Are you feeling overwhelmed by your monthly payments? It's completely understandable, and we're here to help! Our "Skip a Payment" offer allows you a breather, giving you some much-needed financial flexibility without the stress. Curious to learn more about how this could lighten your load? Read on!

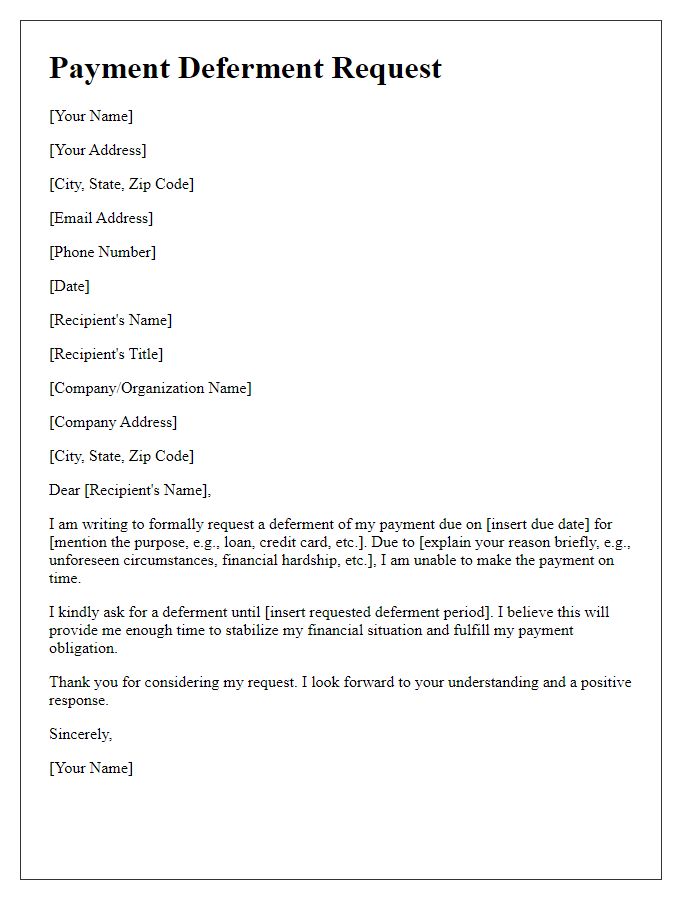

Personalization and Recipient Details

A skip a payment offer provides customers with the option to temporarily defer a payment on their loan or credit account, often during financial hardship. Personalization includes the recipient's name, account number, and specific loan type, which can enhance engagement. The offer details typically outline the payment amount, deadline for acceptance, and any potential fees. It's essential to mention consequences related to credit reporting and interest accrual during the skipped period. Providing contact information for customer assistance encourages communication and addresses any concerns about the offer.

