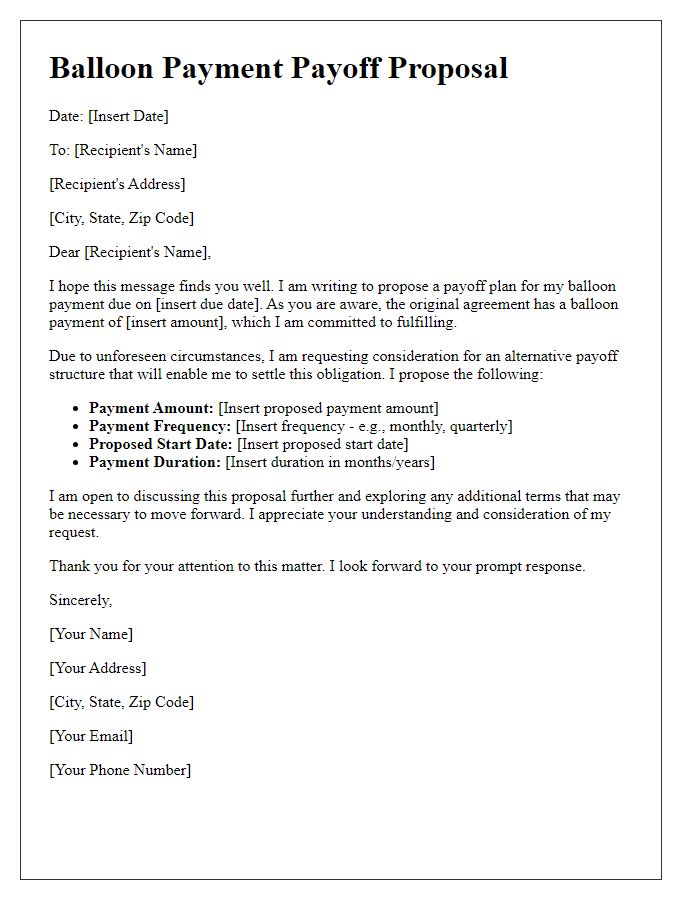

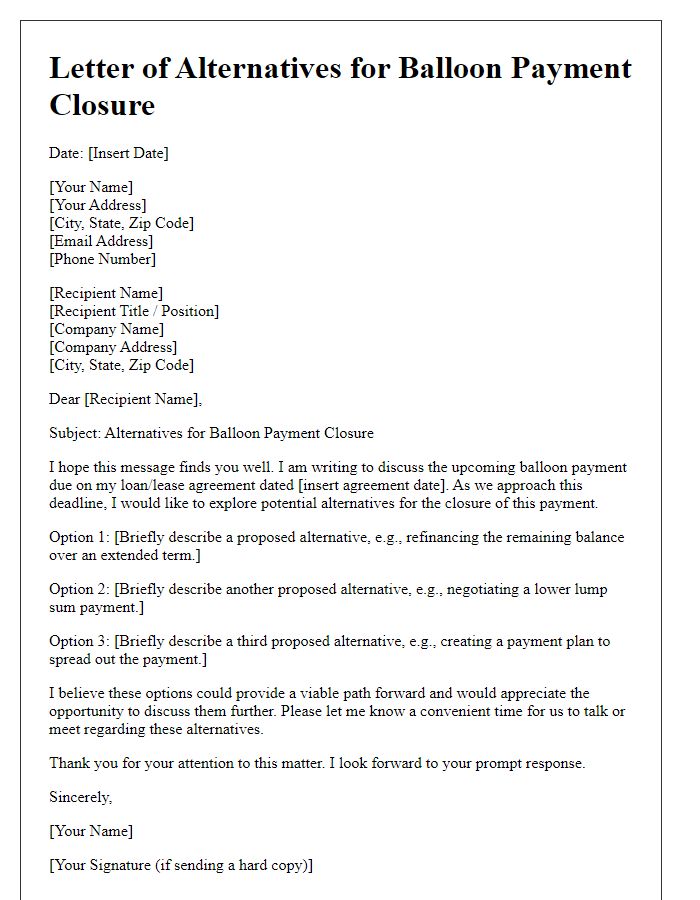

When considering balloon payment payoff options for a loan account, it is crucial to understand the specifics involved. A balloon payment typically refers to a large final payment due at the end of a loan, such as a mortgage or an auto loan. Loan account details include critical information such as the principal amount, interest rate (often fixed or variable), loan term (usually spanning several years), and the remaining balance before the balloon payment becomes due. Borrowers must evaluate options like refinancing (securing a new loan to cover the balloon payment) or selling the asset (liquidating equity to pay off the debt). Factors like current market conditions, interest rates, and personal financial situations significantly influence the best approach for managing the balloon payment effectively.

