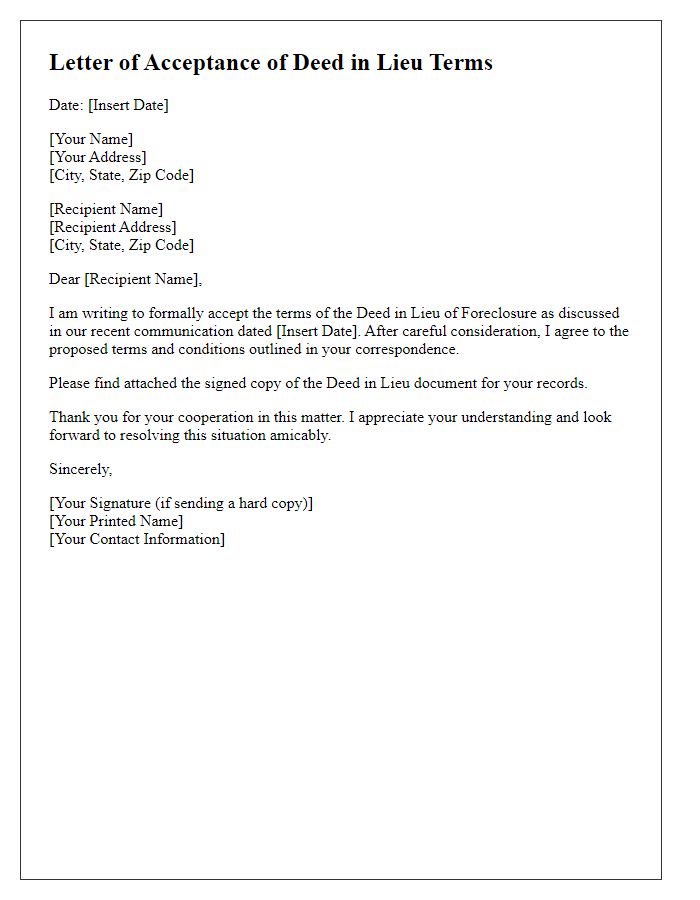

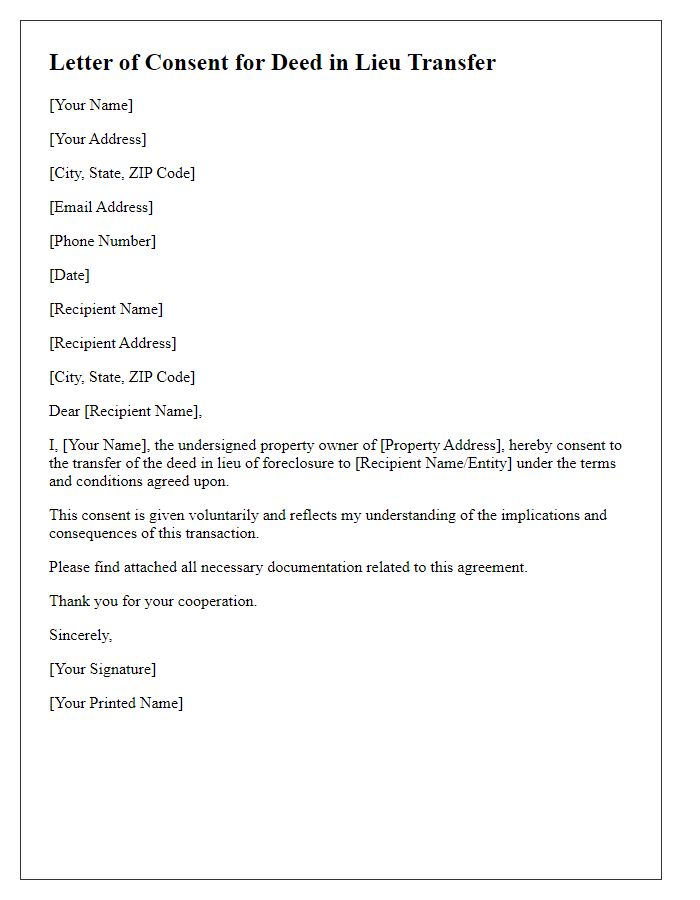

Are you looking for a straightforward way to navigate the often-complex world of deeds in lieu? This letter template serves as a helpful guide, ensuring you cover all the necessary elements while maintaining a professional tone. Whether you're the property owner or the lender, crafting the right communication can pave the way for a smoother transaction. For more insights and tips on creating the perfect letter, keep reading!