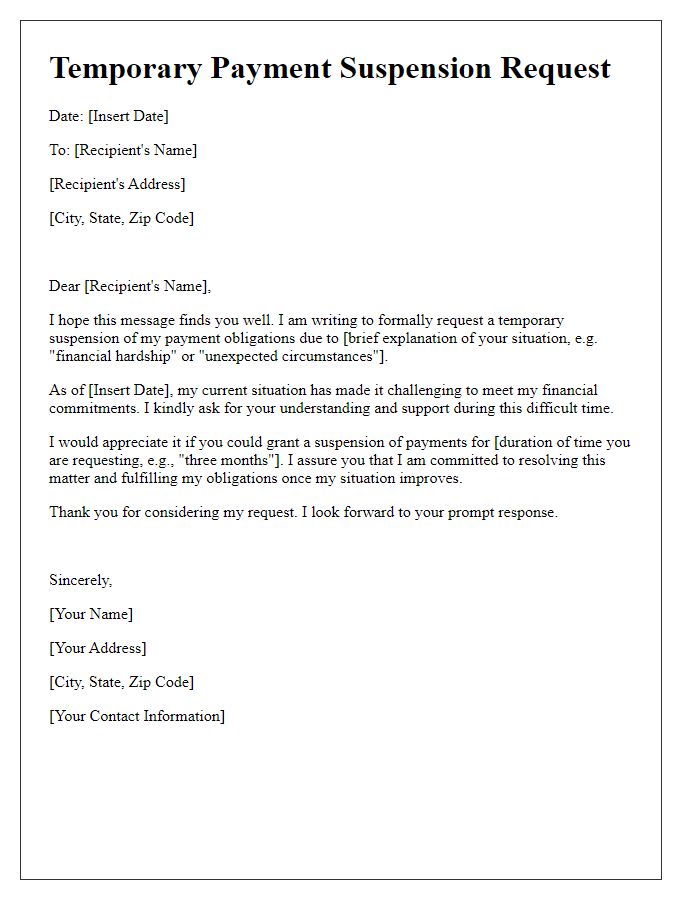

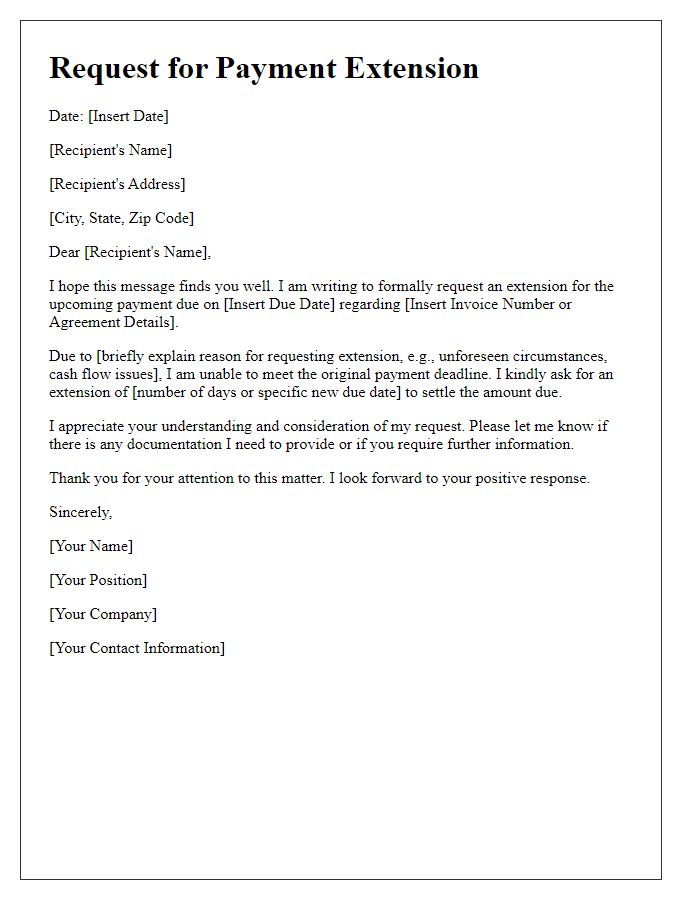

Clear Reason for Request

Financial obligations can sometimes lead to temporary cash flow difficulties, requiring individuals or businesses to seek assistance from lenders. A skip a payment offer allows borrowers to defer a payment without incurring penalties or negatively affecting credit scores. This option is particularly beneficial during economic downturns or personal crises, such as medical emergencies or job loss, which can place significant strain on budgets. By providing a clear reason for the request, such as unexpected expenses or income fluctuations, borrowers can communicate their situation effectively to lenders, potentially increasing their chances of receiving favorable terms on the payment deferment. Communication with lenders is crucial in navigating financial challenges.