Balloon Payment Amount and Due Date

A balloon payment is a larger-than-usual final payment due at the end of a loan or lease. The balloon payment amount can often range significantly based on the loan terms, typically involving thousands of dollars, depending on the principal and interest rate. Due dates for these payments are commonly aligned with the loan agreement's terms, often set for the end of the loan period, such as a 5, 7, or 10-year term. Borrowers should evaluate various payoff options, such as refinancing or making partial pre-payments, to manage the financial impact of the balloon payment effectively. Understanding these details can help borrowers prepare for significant financial obligations ahead, ensuring timely payments and maintaining credit health.

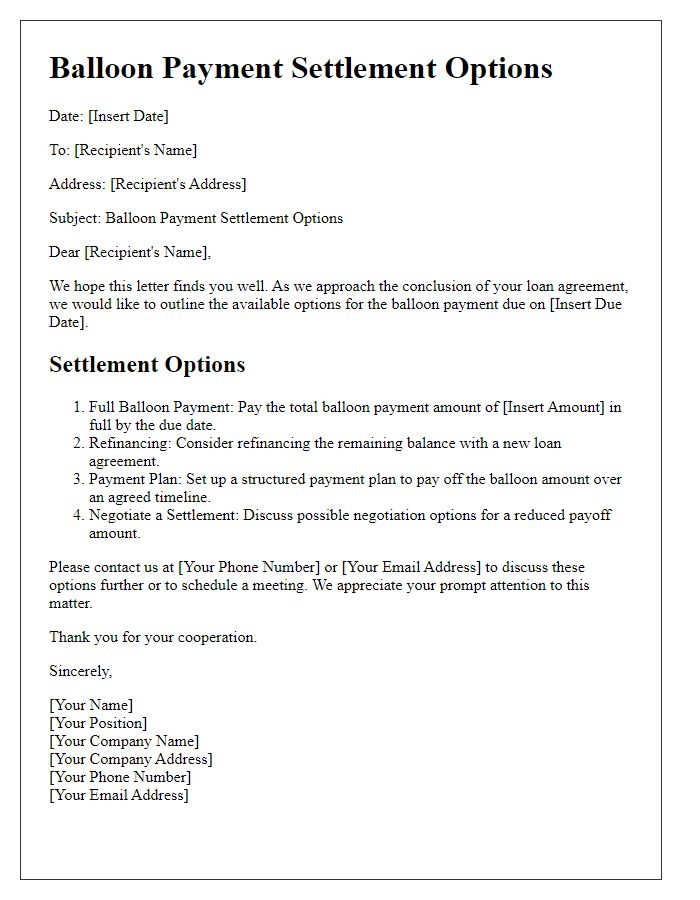

Payoff Options and Instructions

When considering balloon payment payoff options, borrowers must evaluate financial institutions' specific terms and conditions. For instance, lenders such as banks or credit unions may have different procedures for processing the final balloon payment, typically due at the end of a loan term, often spanning five to seven years. The payoff amount, which can include principal, accrued interest, and any fees, should be clarified in the loan agreement. To facilitate the payment, borrowers should obtain a payoff quote from the lender, ensuring accuracy with the final amount due. Instructions often include acceptable payment methods, such as wire transfers or certified checks, to avert any delays in transaction processing. Moreover, borrowers may consider refinancing options available before the balloon payment comes due, which could provide additional payment flexibility or favorable interest rates.

Contact Information for Assistance

Balloon payment options (large final payments due on loans) can significantly impact borrowers. When considering payoff strategies, understanding options is crucial. Loan amortization schedules outline regular payment amounts, usually lower than standard loans, creating potential financial strain at maturity. Refinancing (securing a new loan to cover the balloon payment) may provide flexibility. Alternatively, negotiating with lenders might yield customized solutions tailored to one's financial situation. Moreover, early preparation for balloon payment due dates (often 5 to 7 years from loan origination) is essential to avoid default. Contacting financial advisors can also provide guidance, ensuring informed decisions when approaching significant payment obligations.

Comments