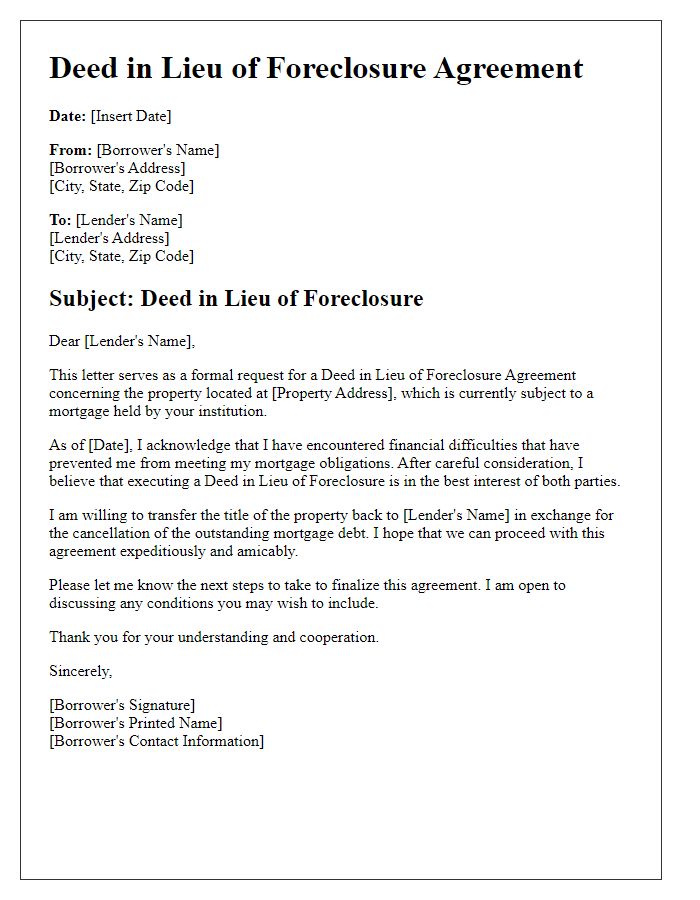

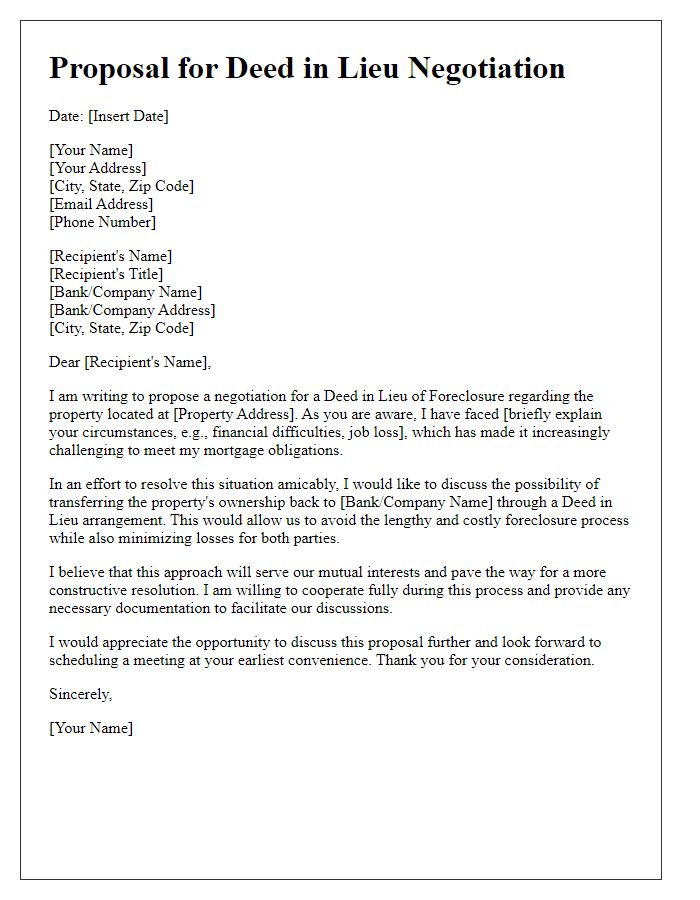

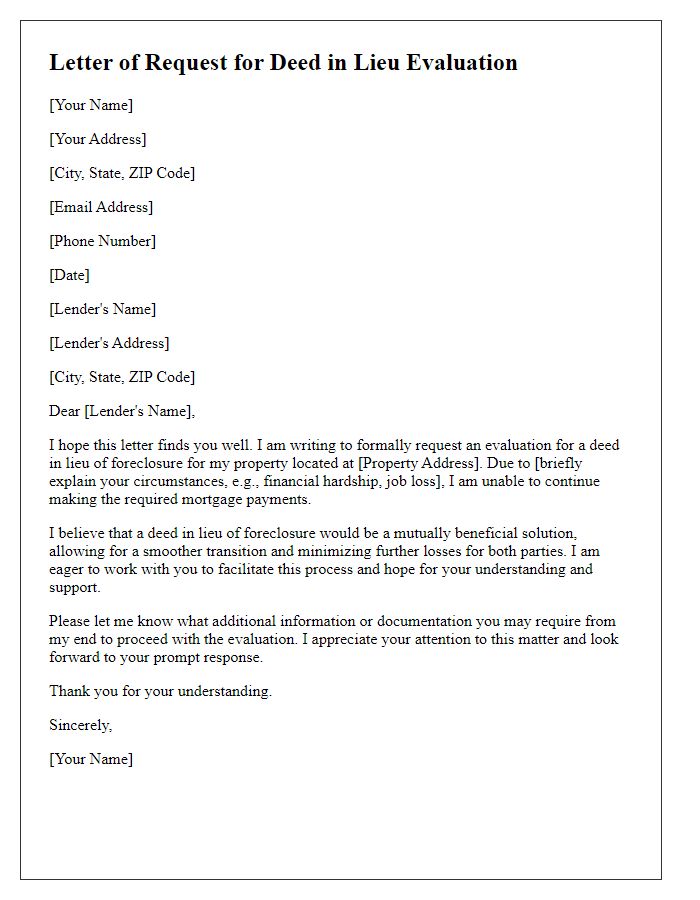

Address recipient and property details

The letter template for a deed in lieu consideration serves as a formal communication tool aimed at initiating the process of transferring property ownership, typically used in real estate transactions to avoid lengthy foreclosure proceedings. The recipient section should include the full name and title of the property owner or representative, ensuring clear identification. Precise property details must encompass the legal address, property identification number, and any pertinent descriptions, which may include the size and current condition of the property. This template acts as a crucial document outlining the intent and details involved in the deed in lieu agreement, facilitating effective communication between parties.