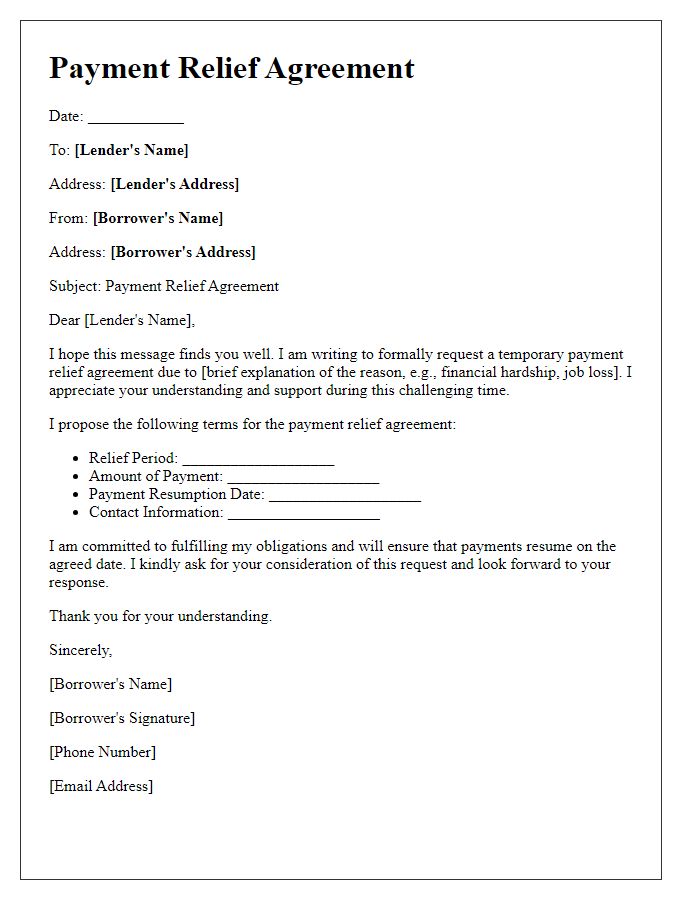

Stated Duration of Payment Skip

A payment skip offer can provide financial relief for borrowers, allowing them to temporarily pause payments on loans such as auto loans, personal loans, or mortgages. Commonly, this option is available for a stated duration of one to three months, depending on the lender and loan agreement. During this period, borrowers may not incur any late fees; however, interest may continue to accrue on the principal balance. It's essential for borrowers to understand the potential long-term impact, as skipping payments can extend the loan term or increase total interest paid. Contacting the lender promptly to discuss the specifics of the payment skip offer ensures that borrowers fully understand the terms and conditions associated with this temporary reprieve.