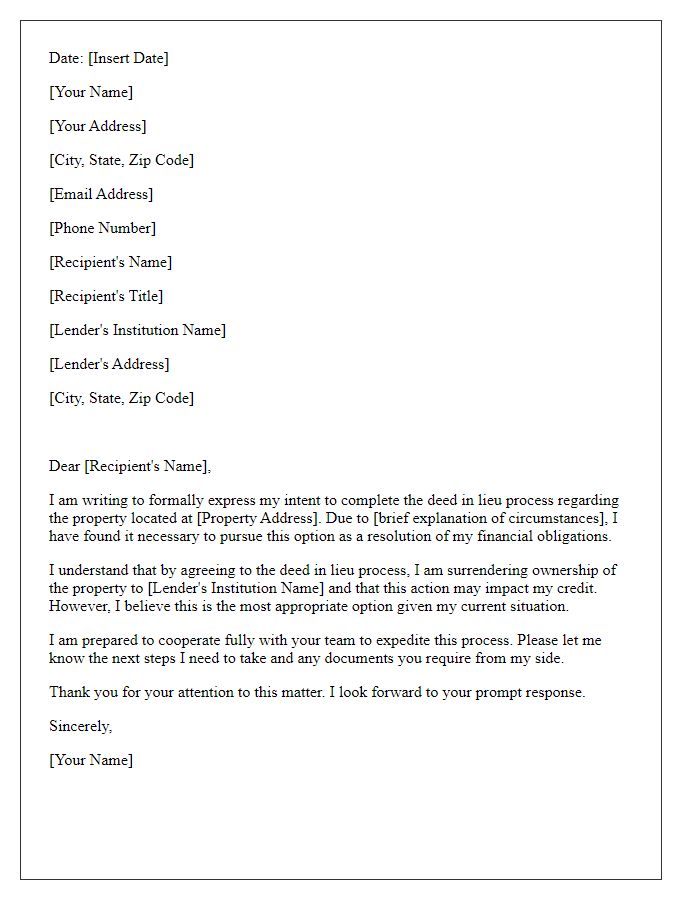

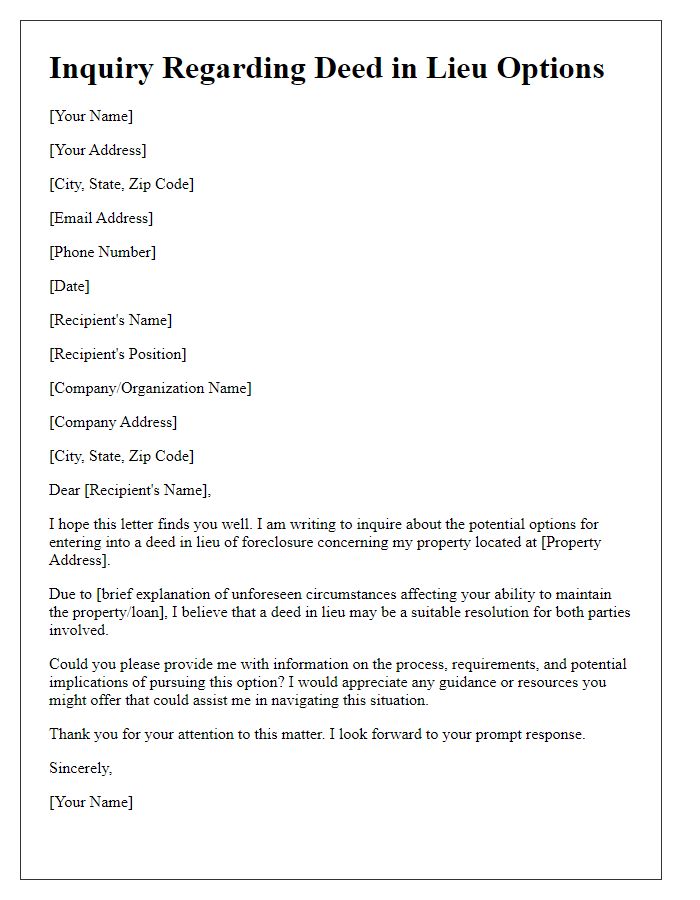

Explanation of financial hardship

Financial hardships often stem from unforeseen circumstances affecting individual stability. Common reasons include job loss, significant medical expenses, or divorce, leading to difficulties in meeting mortgage obligations. For instance, a sudden layoff from a position at a local business, like XYZ Corp, compounded with rising medical bills due to an emergency surgery, can drastically reduce available household income. These challenges create situations where homeowners cannot maintain timely mortgage payments, resulting in the need for alternatives such as a deed in lieu of foreclosure. This legal process allows homeowners to voluntarily transfer property ownership to the lender, alleviating the stress of mounting debt and potential foreclosure consequences. By considering a deed in lieu, both homeowners and lenders can navigate financial struggles more efficiently.