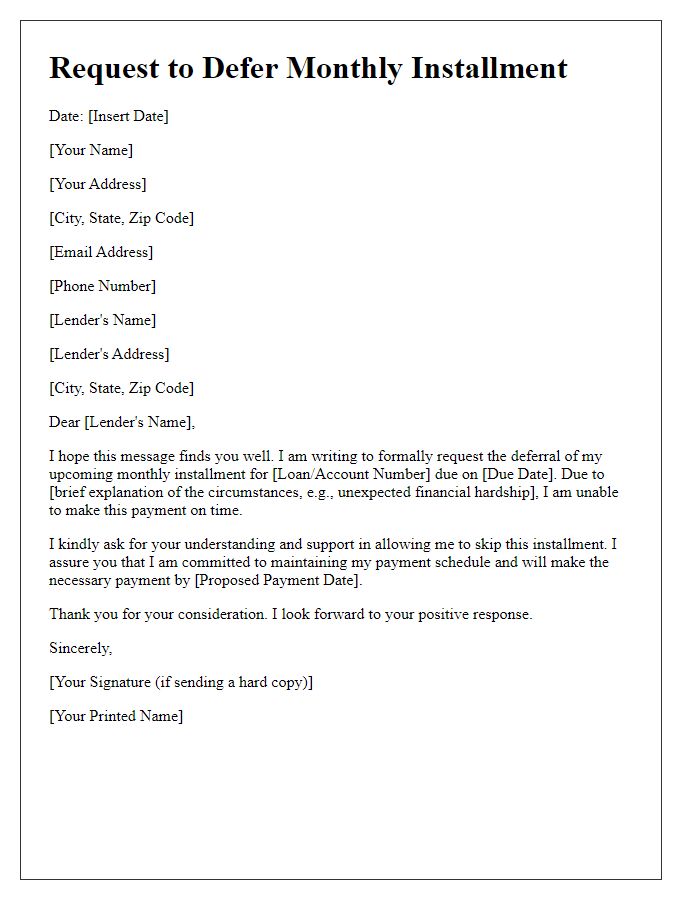

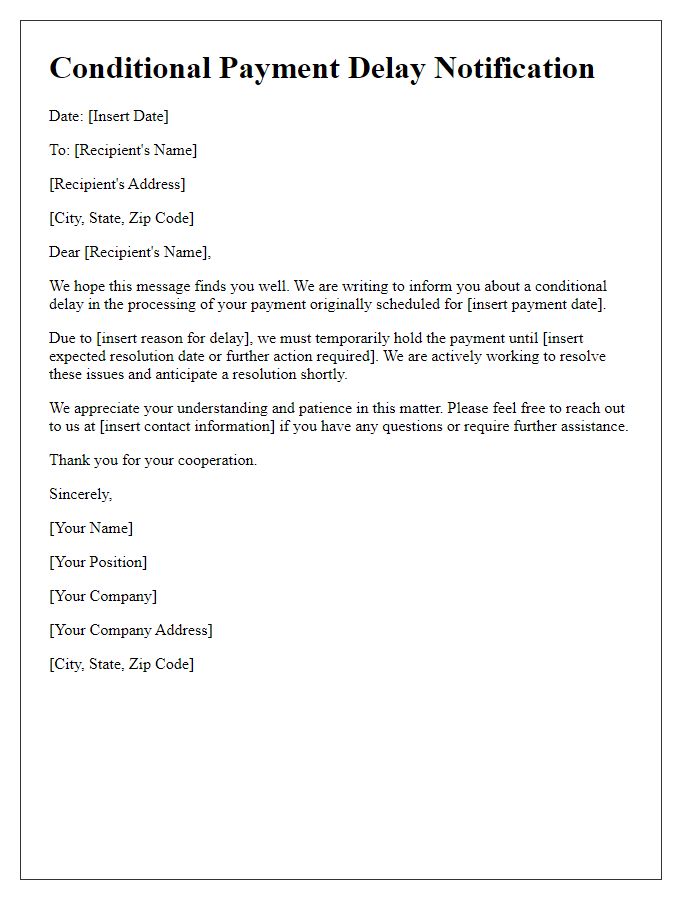

Explanation of Financial Situation

Many individuals face challenging financial situations that can result in difficulties meeting monthly obligations, such as mortgage payments or loan installments. Unexpected events, like job loss, medical emergencies, or significant repairs, can lead to a sudden decrease in income or increase in expenses. For instance, a recent layoff from a position in a company located in New York City may have drastically reduced the available cash flow. This situation can create stress and anxiety, making it crucial for individuals to seek assistance or temporary solutions such as a payment deferment or skip a payment option. Engaging with financial institutions may provide a pathway to secure relief during turbulent times, allowing for recovery of finances without damaging credit scores or incurring penalties.

Contact Information for Follow-up

A skip a payment offer allows borrowers to temporarily defer a scheduled loan repayment, aiding them in managing financial challenges. Customers must provide their contact information, including name, phone number, and email address, to facilitate follow-up. Lenders, such as local credit unions or national banks, often require this information to confirm eligibility and process requests efficiently. Standard procedures typically involve verifying account status and payment history, often needing a client's account number. It is crucial for clients to maintain clear communication channels, enabling lenders to provide updates promptly regarding the status of the request or any additional requirements.

Comments