Request for deed in lieu of foreclosure

A deed in lieu of foreclosure allows homeowners to voluntarily transfer ownership of their property to the lender, helping to avoid the lengthy foreclosure process. Homeowners facing financial difficulties often seek this option when they can no longer meet mortgage payments. The process typically involves submitting a formal request to the mortgage lender, detailing the financial circumstances leading to the request. Key details should include the property address, current mortgage balance, and a description of any hardships, such as job loss or medical emergencies. Providing documentation to support the hardship claim, such as income statements and medical bills, is crucial. This alternative can help minimize the impact on the homeowner's credit rating compared to traditional foreclosure, beneficial for those looking to recover financially in the long term.

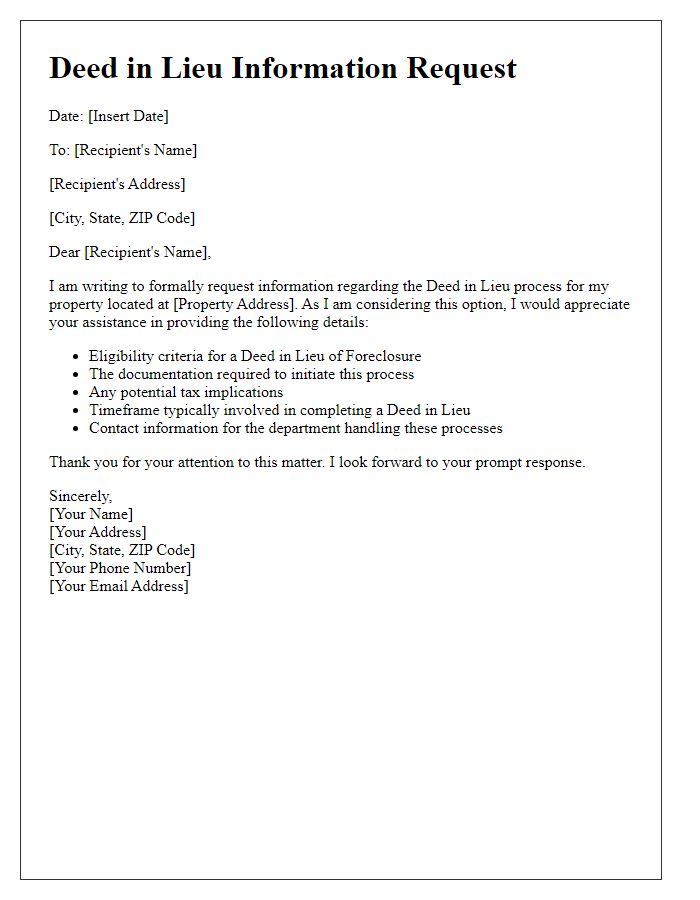

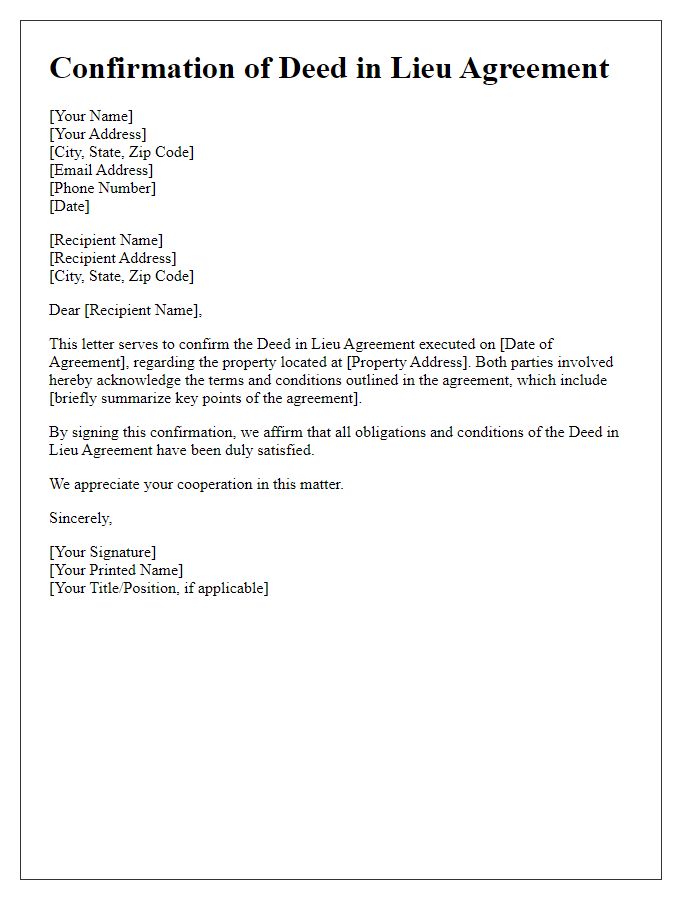

Offer to transfer property ownership

A deed in lieu of foreclosure occurs when a borrower voluntarily transfers ownership of a property to the lender to avoid foreclosure proceedings. This arrangement typically requires the borrower to be in default on their mortgage payments, and the lender's acceptance of the property signifies the end of the mortgage obligation. In this scenario, properties often include details such as the address and legal description fully outlining the real estate involved. It is crucial to include the names of both parties, the date of the transaction, and any relevant loan numbers to ensure clarity. Additionally, both parties may negotiate for the forgiveness of any outstanding mortgage debt, potentially impacting the borrower's credit report. This legal instrument can provide a streamlined alternative to lengthy foreclosure processes, benefiting both borrowers and lenders by reducing costs and time associated with traditional foreclosure methods.

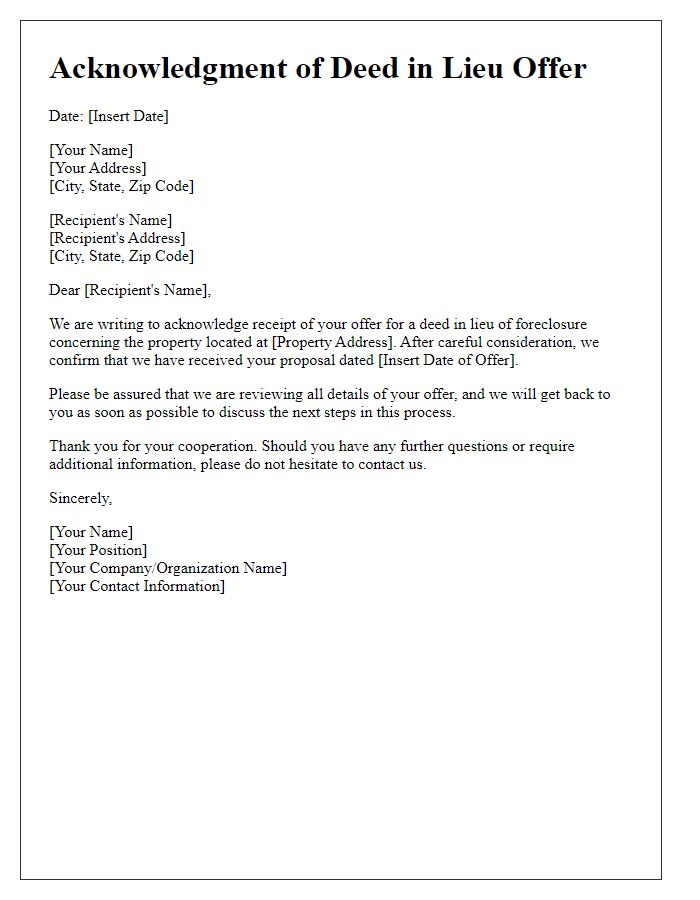

Contact information for further communication

A deed in lieu of foreclosure is a legal arrangement allowing a borrower to transfer ownership of their property to the lender to avoid foreclosure proceedings. Effective communication is crucial for resolving issues related to this process. Contact information should include details such as the full name of the borrower, address of the property in question (e.g., 123 Main Street, Anytown, USA), phone number (e.g., (555) 123-4567), and email address (e.g., borrower@example.com). Additionally, the lender's contact information, including the name of the loan officer, company name (e.g., XYZ Mortgage Corporation), phone number, and email, should also be clearly stated for a smooth transition and further correspondence throughout the deed in lieu process.

Comments